Global Investing: Italy or Singapore?

Many European countries have declining population growth and onerous business regulations. This creates a headwind against the region’s share prices. Many Asian countries have healthy population growth and are embracing free markets. This creates a tailwind behind the region’s stock prices.

Many European countries have declining population growth and onerous business regulations. This creates a headwind against the region’s share prices. Many Asian countries have healthy population growth and are embracing free markets. This creates a tailwind behind the region’s stock prices.

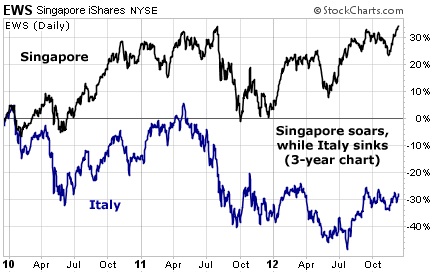

One simple and useful way to monitor this idea is to compare the stock market performance of Singapore with the stock market performance of Italy.

Singapore sits at the center of the booming East Asia/Australia region. It’s a global financial hub and is considered one of the world’s easiest places to do business. It also sports a low corporate-tax rate. All this creates a powerful tailwind for Singapore investments and prosperity.

Italy, on the other hand, is deep in debt and tough to do business in. It’s an economic basket case… And it’s not the only European country that deserves the label.

The chart below shows this trend at work. It’s a performance chart that displays the performance of the iShares Singapore Fund (the black line, up 33%) versus the iShares Italy Fund (the blue line, down 30%) over the past three years.

As you can see, stocks in low-tax, easy-to-do-business-in Singapore are doing well. Meanwhile, stocks in the high-tax, difficult-to-do-business-in Italy are sinking. This trend has been in place for years… and may continue for many more.

You may have an interest in also reading…

Kathrein Privatbank: Investing Today in the Trends of Tomorrow — with Panache

For Kathrein Privatbank, 2021 was all about innovation. In addition to adopting a new brand identity, it worked intensively on

Deficits Matter, but Not the Way You Might Think

By Bob Veres. This originally appeared on Advisor Perspectives. Congress is coming off of a bruising debate over the deficit ceiling

Maserati on Value Creation: Trident Badge and a Heady Rumble Mean Business, On the Road and In the Showroom

How many syllables would you like with your supercar? One? Porsche will do nicely. Two? Bentley, please. Three? Ferrari, of