Asian Development Bank: Towards a Blue Deal to Restore the World’s Oceans

Investments in recovering and maintaining a functioning marine ecosystem can form the foundation of a sustainable “blue economy.”

Marine ecosystems are threatened by extinction. Over the past 50 years, the world has lost nearly half of its coral reefs and mangrove forests, while marine populations have halved and global fish stocks depleted by a third.

Source: ADB

If trends continue, it is estimated that there will be no stocks left for commercial fishing by 2048 in the Asia and Pacific region alone. By 2052, oceans might contain more plastic than fish by weight and 90% of coral reefs may be lost.

The case for protecting oceans is stronger than ever. Oceans contribute to every aspect of life on earth, including regulating climate change. Oceans act as a giant carbon sink, absorbing about a third of the carbon dioxide (CO2) generated by human activities since the industrial revolution. However, while helping mitigate climate change, with greater carbon absorption the oceans are also facing a 30% rise in seawater acidity since the industrial revolution – an acidification rate estimated to be 10 times faster than at any other period during the preceding 55 million years. This is already having an impact on marine biodiversity, and with an estimated 1 billion people dependent on seafood and a global fishing market worth an annual $100 billion, ocean health decline is having an impact on the global economy.

Investments in recovering and maintaining a functioning marine ecosystem are essential to support ocean health and the foundation of a sustainable “blue economy.”

Holistic Strategies

The declining health of the world’s oceans is an issue that does not just affect a single industry, sector, or country; it is a threat to the entire planet. The solutions, therefore, must be broad and systematic as well.

Strategies must cut across multiple sectors and countries in a holistic, “source to sea” approach. This includes reducing marine pollution at the source—including agricultural pollution, wastewater, plastic and other solid waste, and discarded fishing gear—while simultaneously protecting and restoring coastal and marine ecosystems and connected rivers. It also includes sustainable extraction of marine resources including fish and minerals. Governments, nongovernment organisations, businesses, and other stakeholders all need to do their part.

Port and coastal infrastructure is overdue for modernisation. There is an urgent need for ocean-friendly infrastructure including integrated solid waste management, ecologically-sensitive port facilities, and municipal and industrial wastewater and effluent treatment. Also crucial are sustainable agribusinesses that reduce runoff of fertilisers, agrochemicals, waste, and soil erosion, as well as a sustainable aquaculture sector.

With the total asset value of the ocean estimated at $24 trillion and the global ocean economy estimated at $3 trillion per year, there is no shortage of investment opportunities, yet investments themselves have fallen short. In the last 10 years, only $13 billion has been invested in sustainable projects via philanthropy and official development assistance, and even less by the corporate sector. Currently less then 1% of the total value of ocean economy is invested in sustainable projects. At the UN Ocean Conference in 2017, only about $25.5 billion was committed, about one sixth of what is required for achieving the Sustainable Development Goal 14, Life Below Water, by 2030.

We have a good chance to obtain the investments needed if we successfully rise to three challenges. First, we need to agree on a standardised approach to valuing natural assets. Second, we must assist governments to effectively govern ocean resources, and last we need to inspire and attract private sector initiative and capital to invest in a blue future.

Accounting for Natural Resources

The goods and services the ocean provides tend to be significantly undervalued. For example, in the Asia and Pacific region, the benefits of coastal ecosystems such as coral reefs, coastal wetlands and mangrove forests that act as “natural buffers” to storms are rarely quantified and accounted for in coastal protection. This means hazard mitigation and budgetary decisions are being made without fully recognising their value. If damaged during a storm or natural disaster, these assets need to be restored so they can protect us from the next calamity.

Accounting for natural assets on public sector balance sheets will enhance transparency, value improvements to blue assets, and reinforce the need to protect these invaluable resources for future generations.

Building Ecosystem for Investments

Underlining a commitment to protect our oceans is the need to strengthen the enabling environment for blue economy investments. At the national level, this can be done by creating a central body to develop frameworks to incentivise ocean-positive businesses through supportive taxes and subsidies, and discourage and disallow ocean-impacting businesses through fiscal and regulatory reforms.

Encouraging progress has been made. To date, 57 countries have introduced ocean-related laws, policies or regulations. The conducive blue economy ecosystem that will emerge from these efforts can help channel private and public investments, as well as official development assistance, towards the sustainable development and protection of our oceans.

We need to formulate transfer mechanisms to fund support for essential ocean investments that lack revenue streams. These could take the shape of allocating income from fishing licenses, redirection of harmful subsidies, tourist charges or plastic taxes.

A Wave of Private Sector Finance

Large-scale investments are required to support ocean projects; while sovereign investments remain essential, the private sector is required to fill the gap. Attracting private investors, however, can be challenging for ocean projects.

The private sector needs a return on investment and this is usually done through user charges. Given that many ocean investments revolve around a shared common resource, it is sometimes difficult to define discrete users to pay. Moreover, when user charges can be applied, their level is constrained by affordability considerations, such as in municipal wastewater projects. This results in a volatile or at least uncertain revenue model, compromising bankability and constraining the flows of private capital.

The less bankable projects need special assistance. Blended finance can play a catalytic role in lowering risk and enhancing profitability to attract private sector participation and capital for these initiatives. Other ways to create bankable project structures includes risk allocation to the most appropriate party, either public or private, or use of subordinated instruments.

“Blue funds” also have huge potential to help overcome these challenges. Arranged by governments or development finance institutions, they could provide much-needed credit enhancement to projects in the form of blue credits. These credits are similar to carbon credits as they provide revenue support based on the value of the avoided costs from doing a high impact project. Such funds could also support issuance by underlying project sponsors of more creditworthy blue bonds to raise competitive long-term capital from the markets.

Multilateral development banks such as the Asian Development Bank (ADB) can help by developing blue project selection criteria and policy frameworks, creating financial instruments and products, mobilising concessional finance, and preparing bankable project pipelines.

Green versus Blue Finance

Green financing has already beaten a path for blue financing to follow. Green instruments aim to pool projects together to diversify risks and enable wider access to financing by tapping the capital markets through green equities and bonds. By enhancing the bankability of a project, these instruments can encourage the expansion of investments in renewable energy, reforestation, watershed management, air quality, and clean transport.

ADB has issued $9.6 billion of Green Bonds since 2010. With additional support, blue investments can be similarly successful. Given the urgency and scale of the problem, blue investments need to gain traction rapidly.

The time has come to expand the scope beyond terrestrial habitats and include investments in our blue planet. This should be echoed by financial regulators and credit rating agencies.

Globally, work is under way to define the blue universe and sustainability criteria. A detailed approach is required, since blue financing lacks the simplicity of a single metric such as carbon equivalency or a “net zero emissions” target.

One step in this direction is ADB’s Ocean Health Program, which is building a pipeline of bankable projects in marine/ coastal ecosystem protection and pollution reduction. Through innovative finance and partnerships, ADB hopes to catalyse further investments to deliver on the healthy oceans needed for a lasting recovery from the current turmoil.

About the Author

Author: Ingrid van Wees

Ingrid van Wees is the Vice-President for Finance and Risk Management of ADB. She assumed the position in December 2016. She is responsible for the overall management of the operations of the Office of Risk Management, the Controller’s Department, and the Treasury Department.

About ADB

The Asian Development Bank, founded in 1966 and headquartered in Manila, Philippines, assists its members and partners by providing loans, technical assistance, grants, and equity investments to promote social and economic development. Under its long-term Strategy 2030, ADB is committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. ADB is composed of 68 members, 49 of which are from Asia and the Pacific.

You may have an interest in also reading…

Ferdinand Grapperhaus, Jr: Putting a Brave (and Smart) Face on the World’s New Constructions

The building industry is one of the main contributors of greenhouse gas emissions. According to a 2019 report from the

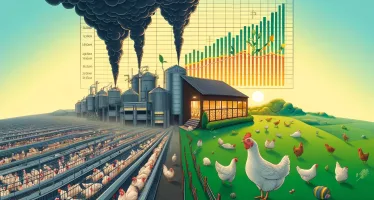

Easter Eggs – Big Business for Egg Farmers?

Easter is traditionally a period of heightened activity for egg farmers, as the demand for eggs surges due to the

Otaviano Canuto, World Bank Group: Commodity Super Cycle to Stick Around a Bit Longer

Some analysts have predicted that the commodity price boom has played itself out. However, natural resource-based commodity prices (with the