Otaviano Canuto, World Bank Group: Commodity Super Cycle to Stick Around a Bit Longer

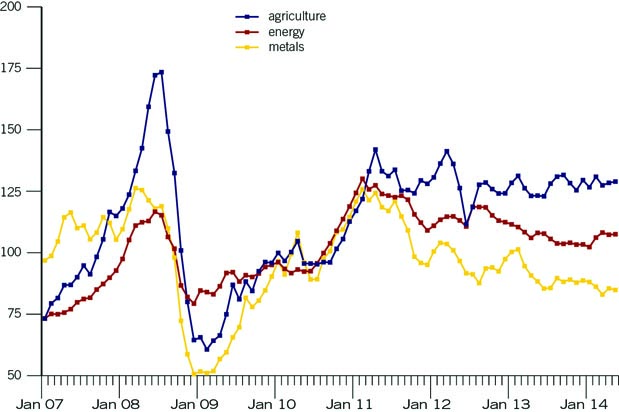

Some analysts have predicted that the commodity price boom has played itself out. However, natural resource-based commodity prices (with the exception of shale gas and its downward pressure on US natural gas prices) have remained relatively high over the last few years, despite the feeble global economic recovery (Canuto, 2014). The commodity price spike that started at the end of the 1990s has not been significantly affected by the global downturn, with average prices similar to 2008 levels (Chart 1).

Some analysts have predicted that the commodity price boom has played itself out. However, natural resource-based commodity prices (with the exception of shale gas and its downward pressure on US natural gas prices) have remained relatively high over the last few years, despite the feeble global economic recovery (Canuto, 2014). The commodity price spike that started at the end of the 1990s has not been significantly affected by the global downturn, with average prices similar to 2008 levels (Chart 1).

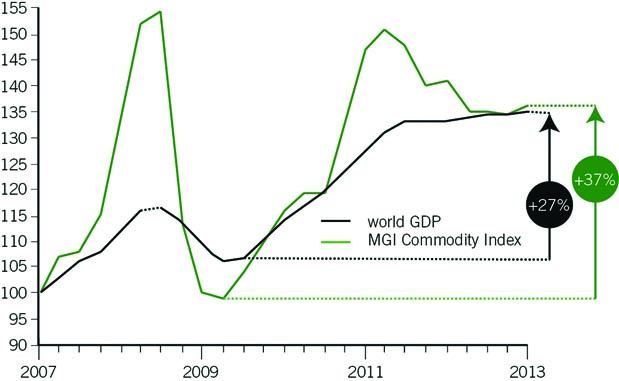

Indeed, commodity prices have occasionally exhibited signs of bouncing back more quickly than the level of global economic output (Chart 2). So the question is: Have we entered a phase of descending commodity prices? Here we argue that it may be too soon to say that we have moved past the commodity super-cycle phenomenon.

Can History Shed Some Light?

Several authors have recently revisited long, historic series of commodity prices – see e.g. Ocampo and Erten (2013), Jacks (2013), and Arezki et al (2013). Their focus has been either on the old Prebisch-Singer hypothesis – according to which the “terms of trade” between primary products and manufactured goods tends to fall in the very long run – and/or on the frequency and shapes of past price cycles.

“Since the late nineteenth century, commodity prices have moved along three long-term general cycles, though a fourth has been recently identified.”

Since the late nineteenth century, commodity prices have moved along three long-term general cycles, though a fourth has been recently identified. The first two cycles spanned roughly four decades, and the third one lasted 28 years. All four upward phases were primarily driven by rising global demand, though the main sources of that demand differed for each. This time, China’s fast economic growth since the beginning of the new millennium has boosted demand, as illustrated by the country’s rising proportion of global natural resource-based commodities use (Canuto, 2008a).

Directions – upward or downward – of long-term price trends vary among different types of commodities and depend on the starting points used as reference. The picture gets blurred in cases where commodities have evolved and are hard to compare over time (e.g., poultry or soybean production today is highly different from what it was several decades ago).

Chart 1: Commodity Prices. Source: World Bank.

Reports on previous cycles and price volatility have been more convergent. These works tend to agree on the localization of at least three super-cycles of commodities since the 19th century, as well as one initiated at the end of the 1990s. Typically 20-year boom periods have reflected strong demand associated with moments of rapid industrialisation and urbanisation – as in the case of the US in the 1890s, or China in the 2000s – in which supply takes a long while before matching that demand. When this happens, periods of much lower commodity prices follow.

Spotting trends or previous cycles is a highly useful exercise. It calls attention to the interplay between demand and supply over time. However, we are unable to use past trends to forecast future paths of specific or general commodity prices at a certain point in time – as illustrated by the non-homogeneity of shapes of previous cycles.

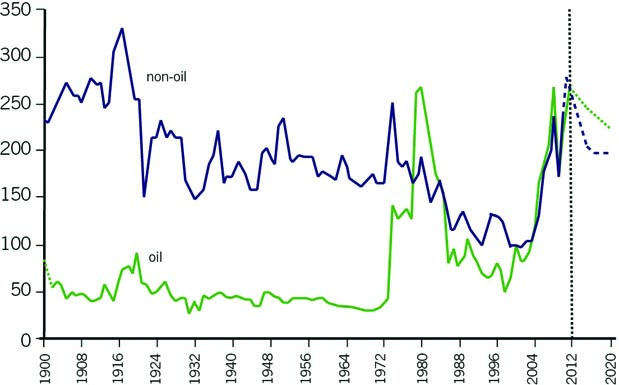

As is clear from Chart 3, commodity prices relative to manufactured goods may move and stay significantly lower or higher for substantial periods regardless of the presence of a long-run trend or drift. It all hinges on the relative strength of forces behind the demand for primary commodities relative to the demand for manufactures, and the supply of commodities relative to the supply of manufactures (Brahmbhatt and Canuto, 2010).

When looking ahead at a certain point in time, it is fundamental to approach the nature, intensity and time length of factors on each side of the equation at that specific moment: One cannot look for any predetermined historic shape of commodity super-cycles.

Whither the Prebisch-Singer Dynamics?

When independently raising their very long-term gloomy prospects regarding commodity prices, Hans Singer and Raul Prebisch in 1949 emphasized the two different sides of the equation. Singer’s price pessimism was based on strong beliefs about the relatively unfavourable price- and income-elasticity of demand for commodities. Prebisch suggested an asymmetry in the appropriation of productivity gains between commodity-dependent and industrialized countries. While eventual productivity gains on the former’s side were automatically transmitted into lower prices, in the latter case they were captured in the form of stable prices and rising wages and profit volumes, given the prevalence of cost-plus pricing and labour unionisation in industry.

Chart 2: Since 2009, resource prices have rebounded quicker than global economic output (Indexes). Source: McKinsey (2013).

This fit well with Prebisch’ critical views about social and political structures inherited by Latin America from its past as a leading commodity producer, as compared with the evolution toward a welfare state in advanced, industrialized US and Europe. From this came his belief that Latin America should diversify towards a manufacturing industry-based society, like other natural resource-rich advanced economies such as Canada, Australia had done.

This is not the time or the place for any evaluation of how dated or incomplete those “structuralist” views are, much less of the policy proposals that came to be associated with them over time. However, in our view, it remains useful to think of the evolution of commodity prices relative to manufactured goods as reflecting the relative paths of demand elasticity, productivity and supply bottlenecks.

Has the Descending Phase of the Super Cycle Begun?

It is worth highlighting two distinctive features of the current commodity super-cycle, the peak of which has supposedly been reached:

First, the correlation between resource prices over the past thirty years has substantially increased (McKinsey, 2013). Beyond the strong demand-pull on all commodities wrought by China’s industrialisation-cum-urbanisation, there is a higher correlation induced by the technological evolution. Natural resource-based products have risen as input and, therefore, as costs to other commodities (e.g., fertilizers in agriculture). Furthermore, substitutability between uses (e.g., sugarcane can either turn into ethanol or sugar) and sources (e.g., alternative fuels and forms of power generation) has increased, making price shock transmission more widespread.

Second, volatility has increased and continues to rise in comparison to the past (Arezki et al, 2013). This is often associated with the increased size of commodities as a class of financial assets, even if supply and demand fundamentals ultimately operate as gravity centres (Canuto, 2008). There is also some discussion of the role played by an increasing incidence of natural phenomena (floods and droughts, variable temperatures) on agriculture production, as well as the social and political factors that accompany oil, metal and mineral extraction (conflicts, labour strikes). Nevertheless, these factors are largely associated with short-term volatility.

Beyond short-term supply and price fluctuations, more structural factors seem to be at play behind the persistent volatility:

“Supply appears to be progressively less able to adjust rapidly to changes in demand because new reserves are more challenging and expensive to access. For example, offshore oil requires more sophisticated production techniques. Available arable land is not connected to markets through infrastructure. Mineral resources increasingly need to be developed in regions that have high political risks. Such factors not only increase the risk of disruptions to supply but also make supply even less elastic. As supply becomes increasingly unresponsive to demand, even small changes in that demand can result in significant changes in prices. Investors may be deterred by the volatility in resource prices and become less inclined to invest in new supply or resource productivity initiatives.” (McKinsey, 2013, p.1)

Chart 3: Commodity Prices in Real Terms (1900-2020). Source: Brahmbhatt and Canuto (2010).

At the margin, supply-side costs are still pointing upwards almost everywhere in the commodities universe, with the exception of shale gas. However, the pace of innovation and physical investment are not enough to grant the supply elasticity necessary for the price-descending phase of the super-cycle to unfold. And, as promising as the shale-gas revolution may look to the US economy in the years ahead, it seems a stretch to expect it – through substitution and correlation – to be a fully countervailing factor to rising marginal costs of other natural resource-based products.

On the other side of the equation, the current growth soft patch faced by many emerging markets does not point to any drastic future reversal of the propensity to create demand for commodities. Urbanisation and poverty reduction have remained steady in the developing world, and there is no sign of a major macroeconomic downturn beyond the recent accommodation to lower growth rates (Canuto, 2013a).

There may be different intensities of demand changes per types of commodities. For instance, China’s changing growth pattern – Canuto (2013b) – may lead to a less metal-intensive growth, but this is not necessarily the case for foodstuffs. As depicted in Chart 1, trajectories of commodity prices do not necessarily follow similar paths.

Back in Canuto (2008b), I argued that:

“If one may paraphrase Mark Twain, recent news about the death of the commodity super-cycle and of a ‘commodity bust’ were somewhat exaggerated.”

Six years later, I think this still applies.

About the Author

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

References

Arezki, R. et al. (2013). “Testing the Prebisch-Singer Hypothesis since 1650: Evidence from Panel Techniques that Allow for Multiple Breaks”, IMF Working Paper n. 13/180, August

Brahmbhatt, M. and O. Canuto (2010). “Natural Resources and Development Strategy after the Crisis”, World Bank, Economic Premise n. 1, February.

Canuto, O. (2008a). “China as a Bulwark and a Raging Bull”, Economonitor (Roubini Global Economics), February 4th.

Canuto, O. (2008b). “Three tiers of commodity price drivers”, Economonitor (Roubini Global Economics), April 21st.

Canuto, O. (2013a). “Lost in transition”, Project Syndicate, December 2.

Canuto, O. (2014). “Macroeconomics and stagnation: Keynesian-Schumpeterian wars”, Capital Finance International, spring.

Canuto, O. (2013b). “China, Brazil: Two tales of a growth slowdown”, Capital Finance International, summer.

Jacks, D.S. (2013). “From boom to bust: A typology of real commodity prices in the long run”, NBER Working Paper 18874, March.

McKinsey (2013). “Resource revolution: Tracking global commodity markets”, September.

Ocampo, J.A. and B. Erten (2013). “The Global Implications of Falling Commodity Prices”, Project Syndicate, August.

You may have an interest in also reading…

Investor Confidence in Dubai Real Estate Sets Tone for Big Year at Mid East’s Largest Property Show

Cityscape Global prepares to host more than 200 exhibitors as Dubai real estate benefits from AED50 billion investment surge in

Autism in Business: Help, or Hindrance?

What do you think the qualities of a successful business leader might be? If you were to ask this question

World Bank Group, FAO Aim to Boost Women’s Land Ownership in Central Europe

Women’s land ownership in the Western Balkans often involves a complex web of statutory, customary, and religious laws. World Bank