Evan Harvey, Nasdaq: Where the Market Stands

The stock exchange industry has been increasingly active in advocating for smart and strategic disclosure of environmental, social, and corporate governance (ESG) performance data. Investors use these non-financial metrics to evaluate the health, resilience, and sustainability of public companies. And these are no longer the niche investors—those exclusively dedicated to socially responsible investing (SRI) or impact investing. This is common practice at the largest and most diverse investment firms in the world.

The stock exchange industry has been increasingly active in advocating for smart and strategic disclosure of environmental, social, and corporate governance (ESG) performance data. Investors use these non-financial metrics to evaluate the health, resilience, and sustainability of public companies. And these are no longer the niche investors—those exclusively dedicated to socially responsible investing (SRI) or impact investing. This is common practice at the largest and most diverse investment firms in the world.

Up until recently, many investors would examine companies for ESG red flags: dependency on fossil fuels, conflict minerals in the supply chain, doing business in corrupt markets, and so on. Some investors screened out alcohol, tobacco, and firearms companies as a matter of course. But the trend has turned towards an inclusionary – or positive screening – model. In theory, this method can mitigate risk and generate alpha.

“According to a 2015 report from UBS and the Sustainable Accounting Standards Board (SASB), intangible assets have become the real drivers of company valuation.”

According to a 2015 report from UBS and the Sustainable Accounting Standards Board (SASB), intangible assets have become the real drivers of company valuation. Fluid dynamics, such as brand value, reputation, health and safety controls, are the necessary components of an investment algorithm. Asset managers believe that sustainability metrics in particular can increase operational efficiency, create more value, and boost brand equity.

The audience for this data goes beyond investors. Regulators, index providers, credit rating agencies, and even consumers are asking more questions, digging deeper into the operational efficiency of corporations. Stock exchanges are, in some very fundamental ways, the only institutions that intersect with all of these stakeholder groups – and they, too, have jumped into the fray.

The State of the Industry

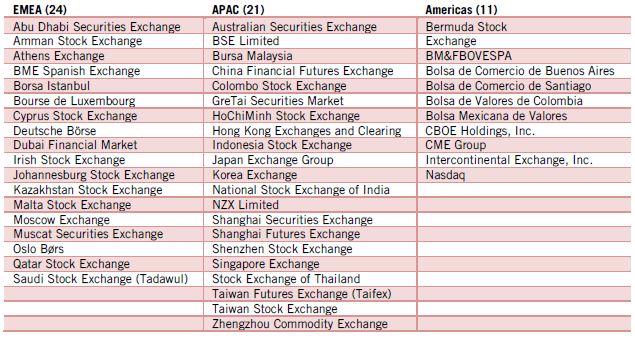

The World Federation of Exchanges (WFE), as part of its ongoing commitment to explore sustainable business practices and provide guidance to exchange members, conducts an annual survey on this topic. The most recent data (2015) was provided by 56 stock exchanges, which represents 93% of WFE members and an overwhelming majority of all the exchanges currently operating around the world. Geographically, the survey respondents represented EMEA (43%), Asia Pacific (37%), and the Americas (20%). See the table below for a complete list.

Table 1: Survey Participants

Since stock exchanges are diverse in structure and purpose, it is useful to consider the following: 38% of the exchanges listed above are themselves publically listed companies (on their own exchange); 16% are demutualised entities; and 14% are private limited companies, almost exclusively owned by their members.

When asked if they had ever received specific inquiries from investors on sustainability issues, 22 exchanges answered affirmatively. In response to this result, the WFE urged member exchanges, “to respond to this heightened investor awareness of sustainability issues by ensuring the stability, fairness, and transparency of their markets and at the same time nurture investor confidence by the provision of information.” This dynamic was central to the survey, in addition to the immediacy and acknowledgement of the perils of climate change.

Sustainability Disclosure

Many exchanges (82%) had already been engaged in some kind of sustainability-related initiative or event at the time of the survey. While most of this activity was concentrated at the larger end of the exchange spectrum, 59% of medium-sized exchanges and 51% of small exchanges concurred. Survey authors concluded that, “exchanges feel they have an important role to play in promoting and improving transparency on global capital markets.”

But when you look more closely at specific exchange practices – such as the prevalence of a listing rule or guideline related to ESG disclosure – the results are mixed. Most exchanges enforce corporate governance requirements for their listed companies, but very few go further than that. Only six exchanges had their own ESG-related listing rules on the books at the time of the survey. This number has since grown to ten exchanges. Another 26 have some related sustainability guidance, mostly driven by market regulators or local lawmakers, but most of those are voluntary disclosures. And it still leaves 24 exchanges with no rules and no explicit guidance for listed companies related to sustainability.

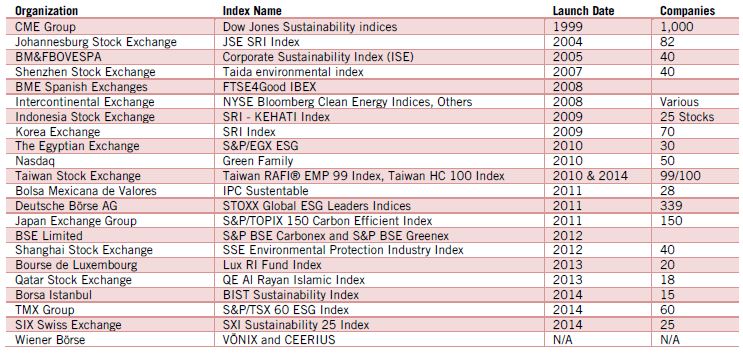

Table 2: ESG Indexes

Even the most progressive exchanges are not likely to be stewards of this corporate disclosure data. Most exchanges (84%) counsel public disclosure of the required data, either in part or in full. The survey also highlights the value of a “comply or explain” rationale; BM&FBOVESPA (Brazil) and the Johannesburg Stock Exchange both leverage this approach. It requires companies to either disclose specific metrics – GhG emissions, for example – or publish a reasonable rationale for not doing so.

Indexes

Exchanges are more than just listing venues. Many of them are also financial product innovators, especially when it comes to the indexing business. Exchanges have created or licensed thousands of indexes, but very few that depend on ESG or sustainability inclusion criteria. There were 21 such indexes in operation at the time of the WFE survey. That number has grown over the last year as well.

“It is clear from our analysis of the survey results,” the authors concluded, “that many exchanges are eager to learn more about – and play a role in the promotion of – sustainability and transparency on ESG issues.” Indeed, the WFE itself took a more active role in the promotion of ESG transparency by issuing formal guidance on the subject in late 2015. i

About the Author

Author: Evan Harvey

Evan Harvey is the Director of Corporate Responsibility for Nasdaq. He also serves on the Board of Directors for the UNGC US Network and chairs the Sustainability Working Group at the World Federation of Exchanges.

You may have an interest in also reading…

Mohamed A El-Erian: How the IMF Can Battle Gradual Irrelevance

This year, I didn’t attend the October annual meetings of the International Monetary Fund and the World Bank in Washington,

Banco Azteca: Pillar of Financial Inclusion and Innovation in Mexico

A bank that’s about people, as well as profit… Banco Azteca, a key component of Grupo Salinas, has established itself

IREIS Conference: UAE Property Market in Phase of Optimistic Consolidation

The conference at the annual IREIS (International Real Estate & Investment Show) at the ADNEC centre in Abu Dhabi is