World Debt Anchor to Keep Interest Rates and Growth Low

Debt — both public and commercial — is exploding in the US, and internationally.

Debt — both public and commercial — is exploding in the US, and internationally.

Interest rates are being kept low by the central banks. The governments in the US and southern Europe cannot afford a rise in the rates on national debt. Nor can the developed world’s private financial system.

One effect would be to decimate commercial banks’ share price by mark-to-market down their bond portfolios. A rise in nominal interest rates would reveal a vulnerable system. Several major central banks across the world share a responsibility to keep rates low and provide the liquidity to support deficit spending. The mortgage and commercial sectors are in continuous need of support.

“Debt requires sustained zero interest rates; yet followed by slow economic growth and modest inflation.”

The pandemic has merely exposed and exasperated this stale dynamic, not caused it. The good news is that even in the face of sovereign and private debts, interest rates will stay low. The alternative is an all-and-every bust scenario.

Still, prepare for modest economic growth (longer term two percent per annum is upper end of optimistic) as debt holds it back. Inflation will stay subdued, with a few sectors as temporary exceptions. Velocity (the speed at which money circulates) is slowed by excess debt as it decreases aggregate demand. Also, debt reduces available bank finance.

Debt and Deficits in the Tns

Many summers ago, in 1984, I was shocked — as youth can be — when I was taught at university that the US federal debt caused by fiscal overspending was unsustainable at $1.6 billion, coming to about 39 percent of GDP. Fast forward 37 years, and now all talk about debt and budget is in the trillions. As an example of just how much a trillion is: one trillion seconds ago would take us back to the age of the woolly mammoth.

US federal debt is currently standing at around $28 trillion in national debt. Within five years, perhaps as early as 2025, this debt will have grown to $35-$40tn according to several world-renowned economists.

With a nominal interest rate at 2.5 percent the interest expense for the government could be around $1tn per annum. The interest on US national debt was $0.4tn in 2020, which came to about seven percent of the federal budget. This year the federal budget is $5.8tn of spending or outlays. The tax revenues are budgeted 40 percent less at $3.5tn. It’s hard to see this wide budget deficit be eliminated in light of voter expectations and increased interest expenses.

With the forecast US national debt, the debt-to-GDP ratio could in a few years reach 180 percent. Some economists claim that a 100 percent ratio is the point of no return in the sense of the interest expenses only being serviceable by issuing more debt. In effect, a sort of a governmental Ponzi scheme where the debt service is paid for by issuing yet more new debt — as the interest cannot be covered by the tax revenues less the public spending.

While there is a theoretical possibility that the federal debt could be reduced relative to the size of the economy through a period of strong GDP growth and inflation. However, that may not happen as the higher nominal interest rates that had to follow such a growth scenario would sacrifice much federal spending in lieu of the higher interest bill on the national debt. Also, higher nominal rates from the Federal Reserve System (the Fed) may collapse the whole or part of the private sector financial system.

A further obstacle is that the services component has grown to 45 percent of the US GDP — and there has been no inflation for the services sector over recent decades. The services sector has a high remuneration proportion, leaving little scope for productivity growth.

But let’s not undercut future fiscal and financial innovation such as creative bookkeeping, moratoriums, new sources of government revenues, and new sources of technological productivity. Also, the growth of population is critical — a point not lost on the US immigration policies of the new Biden administration.

With a debt of $40tn, the US population (328 million) may ask themselves what happened to that money. In a few years, a family of four’s share of the national debt will be half a $million (that they “owe”) and they will have to service through their taxes. Certainly, a dampener on private consumption.

Consider the last economic crisis — 2007-8. That was in part caused by conditions set up by low rates with ample liquidity as well as light touch regulation on rating agencies, mortgage companies and investment banks. The result was the subprime mortgages, an asset price and housing bubble — and the financial system’s meltdown.

Not so different from what we are facing today. The irony is that what set up the last financial crisis was low interest rates whereas in the future it may be an increase. While the Great Recession was caused by US financial engineering in home mortgage derivatives the next crisis could be caused by non-transparent commercial real estate securities innovation. Or just that the rates go up and expose some businesses cannot afford their rent — think high street retail, shopping malls, empty offices, cinemas, hotels etc. Subsequent, the landlords and financial institutions may fold like some intertangled house of cards.

Federal Reserve system chairperson Jerome Powell and his international central bank colleagues have no alternative but to keep rates low and suck up weak corporate paper and support mortgage institutions.

QE+

The Fed under the QE programmes has expanded liquidity to $2tn per annum. This about matches the budget deficit. The sequence goes: the government (over-)spends, issues treasury bills, -notes and -bonds which the Fed then purchases.

The Fed has expanded (say QE+) its purchase mandate and major activities to also buy mortgage bonds, commercial paper, high yield bonds, and direct loans.

High yield bonds are commercial paper which includes “junk bonds” (which is a near-equity security) issued by companies such as Ford and General Motors. Under QE+ the Feds also support industries such as airlines and cruise lines with direct loans.

Corporations have used the low interest rates and central bank liquidity to load up on debt and many sectors are vulnerable.

The industry sector most supported by the Fed is the banking sector with funding rates at minus-one percent interest per annum. This means that when invested in T-paper yielding 1.5 percent p.a. the carry trade is 2.5 percent per annum return, a very benign environment. Should this negative funding rate turn to positive the whole financial system would experience a shot that it might not be able to recover from.

Recently, the inflation monster has surfaced again to dampen expansionary fiscal policies. The “post pandemic” world is experiencing rising prices in commodities. Could that be that sudden higher global demand-supply balance has to adjust after a “quiet” period with little demand and thus supply?

Wage inflation (total compensation) in the US has been subdued for decades. Wage and product inflation in the developed world will be kept in check by low-cost producers in the emerging markets and robotics at home.

However unlikely, inflation taking off would truncate the recovery. If prices rise quicker than wages, real income and any expansion suffers.

The US and thus the global financial system leave no room for increased interest rates from the Feds, nor increased market induced credit spreads. Same story in Europe. Thus, expect the rates to stay low and QE+ to keep a helping hand under the housing market and the US companies.

Rest of the Developed World

Also, the bank of England has joined the $trillion debt party that cannot afford increased interest rates. The pandemic has added $1/2 trillion to the UK national debt. For the next 12 months, double this to an even $1 trillion, as the UK government is borrowing £1.06bn per day since the pandemic struck.

Europe’s ECB has kept deposit rates negative for over two years. While the ECB is lacking in transparency, it’s not lacking in support for the commercial banking system. It’s fair to assume that should base rates, sovereign, and commercial rates as well as credit spreads rise the European banking system would be under assault. Banks are being subsidised with negative funding rates and can carry trade that into long government bond paper — and are thus heavily exposed. The first to go would be the share prices of the major German, Spanish, Italian and other banks.

For decades, Japan’s economy has been one of minuscule growth, low rates, and little inflation. Japan’s national debt has risen, and its debt-to-GDP ratio is currently standing at 256 percent.

Expect that across the developed world the indebtedness will counter intuitively keep a lid on interest rates. And — also counter intuitively — the low interest rates will not spur growth and inflation. The high amounts of debt serve as an anchor.

There may be an innovative financial solution out there.

You may have an interest in also reading…

Looking for a Fig Leaf: US & UK Mull Punitive Action against Syria

Here we go again. The US and Britain are whipping themselves once more into a frenzy over the actions of

New Business-Registration Portal Goes Global

A new web portal has been launched to help companies directly access, and assess the user-friendliness of, business registration websites

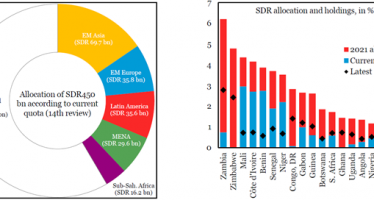

Rescue by Helicopter Reserves

The world woke up on Monday 23 with higher international reserves for all countries. A new allocation of US$650 billion