Otaviano Canuto: Economic Recovery From the Pandemic May Come to Resemble a Square Root

Signs of recovery in various parts of the global economy started in May, after the depressive dip imposed by Covid-19.

Signs of recovery in various parts of the global economy started in May, after the depressive dip imposed by Covid-19.

They emerged after the easing of restrictions on mobility and reflected policies of flattening the recession curve (income transfers to part of the population, credit lines to vulnerable companies, and others).

Far from giving back the GDP lost in all countries, there are doubts about the strength of the recovery. There is a similar sequence in each country, but there are differences due to the rhythms of the pandemic, and the effectiveness, magnitude, and time scale of the policies to flatten the recession curve.

The pace of the pandemic matters not only because of the possibility of returning restrictions on mobility, but also because it affects customer behavior. It is not by chance that the signs of recovery are stronger in the manufacturing industry and weaker in the service segments that involve an agglomeration of people.

Take, for example, China – the “first in, first out”. Its GDP grew 3.2 percent per year in the second quarter, above expectations but still leaving the level of its GDP with a decline of 1.6 percent in the first half of the year. On the other hand, retail sales disappointed. It should be the only large economy to show growth at the end of the year (one percent), but well below its pre-Covid trajectory.

It is worth noting that the Chinese resorted to the growth-cum-debt policy that was applied after the global financial crisis of 2008-09. That led to concerns about its financial stability. Recent drops on Chinese stock exchanges were echoed on Wall Street and in Europe.

In the United States, the recent Federal Reserve Bank report —the “beige book” — showed increased activity in all districts, but again far from pre-Covid levels. Industrial production rose 5.4 percent in June, to a large extent due to the normalisation of production of vehicles and auto parts. High-frequency indicators for services, however, show lower levels than before the pandemic.

Employment levels rose in May and June (two and three million, respectively). To a large extent it was the reversal of temporary layoffs, accompanying the return of mobility. The group of permanently unemployed job seekers increased by two million.

In Europe, the dive caused by Covid-19 was deeper than in the US, and the recovery has been faster. Industrial production fell 29 percent in March and April, regaining 14 percent in May. But, like in China and the US, with services lagging.

Now take Brazil as a reference for emerging markets. The fall in GDP in the second quarter was less than expected, partly because the emergency aid disbursed by the federal government until the end of May was larger than the losses in the wage bill to date. Doubts arise, however, regarding positive surprises in the second half of the year, not least because everything will depend on the pace of recovery of informal employment at the end of emergency transfers in August.

In the second half of the year, everything will depend on the pace of new virus infections, as this will continue to negatively affect the economy. Consumer behavior tends to reflect that, regardless of a possible return to mobility restrictions.

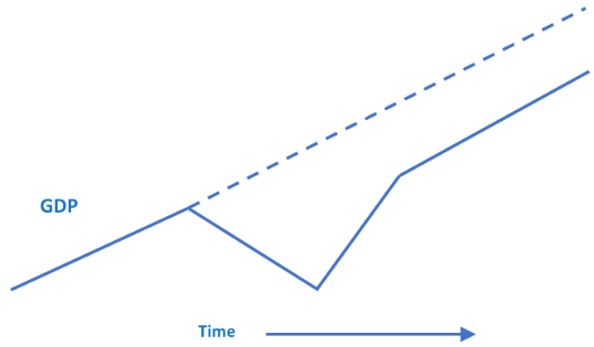

What will be the shape of the economic recovery curve in the different cases? Will any country have a “V”, that is, the return of the economy in a short time to the previous trajectory after suffering a strong blow during the pandemic? Or a “U”? Perhaps a “W” if new outbreaks of Covid-19 appear and new rounds of mobility restrictions are established?

Probably the square root sign illustrates the most likely scenario, with some recovery of the lost GDP but not a return to the previous trajectory. The surge in demand, previously pent-up, is momentary and exhaustible. It is not possible to compensate for dinners in restaurants or trips that did not occur during restrictions. Additionally, as observed in all countries, the fear of physical proximity and restrictions on the occupancy of supply capacity will keep limits on the recovery of services.

The collapse in economic activity will leave scars in terms of closed firms and jobs that will not return. Fiscal restriction walls impose limits on the duration of policies to flatten the recession curve. It is not by chance that almost all economic projections suggest national GDPs at the end of next year will still be below last year’s levels — except, perhaps, for China and India.

Success in crossing the coronavirus crisis will be measured by the proximity, but not return, to the previous GDP trajectory. The task will be to deal with structural unemployment created by changing consumption patterns, increased levels of poverty in much of the world, the concentration of income, the challenges posed by digitalisation and the trend to relative deglobalisation.

One should add the need to move toward a green recovery. The calculation of the square root will depend on the policies applied in each country.

Otaviano Canuto is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, and principal of the Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil.

First appeared at the Policy Center for the New South

You may have an interest in also reading…

Cartica’s Triple Threat: Three Women Leading the Way on Emerging Markets and ESG

Teresa Barger had a dream: to build an investment firm with high-performing individuals and passionate investors who put the needs

Kristalina Georgieva, CEO of the World Bank: Empowering Communities

Worldwide, around 500 million people live in “fragile situations,” mostly caused by armed conflict. Climate change threatens to add another

Mr Putin Spills His Coffee Reading the Morning Paper

Where is a leader when you need one? He is probably jogging around the White House with his running-mate Joe