Right Place, Right Time, Right Attitude: Dutch Firm, Orange Capital Partners Plays Its Cards with Skill

Since its first acquisition in 2014, Amsterdam-based Orange Capital Partners (OCP) has been on a roll.

Set up by two former Goldman Sachs executives, Victor van Bommel (founder and CEO) and Hedde Reitsma (CIO) the company employs 55 people at its offices in Amsterdam, Dublin, and Copenhagen.

Orange Capital Partners main investment strategies are European residential and Dutch convenience retail. Residential accounts for 75 percent of its €4bn portfolio, with the remainder invested in two retail mandates.

The company is better known for its drive in the residential sector, but its left-field move into convenience retail in 2016 proved timely.

Its first residential venture in 2014 was backed by a US state pension fund. The strategy focused on the Amsterdam market, which was lagging behind most European capitals recovering from the Global Financial Crisis. Within three years, OCP had grown to dominance.

“The first few years were good fun,” says Van Bommel. “We were new kids on the block in a market dominated by local families, traders, and housing corporations. The market was completely shut down by a lack of liquidity. We were the first company to invest institutional capital.

“When the dust settled, we owned a substantial portfolio in Amsterdam. We were in the right place at the right time.”

The founders realised that building a best-in-class team was crucial for success. “We didn’t want to be a one-trick pony, so we invested in our team and our culture. We hired people from all walks of life: former athletes, bankers, creatives, real estate people. We laid the foundations of what we are today.”

With a focused and dedicated team, the company quickly became known as a diversity outlier in an industry historically perceived as homogenous. “We employ 14 nationalities, and a third of our employees are female. The diversity brings us creativity, and fresh perspectives.”

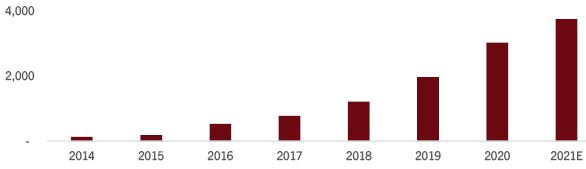

AuM Development. Numbers in EUR (millions).

Out-the-box thinking and that contrarian view paid-off when OCP acquired a €300m convenience portfolio in 2016. Casper Vernooy, former multi-CIO and partner at OCP, said it had been a rare marketplace opportunity. “Due to the paradigm-shift to online spending, the entire retail sector was under pressure,” he says. “After a thorough analysis, we took the view that convenience retail represented exceptional value. When the right opportunity arose, we took our chances and invested in the sector. We stabilised the portfolios, repositioned assets — and today we’re selling in a very strong market.”

Following the recovery of the Amsterdam housing market, OCP was forced to sell its residential portfolio to CBRE Investment Management in a €400m deal in 2017. “Due to our success, our partner wanted to take their chips off the table. Unfortunately, we had to start all over again.”

A New Vision

This interlude changed OCP’s way of thinking about partnership structures, and the wider residential opportunities in Europe. A fragmented residential market, a shortage of housing, and underinvestment in the sector created a perfect opportunity to take a fresh approach.

“Our vision was to create a pan-European housing company,” says Van Bommel, “a credible brand, supported by strong governance, that will still be around in 30 years.” That vision only could be achieved with the right partners, who shared OCP’s longer-term view of the residential sector. In 2017, it closed a new partnership backed by a sovereign wealth fund.

Game Changer

It was another game-changer. Following a string of acquisitions in the Netherlands, Ireland and Denmark, OCP’s residential portfolio grew to include 8,000 apartments by 2021. Offices were opened in Dublin and Copenhagen. OCP managing partner Hedde Reitsma says people always say real estate is a local business, but “we strongly believe that scale benefits are much more important for residential companies”.

Technology and innovation are key differentiating factors, he says. “Do you really think that in 10 years’ time, we will still use external property managers and leasing agents? The entire process will be digitalised, and the living experience for our customers will be revolutionised.”

OCP has ambitious targets to grow its portfolio to €10bn by 2025, with the Nordics, Germany and Poland on the list. “Scale allows us to in-source processes and invest significant sums in innovation and technology,” says Reitsma. “It will create tenant platforms, and all services that come with it. Besides this, we have set firm targets to make all our assets energy-neutral.”

Challenges

One central challenge of a competitive market is to source the correct product. OCP focuses on quantitative modelling by evaluating data for investment decisions.

From a macro perspective, OCP invests only in markets that are supported by favourable demographics, a healthy supply- demand balance, and good affordability compared to ownership. On a micro level, location, apartment types and regulatory environment play crucial roles.

OCP partner Joris Voorhoeve says that by combining entrepreneurial and analytical skills, the company has built a solid track record for closing deals. “Even in the uncertain Covid times, we stood firm at our bids. Reputation does make the difference in sourcing deals. We have built a very strong network in the market, based on trust and respect.”

Success

The innovative housing company is rapidly moving forward. Next year, Orange Capital Partners will launch a housing brand, further in-source operations, and digitalise operational processes. “We are blessed with an incredible energetic and focused team of professionals. It’s undoubtedly the biggest asset we have,” says Victor van Bommel. “One of our key focus points will be to sustain our corporate culture while pursuing our growth ambitions.”

“We push ourselves every day to be the best in what we do — but we need to do it together.”

You may have an interest in also reading…

Bank One Ltd: From Africa, for Africa, with a Wealth of Regional Understanding

In its 12 years of existence, Mauritian-based Bank One has built a strong reputation — regionally, and way beyond its

QNB ALAHLI: Covering All of a Country’s Financial Needs — but Never Losing that Personal Touch

QNB ALAHLI, established in April 1978, is the second-largest private bank in Egypt, and one of the country’s leading financial

FBS: Sharing ‘Inside Line’ and Tech Advances with Clients

FBS has been successfully operating in the Forex market since 2009 – and sharing its accumulated expertise with more than