SBM Securities: Major Changes and a Surge in Capabilities

SBM Securities Ltd, the stockbroking arm of SBM Group and one of the leading brokers in Mauritius, is undergoing a huge transformation.

SBM Group Chairman: K.C. Li | CEO SBM (NBFC) Holdings Ltd: Kris Lutchmenarraidoo | Head SBM Capital Markets Ltd: Anoushka Bhuttoo

With the various entities operating under the SBM Non-Banking Financial Cluster (SBM NBFC), the SBM Group has embarked on harmonising its structure within the new regulatory framework of the Non-Banking space.

With SBM Capital Markets Ltd established and the first Investment Banking License issued from the Financial Services Commission, the SBM Group will transform into a regional financial force serving the Indian Ocean and the Indian Ocean rim, and a key player in the Asia-Africa corridor.

SBM Group is one of the country’s most important banking and financial services institutions. With a market capitalisation of MUR18.2bn ($510m) at end of March 2019, the group’s holding entity, SBM Holdings Ltd, is the third-largest listed company on the Stock Exchange of Mauritius.

The SBM Group has been instrumental in laying the foundations of a solid Mauritian economy since its inception in 1973. Over time, as the financial needs of the population have evolved, the Group has introduced fund management, stockbroking, and registry through the creation of different subsidiaries.

In 2014, in line with international best-practice, the SBM Group separated its activities under different clusters: banking, non-banking, and non-financial.

Building from its strong franchise in Mauritius, SBM Group has started its African foray in May 2017 with the purchase of Fidelity Commercial Bank in Kenya. It further consolidated its Kenyan business in August last year through the acquisition of the carved-out assets and liabilities of Chase Bank Limited (in Receivership). This took SBM Bank Kenya into a strong Tier 2 position in the country.

In India, the SBM Group is the first foreign bank to operate under a Wholly Owned Subsidiary mode. The focus is to tap into the growing trade flows and investments within the Asia-Africa corridor.

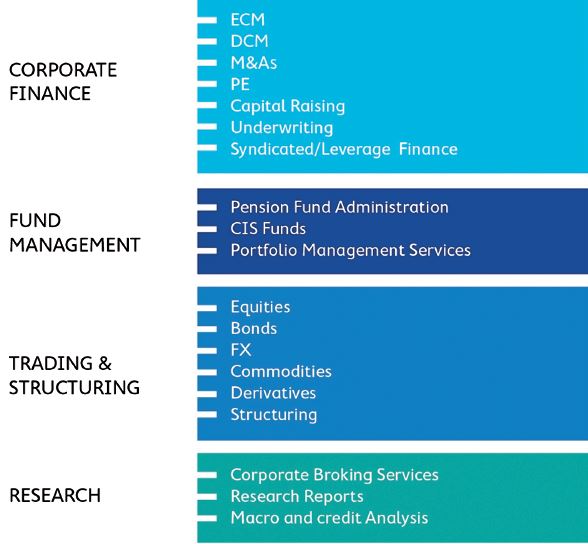

Identified as one of the most promising clusters to bring a positive contribution to the bottom line of the group, the SBM NBFC has evolved and added the services of insurance agency, leasing, and factoring to the existing services: stockbroking, fund management, portfolio management services, registry, fund valuations, structuring and corporate finance advisory.

The renewed focus by SBM Management led to the establishment of SBM Capital Markets Ltd. It was the first entity to be granted an investment banking license by the Financial Services Commission.

SBM Securities Ltd will amalgamate with SBM Capital Markets Ltd. SBM Mauritius Asset Management Ltd will keep only its CIS funds and become a subsidiary of SBM Capital Markets Ltd while the pension fund management and portfolio management services will move to SBM Capital Markets Ltd.

SBM Capital Markets Ltd can operate as an investment bank, serving clients within the various banking entities of SBM Group. It is expected that the increased synergy and cross-selling will bring better value-added services to clients while improving the bottom-line.

The SBM NBFC cluster is capitalising on some key achievements over the past two years to bring its investment bank to new heights.

Key achievements include:

Lead advisor and arranger for listing of Depository Receipts of AfreximBank on the Stock Exchange of Mauritius (fund raising of $166m)

Advisor for set-up of SBM Mauritius Infrastructure Development Company Ltd, structured financing for Government and infrastructure fund (arranging $500m)

50 percent over-subscription for the capital raise for the SBM US dollar and Mauritian Rupee (MUR) bonds in 2018

Lead arranger and advisor for issue and listing of SBMH MUR1.5bn and $65M bonds

Lead arranger for MUR1.5bn Secured Notes Programme for Sugar Investment Trust.

Triple Whammy:

the People at the Top of Vibrant Group

Mauritian economist KC Li, the independent non-executive chairman of SBM Holdings, has held several prominent positions in the public sector.

He was advisor to the Minister of Finance and Chairman of the Stock Exchange Commission. He launched the first Unit Trust and the first property fund in Mauritius in 1989. Li was also board member of the State Trading Corporation, the National Remuneration Board, the National Economic and Social Council, and the University of Mauritius.

In 1992, Li started his own private consulting firm, and served as consultant to the United Nations Economic Commission for Africa (UNECA) and the UN Industrial Development Organisation (UNIDO). In 1993, he founded the Mauritius International Trust Co (MITCO), one of the first professional firms licensed to provide international tax and investment advisory services in Mauritius.

Li was also a member of the Parliament of Mauritius from 2010 to 2014, and sat on its Public Accounts Committee. He sits on the board of directors of several emerging markets and hedge funds, including private equity, infrastructure, and real estate funds in Africa and Asia.

He also sits on the board of the State Insurance Company of Mauritius (SICOM) and Afreximbank.

The CEO of SBM (NBFC) Holdings Ltd is Lakshmana (Kris) Lutchmenarraidoo. He is a seasoned banking professional with over 40 years’ experience across the banking and financial services sectors. During the 13 years (1973 – 1986) he spent at SBM, Lutchmenarraidoo held various positions across the bank, including branch manager, head of Internal Audit, and assistant general manager.

He then moved to occupy senior positions in prominent entities such as Mauritius Leasing Company, Mauritius Post, Mauritius Post and Co-operative Bank, La Prudence Mauricienne Assurances, and Mauritius Union Assurance Co. More recently, he was the group managing director at Phoenix East Africa Assurance Company based in Kenya, supervising operations there and in Tanzania, Uganda, and Rwanda.

Lutchmenarraidoo holds a banking diploma from the FinAfrica Institute in Milan, Italy.

The head of SBM Capital Markets Ltd, the investment bank of SBM Group, started out from a sales and marketing background. Reedhee (Anoushka) Bhuttoo joined the stockbroking world in 2006.

She is a director of the Stock Exchange of Mauritius (SEM) as well as a director of the Central Depository and Settlement Co (CDS). She was also the president of the Port Louis Stockbroking Association.

Bhuttoo holds a BA (Hons) in Economics (First Class) from the MS University of Baroda, India, which she attained following a scholarship from the Indian government. She also studied for the professional Post Graduate Diploma in Marketing from the Chartered Institute of Marketing, and is an Associate Member of the Chartered Institute of Securities and Investment.

A key milestone in Anoushka Bhuttoo’s career has been the structuring of, and capital raising for, the Afreximbank depositary receipts issue – a first on the African continent, whereby funds were raised in Africa, for Africa, by Africa. i

You may have an interest in also reading…

BLKB: Regional Bank that Favours a Future-Orientated Approach

What impact do corporate actions have on individuals, society and the environment? Can we take responsibility for the world we

Norvestor: Seeing — and Seizing — the Full Potential of ESG

Private equity firm Norvestor has partnered with Nordic businesses for more than three decades. It has offices in Oslo, Stockholm,

CFI.co Meets the MD of Curinde, Jacqueline Jansen, and Her Dynamic Team: Curaçao’s Booming Business Parks are in Safe Hands

Curinde is the operator and developer of three business parks in Curaçao. Jacqueline Jansen was born and raised in Curaçao,