Bullish on Chile: Elections Prompt New Thinking

Copper Mining

Copper is set for a price rebound. Manufacturing output in China is up more than analysts predicted and that country’s growing demand for refined copper has significantly decreased global stockpiles. Copper prices have already recovered from this year’s low of $7,155 per metric ton and rose 8.2% in the third quarter.

This is excellent news for Chile where state-owned mining company Codelco in October unveiled plans to invest at least $4bn annually over the next five years to open new mines and increase output at existing pits. Earlier this month, mining minister Hernán Solminihac said he expects copper production levels to grow by 5% or more annually, keeping pace with demand as Europe emerges from its recession and Chinese manufacturing picks up.

The ups and downs of the global trade in copper are monitored carefully by most Chileans. While the country has successfully diversified its economy over the past thirty-odd years, copper mining still represents fully 20% of GDP and accounts for nearly 60% of exports. Chile’s growth rate closely tracks the copper price on the world commodity markets with the country suffering two consecutive quarters of GDP contraction in early 2009 as the red metal lost over half of its value.

“Earlier this month, mining minister Hernán Solminihac said he expects copper production levels to grow by 5% or more annually, keeping pace with demand as Europe emerges from its recession and Chinese manufacturing picks up.”

Since then things have improved significantly. As Chileans head to the polls on Sunday, November 17, to elect a new president, the economy is humming along nicely allowing most of the nine contenders to promise voters the coming of a welfare state that trumps anything ever seen in Latin America. This year, GDP is expected to grow 5.7% while unemployment levels and inflation are kept in check. Next year, the economy is forecast to expand 4.5%.

This enviable performance may suffer on the outcome of the election. A columnist for Chile’s leading daily El Mercurio earlier this week kicked up a dust storm with the contention that too much social democracy will inevitably lead to Chile losing its competitive edge. Writing in Forbes Magazine as a guest columnist, Alex Kaiser accused front-runner Michelle Bachelet of following the populist path beaten by the late Venezuelan president Hugo Chávez: “Bachelet’s new socialist platform promises to make radical changes to the current Chilean economic system.”

Mr Kaiser, executive director of the free market think-tank Fundación para el Progreso, argues that Michelle Bachelet’s plans to rewrite the Pinochet-era constitution will herald the end of Chile’s economic miracle: “Bachelet proposes to create a massive welfare state that provides all sorts of benefits to the people and will replace the market as the main engine of economic growth with government-led industrialization.” Even Steve Forbes himself got into the fray that followed, tweeting – somewhat less coherently – that US president Obama must feel “delighted” about a free market bastion “falling to socialism.”

Analysts with less of an ideological axe to grind are far less pessimistic. A recent report by JP Morgan Latin America Equity Research concluded that the policy platform of Ms Bachelet’s centre-left New Majority coalition is “surprisingly moderate” and does not contain any proposals that would alter the fundamentals of Chile’s economic system. JP Morgan analysts concluded that Ms Bachelet’s ideas are rather timely as the country still leads Latin America when it comes to income inequality and wealth distribution.

Public opinion polls place Ms Bachelet firmly ahead of the pack with 47% of the vote. Runner-up Evelyn Matthei of the centre-right Independent Democratic Union (UDI) is stuck at slightly over 22% of voters’ intentions.

Previously, Ms Bachelet occupied the presidency of Chile between 2006 and 2010. Her administration is generally considered to have been exceptionally successful. She left office with the highest approval rating of any Chilean president ever.

Pundits now expect a repeat performance. Guillermo Larraín, economics professor at the Universidad de Chile, argues that Chile has progressed so far in its development that the country is ripe for the sort of social reforms made decades ago by developed nations and which resulted in a new economic impetus. “We need to give a fresh impulse to our development by addressing the social inequities that still linger. Far from damaging, this process could in fact set an agenda for taking Chile’s development to the next level. The growth-at-all-cost model has now run its course and seems exhausted. New thinking is required.”

OECD secretary-general José Ángel Gurría agrees. During a recent visit to Chile, Mr Gurría ruffled a few feathers by drawing attention to the country’s skewed social makeup. In fact, Chile displays the greatest inequality gap of any member state of the Organisation for Economic Development and Cooperation. While offering lavish praise for Chile’s economic performance, the near absence of corruption, the quality of governance and the country’s competitive prowess, Mr Gurría cautioned that social imbalances may yet undermine future growth prospects.

Meanwhile investors remain bullish on Chile. While the IPSA index of the Santiago Stock Exchange has lost 9.23% of its value over the past year, it has recovered some of that lost ground in the last month. Most analysts expect the rally to continue no matter the election’s outcome. Just last month, the Chilean Central Bank unexpectedly cut its benchmark interest rate by 25 basis points to 4.75%. That cut may signal the start of an easing cycle that well could take the interest rate down to 4%; weakening the peso, contributing to an uptake in direct foreign investment and decreasing the balance of payments deficit.

You may have an interest in also reading…

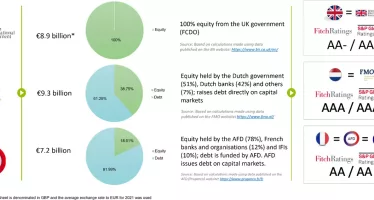

OECD: The Funding Models of Development Finance Institutions

The drum beat of reform is increasing for the development system and particularly for the Multilateral Development Banks (MDBs). While

James Zhan, UNCTAD: Investment – In Need of Direction

Fragmented, incoherent investment policies, and regulatory uncertainty are dampening investor confidence in an economic environment already fragile and bruised by

UN-Backed Project to Help Colombian Farmers Move Away from Illicit Crops Towards Fair Trade Chocolate

A sweet new partnership between the United Nations, the Colombian and Austrian Governments and a renowned chocolate manufacturer is slated