The Swiss Never Miss When it Comes to Perfecting Trade Finance Solutions

Over three decades of experience in developing solutions for the trade finance community.

MIT Make Intuitive Tech SA (MITech) is a Swiss-based fintech firm specialising in the development of banking software solutions for the trade finance community.

Founded in 1984 with clients in Europe, Asia, the Middle East and US — small, middle and top-tier banks. The family-owned business has a unique success story, a perpetual innovation cycle, high customer loyalty and low staff turnover.

And — lest we forget — 100 percent integration success.

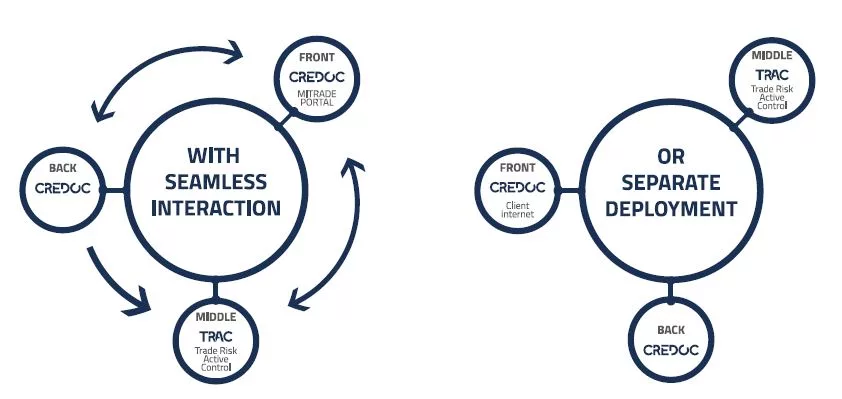

It features three main products: Credoc 5G, TRAC, and MITrade Portal powered by Komgo’s Konsole. Credoc is a user-friendly back-end trade finance solution application for trade finance and document business departments. TRAC (Trade and Risk Active Control) is a middle-office commodity trade finance collateral management system, while the MITrade Portal offering is a front-end customer connect trade finance solution.

“Intuitiveness” is the company mantra, and the MITech team has over 30 years of experience. It is comprised of banking professionals and software engineers who contribute to the development of turn-key solutions for the banking industry.

Credoc and TRAC are available on several platforms with an open and modular architecture allowing their implementation in all types of financial institution.

Range of Services

- Consultancy

- Integration with bank IT infrastructure

- Project management

- Analysis and development

- Training

- Maintenance and support

The firm has won recognition from financial institutions around the world, says President Paul Cohen-Dumani. “Our product line automates every layer of a trade commodity finance organization’s operations.”

For the back-office, Credoc is the complete trade finance package. The MITrade portal is a “white-labelled” web solution that connects clients and banks via the web. Also, for the middle-office is TRAC, supporting transactional commodity finance and structured trade finance.

Credoc covers all the aspects of the sector: Import and export documentary credits (including international and domestic stand-by L/C’s, outward and inward guarantees, import and export document collections, reimbursements (confirmed and unconfirmed), loans and advances, and discounts.

Based on MITech’s 5G proprietary framework, Credoc relies on a service-orientated architecture using adaptable workflow, layout, and rules-based engine components. It can run on various market standard operating systems, application servers, and databases.

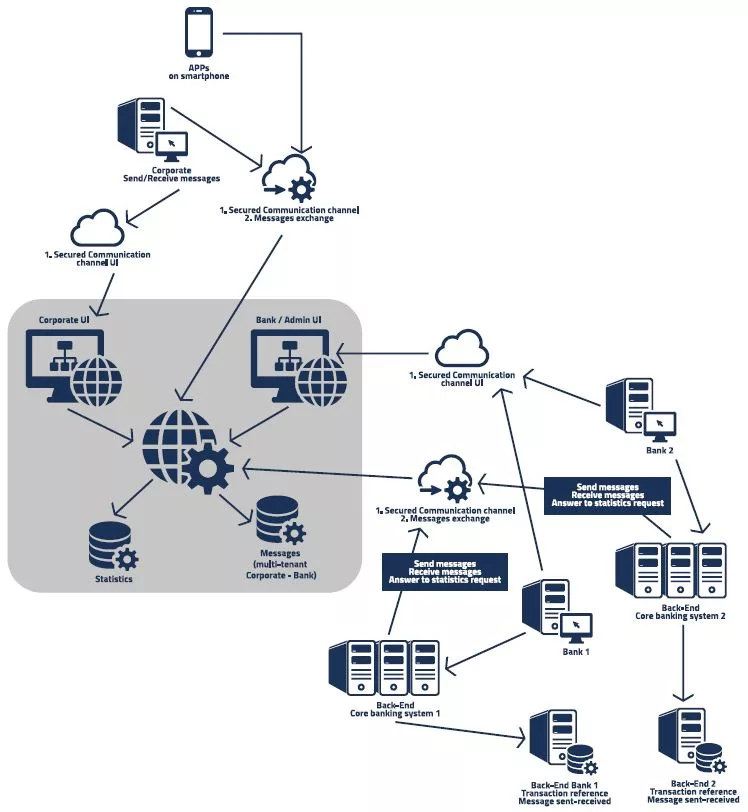

Credoc incorporates full telecommunication environment, such as SWIFT (in and out), , email, and remote customer access.

The comprehensive and fully automatic accounting facility includes contingent liabilities and financial accounting based on “Report Of Event”, a clear and open concept.

There is automatic calculation of fees, charges, interest rates for discounts (including to-yield rates). A step-by-step security concept covers all aspects of the business, and validation may be applied at any step of the process.

Flexibility allows any bank or institution to deal with document and trade finance business.

An advanced MIS engine enables the personalization of statistics and reports, corporate-to-bank messaging, and widget capability.

MITech features true multi-bank, multi-branch, multi-time-zone, multi-language and multi-currency software architecture.

Credoc’s open and modular architecture allows it to be implemented in any financial organisation, and enables seamless integration with all financial infrastructure. Communication is via FTP, MQSeries to webservices, and APIs.

Several implementation scenarios can be envisaged from a “model bank” to toolkit deployment.

TRAC is aimed at trade commodity finance relationship managers, credit risk managers, and top managers who want to track and monitor risks and collaterals. The software replaces the Excel worksheets so widely used in the sector.

The application covers transactional and borrowing-base follow-up of portfolios of active customers’ credit facilities, monitoring of credit limits, sub-limits, covenants, and deviations for individual and group customers.

Account balances per customer and integration is within margin calculation, with collateral follow-up and management related to the lifecycle of a transaction.

Risk assessment and monitoring of credit facilities allow multiple purchases and sales per transaction, the management of vessel information, and control — all based on a bank’s specific standards.

There is follow-up of storage facility per transaction with relevant locations: Built-in BI/reporting facility, multi-commodity applications, risk price monitoring “mark-to market”, with possibility to combine several prices (fixed, floating, hedge, alloy, and complex formulae).

There are graphic chronometers per category of risk (storage inland, prefinancing, transit, B/L), and hedge monitoring at credit facility level with a breakdown at transaction level.

The built-in workflow transaction approval system has a dashboard view for easy, real-time management, a warning management facility per customer (credit limits override, collateral due-date expiry, documentation follow-up, and margin management).

All formats of imaging capability such as jpeg, pdf, Word and Excel are supported. There are also:

- Diary per transaction or customer’s position

- Price charts per commodity

- True multi-branch and multi-bank architecture.

Solutions can be hosted or installed in any type of organization.

The MITrade portal allows bank customers to deal in documentary business from any location. It has the features one would expect from such a tool, as it can be activated via the Internet.

MITrade portal can with integrated to Credoc or any other back-office system.

MITrade portal includes:

- Openings requests of import/export documentary credit

- Amendment requests/acceptance/refusal of import/export documentary credit

- Openings requests of guarantees

- Amendment requests/acceptance/refusal of guarantees

- Openings requests of import/export collections and direct collections

- Amendment requests/acceptance/refusal of import/ export collections and direct collections

- Discrepancy advice

- Query on the status of documents (processed/unprocessed, issued/not issued…)

- Statistics on files between customer and bank

- User profiles (password and language management)

- Template management (creation of reusable templates)

- Security (Visa and access rights management)

- Visualisation of sent and received messages

- Two-way communication facility

- Query on documents choosing multiple criteria

- Clause management

You may have an interest in also reading…

SteadyPay Embedded Microfinance Fintech: Safety Net for the Gig Worker

SteadyPay, the award winning FinTech, is at the forefront of delivering accessible and innovative financial solutions for independent workers in

Mowgli Foundation Report: Mentoring Achieved Return on Mentoring Investment (ROMI) Returns of 890%

The Mowgli Foundation publishes a report that highlights the Return on Mentoring Investment (ROMI) and economic generation impact achieved through

France: Touch and Go

So far this year, Europe’s centre ground has held firm – sort of. After Dutch populist Geert Wilders in March