European Investment Bank: Investment Plan for Europe

Investment Plan for Europe – Paradigm Shift in the Use of Public Resources

Author: Werner Hoyer

The Marshall Plan did much to inject life into the post-war recovery of Europe. Initially comprising $13 billion, mostly in direct aid, the plan constituted a substantial economic stimulus package for war-torn European countries. In addition, the Marshall Plan was one of the first elements of European integration, as it erased trade barriers and set up institutions to coordinate the economy on a continental level. This built the framework for the many years of almost unbroken post-war economic growth that were to follow; and for productivity gains and industrial expansion.

The economic success of the Marshall Plan supplied the spark to set a political chain reaction in motion. In 1957, the Treaty of Rome was signed, which launched the European Economic Community. This was followed by several waves of enlargement, the introduction of the single market, and the economic and monetary union, which became the foundation of a stable and growth-friendly economic environment that supported the success of Europe´s economy and people’s jobs for many years.

However, with the advent of the digital revolution in the 1990s, productivity growth in the EU began to slip behind that in the US and other leading trading partners. This trend has undermined the comparative ability of European firms to compete and to provide rewarding jobs and a high standard of living. Low comparative productivity and misallocation of investment, alongside many structural weaknesses, also explain why the global crisis hit Europe so hard, and why EU-wide recovery still presents such a challenge.

“Added together, the investment gap, aggravated by an increasing innovation and competitiveness gap, amounts to several hundred billion euros a year – which gives a clear indication about the challenge Europe is facing today.”

Principal among the causes of the continued malaise has been a massive investment shortfall, with private sector firms unwilling to commit to new spending in an unfavourable climate, and public expenditure dramatically slashed by years of fiscal consolidation.

Added together, the investment gap, aggravated by an increasing innovation and competitiveness gap, amounts to several hundred billion euros a year – which gives a clear indication about the challenge Europe is facing today.

Investment Plan for Europe

In order to regain its competitiveness, Europe’s economy requires a concerted approach that looks at enabling factors as well as direct innovation performance and sufficient access to finance for economically desirable modernisation investments. This is where the Investment Plan for Europe (IPE) comes into play. It consists of three components:

- Support for strategic investment without increasing public debt

- Promotion of investment through improved advisory services

- Removal of barriers to investment.

The first and probably most prominent part of the IPE is the European Fund for Strategic Investments (EFSI). This is an EU initiative launched jointly by the European Commission and the EIB Group, comprising the European Investment Bank (EIB) and the European Investment Fund (EIF), to assist in overcoming the current investment gap by mobilising private financing for strategic investments and SMEs.

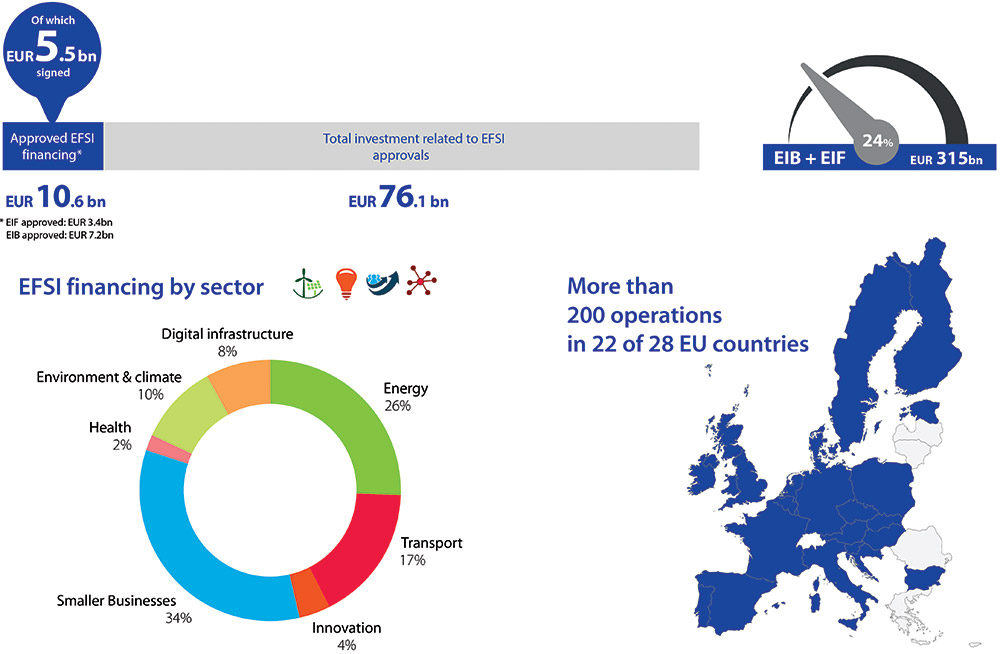

Despite its name, EFSI is not a separate fund or a legal entity in its own right but a contractual arrangement between the commission and the EIB, consisting of an EU guarantee of €16 billion complemented by an EIB capital contribution of €5 billion. It is expected that EFSI support will secure around €60 billion of additional financing by the EIB Group thus further triggering a total of €315 billion in investment in the union over a period of three years.

EFSI allows the EIB Group to do considerably more than it did in the past in terms of financing innovative, higher risk projects. This will enable the group to address market gaps and encourage other financers, public or private, to participate, unlocking investment that is currently slowed down or hindered by economic uncertainty. Emphasis will be put on key sectors identified under the EFSI regulation, although it needs to be stressed that no geographic or sector quotas apply.

Hence the focus will be placed amongst other things on:

- Transport, energy and the digital economy;

- The environment and resource efficiency;

- Human capital, culture and health;

- Research, development and innovation; and

- Support for SMEs and mid-caps.

To achieve this, EFSI has two components: An Infrastructure and Innovation Window (IIW) to be deployed through the EIB; and an SME Window (SMEW) to be deployed through the EIF to support SMEs and mid-caps.

The EIB Group will also continue to develop new tailored products to address specific market failures, based on a needs assessment. The main benefits of EFSI are that the EIB can offer:

- New products (notably in subordinated debt/equity-type financing);

- Scalable risk-sharing instruments with commercial banks as well as national promotional banks; and

- Financing for new client groups (e.g. in the field of mid-caps, turn-around financing).

- As speed is of the essence, the EIB and the EIF rapidly deployed teams to identify potential projects for EFSI support. This was possible due to the group’s decision not to wait for the EFSI governance structure to be put in place, but to start with the roll-out as quickly as possible through the so-called warehousing of projects – still complying with the legislative process, but accelerating all efforts to get the job and growth engine started.

So far, the EU Bank’s governing bodies have approved 54 projects with a volume of €7.2 billion which should support total investment of around €30 billion.

Of these projects, the majority consists of renewable energy, energy efficiency, and other investment that contributes to low-carbon growth. The others include investment in R&D and industrial innovation, digital and social infrastructure and transport, as well as access to finance for smaller businesses.

In parallel, the European Investment Fund is delivering impressive results benefiting smaller businesses as part of the Investment Plan for Europe. The EIF has already signed more than 150 operations, with total financing under EFSI of €3.4 billion which is expected to trigger more than €45 billion of investments.

Some 125,000 SMEs and mid-caps throughout the European Union are expected to benefit. This clearly demonstrates that the crowding-in of capital works. EFSI increases the EIB Group’s capacity to perform this catalytic function. Through EFSI, the EIB will encourage the launch of economically valuable projects, making them attractive for wary investors, and giving economic recovery a boost at a critical juncture.

EFSI No Silver Bullet

However, the European Fund for Strategic Investments is not a silver bullet that bridges the investment and innovation gaps. EFSI needs to work within the context of the other two strands of the Investment Plan for Europe. Europe needs to better structure projects in order to attract promoters and investors.

The new European Investment Advisory Hub (EIAH), offering a single point of entry, will help identify bottlenecks and build the knowledge and capacity needed to get good projects going, in particular through reinforced use of financial instruments and improved access to finance.

The other key condition for the success of the Investment Plan for Europe is, that Europe needs to improve the overall investment environment by cutting red tape, simplifying regulatory frameworks, and deepening the single market – because market integration is the backbone of Europe’s prosperity. In order to preserve its strength, Europe must return to the global innovation frontier.

Conclusion

Europe has ample strengths: the diversity of its people, an abundance of intellectual, scientific and technological capacities, and a rich history of intellectual and business endeavour.

To rebuild its competitiveness and return to long-term sustainable growth, Europe has no choice but to rigorously implement the Investment Plan for Europe. The EIB Group will ensure that investments are only channelled to commercially sound and economically and technically viable projects in sectors that are critical to Europe’s competitiveness.

The means are there. The EU Bank is the world’s largest international public bank with a balance sheet of more than €550 billion. In 2015, EIB Group financing totalled a record €84.5 billion. The EIB alone lent €77.5 billion, supporting nearly 500 projects and catalysing almost €230 billion of investment. The EU has a powerful instrument in its hands to pursue its political goals.

This is imperative because restoring Europe’s competitiveness is central to re-embarking on the EU success story of cohesion, convergence, and prosperity that began with the Marshall Plan – with the one key difference today that Europe is using public resources in a much more efficient manner, not as grants and subsidies, but as loans and guarantees. This marks a true shift of paradigm in the use of scarce public resources which the EU Bank has advocated for many years and which is of truly fundamental importance.

About the Author

Werner Hoyer is the president of the EIB and the chairman of its board of directors, and has been for the last four years. Prior, Mr Hoyer served as minister of state (Deputy Foreign Minister) at the German Foreign Office, responsible for Political and Security Affairs, European Affairs, United Nations and Arms Control, and as commissioner for Franco-German Cooperation. Also, he has been the deputy chairman and Foreign Affairs spokesman of the FDP (Free Democratic Party) parliamentary group in Germany.

Mr Hoyer holds a PhD in Economics from Cologne University where he has also been an associate lecturer in international economic relations. He has researched at UCLA in the US. He is married with two children.

About EIB

The EIB is the European Union’s bank. EIB is the only bank owned by and representing the interests of the European Union member states and as such works closely with other EU institutions to implement EU policy. EIB is as the largest multilateral borrower and lender by volume, a major player. EIB provides finance and expertise for sound and sustainable investment projects which contribute to furthering EU policy objectives. More than 90% of the activity is focused on Europe but EIB also supports the EU’s external and development policies.

About EIF

EIF is part of the EIB group and supports Europe’s SMEs by improving their access to finance through a wide range of selected financial intermediaries. To this end, EIF designs and implements equity and debt financial instruments which specifically target SMEs. EIF fosters EU objectives in support of entrepreneurship, growth, innovation, research and development, and employment.

You may have an interest in also reading…

Green Bonds: How Active Management Aims to Make the Most of a Dynamic Sector

The market for financing linked to environmentally friendly projects and companies has already reached $1trn by some measures and we

FACRA: How Investors Can Help Build SMEs in Angola – The Missing Middle

By any measure, small and medium sized enterprises (SME’s) form a crucial part of any nation’s economic success. Typically, SME’s

Malpass Shows Pragmatism and Relevant Smarts in his New Role

Some critics see the nomination and election of the new president of the World Bank, David Malpass, as a continuation