Rubrics Asset Management: Core Values and Transparency Help Maintain Investor Confidence During Pandemic

CIO: Steven O’Hanlon

Rubrics Asset Management is an independent boutique investment manager, specialising in providing actively managed fixed-income strategies for institutional and private clients.

Since its inception in 2001 as part of a wealth management business, Rubrics has developed a process and delivered a track record based on the core principles of capital preservation and medium- to long-term return focus.

Rubrics’ portfolios are not constrained by benchmarks, which enables the investment to focus on areas of the global fixed-income universe that offer the most attractive risk-adjusted returns. Each of the products was developed within a risk framework designed to control volatility and limit drawdowns over time, delivering robust returns across a variety of market conditions.

The investment team places a strong emphasis on macro considerations as the ultimate drivers of risk and performance across each of the funds. Unlike bulkier, more benchmark-orientated strategies, Rubrics has demonstrated flexibility and conviction to position portfolios in line with the firms’ broader view and risk appetite. This has enabled the funds to deliver strong relative performance over time, particularly on a risk-adjusted basis.

Rubrics’ products cover the broad fixed-income universe, including worldwide government, credit and emerging markets debt, with each fund housed within an Irish UCITS umbrella. Hoping to build on this success, Rubrics has launched an Irish Collective Asset Management Vehicle (ICAV) and authorised a new fund to capitalise on higher yielding opportunities in the corporate fixed-income space. The fund is authorised as an Alternative Investment Fund (AIF), and is aimed at professional investors.

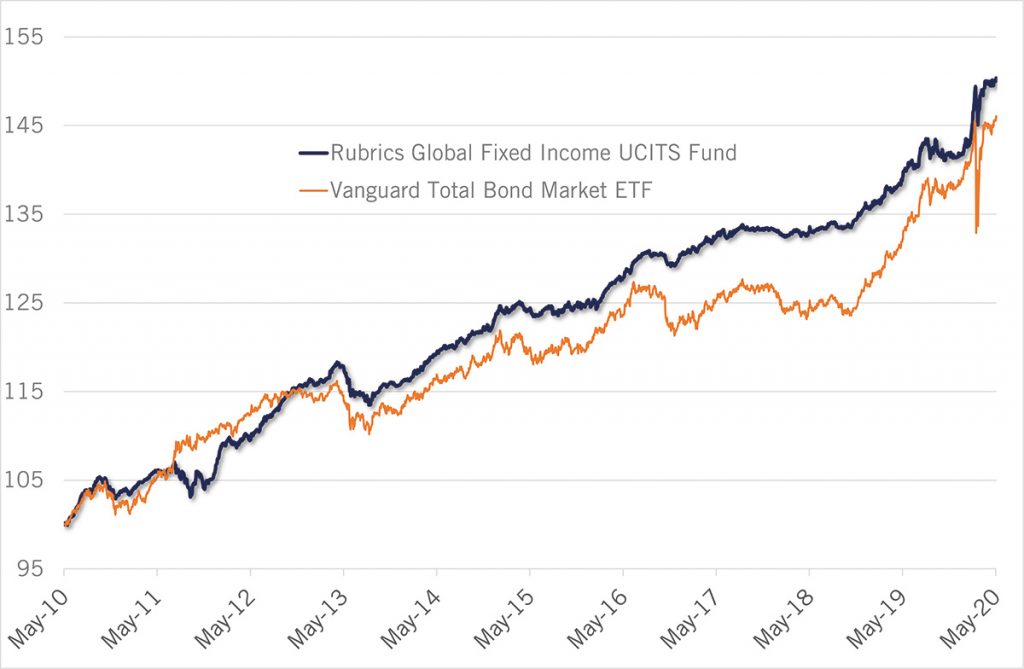

Rubrics prides itself on its ability to deliver an investment experience that differentiates itself from other (often larger) asset managers and ETF providers. In keeping with the investment philosophy of capital preservation and strong performance across the investment cycle, Rubrics Global Fixed Income UCITS Fund was a top performer in its peer group throughout the period of volatility caused by COVID-19, while other key investment offerings (Rubric’s Global Credit UCITS Fund and Emerging Markets Fixed Income UCITS Fund) delivered similarly strong relative performance throughout a challenging period.

Also valuable during the pandemic, and fundamental to Rubrics’ wider offering, is its ability to remain accessible to clients to share market and macro insights, and to provide transparency on product performance and positioning. This strategy helped the company to maintain the investor confidence it has earned during a period of extreme market volatility.

10 Year Performance: Rubrics Global Fixed Income UCITS Fund vs Passive Fixed Income Strategy

You may have an interest in also reading…

CFI.co Meets the Head of Responsible Investments at Nordea Asset Management: Sasja Beslik

Sasja Beslik, head of Responsible Investments at Nordea Asset Management, spends a fair chunk of his time on the road

CFI.co Meets the CEO of Raiffeisen Centrobank: Wilhelm Celeda

Being part of Raiffeisen Centrobank (RCB) more than twenty years, Wilhelm Celeda knows best what his company stands for: “RCB

Alexander Forbes Group: Three Strategies for Growth

Alexander Forbes Group Holdings Limited, a specialised financial services group headquartered in South Africa, successfully listed on the main board