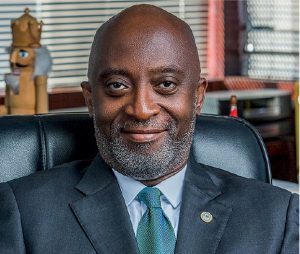

CFI.co Meets the CEO of Ghana Investment Promotion Centre: Yofi Grant

CEO: Yofi Grant

Yofi Grant is currently chief executive officer of the Ghana Investment Promotion Centre. He was appointed by President Nana Addo Dankwa Akufo-Addo in February 2017. Mr Grant is a renowned Ghanaian investment banker with over thirty years of experience in banking and finance. Having served in various capacities in corporate finance and advisory, and corporate banking and marketing, Mr Grant has accumulated broad knowledge in, and great exposure to, the international finance markets and cultivated strong relationships with international private equity funds, portfolio and investment managers, and brokerages. He was responsible for the development and implementation of AAF SME Fund LLC, one of the largest agriculture SME funds in Sub-Saharan Africa and helped achieve its first close of $30 million.

Mr Grant is a council member of the Continental Business Network of the African Union which advises African governments on private sector finance and infrastructure and has served in many directorship roles in both the public and private sector. As a partner in the Databank Group, he also served as director in the following subsidiaries of the Databank Group: Databank Agrifund Manager, Databank Financial Services, and Databank Brokerage Services. In 2009, he was the executive director for Business Development for the entire Databank Group. In 2002, Mr Grant was a consultant on finance and business for the Africa Asia Business Forum (AABF) organised by the UNDP which run workshops in twelve African and six Asian countries. Additionally, he has been in senior advisory roles and led many of the ground-breaking transactions in Ghanaian and other African capital markets.

Mr Grant is partner and co-founder to a number of companies including Grant Dupuis Investment, a real estate investment advisory firm, and Coldwell Banker Ghana, a company which holds the master franchise license for Coldwell Banker – part of the Realogy Group in New Jersey, US, the world’s largest real estate organization – for Ghana and Nigeria. In addition to this, he founded Praxis Fortune Calibre, a firm that offers general business advisory and consulting services across the continent.

Mr Grant holds several supervisory board mandates in private sector companies in the telecommunications, commodities, and education sectors and has also played many policy advisory roles for government, particularly in private sector development. He was chairman of Ghana Telecom (One Touch) and the Listing Committee of the Ghana Stock Exchange, amongst other prestigious organisations.

Mr Grant was also special advisor to the minister for Private Sector Development between 2002 and 2007 where he advised and assisted the minister with policy formulation and implementation and also on financing for private sector development projects. He currently serves on the advisory boards of the ministry for Foreign Affairs and Regional Integration, the Ghana Export Promotion Authority (GEPA), and is a member of the Ministerial Private Public Partnership Approval Committee of the ministry of Finance and Economic Planning.

As the CEO of the Ghana Investment Promotion Centre, which reports to the Office of the President, it is Mr Grant’s singular vision to make Ghana the ‘best place to do business in Africa’. He lives by the guiding principles of honesty, integrity, and a constant search for solutions, and is a fellow of the Aspen Global Leadership Network’s African Leadership Initiative, West Africa.

You may have an interest in also reading…

Dr Manny Pohl: A Survivor With a Cool Head and a Knack for Long-Term Investment

As a survivor of the 1987 stock market crash and the 2008 Global Financial Crisis, Manny Pohl has learned the

Cristina Junqueira, Nubank Co-Founder: Brazil’s Wonder Woman of Fintech

When the first Nubank card transaction was made in Brazil on April 1, 2014, you wouldn’t have been a fool

CFI.co Meets the CEO of JSW Energy: Sanjay Sagar

Mr Sanjay Sagar is the Joint Managing Director and Chief Executive Officer of JSW Energy Limited. An alumnus of Modern