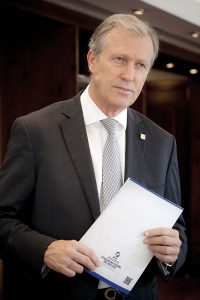

CFI.co Meets the Executive President of CABEI: Dr. Nick Rischbieth

CEO: Dr. Nick Rischbieth

Dr. Nick Rischbieth, Executive President of the Central American Bank for Economic Integration (CABEI), holds a Bachelor’s Degree in Economics from Rice University in Houston, Texas; a Master in Business Administration from Washington University in St. Louis, Missouri; and a PhD in Finance from the Institute of Money and Capital Markets of the University of Hamburg in Germany.

Prior to joining CABEI in 1995, Dr. Rischbieth held several key positions within the Financial Division of Dresdner Bank in Germany. His experience in Germany led him to be named as Treasurer of the Central American Bank for Economic Integration in 1995 to eventually become the Bank’s chief financial officer. In 2007, he was appointed vice-president of CABEI, a position which he held for two years until he was elected as CABEI’s executive president for a five-year period that began in 2008. In 2013 he was re-elected for another five-year period as CABEI’s executive president, becoming the first president in the Bank’s history to be elected for a second term.

During his first period as CABEI’s executive president, Dr. Rischbieth led the implementation of a modernisation plan that would lay the groundwork for a new capitalisation scheme aimed at increasing the bank’s relevance for the Central American region. As a dedicated promoter of human development initiatives to increase the impact of the bank’s operations in the region, in 2010, Dr. Rischbieth supervised the implementation of a development impact assessment tool (I-BCIE) that is used to measure the bank’s contributions to the MDGs and the SDGs.

In his second term as CABEI’s executive president, Dr. Rischbieth has taken strategic decisions that have made the bank evolve into a new and dynamic institution ready to face the challenges of an ever-changing economic and financial outlook. The approval of amendments to CABEI’s Constitutive Agreement by the board of governors in 2015, can be described as one of the main and critical decisions taken by the bank throughout its history. These amendments seek to consolidate CABEI’s preferred creditor status; strengthen its capital base to become more attractive to new members; and diversify its geographical loan portfolio. Specific results of this strategic decision were immediately seen with an increase in capital by the Republic of Panama and the Dominican Republic, a change in status by Belize, and improvements in CABEI’s credit rating to stand as the third best in Latin America.

Dr. Rischbieth’s commitment to have a new bank that complies with the highest international standards led CABEI to reform its environmental and social policy and governing instruments. These and other reforms allowed CABEI to become an international observer of the United Nations Convention on Climate Change and obtain its accreditation to the Adaptation Fund and Green Climate Fund between 2015 and 2016.

Dr. Rischbieth was born in Tegucigalpa, Honduras, in 1954 and is a father of two children.

You may have an interest in also reading…

UniCredit’s Roberta Marracino: Banking with a Social Impact

Determined to help shape the post-pandemic ‘new normal’, UniCredit is stepping on the accelerator to redouble its efforts at sparking

CFI.co Meets the Management of Masthaven Bank: Andrew Bloom & Jon Hall

A poster in the kitchen of Masthaven Bank’s busy head office off London’s Oxford Street reads: ‘Happiness lies in the

Kathrein Privatbank: Investing Today in the Trends of Tomorrow — with Panache

For Kathrein Privatbank, 2021 was all about innovation. In addition to adopting a new brand identity, it worked intensively on