The Twilight Zone of Fiscal Stimulus

Now in its second iteration, the corona pandemic no longer inspires the blind fear it did just six months ago. Governments are taking stock of the damage wrought and have begun exploring ways to repair economies derailed by lockdowns, social bubbles, travel restrictions and other emergency measures.

Now in its second iteration, the corona pandemic no longer inspires the blind fear it did just six months ago. Governments are taking stock of the damage wrought and have begun exploring ways to repair economies derailed by lockdowns, social bubbles, travel restrictions and other emergency measures.

A consensus is building around the rather novel idea that this recession must be addressed by a strong and sustained fiscal stimulus. Austerity has become a dirty word and is only mentioned, if at all, as a distant mirage – a sort of utopian vision of a future reckoning when the budget hawks may be uncapped to hunt down big spenders.

Whilst funds are being sourced and plans hatched, policymakers wrestle with the political dimension, and framing, of the coming spending spree. This week, or more precisely on Sunday, September 13, a few people remembered to either celebrate or lament the fiftieth anniversary of the publication, in The New York Times, of an essay that changed the world.

In The Social Responsibility of Business Is to Increase Its Profits, Professor Milton Friedman (1912-2006) of the University of Chicago unleashed the economic doctrine that would form the bedrock of the neoliberalism that was to come, embodied by Ronald Reagan in the US and Margaret Thatcher in the UK, alongside countless minor players who eagerly jumped on the bandwagon.

Just a single year after Woodstock, and whilst Karl Marx was being dusted off and put on a pedestal and anti-war protesters were rocking the world, Friedman sparked a true revolution. His words, thoughts, and advice transformed the make-love-not-war hippy generation into a pack of rapacious wolves that plundered capitalism by ripping up the fabric of societies and raiding corporate icons.

The rejection of any and all social values in business would ultimately give rise to the ‘Greed Is Good’ generation of the 1990s and beyond. Wolves of Wall Street, such as market manipulator par excellence Ivan Boesky and junk bond king Michael Milken, were not merely crooked but possessed a philosophical excuse for their misbehaviour – one kindly handed to them by Friedman: the pursuit of profit trumps any other consideration.

The Professor’s Discrete Debt

Echoes of Friedman’s lectures resonate in renewed calls to stop the march of zombie companies – a term that has been broadened significantly to include almost any business in a legacy sector that has dipped too deep in debt. In June, The Financial Times warned policymakers against funding a ‘corporate twilight zone’. Simultaneously, the venerable newspaper appeared to suggest a reappraisal of ‘creative destruction’ as eloquently proposed by US-Austrian political economist Joseph Schumpeter (1883-1950) – to whom Friedman owes a debt of discrete gratitude.

The question before policymakers is actually not complex, though its answer may have far-reaching consequences: use the present crisis, and the fiscal stimulus already decided upon, as an opportunity to disrupt, innovate, and creatively destroy, or make a safe bet by helping quasi-zombies survive and revive.

Though the classification lacks a clear and uniform definition, zombies may include up to 16 percent of all companies in Germany – some 550,000 ‘living dead’. The number was produced by risk management agency Creditreform. According to research conducted by Bank of America in July, the UK presently accounts for fully one-third of all zombie companies in Europe. Since March, when the viral outbreak gathered speed, the country’s tally of ‘living dead’ businesses has increased by 26 percent as the hospitality, food, recreation, arts, and entertainment sectors took severe hits.

In the US, an estimated 15 percent of the companies included in the Leuthold 3000 Universe subsist in the twilight zone – up almost 3 percentage points over last year. Corporations of nearly all sizes and ratings have inundated the bond market to raise a total of $1,919 trillion so far this year, sailing at speed past the 2017 record of $1.916 trillion (for the entire year). The binge trickled down into junk bond territory and was fuelled by opportunistic issuers eager to secure long-term (non-emergency) funding at rock-bottom rates. In June, yields on investment-grade US corporate bonds dipped below the 2-percent mark for the first time in living memory.

The Basel-based Bank for International Settlements (BIS) found that during the first eight months of this year, non-investment grade corporations issued a whopping $322 billion in fresh debt – a volume equal to the whole of 2019. BIS data suggests that a fair number of older zombies received – paradoxically – a new lease on life for which they may thank the novel virus. The BIS based its finding on the most accepted definition of a zombie: a business that is consistently unable to cover its debt servicing costs with its EBIT (earnings before interest and taxes).

Swap for Growth

As governments in Europe prepare to wind down support schemes and mechanisms, grandees from the world of high finance are pushing debt-for-equity swaps. Baron Leigh of Hurley in the Royal County of Berkshire, a life peer of the British House of Lords who entered this world 61 years ago as Howard Darryl Leigh, has been particularly active in advocating for such swaps which, he says, provide a win-win: businesses benefit from interest-free liquidity whilst banks may recoup a larger part of their credit portfolio. Former Chancellor of the Exchequer George Osborne even suggested wiping the slate clean for small- and medium-sized businesses that took on corona debt.

However, the plans presented by Leigh and Osborne do not solve the plight of the zombie behemoths whose final passing could spell trouble to undercapitalised banks. The trouble with a proliferation of zombies is that their mere existence discourages innovation and the exploration of novel paths to sustainable growth. Allowing these failing companies to deal with reality, and founder sooner rather than later, would entail a (probably far from creative) destruction of equity which, as an event, will send shockwaves through the financial world – and possibly bring the carefully constructed house of cards down.

Yet, the flipside of this argument offers little to no solace either. It would imply a post-pandemic normal that is neither new nor sustainable. When faced with such conundrums, policymakers have a at their disposal an unusually effective instrument: a can that can be kicked down the road. Thus, the consensus emerging from the pandemic does not so much involve a nascent agreement on the preferred economic model but is limited to the volume of fiscal stimulus to be supplied: a lot.

Which sectors are to benefit remains, at least for the moment, a canned question. However, fiscal support usually comes with a few political strings attached: the late professor’s dictamen that business is only about profits has been relegated to the dustbin, fifty years after it was formulated.

Zombies such as legacy airlines and steel mills may be kept alive on the taxpayers’ dime, but must adapt their operations to the new normal – one that has not been brought about by a viral disease but by the now almost universally recognised need to observe the boundaries imposed by a planet of finite resources. After the pandemic has petered out – as it must eventually – it is time to restore nature’s health as well and undo the damage caused by Friedman’s, in hindsight, rather unidimensional and simplistic philosophy regarding the role and place of business in society.

You may have an interest in also reading…

Interest Rate Hike Key to Turkey’s Economic Fortune

Amidst the cacophony produced by Messrs Trump and Jinping, the drumbeat of a small war was almost drowned out. Last

World Bank on Sustainable Recovery: The Need for Long-Term Financing

The COVID-19 pandemic is affecting every country’s health system and economy to a degree not seen for a century or

Otaviano Canuto: Shapes of the Post-Coronavirus Economic Recovery

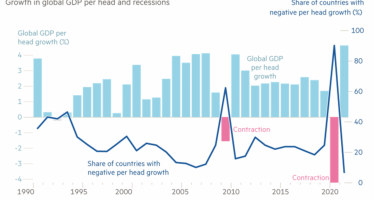

Data recently released on the first-quarter global domestic product (GDP) performance of major economies have showed how significant the impact