Embracing Disruption: The Path to ‘Insurance for All’ by 2047 – by IRDAI Chief Debasish Panda

IRDAI Chairman Debasish Panda stressed the need for insurers to adapt to disruptions and aim for ‘insurance for all’ by 2047.

In a recent address at a global actuaries conference, IRDAI Chairman Debasish Panda highlighted the imperative for insurance companies to innovate and adapt in the face of technological disruptions. With India’s digital footprint expanding rapidly, Panda emphasized the need for leveraging data to provide personalized experiences, underlining the shift away from traditional ‘one-size-fits-all’ policies.

He pointed out the critical role of actuaries in this transformation, urging the sector to adopt agility and dynamism. Technologies like blockchain, AI, and machine learning are not just altering the landscape; they’re setting new standards for efficiency, fraud detection, and customer engagement.

Panda’s vision for 2047 is not just a goal but a roadmap for insurers to thrive by predicting and meeting customer needs through innovative products and channels. This new era demands that insurance players not only anticipate change but become architects of it, ensuring that the journey towards ‘insurance for all’ is not just aspirational but achievable.

Insurance 2047: Artivatic Innovating as Enabler for Insurance 2047 for All

Read Article here published by Economic Times.

Beyond the Traditional: As Panda emphasized, the “one-size-fits-all” approach is fading rapidly. India’s massive digital footprint, boasting over 850 million internet users and 750 million smartphone users, generates a wealth of data waiting to be tapped. Customers readily share this information, seeking personalized experiences in return. Insurers who cling to traditional methods risk irrelevance, unable to predict needs and deliver tailored offerings through the right channels.

Embracing Dynamic Change: Panda urges insurers to move beyond their “conventional roles” and embrace dynamism and agility. This requires viewing the sector through a new lens, one that welcomes innovation and disruption.

The Actuarial Role in a Disruptive World: Recognizing the crucial role of actuaries in navigating these changes, Panda highlights their responsibility in designing future-proof insurance products and driving industry growth. They must break free from traditional models and embrace new data sources and analysis methods to accurately assess risk and design relevant products.

Technology as a Disruptive Force: Emerging technologies like blockchain and AI are already transforming the industry. Blockchain-enabled smart contracts are streamlining claim settlements, while AI and data analytics enhance fraud detection. The Internet of Things (IoT) holds immense potential, allowing for real-time risk assessment and personalized coverage based on individual behavior.

The Urgency of Adaptation: Panda’s message is clear: adapt or risk extinction. Those who fail to “underwrite disruptions” will struggle to survive against agile competitors who predict customer needs and deliver the right product through the right channel.

The Road Ahead: The journey towards “insurance for all” demands a fundamental shift in mindset. Insurers must actively collaborate with technology companies, embrace new risk assessment models, and develop innovative products tailored to diverse customer segments. By harnessing the power of disruption, the industry can unlock its potential to offer financial security and peace of mind to every individual.

This article merely scratches the surface of the exciting transformations underway in the insurance industry. As technological advancements accelerate, the conversation will continue to evolve, demanding continuous adaptation and innovation from all stakeholders. The ultimate prize is a future where everyone has access to the protection and peace of mind offered by insurance, a future truly realized through embracing the power of disruption.

It recognizes the necessity of leveraging technological advancements to democratize insurance access, enhance customer experiences, and streamline operations.

Artivatic.ai: Spearheading Innovation

Artivatic.ai stands at the forefront of this transformation, embodying the shift towards data-driven and customer-centric solutions. Their work spans various critical areas, including:

- Artivatic Further Revolutionizing Insurance: Embracing Clinical Data for Personalized Product Design and Underwriting: Smart personalized underwriting in insurance utilizes advanced analytics and diverse data sets, including alternative and location data, to tailor policies to individual risk profiles. This approach leverages information such as lifestyle habits, health records, and geographical data to offer customized insurance products. By integrating these data sources, insurers can more accurately assess risks, leading to optimized pricing, enhanced customer satisfaction, and improved risk management. This innovation marks a shift towards more dynamic, data-driven strategies in the insurance industry, ensuring policies are more aligned with the specific needs and risks of each customer.

- Intelligent & augmented Onboarding platform: The policy buying journey for a customer in today’s digital age involves a streamlined and interactive process. Initially, customers research and compare different insurance policies online, leveraging tools and platforms that provide comprehensive policy comparisons and reviews. Once a suitable policy is identified, the customer often undergoes a digital onboarding process, which may include providing personal information, undergoing risk assessments, and receiving personalized quotes. Advanced technologies such as AI and data analytics enable a more customized and efficient experience, guiding customers through the selection of add-ons or adjustments to coverage based on their specific needs. Finally, the purchase is completed online, with digital documentation and immediate policy activation, enhancing convenience and accessibility for the customer.

- AI Sales Enablement and Intelligence: By utilizing AI and data analytics, Artivatic.ai enhances sales strategies, enabling insurers to identify and capitalize on emerging market opportunities more effectively. Artivatic.ai’s MiO Platform, an AI Sales Engine, revolutionizes sales enablement and intelligence for insurers by integrating advanced AI, data analytics, ML, speech recognition, OCR, and India Stack. It automates sales processes, CRM, and communication, offering product recommendations and enhancing sales strategies. This platform enables effective identification of market opportunities, improving sales conversion, analytics, and agent-to-customer interaction. Connected technologies such as ABDM, IIB, and account aggregation tools further streamline the sales ecosystem, making it more efficient and customer-centric.

- AI Fraud Intelligence: Leveraging advanced algorithms and machine learning, Artivatic.ai significantly improves the capability of insurance companies to detect and prevent fraudulent activities.

- Data-Driven Product Design & Pricing: Tailoring insurance products and pricing models based on comprehensive data analysis ensures more accurate risk assessment and customer-centric offerings.

- Adapting to Change: Artivatic’s No-Code Rule Configurator for Dynamic Insurance Products: Artivatic’s dynamic/no-code rule configurator is designed to cater to the ever-evolving needs of products and customers. This tool enables insurers to swiftly adapt and update their offerings without requiring extensive coding knowledge. By simplifying the customization of rules and processes, Artivatic ensures that insurance products can be quickly aligned with changing market demands and individual customer preferences, significantly enhancing the responsiveness and flexibility of insurance services.

- Claims Experience Improvement: Streamlining the claims process not only enhances operational efficiency but also significantly improves customer satisfaction. Improving the claims experience involves integrating systems like NHCX/IndiaStack with advanced AI technologies, such as GenAI, to streamline and personalize the claims process. This approach enhances efficiency, accuracy, and customer satisfaction by leveraging real-time data, automating assessments, and providing tailored support throughout the claims journey.

- Customer Reach and Top-Line Growth: Innovative strategies powered by Artivatic.ai’s technologies facilitate broader customer outreach and engagement, contributing to revenue growth.

- Low-Cost Insurance Delivery Technologies: By optimizing operations and leveraging digital platforms, Artivatic.ai enables insurers to reduce costs and offer more affordable products. Artivatic.ai’s strategy for low-cost insurance delivery focuses on utilizing digital technologies and optimizing operations to streamline the insurance process. By integrating AI and machine learning, operational efficiencies are significantly enhanced, allowing for the automation of underwriting, claims processing, and customer service. This not only reduces operational costs but also improves the accuracy and speed of service delivery. Digital platforms facilitate direct engagement with consumers, further reducing overheads associated with traditional distribution channels. The result is more affordable, accessible insurance products tailored to meet the diverse needs of consumers, enabling insurers to expand their market reach and provide value to a broader audience.

- Healthcare and Wellness Recommendations: Integrating healthcare data allows for personalized health recommendations, promoting preventive care and wellness. Integrating healthcare data for personalized health recommendations is at the core of Artivatic.ai’s NiO health app. This platform aims to revolutionize health advocacy by offering a suite of features including health recommendations, a health locker for secure data storage, health consent management, OPD services, personalized health insights, and wellness programs. By leveraging AI and machine learning, NiO intends to deliver a comprehensive health and wellness ecosystem tailored to individual needs, encouraging preventive care and fostering a proactive approach to health management.

- Data Augmentation and Product Recommendation: Enhanced data analytics capabilities enable more accurate customer profiling and product recommendations, aligning offerings with individual customer needs.

- Facial Recognition and Partnership Enhancements: Technologies like facial recognition not only improve security but also streamline onboarding processes, while digital tools foster stronger partnerships and collaborations.

- Insurance in a BOX – Connected Insurance : The PRODX Distribution “Insurance in a Box” revolutionizes how insurance products are offered, integrating a single API to distribute across platforms like fintechs, banks, and brokers, and planning for future Bima Sugam connectivity. It extends to embedded insurance, allowing seamless, relevant coverage within customer journeys, enhancing convenience and value. This unified solution facilitates connections for risk management, underwriting, claims, servicing, and utilizes data intelligence, making it a holistic tool for modern insurance distribution and embedded insurance offerings.

Artivatic.ai’s core innovation lies in its utilization of data intelligence, marking a paradigm shift in how insurance and healthcare services are designed, delivered, and experienced. This approach not only addresses current challenges but also anticipates future needs, ensuring the industry remains resilient, responsive, and relevant.

Bima Sugam is envisioned as a dynamic transaction and connected platform, designed to revolutionize the insurance sector in India. It aims to streamline the insurance buying and selling process, making it more accessible, efficient, and transparent for consumers and providers. By integrating various stakeholders on a single platform, Bima Sugam facilitates easier policy management, claims processing, and provides a consolidated marketplace for insurance products, enhancing the overall customer experience in the insurance ecosystem.

The synergy between visionary leadership and cutting-edge innovation, as demonstrated by Debasish Panda’s goals and Artivatic.ai’s initiatives, underscores a transformative era for the insurance industry. By embracing these disruptions, the sector can ensure it not only meets the ambitious target of “insurance for all” by 2047 but also sets a global standard for innovation, inclusivity, and customer empowerment in the digital age.

Interested to know more about Artivatic and its offering /innovations for Insurance & healthcare to make vision for 2047, write to [email protected]

You may have an interest in also reading…

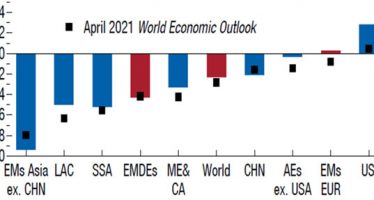

Permanent Output Losses from the Pandemic

In the World Economic Outlook, published October 12, the International Monetary Fund (IMF) slightly lowered its forecast for global economic

Investors Depart as Tech Stocks Come Under Assault

Zoom zonked out this week. Investors dumped shares in the videoconferencing service during a wholesale selloff that drove the company’s

Why are US Conservatives Against Investment in ESG?

Republicans balking at ‘woke liberal agenda’ that they claim could erode profit margins and threaten livelihoods US politicians are treating