Paolo Sironi, IBM: Mind the Gap Between Small-Medium Businesses and Their Banks

Financial services are adapting to better serve SMEs, but a gap remains between what banks offer and what these businesses truly need.

Financial services are particularly susceptible to fluctuations in macroeconomic conditions, as starkly illustrated by the 2008 financial crisis in which interest rates dropped sharply, affecting banks’ profitability worldwide. Banks play a vital role in the economy by facilitating the efficient allocation of financial resources. However, when banks encounter difficulties, the consequences ripple throughout local and international ecosystems.

Author: Paolo Sironi

This has significant implications for small and medium-sized enterprises (SMEs), which are particularly vulnerable to economic fluctuations, funding costs, and credit availability. As the backbone of the global economy, SMEs make up 90 percent of all firms globally, employ approximately 70 percent of the world’s workforce, and contribute about 50 percent to global GDP. Despite their pivotal role, these enterprises are often overlooked by banks, which can be discouraged by the substantial costs involved.

The Organisation for Economic Co-operation and Development (OECD) estimates that SMEs pay a significant risk premium relative to larger corporates when borrowing from financial institutions—up to 300 basis points in major advanced economies and 1,000 basis points in emerging markets. This is because of the higher costs required to serve SMEs, including the manual processes needed to collect and aggregate information on SME financials and economic situations. The lack of standard data also makes it harder to calibrate risk management models, forcing banks to charge a higher premium.

Today, banks are uncovering new opportunities to improve their services by leveraging data and AI to compete in SME markets. However, there remains a gap between what bankers perceive as competitive value and what SMEs truly need. Recent research by the IBM Institute for Business Value highlights this discrepancy, based on a global survey of nearly 700 banking executives and more than 1,200 SME owners.

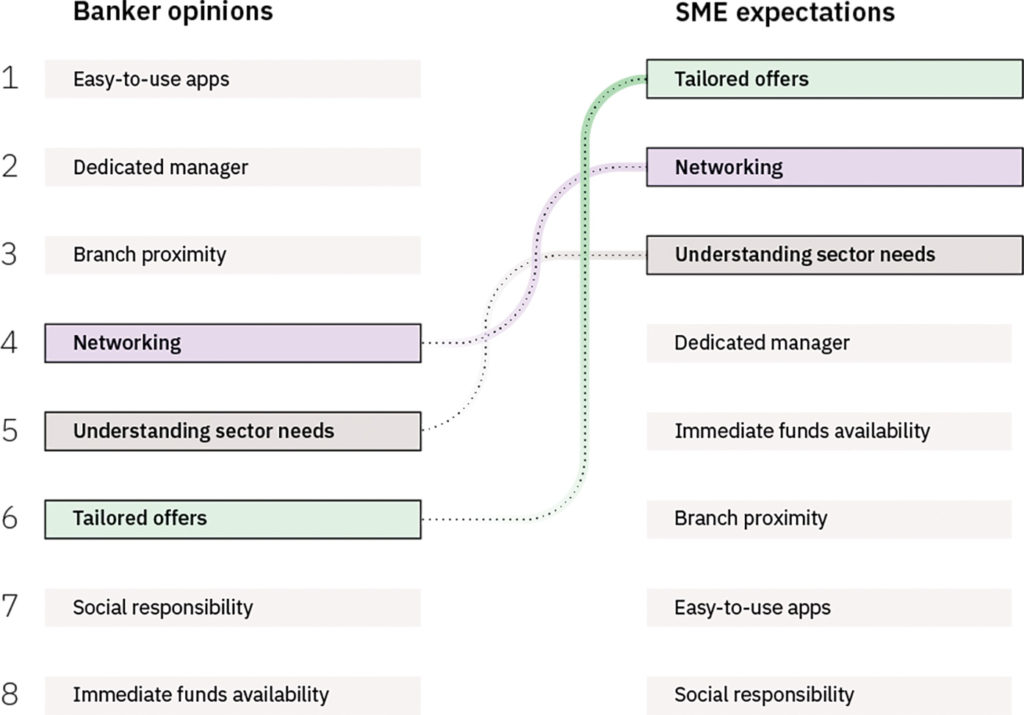

Figure 1: SMEs prefer banks that demonstrate deeper understanding of their sector and business ecosystems.

Banks as Central Actors in SME Ecosystems

The research reveals an interesting disparity between the perspectives of bankers and SMEs when it comes to choosing a bank. SMEs expect bankers to understand their unique business needs, offer tailored solutions, and facilitate networking with business partners and clients. In contrast, bankers tend to focus on the basics, such as easy-to-use apps, dedicated banking managers, and branch proximity. However, these foundational services alone are no longer enough. Banks need to be embedded in the business communities in which SMEs operate.

Geographical nuances also play a role. For example, SMEs in the UK still cite branch proximity as a top priority, even as many bank branches have closed due to digital advancements and industry consolidation. SMEs in India, on the other hand, highly value mobile apps as the government has accelerated digital adoption across society. While a full return to branch expansion is unlikely, a blend of branch services, human relationships, and enhanced digital access is emerging to meet SMEs’ diverse needs.

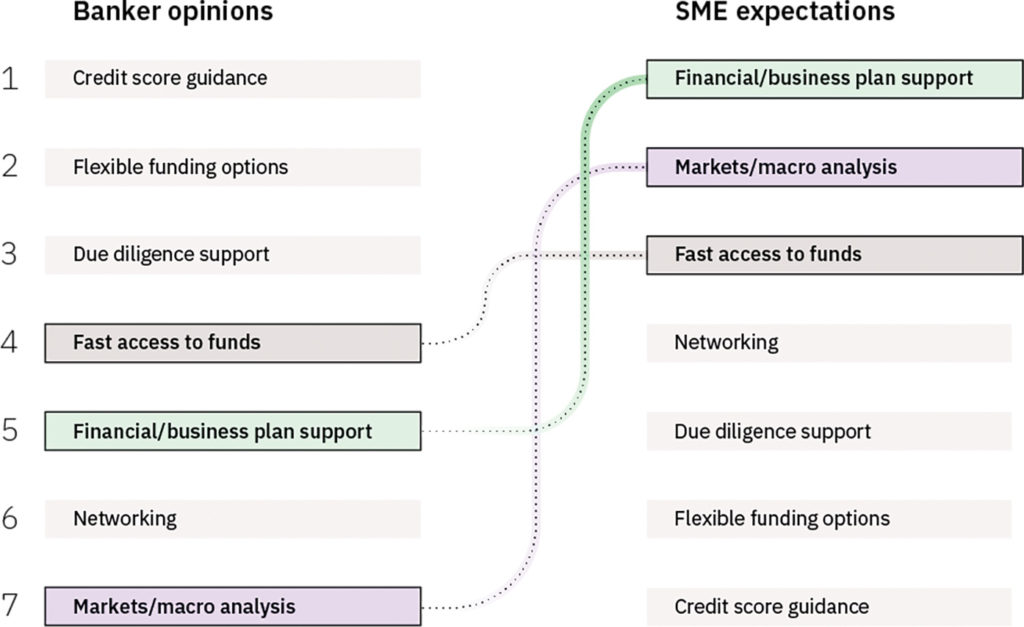

Figure 2: Bankers look inward, underestimating the SME need for fast money and expert advice to grow their businesses.

Banks as Expert Advisors for Growth

When it comes to the banking services that can facilitate growth, SME owners and managers emphasise the importance of expert support in planning for expansion, backed by market and economic analysis. In the US, key priorities include guidance for credit scoring, flexible funding options, and expert support in planning. SMEs recognise the role of banking stewardship and are looking for trusted advisors to help navigate business complexities. Fast access to funds also ranks high, as SMEs need to minimise bureaucratic hurdles and save time.

Nearly 60 percent of SMEs say they rely on their banker’s support and online searches when making important financial decisions, with only 23 percent relying solely on internal expertise. As new fintech competitors engage digitally, financial institutions can differentiate by empowering both clients and relationship managers through a combination of human and digital advice.

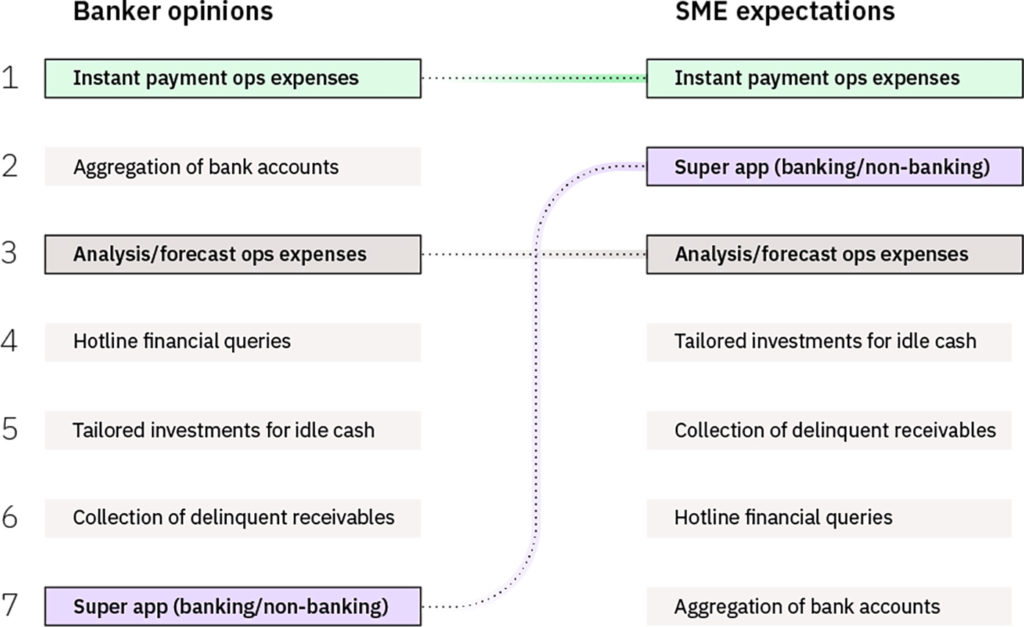

Figure 3: SMEs recognise the value of integrated ecosystem platforms with banking and non-banking services.

Banks as Platforms Beyond Banking

In pursuit of business efficiency, SMEs place a high value on instant payments and digital access to both banking and non-banking services. Comprehensive super apps have broad appeal to SMEs not just in emerging markets but also in EU countries. These centralised platforms offer a range of benefits, including data-driven insights and cash flow forecasts.

By integrating banking and non-banking services into a single platform, banks can help SMEs simplify administrative tasks, enabling them to focus on strategic growth, innovation, and competitiveness. This ecosystem approach fosters long-term relationships, allowing banks to become key enablers of SME success.

Scaling AI across the enterprise requires both strong technical foundations and governance. Effective AI governance guides banks as they innovate and apply use cases responsibly.

The Value of Time

As banks redefine strategies to compete in SME markets, one consistent factor emerges: time. For SMEs, time is money. Banks can use data and AI to help clients save time when accessing financial services and beyond. This added value strengthens client trust and contributes to the global economy’s overall growth.

For more insights, explore the IBM Institute for Business Value’s research: Banking for Small and Medium Enterprises – Serving the World Economy with Data and AI. ibm.co/sme-banking

About the Author

Paolo Sironi is the global research leader in banking at IBM, the Institute for Business Value, and he is author of business literature. His latest Banks and Fintech on Platform Economies has been Amazon bestseller in banking books worldwide. relinks.me/1119756979

You may have an interest in also reading…

Rosabeth Moss Kanter: A Glowing Academic Career that Defies Attempts at Abbreviation

The problem of profiling Rosabeth Moss Kanter, holder of the Ernest L Arbuckle Professorship at Harvard Business School, is trying

World Bank on Sustainable Recovery: The Need for Long-Term Financing

The COVID-19 pandemic is affecting every country’s health system and economy to a degree not seen for a century or

How Will Artificial Intelligence Affect the Economy?

Artificial intelligence (AI) is the name given to the broad spectrum of technologies by which machines can perceive, interpret, learn,