TD: Making the Environment Part of the Bank’s DNA

When Mike Pedersen joined TD Bank Group in 2007 as Group Head, Corporate Operations, he was tasked with putting an environmental strategy in place for the bank. Early on, he saw the need for full-time executive leadership to drive the strategy, and in 2008 Pedersen hired environmental scientist Karen Clarke-Whistler as Chief Environment Officer – a first for TD Bank Group, and indeed for any major North American bank. TD had long been committed to the environment – the TD Friends of the Environment Foundation is celebrating its 25th anniversary this year – but the bank’s leaders believed it needed to do more. The environment was a key issue that would shape the future and there was a need for greater understanding of the links between the environment and the economy. And it was important to customers and employees, which meant it was important to the bank.

When Mike Pedersen joined TD Bank Group in 2007 as Group Head, Corporate Operations, he was tasked with putting an environmental strategy in place for the bank. Early on, he saw the need for full-time executive leadership to drive the strategy, and in 2008 Pedersen hired environmental scientist Karen Clarke-Whistler as Chief Environment Officer – a first for TD Bank Group, and indeed for any major North American bank. TD had long been committed to the environment – the TD Friends of the Environment Foundation is celebrating its 25th anniversary this year – but the bank’s leaders believed it needed to do more. The environment was a key issue that would shape the future and there was a need for greater understanding of the links between the environment and the economy. And it was important to customers and employees, which meant it was important to the bank.

TD’s strategy is simple: embed the environment across all business lines and in TD’s core business strategy, making it a factor in business decisions and how the bank operates. Today, the impact of this strategy can be seen across the bank, from the design of its facilities and approach to technology to its products and services and even the work of its economic think tank. Says Ms Clarke-Whistler: “We want to model an approach to business where the environment and business go hand in hand – where the environment is in fact a driver of success.”

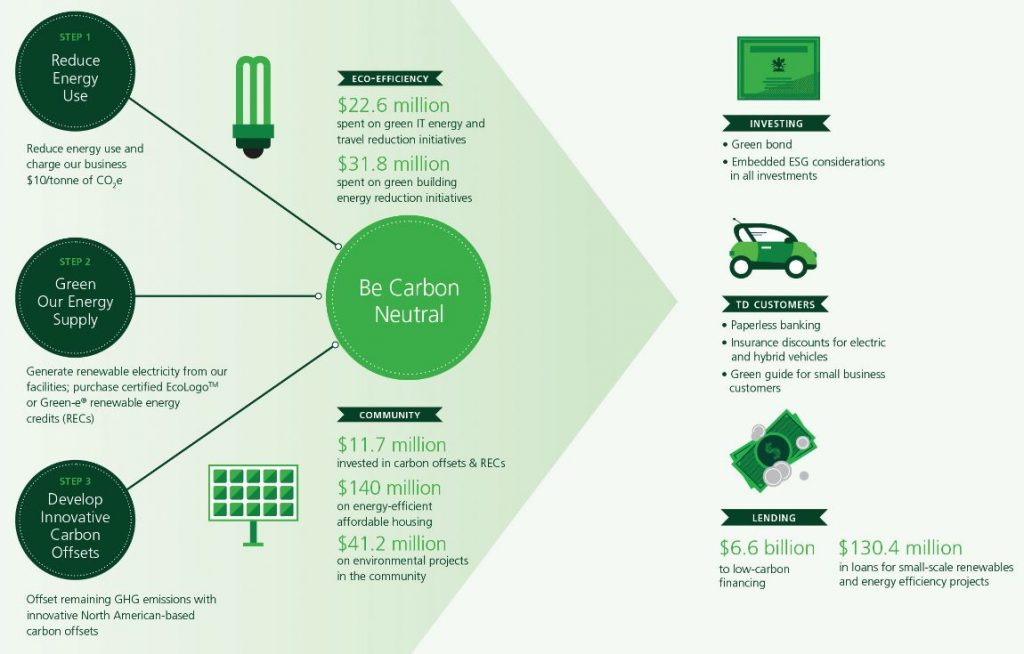

The year Ms Clarke-Whistler joined TD, she and Mr Pedersen made a recommendation to the bank: that TD become carbon neutral — something it achieved in 2010, becoming the first North American-based carbon neutral bank. The impact has been enormous. For one thing it inspired a major green building initiative that has seen the bank open North America’s first two net zero energy branches and install solar energy generation at 116 facilities and counting.

About TD Bank Group

Headquartered in Toronto, Canada, with more than 85,000 employees in offices around the world, the Toronto-Dominion Bank and its subsidiaries are collectively known as TD Bank Group (TD). TD offers a full range of financial products and services to approximately 24 million customers worldwide through three key business lines:

- Canadian Retail including TD Canada Trust, Business Banking, TD Auto Finance (Canada), TD Wealth (Canada),TD Direct Investing and TD Insurance

- U.S. Retail including TD Bank, America’s Most Convenient Bank, TD Auto Finance (U.S.), TD Wealth (U.S.) and TD’s investment in TD Ameritrade

- Wholesale Banking including TD Securities

TD had CDN$1 trillion in assets on April 30, 2015. TD also ranks among the world’s leading online financial services firms, with approximately 10 million active online and mobile customers. The Toronto-Dominion Bank trades on the Toronto and New York stock exchanges under the symbol “TD”.

Becoming carbon neutral has also resulted in TD gaining a tremendous amount of expertise related to renewable energy and the low carbon economy. This expertise is helpful to customers and clients alike and has led to business opportunity. Last year, for example, TD issued a green bond – a first for a Canadian commercial bank. Proceeds from the $500-million, three-year bond will be used to contribute to the low carbon economy through renewable and low carbon energy and related infrastructure; energy efficiency and management, with a focus on green buildings; and green infrastructure and sustainable land use management. The bond sold out almost immediately, while attracting new investors to the bank. “This was a clear sign to us that there is a real appetite for these kinds of offerings,” says Ms Clarke-Whistler, adding that the expertise the bank had gained from its own carbon journey enabled it to put the bond together. Since 2006, TD has invested more than $7 billion in the low-carbon economy (see Our Low-Carbon Journey chart below). “It’s a clear illustration that the environment can be a driver of business success. The more people understand the economic benefits and opportunities inherent in the greening of our economy, the more they’ll support and embrace the transition to a low-carbon economy.”

***

2012 saw the bank launch TD Forests, which works to help protect critical forest habitat, grow urban forests and green space and encourage the responsible use of forest products. The program was inspired by two findings. In a survey the bank conducted within its North American footprint, more than 90% of respondents indicated that they thought forests were important and more than 90% said they were in need of protection. And when the bank asked customers what they felt the bank should do to help the environment, the overwhelming response was: “use less paper”. TD set a goal to reduce its paper use by 20% by the end 2015 (versus 2010), and through TD Forests the bank works with The Nature Conservancy of Canada and the Nature Conservancy in the U.S. to protect critical forest habitat equivalent to its paper use. “We are paper neutral as well as carbon neutral,” says Ms Clarke-Whistler.

By the end of 2014, TD had helped protect nearly 33,000 acres of critical North American forest habitat. To grow urban forests and green space, particularly in low- to moderate- income communities, two key TD Forests programs come into play: TD Tree Days and TD Green Streets. Through TD Tree Days, employees, their families and friends and members of the public plant trees – mostly in Canada and the U.S., but also in the U.K. and Luxembourg. To date more than 185,000 trees have been planted, and this year that number will grow by more than 50,000. TD Green Streets provides matching grants of up to $15,000 to support urban greening and innovative municipal forestry practices in North America and the U.K.

TD’s commitment to the environment also means providing thought leadership. Two years ago TD Economics hired an economist to focus on the environment, working closely with the bank’s Chief Environment Officer. The result has been a number of papers that are helping to build understanding of the links between the environment and the economy.

Over the past year, natural capital has been a major area of focus for the bank, particularly the economic value of the environmental benefits provided by the natural environment. In Valuing the World Around Us: An Introduction to Natural Capital, TD Economics showed very clearly that our natural resources and ecosystems provide enormous, measurable benefits each year and that including natural capital valuation in decisions can give us a better understanding of the true costs, benefits and return on investment of planned activities. “Take Toronto’s urban forests,” says Ms Clarke-Whistler. “We have 10.2 million trees, which provide over $80 million worth of environmental benefits and cost savings to residents each year.” How? Through factors such as filtering pollutants from the air; reducing the strain on infrastructure by absorbing groundwater; cooling the air, leading to energy savings; and absorbing carbon dioxide. “Considering the natural capital value of trees is vital when it comes to urban development,” adds Ms Clarke-Whistler, “not just from a quality of life perspective but for very real economic reasons.”

To help build understanding of natural capital, TD has provided natural capital valuations of some of its own initiatives. For example, its net zero energy branch in Florida provides more than $100,000 of savings through reduced operating costs and natural capital impacts. And the value of the reduction in greenhouse gas emissions associated with the carbon offsets and renewable energy credits TD purchased in fiscal 2014 has a lifetime impact of about $118.5 million.

TD’s perspective is that the more people understand the economic benefits and opportunities inherent in the greening of our economy, the more they’ll support and embrace the transition to a green economy. “We need sound, transparent conversation about what a green economy can mean, and those of us who are proponents of a green economy need to put our money where our mouth is,” says Ms Clarke-Whistler.

You may have an interest in also reading…

The Fed’s Flawed Model

In May 22 testimony to the Joint Economic Committee of Congress, Fed Chairman Ben Bernanke issued another of many similar

Luxury Living: Music Delivered the Old-Fashioned Way

The news of its death was greatly exaggerated. Sales of vinyl records are spinning through the roof. According to Nielsen

Evan Harvey, Nasdaq: The Board Perspective on ESG

Sustainability is a moving target. Though we might want uniformity, unanimity, and harmonisation — of standards, disclosures, and data points