Author: Otaviano Canuto

Back to homepageOtaviano Canuto

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, a professorial lecturer of international affairs at the Elliott School of International Affairs – George Washington University, and principal at Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil. Otaviano has been a regular columnist for CFI.co for the past 10 years.

Otaviano Canuto: More Than One Coronavirus Curve to Manage – Infection, Recession and External Finance

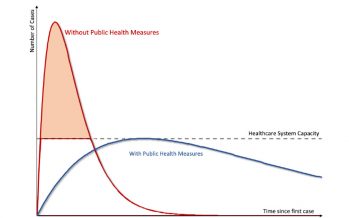

Flattening Coronavirus Curves – Otaviano Canuto First appeared at the Policy Center for the New South The global reach of COVID-19 is now clear. In a short time, country after country has suffered outbreaks of the new coronavirus, with each

Read MoreTurning Promises Into Reality – The Business Case for Gender Equality in Achieving the SDGs

By Paula Tavares and Otaviano Canuto As world leaders gathered this month for high-level talks at the 74th United Nations General Assembly, pressing global issues were at the forefront of discussions, including progress toward the 2030 Agenda and the

Read MoreOtaviano Canuto, Center for Macroeconomics and Development: Is There a Middle-Income Trap?

The “middle-income trap” has become a broad designation trying to capture the many cases of developing countries that succeeded in evolving from low- to middle-levels of per capita income, but then appeared to stall, losing momentum along the route toward

Read MoreOtaviano Canuto, Center for Macroeconomics and Development: China’s Rebalancing Act is Slowly Addressing Sliding Growth Figures

China’s economic growth has been sliding since 2011, while its economic structure has gradually rebalanced toward lower dependence on investments and current-account surpluses. Steadiness in that trajectory has been accompanied by rising levels of domestic private debt, as well as

Read MoreOtaviano Canuto, Center for Macroeconomics and Development: How to Heal the Brazilian Economy

If I were to encapsulate the current situation of the Brazilian economy in one sentence, I would say: “It is suffering from a combination of ‘productivity anemia’ and ‘public sector obesity’”. On the one hand, the country’s mediocre productivity performance

Read MoreOtaviano Canuto, World Bank: Making Returns on Knowledge – How Innovation Can Flow from Globalisation

The April issue of the International Monetary Fund’s World Economic Outlook (WEO) included a chapter on how globalisation has helped technology leaders’ knowledge spread faster. Cross-border technological diffusion has not only contributed to rising domestic productivity levels in advanced and

Read MoreOtaviano Canuto, World Bank: Can Services Replace Manufacturing as an Engine for Development?

Manufacturing expansion has been a vehicle for job creation, productivity increases, and growth in non-advanced economies since the second half of the last century. First in Latin America, followed by Asia, and a renewal of production systems in Eastern Europe,

Read MoreOtaviano Canuto, World Bank: Overlapping Globalisations

Current technological developments in manufacturing are likely to lead to a partial reversal of the wave of fragmentation and global value chains that was at the core of the rise of North-South trade from 1990 onward. At the same time,

Read MoreOtaviano Canuto, World Bank: The Metamorphosis of Financial Globalisation

After a strong rising tide starting in the 1990s, financial globalisation seems to have reached a plateau since the global financial crisis. However, that apparent stability has taken place along a deep reshaping of cross-border financial flows, featuring de-banking and

Read MoreOtaviano Canuto, World Bank: Matchmaking Finance and Infrastructure

The world economy – and emerging market and developing economies in particular – display a gap between their infrastructure needs and the available finance. On the one hand, infrastructure investment has fallen far short from of what would be required

Read More