Author: Otaviano Canuto

Back to homepageOtaviano Canuto

Otaviano Canuto, based in Washington, D.C, is a former vice president and a former executive director at the World Bank, a former executive director at the International Monetary Fund, and a former vice president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at the University of São Paulo and the University of Campinas, Brazil. Currently, he is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs - George Washington University, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development. Otaviano has been a regular columnist for CFI.co for the past 14 years.

Permanent Output Losses from the Pandemic

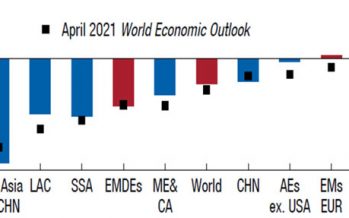

In the World Economic Outlook, published October 12, the International Monetary Fund (IMF) slightly lowered its forecast for global economic growth this year to 5.9%, while maintaining a forecast of 4.9% for 2022. It also emphasized the “divergence” in the

Read MoreThe Road to Decarbonisation

The transition to zero emissions will involve three simultaneous economic processes: change in the relative prices of goods and services, with prices starting to reflect the intensity of emissions of carbon; labour relocation; and asset value scrapping. The socioeconomic return

Read MoreGlobal Imbalances and the Pandemic

The International Monetary Fund’s tenth annual External Sector Report (ESR, August 2021) shows how current account deficits in the global economy widened in 2020 during the pandemic. On the other hand, the ESR also argues that overall, the misalignment between

Read MoreMatchmaking Private Finance and Green Infrastructure

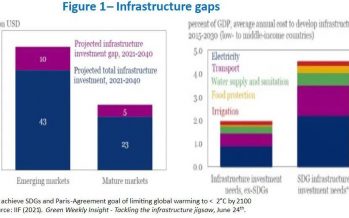

The contrast between the scarcity of investments in infrastructure and the excess of savings invested in liquid and low-return assets in the global economy must be dealt with. Greening infrastructure in emerging and developing economies would benefit from being able

Read MoreRescue by Helicopter Reserves

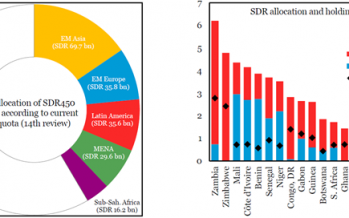

The world woke up on Monday 23 with higher international reserves for all countries. A new allocation of US$650 billion (SDR450 billion) in Special Drawing Rights (SDRs) by the International Monetary Fund (IMF) to its member countries has entered into

Read MoreChina’s Renminbi Needs Convertibility to Internationalise

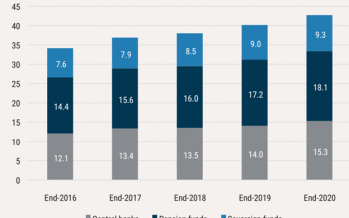

On July 21, the Official Monetary and Financial Institutions Forum (OMFIF) published its eighth annual report on Global Public Investors (GPI). It included a survey the asset allocation plans of reserve managers of central banks, sovereign wealth funds, and public

Read MoreOtaviano Canuto: Are We on the Verge of a New Commodity Super-Cycle?

Commodity prices have recovered their 2020 losses and, in most cases, are now above pre-pandemic levels (Figure 1). The pace of Chinese growth since 2020 and the economic recovery that has accompanied vaccine rollouts are driving demand upward, while supply

Read MoreOtaviano Canuto: Middle-Income Countries Should Not Be Rushed to ‘Graduate’ Status

Many donor countries seem eager to see middle-income countries (MICs) graduate to non-client status in multilateral development institutions before achieving their full development potential. Such institutions can significantly contribute to the sustainable development of MICs, while seizing many benefits from

Read MoreThe Size of Biden’s Fiscal Package

The monetary policy report submitted by the Board of Governors of the Federal Reserve System to the U.S. Congress on Friday Feb. 19 showed that the Fed’s members have improved economic growth expectations for 2021 and 2022, expect lower unemployment

Read MoreOtaviano Canuto: Central Banks and Inequality

While the economic recovery around the world remains uneven, fragile, and unbalanced across sectors, financial markets are generally doing very well, thanks! In the United States, only half of the unemployment caused by the pandemic last year has been reversed,

Read More