The Fed vs the Communist Party

Author: Mads Pedersen. Photo: PR / Human Edge

Recent quarters, months, and weeks have seen a remarkable clash between the goals of the US Federal Reserve and Chinese Communist Party.

One is trying to expand credit into a “supercharged, super-fair recovery”, the other trying to rein-in what they see as excessive capitalism in general and, particularly, as market excesses.

This is not a war between enemies, or even a battle in a traditional sense. But it is a significant clash for the global political narrative and economic development in coming years. In the short-term, global market stability is at stake.

Supported by low interest rates and strong earnings, US equities made further progress since the last edition of the Human Edge Global Market View publication, and we had another strong quarter across mandates and funds. The situation was very different in emerging markets caught between a strong US dollar and Chinese politics.

We at Human Edge hold little exposure in this sub-asset class and don’t see the sell-off as a reason to add. To assess whether to remain fully invested in equities, or “risk on”, as we call it, in a tense environment like this, we rely on our algorithms and their daily assessment of the risk to global financial stability.

“It would be foolish to assume that some of the best-educated and best-informed people in the world would not have foreseen that the blows that they delivered to these growth companies would have devastating consequences.”

Since 2011, these algorithms have been set up as a traditional investment committee, with human analysts and portfolio managers organised in “teams” covering macro, fixed-income, credit market, equities, and market risk. Compared to a traditional investment committee, the algorithms are more concise and consistent in their communication and conclusions, which they provide every morning around 4am CET. Like markets, the Fed, the Communist party, and their regulators, the algorithms work every day, winter and summer.

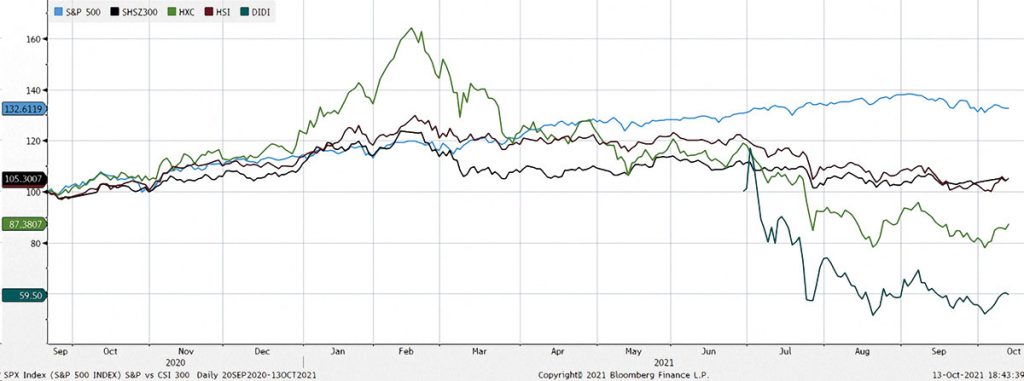

We have often discussed the perspective of the Fed and the US Administration; let’s now focus on the action in China. What initially looked like a campaign focused on tech tycoons has developed into something more akin to a massacre of Chinese equities, expressed by the decline in the Nasdaq Golden Dragon China Index, (HXC), the Hong Kong index, CSI 300 and in DIDI, seen in Figure 1.

This campaign has a primary goal, but also produces collateral damage. It’s clear that the Chinese Communist Party is happy to encounter less rivalry from billionaires for the attention of society, which runs across the board from public prestige to cash and data control.

The same holds true for cryptocurrencies. On one hand, Bitcoins collide with the environmental goals of the Chinese government, and the governments of most other developed countries. On the other, decentralised finance and crypto currencies collide, in general, with government control of markets and movements of capital. This is not in the interest of a country such as China, with controls on movements of capital.

Human Edge therefore cautions anyone from excessively celebrating the recent bounce in crypto prices. A more interesting development will be the digital currencies from the Swiss and the Chinese central banks, and whether they can be used to ease global transactions without upsetting the US Department of Justice.

The fact that the clampdown started more than half a year ago and included Ant Financial, the politically sensitive education sector, and the Didi listing, makes it clear that even though Chinese market regulators have talked to local and western banks and calm the situation, the aims are backed by the real powers in the Communist Party.

It would be foolish to assume that some of the best-educated and best-informed people in the world would not have foreseen that the blows that they delivered to these growth companies would have devastating consequences. It is likely that even the latest game of chicken — in which the Chinese “blinked first” — was part of the original strategy.

As our market risk algorithms show, stay positively positioned is warranted, because the recovery is on-going, markets are well supported, and the outlook favours equities and credit risk over high-grade bonds and duration. We therefore remain fully invested in these types of assets, together with our long held US equity and USD overweight, across our USD, Euro and CHF mandates and funds.

We maintain a 100 percent equity allocation in our Systematic Equity Allocation Strategy, significantly above the long-term balanced level of 60 percent. The year-on-year return is a respectable 25% percent at the end of Q3. The year-to-date return is 15 percent. The associated ACCI SA fund is comfortably in the top 10 percent of its peer group.

In our multi-asset mandates and funds, we retain the full allocation to equities and the enhanced 30 percent allocation to high yield bonds with duration of around 3 years. These portfolios are up 9-12 percent year-to-date. and 12-15 percent year-on-year— all dependent on risk level and currency.

In our Global Fixed Income Opportunities strategies and funds, we maintain our high-yield bond positions. These portfolios are up two percent year-to-date and eight percent year-on-year. It is worth noting here that the current short duration positioning has not helped much in recent months but should find support if the Fed’s renewed optimism regarding the US recovery turns out to be justified.

The Chinese Market Massacre and Global Markets

Human Edge has a long record of participating in and chairing investment committees, and for a number of years we were simultaneously running a traditional committee and a virtual committee of algorithms.

In recent years we have shifted to the virtual version, where the actual Global Investment Committee is a group of virtual “analysts” represented by algorithms which are combined to form an aggregate reading. They always have a consistent and updated conclusion (much easier to understand than policy language of economists).

At the moment, that conclusion advises us to stay invested in equities. Unless there is more noise from China, global investors are probably best advised to ignore it. This is not always the case, but as opposed to the situation in the second-half of 2015 and early 2016, the rest of the world is running full steam ahead.

According to our analysis data for equities, fixed income, macro, monetary policy, and looking at market momentum and the vulnerability of market sentiments, the correction in Asian markets is visible at the segregated data level. When we combine these data to obtain an overall reading, we get a rather solid signal of 0.4 — much like in early 2017.

Figure 2 shows the readings of these algorithms in 2015 and 2016 the collapses during that period. Figure 3 shows the situation on the macro side of the economy back in 2015. After a severe setback in the commodity sector, investment demand and commodity prices took a severe blow, credit spreads widened, and financial conditions tightened in a classical reflexive move of self-reinforcing deteriorations across macro and markets.

Figure 2: Return across bond market – US aggregate bonds index. Note: ACCI Global Fixed Income Opportunities (blue line) is managed by Human Edge.

Now the situation is different, because the Fed’s fixed-income market operations — and the strong cyclical position of the US economy — support credit formation and markets. So does the extreme profit recovery, much stronger than expected by a chorus of equity analysts and macro strategists.

The reading of our profit algorithms remains at 1.0, the maximum capped-out reading, and well above where they went even in the period January 2015 to July 2017, as shown in Figure 3.

Our profit algorithms are useful, because they have helped us to remain fully invested and to enter the market in early 2016 and stay invested in 2017 — which proved to be beneficial. And while we maintain that earnings is a lagging indicator, we also know that selling early feels great for the portfolio manager who executes the sale or for the analyst who recommends, but it is not necessarily quite as beneficial for the actual investor.

Other important factors are technology trends, optimism, exuberance and nervousness and the panic probabilities of the markets. The aggregate result of our algorithms have not changed much. For the time being, we remain fully invested. If the algorithms change across their respective thresholds, we will change our positions — accordingly and decisively.

The clash between the US Federal Reserve and Chinese Communist Party is not a war; the main goal is not to inflict damage. But it is a significant battle, with the global narrative and global markets at stake. It would be optimistic to expect the result to be a stable equilibrium. And it was probably judicious for the Communist Party to blink first.

In our experience, the Chinese authorities know what they want to achieve on a one- to five-year horizon. They will then move back and forth as they feel their way. The overall target is to re-establish respect for, and the undisputed authority of, the Chinese Communist Party.

The immediate effect has been the largest slaughtering of potential and prospective unicorns in Asian history and a severe correction in Chinese and Hong Kong equity markets and their US sister listings. As of July 28, the Nasdaq Golden Dragon Index was down 50 percent from its peak and on the morning of the 30th it was down 20 percent for the month.

In this context it is worth remembering that a core lesson learned the hard way is that the Chinese cannot control the value of their own currency, since any significant movement has uncertain consequences for exports, imports and growth.

The US is a large economy with limited dependence on trade and strong and well-tested institutions. The Chinese economy is driven by domestic demand for investment and consumption, but China is a large economy with a dependence on foreign trade and new institutions. No one is more aware than Xi Jinping, for example, that the presidential re-election is locked in a fixed framework and can be changed.

Returning to the currency and markets, England, Germany, and France learned long ago that they cannot control their currencies, interest rate levels and financial markets, independently of the US or the Fed. We also expect the Chinese to maintain the nationalistic façade, while in practise the issue will remain hidden under a capital account that remains closed for the masses — and for the publicly known billionaires as well. It is now clear that to be rich in China is a lot less glorious than it used to be.

For the current leadership in China, the number one institution is the Communist Party — and it has lost too much control in relative and absolute terms. Xi has therefore made it a top priority to turn this development around. Such a development is not easy to control or stop once it has started, and it should therefore be assumed that the trend will continue — but it is unlikely to bring down global finance.

The Chinese depend on global trade and will keep it open. They don’t depend as much on their currency reserve as they used to, so maybe they could sell their holdings of US treasury. A simple calculation might solve the issue. If the Chinese hold $1,200bn, this will equal 10 months of current QE. If they had $3,600bn, it would require three years’ worth QE at the current run rate.

In both cases, it could be an extension to the QE. If this were to happen overnight, it would be very disruptive. In some ways the situation would be comparable to the moment when world realised that Covid was not just a Chinese problem, but a global one. It would therefore require a pandemic-like response from the Fed and the Treasury.

And it could take weeks to get the situation under complete control, because markets would be very volatile. It is unlikely, however, that $2tn in fiscal support would not be required. Also, BOE, BOJ, SNB and even the ECB would probably help; in this case, hopefully without the president feeling the need to say anything unhelpful or unwise.

By Mads Pedersen Managing Partner & CIO of Human Edge

You may have an interest in also reading…

Taiwan’s Chunghwa Telecom Takes Private 5G Tech to the Next Level

The pandemic has negatively affected enterprises in many ways — but it has also accelerated digital transformation in Taiwan’s activity

WTO: China’s Role in Global Economic Governance

By WTO Director-General Pascal Lamy Extracts from his Speech delivered at the China Development Forum in Beijing, 24 March 2013

Jim O’Neill: A Living Wage for Capitalism

At 3.6%, unemployment in the United States remains near its lowest level since the late 1960s. There are even signs