New World Bank Green Bond Is a Story of Market Growth and Innovation

- Green bonds have created a new way for investors to achieve the return they need while also supporting climate-friendly development projects. Many long-term investors today consider climate risk and sustainability in their investment choices.

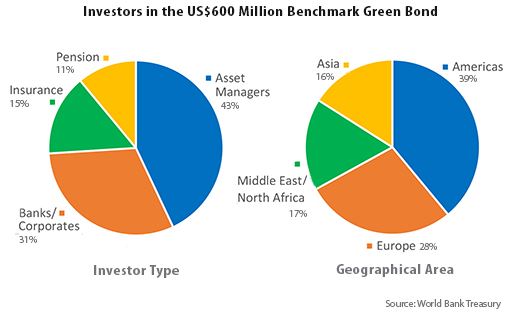

- The investor base in green bonds is expanding quickly, as the World Bank’s new US$600 million benchmark green bond shows.

Green bond proceeds have helped support the deployment of rooftop solar photovoltaic systems on schools in China, among many other climate-friendly projects. In this video, students in Beijing show off a model of their school’s new solar panels. World Bank

The arrival of the World Bank’s newest benchmark green bond, its largest in U.S. dollars to date, is a story of innovation and the growth of a market, one that is supporting climate-friendly development by reaching an expanding pool of investors who are seeking investment opportunities that have a positive impact.

The World Bank routinely issues benchmark bonds in the billions of dollars that are sold to central banks and other large institutional investors to help fund its development work while providing a AAA-rated, fixed-income return. With “green” bonds, the Bank can provide the same benefits while applying a unique approach: it reaches out to investors who consider longer-term climate risk and sustainable and responsible investing in their analyses and creates bonds that both fit their needs and support climate-friendly projects.

“Landmark green issuances from triple-A issuers such as the World Bank further enhance the appeal of the green bond market, promoting investment in sustainable projects that mitigate the effects of climate change at commercially appealing returns.”

– Alex von zur Muehlen, Group Treasurer of Deutsche Bank

These investors are important for mobilizing private sector climate finance, which is the main purpose of the green bond market. With each new green bond issued, the size and the interest from investors has been growing.

The $600 million, 10-year green bond issued last week was both the World Bank’s largest in U.S. dollars and longest-dated benchmark-sized green bond.

The 25 investors in the new bond reflect the expanding interest in green bonds from around the world. They include Swedish pension funds AP2 and AP4, Deutsche Bank Treasury, asset managers Blackrock, Mirova and Nikko Asset Management, Nippon Life Insurance Company, Praxis Intermediate Income Fund, the United Nations Joint Staff Pension Fund and Zuercher Kantonalbank.

“Landmark green issuances from triple-A issuers such as the World Bank further enhance the appeal of the green bond market, promoting investment in sustainable projects that mitigate the effects of climate change at commercially appealing returns,” said Alex von zur Muehlen, Group Treasurer of Deutsche Bank.

Deutsche Bank announced plans the same day to invest Euro 1 billion equivalent in a portfolio of green bonds, starting with the new World Bank 10-year benchmark bond. “Deutsche Bank’s decision to set up a dedicated portfolio shows the growing appeal of green bonds,” said Doris Herrera-Pol, Director and Global Head of Capital Markets at the World Bank. “It supports the expansion of the green bond market as it continues to mobilize private sector funds for climate finance.”

Other large investors are making similar commitments to sustainable investing. Barclays announced in September that it would invest at least GBP1 billion equivalent in green bonds over the year.

Supporting Climate-Friendly Growth

The success of the new World Bank green bond was the result of seven years of work by the World Bank Treasury developing the green bond market. It started with the World Bank issuing the first labeled green bond in 2008 in response to requests from large institutional investors who were looking for a liquid investment that explicitly supported the financing of climate-related projects.

The World Bank has since issued nearly US$8 billion in green bonds through 80 transactions in 18 currencies.

The proceeds are helping to finance a range of climate- and environment-friendly projects, including sustainable urban transportation in India, geothermal power development in Indonesia, energy efficiency improvements in China, sustainable forest management in Mexico, and disaster-risk management in the Dominican Republic, among many other projects.

Investors, Principles and Standards

The World Bank has also been driving growth and innovation in the green bond market and helping further develop standards and principles for green bonds.

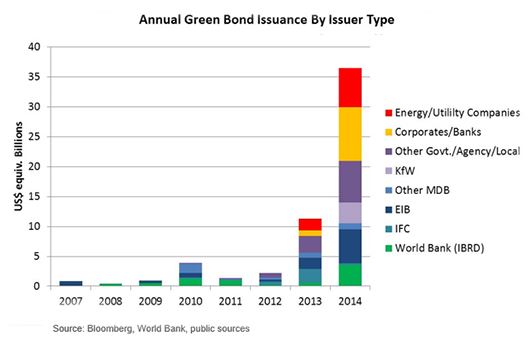

The growth of the market – new green bond issuances globally more than tripled last year, from US$11 billion in 2013 to more than US$36 billion last year – reflects an increasing diversity of both issuers and investors.

U.S. investors such as the California State Treasury, as well as well-known sustainable and responsible investors like the California State Teachers Retirement System (CalStrs), Trillium, and TIAA-Cref, were early green bond investors. Asset managers like Blackrock, Mirova and Nikko Asset Management are also increasing their support of this market.

Another investor group showing increasing interest in green bonds is insurance companies, with around 15-20% participation for benchmark World Bank green bonds with 5 and 10-year maturities. Last year, Zurich Insurance announced plans to double its investment in green bonds to over US$2 billion in green bonds as the sector grows, and it recently purchased a 30-year World Bank green bond.

The latest investor group to join the green bond market is corporate bank treasuries looking for high quality assets that support their corporate sustainability mandate.

While there is growing demand for green bonds in general, investors are also looking for high standards of project selection, due diligence and monitoring as well as throughout the green bond process of defining “green” projects, and earmarking and allocating funds to eligible projects. The World Bank is recognized by the market as a leader with a transparent approach to reporting on projects that help its client adapt to and mitigate the effects of climate change. It also supports the market’s development through collaboration with investors and issuers on developing principles and standards.

“IBRD’s effort in moving forward robust impact reporting on its green bond program is impressive. We view this as an important component of our green bond evaluation,” said Blackrock’s Ashley Schulten, Director, Portfolio Manager. “Blackrock has been a strong supporter of World Bank Green Bonds in the past, and this pioneering work on reporting standards was a key factor behind our involvement in today’s 10-year bond.” Source

You may have an interest in also reading…

UN Spotlights Key Role of Evaluation in New Development Agenda

Evaluation will become more necessary for the post-2015 Sustainable Development Goals, a United Nations body said today, as it launched

Bangladesh Receives $600 Million to Improve Rural Electricity Supply

The Government of Bangladesh today signed a $600 million credit to improve the quality of electricity supply for 25 million

Emerging Managers Summit South

October 2012 – Las Vegas, NV If you are looking to expand and diversify your asset allocation by investing in emerging