World Bank MENA Chief Economist: Towards a New Social Contract in the Middle East and North Africa

By Shanta Devarajan

Dubai

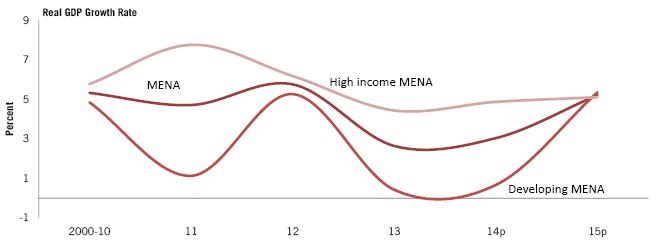

A snapshot of the Middle East and North Africa (MENA) Region today reveals a diverse and discouraging picture (Figure 1). Syria, Iraq, and Libya are suffering from violent conflict that has devastated people’s lives, infrastructure, and national economies, with spill overs to neighbouring countries.

The “Arab-Spring” countries of Tunisia, Egypt, and Yemen are in the midst of turbulent political transitions. They, as well as countries undergoing more gradual transitions, such as Jordan and Morocco, are experiencing slow economic growth and worsened macroeconomic imbalances. Until the recent fall in oil prices, the resource-rich GCC (Gulf Cooperation Council) member states had been growing rapidly, but they now too face problems of unemployment and undiversified economies.

But a longer-term perspective – a movie rather than a snapshot – indicates a more homogeneous region and a more hopeful future. Despite differences in their current circumstances, MENA countries have been following more or less the same development model since independence.

In this model, there was a social contract between the state and citizens, whereby the government would subsidize food, fuel, and water, and provide health and education for free. The public sector was the main employer. In turn, the private sector was based on privilege rather than competition, with evidence from Tunisia and Egypt that the privileges were often enjoyed by politically connected families. Most governments were considered autocratic, albeit to different degrees.

Furthermore, through the first decade of the 21st century, this common social contract delivered similar and relatively successful results. Annual economic growth averaged 4-5 percent. Extreme poverty (people living on less than $1.25 a day) was effectively eliminated. Almost everyone completed primary school, and enrolment rates in secondary and tertiary education – for both men and women – were high and rising.

Figure 1: Economic growth in MENA. Source: World Bank, MENA Economic Monitor, October 2014.

MENA registered the fastest decline in child mortality rates in the world (Figure 2). Contrary to perceptions, inequality – as measured by conventional indicators such as the Gini coefficient – was lower than in comparable countries elsewhere and either constant or declining.

Yet, in 2010-11 this same region saw widespread protests that led to the overthrow of the government in power in Tunisia, Egypt, Libya, and Yemen, and greater political opening in Morocco and Jordan. Why? Alongside numerous political, social, and cultural explanations, there is an economic one: The old development model had reached its limits.

Governments could no longer afford to subsidize food and fuel, provide free health and education, and keep such a large share of the labour force employed. Faced with unsustainable fiscal deficits, governments cut back (or slowed the growth of) public employment. But the private sector, having been protected from competition, could not grow fast enough to absorb the large number of educated young people entering the labour force.

In particular, there was little room for the young small and medium enterprises – typical engines of job creation around the world – to grow. The causes were the host of business regulations that restricted entry and exit, especially in sectors such as banking, transport, and telecommunications in Tunisia where the Ben Ali family had a significant interest.

![Figure 2: Rapid decline in child mortality in MENA. [Mortality rate, under-5 (per 1,000 live births): population-weighted averages] Source: Iqbal and Kiendrebeogo (2014), “The Reduction of Child Mortality in MENA: A Success Story.”](https://cfi.co/wp-content/uploads/2015/01/f2.jpg)

Figure 2: Rapid decline in child mortality in MENA. [Mortality rate, under-5 (per 1,000 live births): population-weighted averages]

Source: Iqbal and Kiendrebeogo (2014), “The Reduction of Child Mortality in MENA: A Success Story.”

The resulting high cost of these services made it difficult for Tunisia’s labour-intensive export sector to take off. Similarly, energy subsidies, by favouring energy-intensive and therefore capital-intensive firms, discriminated against younger, smaller, labour-intensive firms. There is also some evidence from Egypt that these subsidies went disproportionately to politically-connected firms.

The result was the highest unemployment rate in the developing world, with youth unemployment exceeding 25 percent. Men who could not afford to be unemployed, took highly insecure jobs in the informal sector. Women, including educated women, dropped out of the labour force. At 25 percent, MENA has the lowest female labour force participation rate in the world.

Meanwhile, although it delivered basic health and education, the public system was falling short on quality. Secondary-school students, even those from high-income countries like Qatar and UAE, were scoring poorly in international standardised tests. In Egypt, about seventy percent of the students used private tutoring. Students in secondary schools and universities were not being taught the skills that the market demanded, creating job vacancies alongside high unemployment.

With doctor absentee rates of 20-30 percent in public clinics in Egypt, Morocco, and Yemen, patients, desperate for care, resorted to private clinics. As one woman put it, “You can go to the private clinic and lose your money, or to the pubic clinic and lose your life.” In addition, subsidised energy and water contributed to chronic power cuts and water shortages, hurting industry and agriculture.

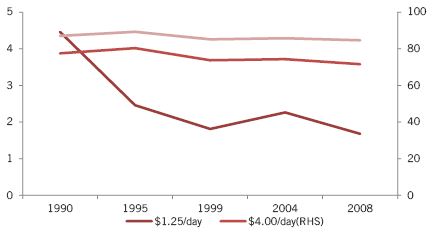

The combination of lack of jobs and poor services meant that the middle class was stagnating, breeding resentment and alienation among the population. In Egypt, when extreme poverty was falling rapidly, the share of the population earning $4 or $5 a day had hardly changed since the 1990s (Figure 3). In Tunisia, when incomes were rising at four annually, the percentage of people who said in a Gallup Poll that they were “thriving” declined every year.

Figure 3: Egypt – population living on $4 and $5 a day (% of population living below poverty line).

Source: World Bank, World Development Indicators.

The few jobs that were available, were allocated based on connections rather than merit. In a Gallup Poll survey, the percentage that agreed with the statement, “Connections (wasta) are critical to getting a job,” was 80 percent (Figure 4).

In short, the people protesting in the streets were calling for a new social contract, one where the government, instead of being the employer of first and last resort, would enable the private sector to grow and create jobs. And one where citizens could hold the state accountable for quality services, rather than the other way around.

Unfortunately, the aftermath of the Arab Spring has been so turbulent – and in some instances so violent – that economic performance in almost every country declined. Economic growth fell from an average of almost five percent a year to two percent. Fiscal deficits increased to the point where some countries’ debt reached dangerous levels. Unemployment increased, especially for women and young people. The unemployment rate for young Egyptian women currently stands at over sixty percent.

To quell the political unrest, some governments increased subsidies and public sector employment. In Syria and Libya, bloody civil wars have made it difficult, if not impossible, to address the underlying economic distortions that triggered the uprising in the first place. And in those countries that have not had an uprising, but are facing the limitations of the old development model, reform progress has been slow, not least for fear of triggering an uprising.

In this situation, what can be done? While each country’s situation is different, the fact that they all followed the same development model, and are facing the same limitations to that model today, suggests two common elements of a new social contract.

Fostering competition in domestic markets. Policies and regulations that promote competition, including competition from foreign companies, will reduce the risk of political capture and allow SMEs to grow and create jobs.

Strengthening accountability in the delivery of public services. Institutional arrangements that enable students and patients to hold teachers and doctors accountable – vouchers, empowered school management committees, etc. – will contribute to improving the quality of service delivery.

Although not sufficient, two concrete steps can further both these elements significantly. One is the replacement of energy subsidies (which account for five to ten percent of GDP in the region) with targeted cash transfers. Not only will this reform enable the poor – who now receive only a small fraction of the subsidy – to benefit more, but it will reduce the advantage enjoyed by large, capital-intensive enterprises, thereby promoting SMEs’ growth. Such a reform will also reduce some of the other distortions caused by energy subsidies, such as air pollution, congestion, and the depletion of water resources. Finally, it will reduce the fiscal deficit.

The second, albeit controversial, step would be to provide poor people with cash so that they can “buy” education and health services in the private sector. At present, there is a thriving private market in these services, but only those with means can use them. Instead of pouring more money into the free, public system (which does not seem to be delivering quality services), it is worth exploring whether protecting poor people with cash transfers, and regulating the private system, would lead to better outcomes. It will certainly strengthen citizens’ ability to hold providers accountable.

![Figure 4: “Connections (wasta) are critical to getting a job.” Source: Gallup World Poll, 2013. [legend: dark red - ‘agree’ / light red - ‘not agree’]](https://cfi.co/wp-content/uploads/2015/01/f4.jpg)

Figure 4: “Connections (wasta) are critical to getting a job.” Source: Gallup World Poll, 2013. [legend: dark red – ‘agree’ / light red – ‘not agree’]

Needless to say, the application of these principles will be different across countries. For countries in conflict, the short-term demands of humanitarian assistance and peace-building will have to take precedence. However, these principles could be part of a post-conflict recovery program. The demand for a new social contract was explicit in the transition countries, but it is equally relevant to other countries that are suffering from high unemployment, sluggish private sector growth, and weak accountability in public services. The principles could also be relevant for the GCC where the effectiveness of the development model of oil rents’ being distributed through public employment and subsidies is being questioned.

In applying the approach, it is important to recognise that the proximate effects of a policy reform or investment may not be the relevant indicator. For instance, a public-sector investment that creates jobs, but maintains or reinforces the oligopolistic structure of the private sector, would not be contributing to the new social contract. Conversely, a reform that leads to a more open economy, allowing domestic entrepreneurs freedom to participate, may at first blush appear to be destroying jobs (those in the protected firms), but is in fact promoting the competitive private sector that is needed for the new approach to function.

Moving to the new development model will be neither easy nor quick. But the facts that (i) MENA countries made outstanding progress on poverty reduction and human development; (ii) in 2011, people rose up to demand what is their due, namely jobs and quality services; and (iii) we now understand the limits of the old development model and the contours of the new one; signal that the people of the MENA region will emerge from their present-day difficulties and realise their goals of a dynamic private sector, quality public services, and accountable government.

The views expressed in this article are not necessarily those of the World Bank.

About the Author

Shanta Devarajan

Mr Shantayanan Devarajan is the Chief Economist of the World Bank’s Middle East and North Africa Region. Since joining the World Bank in 1991, he has been a Principal Economist and Research Manager for Public Economics in the Development Research Group, and the Chief Economist of the Human Development Network, of the South Asia Region, and of the Africa Region. He was the director of the World Development Report 2004, Making Services Work for Poor People. Before 1991, he was on the faculty of Harvard University’s John F. Kennedy School of Government. The author or co-author of over 100 publications, Mr. Devarajan’s research covers public economics, trade policy, natural resources and the environment, and general equilibrium modeling of developing countries. Born in Sri Lanka, Mr. Devarajan received his B.A. in mathematics from Princeton University and his Ph.D. in economics from the University of California, Berkeley.

About The Office of the Chief Economist

The Office of the Chief Economist of the World Bank’s MENA Region (MNACE) seeks to bring the best possible knowledge to bear on the development problems of the region. In addition, MNACE leads the formulation of the Bank’s regional strategy, while overseeing the country strategies. The chief economist is responsible for the quality of economic analysis in the Bank’s products in the region. Finally, the office helps to build a community of economists working on the MENA region.

You may have an interest in also reading…

Department of Finance, Government of Ajman, UAE: Ajman Finances in Good Hands

The Department of Finance of the government of Ajman plays a key role in providing financial services for the sustainable

Oil Price Plunge Analyzed In New World Bank Policy Research Note

Rapid expansion of oil supply from unconventional sources, a significant change in OPEC’s policy stance, and weak global demand are

‘Deep-Tech’ Founders-Turned-Investors Forge VC Powerhouse

‘We’re building the VC firm we wish we’d had as technical founders’. UK early-stage deep-tech VC firm SCVC focuses on