OECD: The Funding Models of Development Finance Institutions

The drum beat of reform is increasing for the development system and particularly for the Multilateral Development Banks (MDBs). While the reform is looking to address a number of areas, there is a repeated call for the mobilisation of the private sector. Multilateral organizations are the primary actors, accounting for 74% of total private finance mobilised in 2018-20. MDBs played a leading role, with USD 33.8 billion mobilised per year (accounting for 69% of the three-year total). Bilateral providers were also significant actors, representing 25% of the total private finance mobilised (USD 12.4 billion).

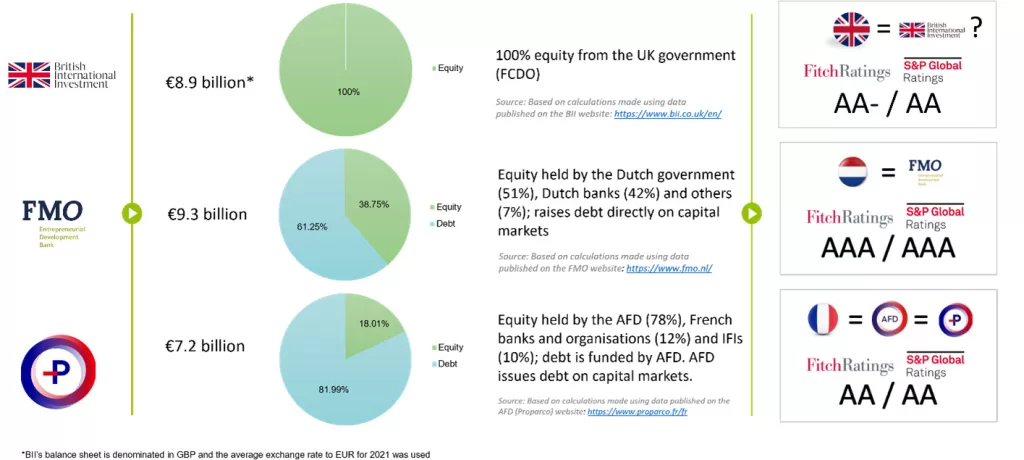

Summary of the three DFI’s business models

According to the OECD report Private Finance Mobilised by Official Development Interventions, the United States’ DFC is clearly the primary mobiliser amongst Development Finance Institutions (DFIs) (USD 4.7 billion). This is followed by France’s Proparco, the United Kingdom’s BII, the Netherlands’ FMO and Denmark’s IFU, which were among the DFIs with the largest volumes of mobilised private finance in 2018-20, with annual averages of USD 1.8 billion, USD 0.7 billion, USD 0.6 billion, and USD 0.5 billion respectively.

However, could more mobilisation occur at the bilateral DFI level? The OECD, together with the Centre for Development Finance Studies, sought to answer this question among others. DFIs have contrasting funding models, resulting in differences in their ability, incentives, optimisation of their balance sheets and mobilisation of private capital, with implications on development impact. A comparative analysis was undertaken of the funding models of three of the largest European bilateral DFIs: France’s Proparco, the Netherlands’ Financierings-Maatschappij voor Ontwikkelingslanden (FMO) and the United Kingdom’s British International Investment (BII). What is clear from the analysis is that he ratios of the leveraged DFI’s portfolio to the equity held, either by the government or by an entity wholly owned by government (in which case it is adjusted for this entity’s sources of funding) deliver considerable differences.

What became clear through the research is that bilateral DFIs have built up capabilities, expertise and networks that increasingly position them as major actors in the development finance space, alongside multilateral development banks. The mobilisation agenda is increasingly on the minds of policymakers, with that focus likely to also shift to bilateral DFIs.

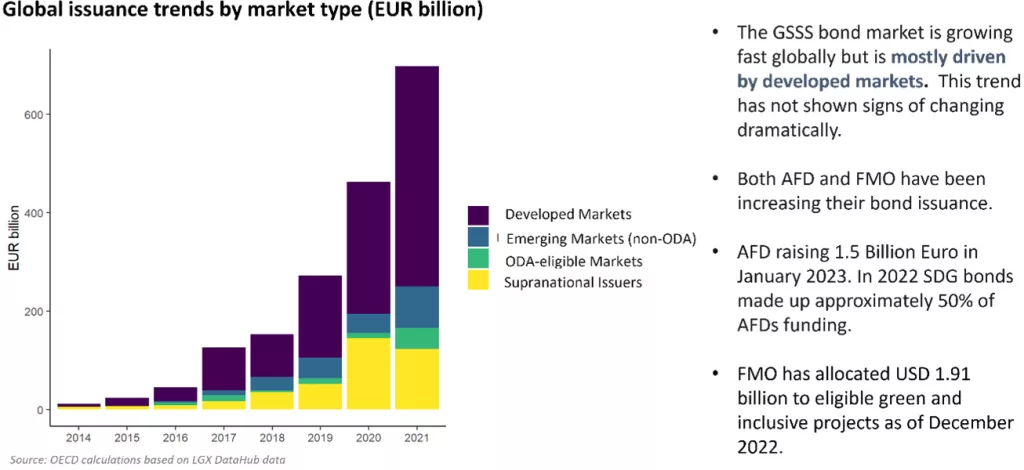

The GSS bond market in the case of AFD and FMO

Meanwhile, public funding is looking increasingly constrained, and so the mobilisation of private capital and the optimisation of DFI’s balance sheets are indeed increasingly necessary to ensure the potential of bilateral DFIs is realised in full and in line with agreed development targets.

In this mobilisation context, it is both difficult and ultimately important, to understand why the debt capital markets issuance programmes of DFIs and MDBs have to date not been recognised as a legitimate mobilisation instrument by development actors. The reality is that leverage has always been at the core of financial institutions business models, and that those tasked with the delivery of just and sustainable economic development for all should, as their purely commercial counterparts do, seize its opportunity.

A funding model that leverages taxpayer-funded equity by providing investors with simple instruments they have always used as the building blocks for their portfolios may be seen as a straightforward and time-efficient way to mobilise private capital. Green, Social and Sustainability bond market dynamics could provide DFIs with an opportunity they are uniquely positioned to seize, as demand from the private sector investors for these labelled financial instruments increases.

Leverage does, however, of course increase the risk taken on by shareholders and cannot be ramped up in infinitum. Here again, financial institutions have long resorted to risk transfer techniques in support of an ‘originate to distribute’ model, which focusses on their core value proposition rather than solely on their capital. And this DFIs must also consider.

Reflections on the policy implications of the report should inform decisions pertaining to the optimal model for equity investment programmes. Off-balance sheet solutions should be explored and their potential to deliver a combination of regulatory capital benefits and mobilisation efficacy analysed. Private equity investing and lending are fundamentally different endeavours and thus are seldom found under the same roof. It may in fact be argued that the teams responsible for their delivery should be equipped with differentiated frameworks and incentives.

However, it should be recognised that there is an inherent risk to a wider adoption of a leveraged model by bilateral DFIs. The frameworks that guide the activities of financial institutions were designed to channel behaviours towards alignment with desired objectives, and so the ‘laws’ of leveraged finance are as a result normative. In a context where the scarcity of bankable opportunities is already flagged as a key issue, converging funding paths delivering higher volumes of available financing risk leading to the same, already overcrowded pipeline.

Our analysis is therefore not suggesting that there exists a single optimal funding model, or that leverage should be universally or uniformly applied. It rather proposes that a greater level of coordination amongst DFI shareholders needs to be introduced, to ensure there is complementarity across the offering of individual DFIs.

Ultimately, it is through ever-closer collaboration that DFIs can reap the rewards of the successful harnessing of capital markets. Together, their combined portfolios can offer the size and diversification that efficient risk transfer transactions require. Together, small institutions can hope to gain from the very tangible benefits of large-scale, regular issuance programmes. Together, they can tap an investor universe beyond their own ‘turf’ that is vast enough to provide the basis for a successful market-building exercise. Together is of course easier said than done, and civil society must continue to investigate, challenge and support DFIs on the path to greater collaboration, ensuring we are greater than the sum of our parts.

By Paul Horrocks & Thomas Venon

You may have an interest in also reading…

Merkel: Convergence in Competitiveness Across the EU

In an address at the 2013 World Economic Forum Annual Meeting, German Chancellor Angela Merkel said that reforms implemented in

Keiko Honda, CEO MIGA: Crucial Role for Investment Guarantees

The Multilateral Investment Guarantee Agency (MIGA), part of the World Bank Group, is a financial institution exclusively dedicated to political

High Street Icon Pulled Itself Up by its Own Bootstraps But Tough Times are Coming

Humble beginnings, immense success, and modern challenges for Boots UK. In 1849, in the heart of Nottingham, a small herbalist