World Bank Group: Create Jobs by Focusing Industries to be Competitive

Focusing Investment in Industries Poised for Growth Can Help Generate Jobs, Income and Wealth.

By Janamitra Devan

Job creation is the top priority of governments worldwide, as countries large and small struggle to overcome the prolonged global economic downturn. Amid the euro crisis in Continental Europe, the abrupt slowdown in the United Kingdom and the United States, and the sudden sluggishness in many once-vibrant emerging markets, policymakers everywhere are urgently seeking activist pro-growth strategies.

To energize their economies for the long term, both the wealthy West and the developing world would be wise to look toward countries where a disciplined approach to making strategic investments in specific industries has paid dividends. Such an industry-focused approach can be especially effective in developing countries, where about 1.5 billion “vulnerably employed” people are barely surviving on subsistence-level incomes – and where intensifying demographic pressures foreshadow an overwhelming unemployment threat.

“… policymakers everywhere are urgently seeking activist pro-growth strategies.”

– Janamitra Devan

Propelling job creation will require a more comprehensive approach to focusing investment in integrated industrial ecosystems – networks of industries, innovators and investors that bring together all the creative elements that help economies thrive. The private sector must take the lead in organizing such industrial ecosystems, yet the public sector certainly also has a vital role to play. Sound policies must provide the enabling legal and regulatory frameworks that allow industries to compete – and not just by setting macro-level policies, but also by devising industry-specific strategies.

This challenge calls for countries to focus investments in industries with strong potential for success. Pursuing such a strategy will require both business and governments to reach deeper into their policy toolkit. Supportive public policies must ensure that a strong and agile infrastructure is in place; that a well-educated workforce is equipped with flexible job skills; and that advanced industries are incubated and encouraged with positive incentives.

This challenge calls for countries to focus investments in industries with strong potential for success. Pursuing such a strategy will require both business and governments to reach deeper into their policy toolkit. Supportive public policies must ensure that a strong and agile infrastructure is in place; that a well-educated workforce is equipped with flexible job skills; and that advanced industries are incubated and encouraged with positive incentives.

Deciding where to promote job-creating investment will inevitably be a complex process, but policymakers can apply a range of targeted strategies, tailoring them for the particular conditions of each country. Such a pragmatic approach should aim to induce investment in industrial sectors where countries foresee that they can sustain a competitive edge, building on their distinctive but as-yet-unrealized comparative advantages in the global value chain.

The World Bank Group is now actively helping our clients – low- and middle-income countries – make careful plans for focused investments through what we call the Competitive Industries approach. The Bank’s industry-focused efforts are now most active in Africa. In Burkina Faso and Niger, for example, the Bank is supporting an analysis of the agribusiness value chain to identify potentially job-creating areas, prioritizing investments in industries and infrastructure while pursuing regulatory reforms and regional trade integration. Similarly, in Mozambique, the Bank is helping intensify the focus on expanding the country’s tourism industry and on developing its natural resources.

Competitive Industries engagements are also under way in fragile and conflict-afflicted states, where job creation is critical to stability and security. In Afghanistan, the Bank is helping the government leverage mining investments into a resource corridor. In the West Bank and Gaza, projects are focusing on the value chains in agribusiness and information technology. In Haiti, projects are helping develop tourism and textiles.

Responsiveness to market signals is a key factor in the Competitive Industries approach. Policymakers must be bold enough to double-down on early signs of progress – and must also be realistic enough to withdraw support when the marketplace sends signals that failure is likely. Transparency and good governance are essential to maintaining confidence in an era when instant information-flows provide real-time data about industries’ performance. Adjusting to trends in technological change is another priority that calls for agile decision-making by the public and private sectors, working in concert.

Such coordinated public-private approaches have long been pursued successfully in Singapore, South Korea and Malaysia. Each country, in its own way, has made successful strategic investments – focusing on high-value industries, such as financial services and chemicals in Singapore, electronics and shipbuilding in South Korea, and semiconductors and electrical equipment in Malaysia. The same type of strategic analysis that these countries have applied to their industrial ecosystems can help inspire other nations to creatively focus their economic plans.

Such coordinated public-private approaches have long been pursued successfully in Singapore, South Korea and Malaysia. Each country, in its own way, has made successful strategic investments – focusing on high-value industries, such as financial services and chemicals in Singapore, electronics and shipbuilding in South Korea, and semiconductors and electrical equipment in Malaysia. The same type of strategic analysis that these countries have applied to their industrial ecosystems can help inspire other nations to creatively focus their economic plans.

Lower-income nations with limited resources are, in a sense, destined to make strategic choices about where to invest: Lacking the wealth to spread their bets too thin, they

must conduct shrewd analyses about where to channel their limited resources to try to create jobs. The developing world is in a race against time, as outlined in the latest edition of the Bank’s “World Development Report.” At least 350 million additional jobs must be created in developing nations over the next decade – just to keep up with the pace of population growth, much less to reduce today’s level of unemployment.

Taking a strategic approach to investment is increasingly important for wealthier countries, as well. Even the West’s most free-market-oriented economies – including the United Kingdom and the United States – have increasingly been pursuing activist economic policies to jump-start job creation in the private sector. Policymakers in the U.K. are often candid enough to use the term “industrial policy” to describe their initiatives, although that phrase sounds slightly off-key in the Washington debate.

Competitive Industries includes a somewhat more robust role for the public sector than Washington has been accustomed to, yet its logic is not out of step with the market-driven inclination of U.S. policymaking. Washington has traditionally preferred to let the private sector take the lead in industry-level decisions, but, in recent years, the federal government has been pursuing a range of more activist approaches. The Obama Administration launched a public-private Advanced Manufacturing Partnership and a new Office of Manufacturing Policy in 2011, and created a new National Network for Manufacturing Innovation in 2012, aiming to foster closer alliances among manufacturing companies, universities and federally funded research laboratories.

Public-private cooperation in shaping investment priorities does not amount to “picking winners and losers.” That approach, attempted in some countries in the 1960s and 1970s, sometimes merely propped up losers and cronies. Instead, the Competitive Industries approach considers such market-based criteria as agility, innovative capacity and responsiveness to global demand.

Public-private cooperation in shaping investment priorities does not amount to “picking winners and losers.” That approach, attempted in some countries in the 1960s and 1970s, sometimes merely propped up losers and cronies. Instead, the Competitive Industries approach considers such market-based criteria as agility, innovative capacity and responsiveness to global demand.

Many nations, both developed and developing, have come to grasp that shrewd industry-level interventions can help boost prosperity. Germany has long concentrated investments in high-value-added electronics and machinery, and it now enjoys an impressive lead over its competitors in many advanced energy systems. Brazil has made strong investments in its aerospace industry and clean-energy sector. China remains the standard-bearer for state-led dirigisme, yet its strong growth in recent decades illustrates the impact of targeted investment.

Making successful investment choices is especially important for developing economies – such as Indonesia, Vietnam, Morocco or Jordan – where rapid population growth makes the employment imperative most urgent. Strategic analysis of each country’s best opportunities, especially in tradable goods that compete in the global marketplace, can help policymakers calculate how to nurture the supportive innovation ecosystems that empower entrepreneurs.

Public policy may play only a supportive role in guiding each nation’s decisions about investment, with the private sector continuing to drive growth. Nonetheless, governments should play their role effectively rather than only grudgingly.

Nations can make strategic investments consciously, or they can take their chances blindly and hope to blunder into success – but, one way or another, the economic future will be shaped by those who analyze market forces and organize themselves strategically. Applying a pragmatic approach that targets a country’s comparative advantages through the lens of its industries is a promising way for each nation to strengthen its competitive assets. In a global economy that will relentlessly cull the losers and reward the most productive competitors, the winners will be those who anticipate events rather than merely react to them.

Janamitra Devan is a Vice President of the World Bank and International Finance Corporation, leading its network on financial sector and private sector development. Since joining the World Bank Group in 2009, he has focused on working with the Bank’s client countries to strengthen job creation; promote innovation and entrepreneurship; improve the climate for investment; provide broader access to finance for the poor; and oversee resilient banking systems and capital markets. Devan also represents the Bank on the Financial Stability Board in Basel.

The views expressed in this article are those of the author and do not necessarily represent the views of, and should not be attributed to The World Bank or IFC.

You may have an interest in also reading…

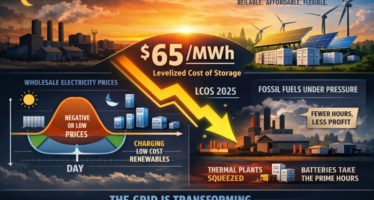

The Cost Curve That Is Squeezing Coal and Gas

By the end of 2025, the energy transition’s most persistent objection — that renewables cannot be relied upon when the

EBRD: Investing in Sustainable Infrastructure Helps Advance the UN’s SDG Agenda

At the beginning of this year, the European Bank for Reconstruction and Development (EBRD) created the Sustainable Infrastructure Group (SIG).

AccountAbility: Building Better Boards

Building a strong and effective board of directors can be a daunting challenge in today’s world. High-profile board failures, the