CBRE: Proptech Fuels Commercial Real Estate Leasing Market

It is easier than ever to evaluate and compare the features and prices of residential rental properties.

It is easier than ever to evaluate and compare the features and prices of residential rental properties.

The obvious first step to find a rental home or apartment is to go online. Filter by size, number of rooms, equipment, location, common facilities, price and conditions, scroll the listings that meet our criteria, and view their details. A virtual tour is often possible, and the landlord or broker can be directly approached.

But the digitalisation of commercial real estate leasing has been slow to develop.

Digital leasing solutions are now on the rise, amid an effort to slash deal times and improve client engagement. Younger generations of commercial real estate consumers are demanding greater tech capacity from brokers and landlords for the sake of comfort and transparency.

The shift has been in the making for years, but the pandemic further exposed the shortcomings of low online exposure for asset types not traditionally listed online. New technologies and software have emerged based on virtual tours and online communication. The blindsiding impact of the pandemic forced real estate professionals to adopt a digital transformation roadmap in response.

Digital Leasing Solutions

Many real estate teams still suffer from inefficient processes, long lead times, and slow decision-making. But digital lease management tools can significantly streamline the listing and leasing process.

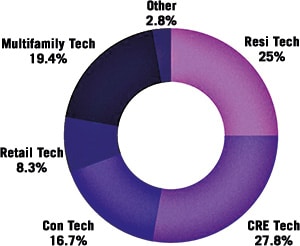

The market has an appetite for proptech solutions and in 2021, venture capital firms invested $32bn in digital solutions, 30 percent of which went specifically to commercial real estate tools.

Figure 1: Proptech 2021 investment rates per asset class.

Source: CRETI (Center for Real Estate Technology and Innovation), 2022.

Business intelligence products allow better decision-making because leaders are armed with more dynamic data. Much of that data underpins technology platforms that remain unstructured and unusable, so enterprise architecture and end-to-end integration will become increasingly important areas of focus.

AI-enabled business intelligence tools can gather and centralise leasing data regionally and globally, allowing firms to proactively manage lease contracts and transactions end-to-end through a one-stop platform. Data and analytics-enabled tools are central to streamlining listing operations and strengthening the asset portfolio strategy.

Despite the pandemic adding impetus to the digital transformation, the industry has been slow to integrate new technologies. Reasons include the complexity of property transactions. Most sales software adoption has followed a top-down pattern, which has often deterred software developers.

Online Leasing Marketplaces

Existing platforms mainly focus on smaller, less complex transactions or specific asset classes. This is changing as the sector gains scale and expands into new areas. Digital marketplaces for commercial properties offer significant scope to improve conversion rates, shorten deal times and increase efficiencies. But integrating fragmented back-office processes and systems is key to leveraging the full potential.

Tools such as VTS Marketplace enable tenants to search, view and share listings, while also allowing landlords to integrate listings and marketing content with management solutions or match space with prequalified tenants. In early September, CBRE announced a $100m capital injection to accelerate its growth and form a strategic partnership to create a differentiated technology platform for brokers, building owners and tenants.

“VTS’s proprietary technology has redefined how industry professionals lease and manage space, and has been widely embraced by property owners and leasing agents,” says CBRE CEO Bob Sulentic.

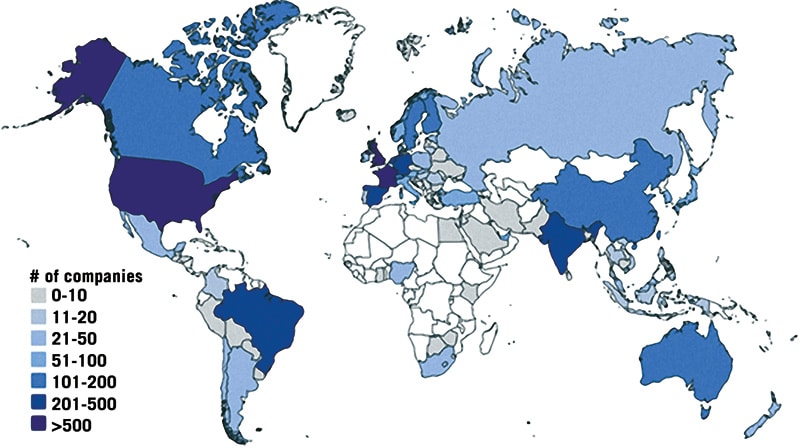

Figure 2: Number of proptech companies funded in 2021, per country. Source: LSE, Crunchbase. 2022.

Sizing the Market

The number of companies providing technology-based services has expanded by over 300 percent since 2010, while venture capital and other funding has also risen. It remains a relatively young technology ecosystem, with around three-quarters of these companies founded in the last 10 years.

As the technologies being used become more widely embedded and the industry matures, consolidation and in-house investment by established property companies has slowed the number of new start-ups being founded. Funding to the sector remains at elevated levels, driven by a variety of capital sources.

The US continues to account for the majority of company conceptions and fundraising, and is home to over half of funded companies over the past decade. China has significantly fewer companies, but is the next-largest market in terms of funding with over $16bn raised since 2010.

Western European and other major Asia Pacific countries also have clusters of start-ups. In Europe, the UK and Germany lead fundraising, followed by France, Spain and Sweden. India, Singapore and Australia have been the principal markets for fundraising outside China in Asia Pacific.

Potential and Challenges

The benefits to be gained from being a market leader in property technology solutions expand as the sector and its underlying technologies mature. There is greater customer engagement and increased efficiency, new sources of income and an ability to track and fulfil corporate ESG commitments.

However, in a fractured landscape with many start-ups providing overly-specific products and battling to measure ROI, it can be hard to find the right solution to maximise impact.

That requires a full-process technology adoption roadmap. And 2021 was a year to remember for proptech, as VCs set a new record for investment in private real estate tech companies. With over $32bn invested in proptech companies, the industry should continue to grow.

Analytics will drive bring improvements to the portfolio strategy. The massive increase in data collection made possible by new technologies will bring a need for enhanced cybersecurity, privacy and transparency capabilities.

Author: David Casas Alarcón Property Management Accounting Lead at CBRE’s European Center of Excellence

You may have an interest in also reading…

From Australia to the World – Rupert Murdoch: The Future of Newspapers in the Age of the Internet

Australia is simply not big enough for Rupert Murdoch, though the country did give him his first break into publishing

SDG Lab at UN Geneva: Delivering the 2030 Agenda in Decade of Action Will Call for Co-operation and Courage

In 2020, to mark its 75th anniversary, the United Nations have initiated UN75, the largest and most inclusive global conversation

Janamitra Devan: The Innovation Imperative

Overcoming the Myths and Recognizing the Realities of Innovation, Job Creation and Prosperity By Janamitra Devan Innovation drives competitiveness, and