IBM Thought Leadership: Transform Bank Business Models and Client Engagement With Open Hybrid Multicloud

Author: Paolo Sironi

Paolo Sironi is the global research leader in Banking and Financial Markets at IBM, Institute of Business Value. IBV is the thought leadership centre of IBM. In this article, Paolo discusses banks’ transition to new business architectures based on open hybrid multicoud, to reinvent client engagement on platform economies.

What do you see in the future of banks in the post-pandemic world?

The COVID-19 pandemic has claimed thousands of lives, stricken many more ill, and devastated entire economies. In response, many financial institutions have safeguarded employees, enabled alternative working models, focused on business continuity and resilience, and learned new ways of serving customers. Yet, the post-pandemic economic environment is unexplored terrain. Long after the medical threat has passed, the pandemic will bestow lasting consequences on business and society. Depending on the scale of government assistance, credit defaults could be higher than during the 2008 global financial crisis. Lower interest rates could prevail globally, potentially accelerating compressed net interest margins and impacting a key revenue stream for banks.

The new normal for financial services could compel banks to embrace continual reinvention of their business models and solutions. Forward-looking financial institutions can seize this opportunity to accelerate their migration to a new business architecture, essential to win in the platform economy.

This architecture can be built on next-generation customer experiences embedded in customer ecosystems, enabled by AI engagement and digitalized end-to-end journeys. It relies on a data environment transformed with structured and unstructured, open or proprietary data. Advanced analytical tools and AI help manage vast information flows and help banks to contextualize their offers inside non-banking client journeys.

This new architecture can be security-rich and compliant with effective risk reduction and more efficient compliance operations. Finally, operations can radically transform to be digital, agile, and intelligent, with modernized applications deployed on open hybrid multicloud environments. They can be designed for virtually zero risk tolerance, at structurally lower cost, and offer entire new ways of working and serving clients.

What is open hybrid multicloud, and why does it matter for banks?

Open hybrid multicloud is a foundational environment enabling effective digital transformation that integrates traditional computing platforms with private, public, and managed cloud services. In essence, a hybrid cloud becomes a virtual computing environment that aligns workloads and interfaces with the most appropriate computing platform. All these services need to be managed as though they were designed to behave as a single unified environment. Open hybrid multicloud is a logical solution for banks, because it offers them the needed flexibility while addressing all security and cost concerns.

Accelerated digital adaptation and macroeconomic factors have driven structural changes in the banking industry. Banks are rethinking their business models and operations to remain competitive amid economic, industry, and consumer-related shifts. Part of this includes migrating to a new business architecture to better accommodate today’s digital reality, and the shift from output economies (how many products do I sell) towards outcome economies based on platform engagement (how do I help my clients achieve their personal, business and financial goals).

In building this new digitally agile architecture, banks are challenged to balance their infrastructure platform need for flexibility to support business model innovation and digital transformation with security and compliance requirements. An open hybrid multicloud environment that offers a mix of public cloud flexibility and private cloud customization is ideally suited for the financial services industry. While the benefits of moving to open hybrid multicloud are clear, the path – which workloads to move and when and where to move them – is a bit muddier. An industry-tailored approach designed to prioritize workflows according to both technical and business criteria can help clear the way with a map toward success.

What is IBM “How to” for banks to successfully migrate to an open business architecture?

Recently, the IBM Institute for Business Value (IBV) published a paper Banking on Open Hybrid Multicloud addressing the key question: “How do I determine what functions sit on which platforms?” The goal, obviously, is for each of the various environments to handle what it does best, with each workload in the right place for reduced risk, increased agility, etc.

This requires not only looking at the puzzle from a technical point of view, but also considering the business objectives. An organization has to make decisions about which workloads to prioritize for public cloud, which ones to prioritize for private cloud, and which to leave on a more traditional platform. They also need to separate what can be done—in terms of ease and feasibility—from what should be done from a strategic standpoint.

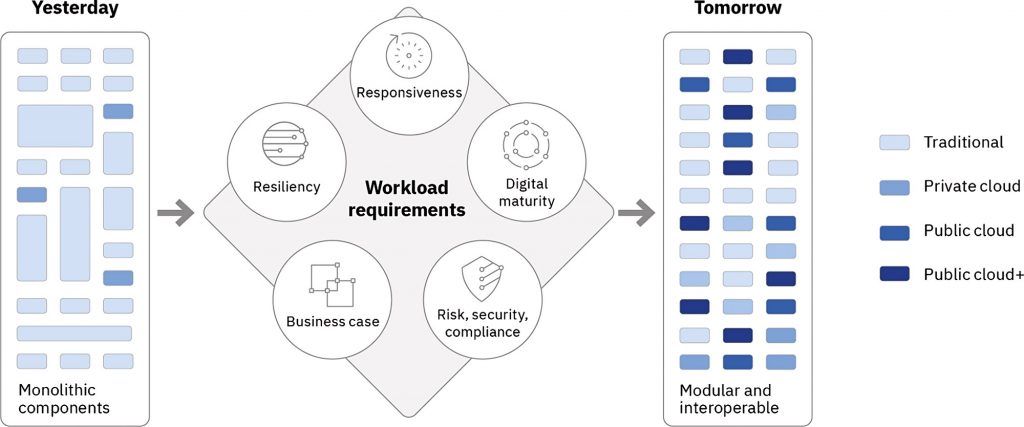

Making these decisions requires an industry-tailored approach and framework to evaluate workflows and determine the appropriate operating environment. By evaluating workloads according to industry-specific benchmarks, a bank can align and prioritize each workload with an optimal platform – traditional, private cloud, public cloud, or public cloud – designed to support a workload’s unique requirements. Both operational and business criteria should be considered in workload evaluation: a robust multicriteria evaluation framework can help determine the optimal platform for each workload, with both a business and operational perspective.

This entails evaluating each workload’s requirements related to five critical elements:

- Resiliency. Evaluate the volume, stability, and business criticality of the data and transactions involved.

- Responsiveness. Consider the latency, response, and service requirements associated with the workloads.

- Digital maturity. Evaluate the evolution of the financial institution’s digital transformation from monolithic operations to modular services. Workloads more easily decoupled from other workloads without loss of interoperability are candidates for migration.

- Risk, security, and compliance. Gauge the regulatory requirements and security features associated with a workload. These can vary significantly depending on a financial institution’s security posture and geographic and segment regulatory regime.

- Business case. Examine expected investment requirements, cost and revenue benefits, and potential impacts on competitive advantage and disruption.

Each bank has to make its own individual decisions about how to configure and manage the sub-components of its operations and how much flexibility is built into the open hybrid multicloud set up it deems most advantageous. The evaluation criteria can help guide these decisions, identifying and mitigating real and perceived hurdles.

Evaluating workloads for migration to open hybrid multicloud

What can banks achieve with this open business architecture?

A dramatically different normal calls for financial institutions to play a crucial role both in their business operations and in their clients’ lives. They’ll need to step up and guide customers through economic and financial instability. And they’ll need to help those customers navigate and even thrive in an uncertain world. Taken together, the challenges of this next environment point to the need for open business architectures.

Until now, client-centric operations have been anchored to products typical of “output economies,” in which customers are those who buy. The next normal might accelerate the transformation to human-centric, service-based platforms, ones that place relationships front and center.

These platforms are based upon value-generating interactions that are typical of “outcome economies,” in which customers achieve their goals through seamless experiences. Consider interactions that create transparent banking relationships, directly or digitally augmented, with trust generated through a value exchange between banks and their most precious assets, their clients.

Therefore, banking architectures and their corresponding business models could see a dramatic transition. A bank’s purpose could evolve from credit institutions, which provide relevant accessory solutions (payments, investment, insurance), into platform-driven centers of competence (CoC). These CoCs would integrate lending operations into advisory relationships for families and businesses. The emphasis shifts from distribution channels of lower-margin products to relationship-based services built on client engagement and experience as discussed in my latest book on banking economics “Financial Market Transparency”, which provides theory and principles for a new engagement mechanisms that allows banks to remain sustainable and competitive against Bigtech players.

The bank of the future will redesign customer proximity not only by using data to personalize their offers (output economy), but also by infusing AI into interactions. The “data-driven bank” will be based on the “data-enabled client.” This model generates new value, understanding how digital relationships can truly create closeness and positive impact even during a crisis such as a pandemic lockdown.

Trusted digital relationships are not only the real asset of financial institutions facing a different normal, but a necessary mechanism to help communities weather the storm, and emerge robust and ready for the future.

About the Author

Paolo is the global research leader in banking and financial markets at IBM, Institute for Business Value. He is one of the most respected Fintech voices worldwide, providing business expertise and strategic thinking to a network of executives among financial institutions, startups and regulators. He is a co-host of Breaking Banks Europe Fintech podcast, and celebrated author on quantitative finance, digital transformation and economics theory. Paolo’s literature explores the biological underpinnings of financial markets, and how to bolster with technology and business innovation the global economy’s immune system in today’s volatile times.

Paolo’s website: thePSironi.com

You may have an interest in also reading…

Brain Capital: An Emerging Investment Opportunity

To solve existential brain challenges spanning neurology, mental health, psychiatry education, workforce development, and neuroscience, we need a fresh approach

Philippe Le Houérou, CEO of IFC: Redefining Development Finance

Complementing – and driving – World Bank President Jim Kim’s vision to transform the multilateral financier into an “honest broker”

CFI.co Meets the CEO of SSF: Sam Shawki Fawaz

Mr Sam Shawki Fawaz, managing director and CEO of SSF Entrepreneur, has accumulated over forty years of experience in Liberia’s