Blockchain Technology Proves Its Point

Blockchain is playing its part in the unfolding Fourth Industrial Revolution.But this key technology – that powers and sustains Bitcoin – has yet to gain a solid foothold outside the cryptocurrency domain. The technology’s revolutionary powers and impact have been praised to such a degree that it is difficult to separate the hype from the vision. And the facts.

Blockchain is playing its part in the unfolding Fourth Industrial Revolution.But this key technology – that powers and sustains Bitcoin – has yet to gain a solid foothold outside the cryptocurrency domain. The technology’s revolutionary powers and impact have been praised to such a degree that it is difficult to separate the hype from the vision. And the facts.

Blockchain is not magic stardust to be sprinkled on any challenge, but blockchain has demonstrated its effectiveness as an enabling technology beyond the scope of cryptocurrencies. The hype may yet approach reality, as blockchain is combined with other Fourth Industrial Revolution technologies – artificial intelligence, quantum- and edge-computing, and the Internet-of-Things (see Ian Fletcher’s article in the Summer 2018 issue of CFI.co).

A Definition

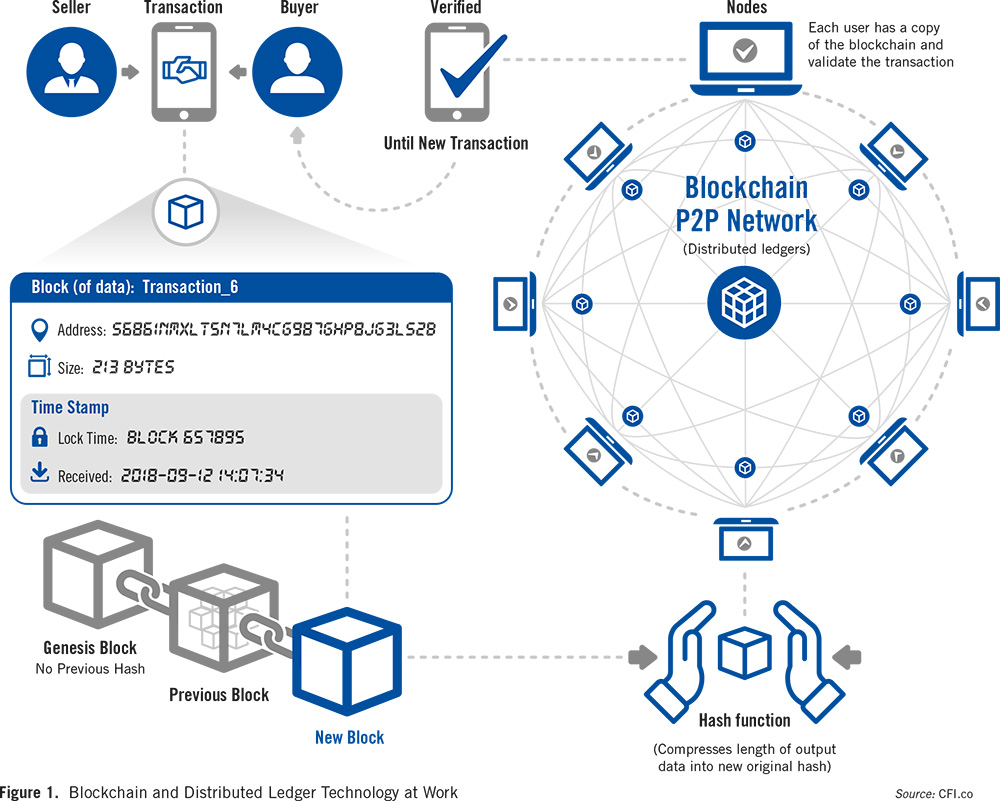

Blockchain could be defined as a distributed ledger of transactions between two parties recorded in a way that ensures data integrity, and is resistant to modification – a process that is enforced by every node in a decentralised network (Fig. 1).

How Blockchain Works

Blockchain technology gathers, orders, and fits data into blocks, then strings these together in a process that is secured by cryptography. Each transaction is stored in a block of data with a hash – a string of characters generated in real time to serve as a unique stamp, and a way to transform data to a uniform, fixed size.

“Blockchain has demonstrated its effectiveness as an enabling technology beyond the scope of cryptocurrencies.”

These hashes are cryptographically produced, making the blockchain virtually impervious to tampering. As the information is sequential and time-stamped, duplicate entries are not possible (Fig. 1).

After two parties agree to undertake a transaction, information specific to the deal is digitally signed and broadcast to every other user node in the network. Once these nodes have checked the information and deemed it legitimate, the transaction is confirmed, and each node updates its copy of the blockchain accordingly. The block is then data-packed with other chronologically ordered transactions and, once all have been connected and timestamped, a blockchain is formed (Fig.1).

Distributed Ledger Technology (DLT) vs. Blockchain

Blockchain is a distributed ledger technology (DLT) which can be implemented in various ways. As Chris Kacher notes: “Every blockchain is a DLT, but not every DLT is a blockchain.

“A distributed ledger is a database that is shared and synchronised across networks. It could be said that the beating heart of blockchain is its underlying distributed ledger technology, just as the beating heart of Bitcoin is blockchain.” (To read more of Dr Kacher, look online at CFI.co.)

Brief History

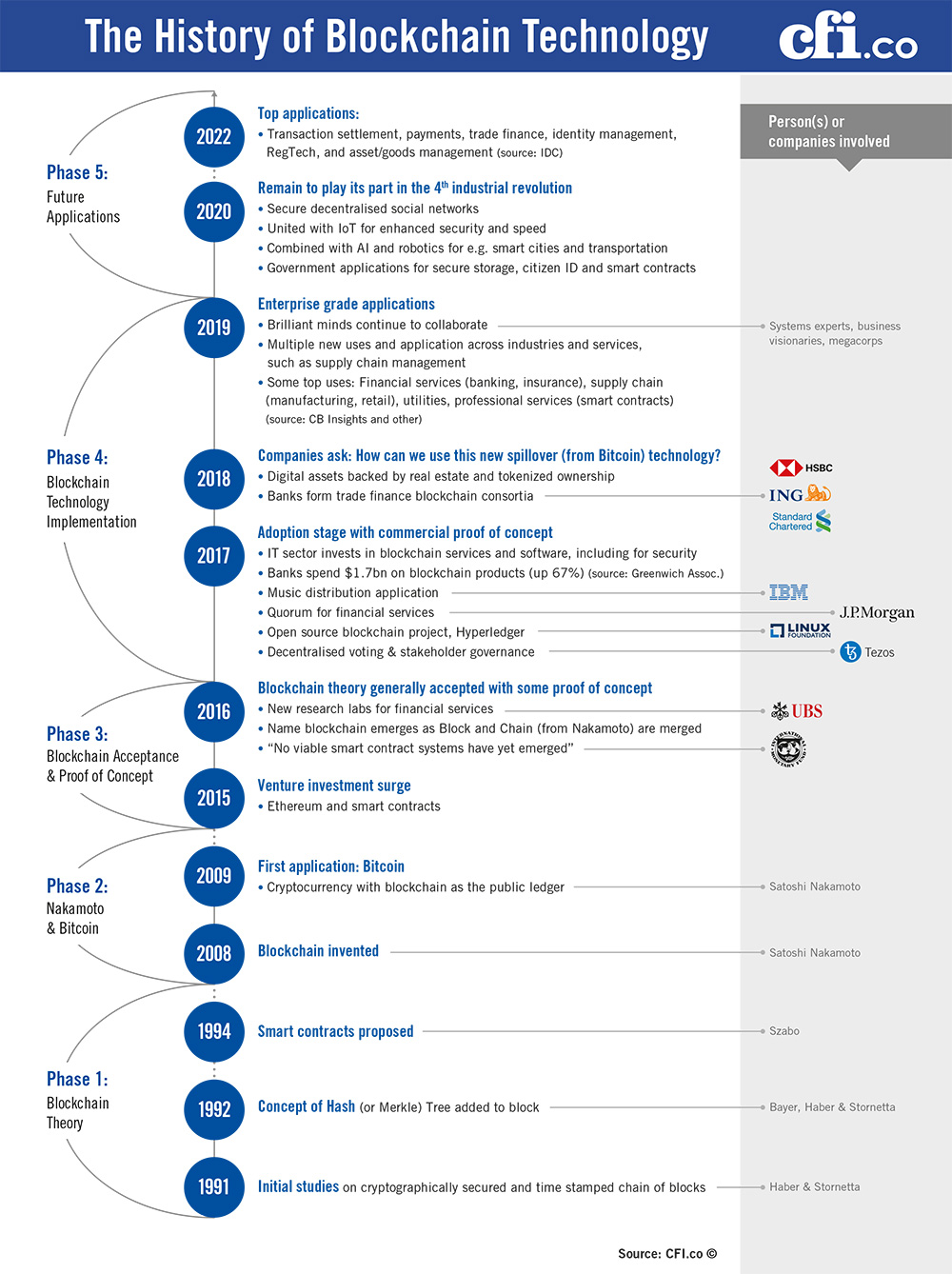

The history of blockchain can be split into five distinct phases – the last of which is still to play out (Fig. 2).

It all started with some theoretical work in the early 1990s (phase 1). Blockchain proper was invented by Satoshi Nakatomo in 2008 (phase 2). He followed-up his findings the next year by using blockchain as the cornerstone of Bitcoin. Interest in blockchain only really exploded in 2015 (phase 3) when the technology had become generally accepted, and mainstream.

Since then, blockchain has been all about deploying the technology and adapting it to the requirements of different industries (phase 4). Large global corporates, including banks, have now entered this new space looking for value-creation through enterprise-grade commercial applications (phase 5).

Uses of Blockchain

Even modestly sized companies have asked: How can we use this new digital technology to improve our business? The answer stretches across a broad spectrum.

Blockchain technology can be used in multiple paperless ways to improve efficiency and security, as well as simplify transactions and cut-out intermediaries (Fig. 3).

CB Insights, a purveyor of market intelligence to companies, identifies some 42 sectors and industries that blockchain could help to transform.

Some of the key current and future uses for blockchain are financial services – trade finance, transaction settlement, payments, identity management, FinTech, RegTech – as well as supply chain (manufacturing/retail) management, utilities, professional services (smart contracts), and asset/goods management.

Waiting for the Killer App

There may not be a single killer application for blockchain yet – other than, perhaps, cryptocurrencies.

According to Vitalik Buterin, co-founder of Ethereum cryptocurrency, there is unlikely to ever be a “killer app” for blockchain technology. “The reason for this may be found in the doctrine of low-hanging fruit,” he says. “If there existed some particular application for which blockchain technology is massively superior to anything else, then people would be loudly talking about it already. And so far, there has been no single application that anyone has come up with that has seriously stood out to dominate everything else on the horizon.”

Most banks are currently facing the 3C conundrum (see my article on Reg-Tech in the previous issue of CFI.co): How simultaneously to reconcile compliance with multiple new regulations – with the need to cut costs and improve customer service.

New FinTech companies hold the upper hand, with large commercial banks with heritage systems neither suited nor designed for tomorrow’s world. Banks have now built consortia to explore and exploit blockchain and DLT in trade finance pilot projects (Fig. 2). Blockchain can be used to streamline international trade transactions and also shows great potential for efficient and secure global financial services enterprise applications.

Key advantages include operational efficiencies, cost-effectiveness, traceability, transparency, and accountability. These partnerships can also cut down on compliance costs, as they are fully scalable across the globe.

To this new technology – which favours the rapid progress of agile players such as, say, FinTech start-ups – this is important when considering the disadvantages of the millstone of legacy systems around major banks’ necks.

Playing to Its Strengths

The advantages of blockchain are plenty and easily identifiable:

- Blockchain can be used to record or store anything of value, not just financial transactions

- Blockchain is a secure validation mechanism and as such is accountable for the fail-free objective truth, without the possibility of human or digital error

- Blockchain cannot be controlled by any single entity

- Blockchain is incorruptible: no unit of information in the blockchain can be altered without overriding the entire network.

- Fourth Industrial Revolution Applications

Here are a few of the many promising applications of blockchain technology as the Fourth Industrial Revolution takes shape:

- Supply-chain management

- Trade finance replacing often archaic and fallible banking procedures

- Improving secure-edge computing, which is data-processing near the data creation (a mesh network of microdata from, for example, one or more sensors)

- Smart contracts tracking multiple assets, automatic and self-executing when set conditions are met

- Digital assets management backed by real estate and tokenised ownership

- Secure decentralised social networks

- Combined with the IoT for enhanced security and speed

- Combined with AI (artificial intelligence) and robotics for smart cities and mobility

- Government applications for secure storage, citizen IDs, and smart contracts

Myth of Immutability

Just as the claim that encryption can resist new quantum computer power, the myth of immutability of the blockchain can be hard to accept. Surely, no technology can be 100% secure…

An efficient and direct blockchain, cutting out the middle man, could lead to lack of accountability and less transparency – with some actors missing out on value-added services and requiring human knowledge and assistance.

Fear and Hope

The optimism that blockchain will revolutionise business in general, and the financial services industry in particular, could merely be a reflection of an intense desire to change a global financial and monetary system deemed unfair by some. The way in which banks operate and the increased inequality, fuelled by successive asset bubbles inflated by quantitative easing, are cause for concern. The hope for a more inclusive, equitable, and egalitarian society, as well as for a fairer, decentralised form of governance, has inspired many to consider blockchain an agent of change.

And while mankind continues to yearn for new technologies to cure its many ills, it has so far failed to find any that fit the bill. The internet and the mobile phone have been transformative, but the societal impact of the humble washing machine has been more measurable – at least according to Cambridge economist Ha-Joon Chang, who regularly cautions against too much optimism on determining the transformative potential of new technologies.

Blockchain, though useful in many ways, including those that cannot yet be foreseen, is no doubt a game-changer for some. To others, it will end up being a disappointment. What to do if blockchain gets it wrong? Is it uncrackable, or hackable? There surely be no such thing. So, if the computer says no, where to turn to for a human override to stop your assets from becoming trapped in virtual reality…

You may have an interest in also reading…

DESERTEC: Clean Power From Deserts

By Michael Düren Solar power from deserts can contribute significantly to a future renewable energy system. The technically accessible solar

Paolo Sironi, IBM: 2022 Global Outlook for Banking and Financial Markets

In the third year of a global pandemic, the financial services industry appears to be acclimating to a new reality.

DESERTEC Foundation Endorses DESERTEC Power for Kingdom of Saudi Arabia

DESERTEC Power was established to advance the energy supply in the Kingdom of Saudi Arabia. This follows the direction of