Decarbonisation and “Greenflation”

Accelerating the transition toward low or net-zero carbon emissions is necessary to keep global warming at theoretically safe levels. That will likely bring price shocks associated with rising metal prices, energy costs, and carbon taxes – what has been called “greenflation”. Greening the economy will also require public spending and redistributive policies.

Accelerating the transition toward low or net-zero carbon emissions is necessary to keep global warming at theoretically safe levels. That will likely bring price shocks associated with rising metal prices, energy costs, and carbon taxes – what has been called “greenflation”. Greening the economy will also require public spending and redistributive policies.

Moving Faster Along the Road to Decarbonisation

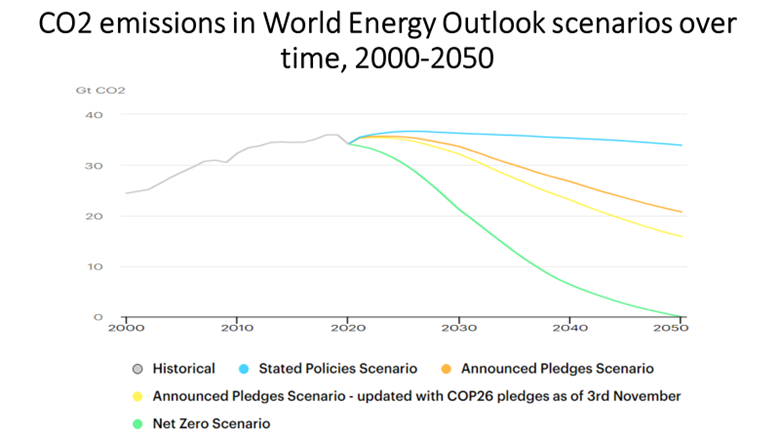

In the wake of the COP26 Climate Change Conference in Glasgow, the International Energy Agency has updated the CO2 emissions scenarios in its World Energy Outlook from October (IEA, 2021a), taking into account the most recent country pledges. Despite a steeper decline in emissions, the world would still be far from reaching the dreamed-of net zero emissions scenario by 2050 (Figure 1).

Figure 1. Source: Birol, F. (2021).

According to the IEA, if all Glasgow commitments are met, global warming will be bound to 1.8oC above pre-industrial levels by 2100. That would be a substantial decrease from the 2.7oC which pre-COP policies would have been expected to lead to, but obviously still distant from the “substantially below 2oC” promised in the 2015 Paris Agreement.

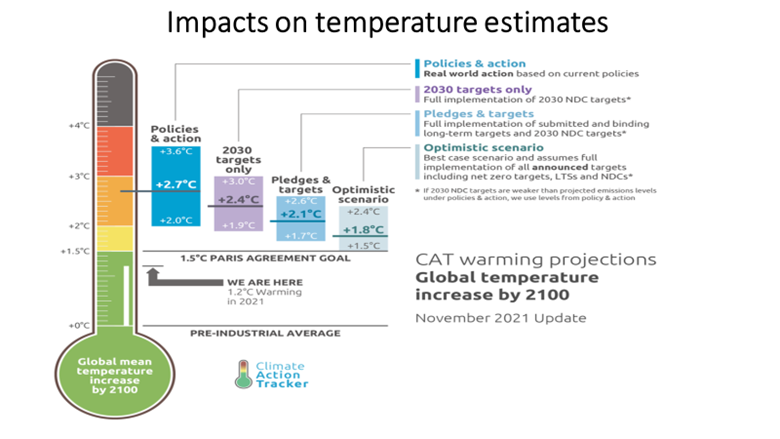

Estimates by Climate Action Tracker (CAT) suggest that current pledges for 2030 will not deliver the emissions reductions necessary to push long-term warming down, leading to warming of 2.4oC if further revisions are not made. Figure 2 shows that, while the continuation of current policies would imply a 2.7oC increase in global mean temperatures, the full implementation of ‘nationally determined contributions’ (NDCs)—efforts by each country to reduce national emissions and adapt to the impacts of climate change—up to 2030 would lead to more 2.4oC of warming by the end of the century. Climate Action Tracker’s ‘pledges and targets’ scenario temperature of 2.1o C reflects all NDCs and submitted or binding long-term targets, including the United States’ and China’s net-zero targets, now that both countries have submitted their long-term commitments. The optimistic scenario of 1.8oC of global warming requires faster emissions reductions in the coming decade.

Figure 2. Source: CAT – Climate Action Tracker (2021).

Agriculture, forestry, and land use matter as they correspond to about 20% of total greenhouse gas emissions, and forest cover can help remove CO2 from the atmosphere. Preventing deforestation can play a significant role in lowering CO2 emissions, and can even provide a net sink.

In what follows, we focus on energy.

There Will Be Metal Price Shocks on the Road to Decarbonisation

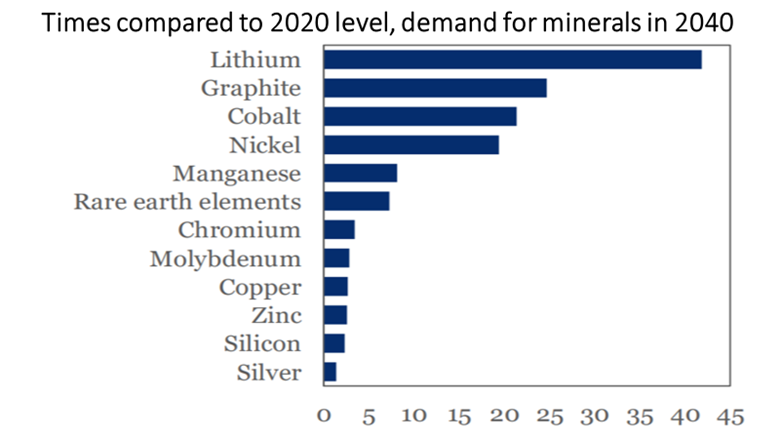

Supplies of renewable energy and biomass need to rise to meet global primary energy needs, and the trajectory towards decarbonisation will bring a sharp increase in the demand for metals, including copper, nickel, cobalt, and lithium, used intensively in green electricity and electricity storage. IEA (2021b) predicts that lithium and cobalt consumption, for instance, will need to increase more than sixfold to meet the needs of batteries and other uses in the production and non-consumption of clean energy.

Figure 3 shows how many minerals used in green technologies will go through a significant surge in demand during the energy transition. Demand for raw materials used in existing clean-energy technologies, such as solar panels and wind turbines, is expected to increase significantly.

Figure 3. Source: IIF (2021).

Such an increase in demand will face a slow-motion supply response. Copper, nickel, and cobalt mines are investment-intensive and take an average of more than a decade from discovery to production, according to the IEA. Lithium is often extracted from mineral sources and brine through salt water pumped from the ground. This reduces lead times for new production to an average of about five years. There will also be the challenge of ramping up production without going against social and environmental safeguards.

The combination of increasing demand and slower changes in supply could cause the prices of these metals to skyrocket. In fact, according to International Monetary Fund projections, if mining were to satisfy consumption in the IEA’s net-zero emissions scenario, prices could reach historic highs for an unprecedented period (Boer et al, 2021). For example, the price of lithium could rise from $6,000 a metric ton in 2020 to about $15,000 this decade.

The production value of the four metals could increase up to six times to US$12 trillion in two decades, according to the IMF.

There Will Also Be Energy-Cost Shocks

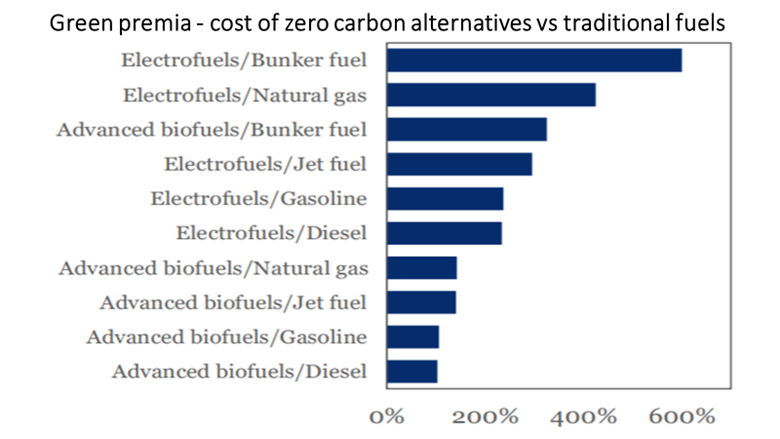

Given the state-of-the-art in terms of technology, there may have to be a switch to more expensive non-carbon energy alternatives, for a significant period, if they are ultimately to replace conventional fossil fuels. Green premia—price of clean technology/price of carbon-emitting alternative—will have to be paid. Figure 4 illustrate this in the case of transport fuels.

The good news about such replacement is that the evolution towards cleaner technologies with declining costs is already taking place. The bad news is the presence of obstacles to such investments—particularly in the case of green infrastructure in non-advanced countries (Canuto, 2021).

Figure 4. Source: IIF (2021).

Fossil fuels have also provoked price shocks. The expectation has been that their prices will fall as the transition away from fossil fuels pushes demand for them to the bottom. However, supply conditions have also deteriorated because of the drop in investment in oil wells, natural gas centers, and coal mines.

In 2021, the lack of investment has been one of the causes of the spike in the prices of the three energy commodities. Oil surpassed $81 a barrel after the Organization of Petroleum Exporting Countries (OPEC) and allies such as Russia, which are part of the OPEC+ alliance, at an October 4 meeting, resisted calls to increase production. Unlike what has been seen since 2015, when oil and gas prices changed levels, this time U.S. gas and shale oil were not ready to close the gap. The trajectory of fossil fuel prices will not be steady…

In fact, public policy measures seen as favorable to the energy transition already place a price burden on the use of fossil fuels. Such policy measures include a price (tax) on carbon, elimination of remaining subsidies, mandatory transparency and sanctions on financial assets, and future bans on internal combustion engines.

We have then experienced what can be called the ‘first energy shock of the green economy era’ or, for those who deny that we have already entered that era, the ‘last energy shock of the fossil fuel era’. From May to October 2021, oil, coal, and gas prices together rose 95%. This year’s strong economic recovery has been confronted by oil stocks at levels 6% lower than usual, as well as gas stocks in Europe at just 86% of previous levels, and below 50% in the case of coal in China and India.

At the same time, besides green premia still paid to replace carbon-emitting technologies with clean alternatives, existing stocks of investments in renewable energy have been shown to be insufficient to serve as a full alternative. According to figures from the International Energy Agency (IEA), in 2020, the share of renewable energy sources in domestic energy in the world was 13.8%, and 11% in OECD countries. In Brazil, according to the Energy Planning Company, the level was 46%. The year’s energy shock reflected climatic phenomena—low wind in Europe, droughts affecting hydroelectric production in Latin America, floods in Asia affecting coal delivery—but also that investments in renewable energy are evolving below what is necessary for the energy transition—that is, driving the use of fossil fossils to net-zero between 2050 and 2060.

Higher input prices in energy production and use, as well as accelerated spending on climate change mitigation, will be tolls on the decarbonisation route.

A Carbon Price Shock Will Be Needed to Move Ahead on the Road to Decarbonisation

Moving along the road to decarbonisation will also demand a significant change in the relative prices of goods and services, with these starting to reflect their carbon-intensity in a context in which the carbon price will have to rise from zero to significant levels everywhere. Gaspar and Parry (2021) propose that, at the international level, measures be taken to reach a carbon price equal to or greater than US$75 per ton by 2030.

Such a carbon price may be established and charged explicitly and/or indirectly through the effects of regulations or limits on uses. Decarbonisation will be negligible if the price of carbon remains that of a ‘free good’ from nature. Carbon prices will also have to be among the factors influencing people’s behaviors and lifestyles.

Transitioning away from fossil fuels and carbon-intensive production and consumption implies a wide-ranging switch to emissions-neutral alternatives in all sectors. Policymakers can stimulate this transition by raising the implicit cost of emissions. As it will take some time until alternative technologies are fully developed and deployed, the road to decarbonisation may entail higher costs along the way.

Greening the Economy Will Also Need More Public Spending and Redistribution Policies

The decarbonisation trajectory will also have consequences for public accounts. Necessary public expenditure on infrastructure to enable the transition will be required. Transitioning to a net-zero emissions economy will necessitate investment flows towards mass deployment of green electricity and electricity storage.

Except in the unlikely event of full coverage of expenditures with a carbon tax, the trend will be of increases in public debt, though in this case without intertemporal injustice, as future generations will be grateful not to have to live permanently with an even more adverse climate.

Decarbonisation will possibly have regressive income impacts. For example, real estate to be rebuilt or retrofitted corresponds to the largest share of assets of people in the lower half of the income pyramid. Direct carbon taxation will have different impacts on different urban groups. Compensating expenditures for regressive carbon pricing impacts will be demanded, as direct carbon taxation will have different impacts on different urban groups. It will be important to ensure income-transfer mechanisms both within countries and internationally associated with carbon pricing, to mitigate the regressive impacts of combating climate change.

Additionally, workers will have to move from carbon-intensive activities to greener substitutes. There will be not only the challenge of labor reskilling, but also of ensuring that new jobs are created in large enough numbers in dynamic activities. It is known, for example, that the production of electric cars requires less labor than that of combustion engine vehicles.

In addition, there will also be accelerated obsolescence of existing stocks of physical assets (machinery and equipment, buildings, vehicles), and intangible assets associated with carbon-intensive activities. The counterpart will have to be accelerated investment in new assets to replace them.

Bottom Line

What about GDP and its growth during the transition? Here the duality of impacts discussed above is repeated. On the one hand, there will be capital destruction, in addition to relative price shocks and the transitional impacts of reduction of potential growth. If the need for higher investment rates in GDP accompanying decarbonisation collides with supply capacity limits, consumption will have to adapt downwards throughout the transition.

On the other hand, cleaner technologies will also offer opportunities to increase productivity. In any case, the socioeconomic return of decarbonisation must include stopping heat waves, floods, hurricanes, droughts, floods, and storms from becoming even more intense and frequent, because the cost of that would be even higher losses of GDP of nations.

High metal prices, carbon taxes, and accelerated obsolescence of capital associated with fossil fuels, are tolls to be paid on the road to decarbonisation. Bearing in mind the consequences of not doing so, it will be worth paying such tolls. “Greenflation” will be worth paying for decarbonisation.

Policy Center for the New South, PB-51/21

References

Birol, F. (2021). COP26 climate pledges could help limit global warming to 1.8 °C, but implementing them will be the key, IEA Commentary, November 4.

Boer, L.; Pescatori, A.; Stuermer, M.; and Valckx, N. (2021). Soaring Metal Prices May Delay Energy Transition, IMF Blog, November 10.

Canuto, O. (2021). Matchmaking Private Finance and Green Infrastructure, Policy Center for the New South, July 7.

CAT – Climate Action Tracker (2021). Glasgow’s 2030 credibility gap: net zero’s lip service to climate action, November 9.

Gaspar, V. and Parry, I. (2021). A Proposal to Scale Up Global Carbon Pricing, June 18.IEA –

IEA – International Energy Agency (2021a). World Energy Outlook 2021, October.

IEA – International Energy Agency (2021b). Net Zero by 2050, May.

IIF – Institute of International Finance (2021). Navigating to Net-Zero: Greenflation Risk, December 2.

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a nonresident senior fellow at Brookings Institution, a professorial lecturer of international affairs at the Elliott School of International Affairs – George Washington University, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil.

You may have an interest in also reading…

Otaviano Canuto, World Bank: Global Imbalances on the Rise

Discussions around large current account imbalances among systemically relevant economies as a direct threat to the stability of the global

IFC: Capital Markets Key to Development

Ending extreme poverty for good and building shared prosperity across the developing world takes money – a lot of money.

The Time Is Now: Paradigm Shift Signals Opportunity

Few people realise that in 2013 a turning point was reached. In that year, emerging economies displaced developed markets as