AccountAbility: Building Better Boards

Building a strong and effective board of directors can be a daunting challenge in today’s world. High-profile board failures, the rise in activist investing, and innovative market disruptions are just the tip of an iceberg highlighting the imminent need to rethink effective board governance.

Most boards often wrestle with their core mission – which is providing clear oversight and strong strategic support for management’s efforts to create long-term value for the organisation. Management and directors around the world face similar pressures on how to deliver short-term financial results and tackling an underemphasis on long-term value creation.

Future-Focused Boards. Source: AccountAbility International, 2023

Company Boards have long been expected to set a “tone at the top” for organisational culture, modeling company values and sound business practices. Each director, therefore, serves as a “link” in the chain between the company’s core values and its ultimate business performance. Boards can play a critical role in helping companies navigate a complex business landscape by guiding the appropriate choices in strategy, risks, and economic return.

As the mandate of the board shifts, directors must ensure that they demonstrate competencies that fit not just the present but also future needs.

The fundamental question at large is – “How do we build an effective future-focused board that is fit to confront the challenges of the 21st century?”.

1. Understand the Industry Dynamics

The challenge for independent directors is to stay fully informed about the companies on whose boards they serve, as well as the ecosystems in which the company operates. Too much time is spent reviewing company financials, plans and engaging in “check-the-box” exercises. Relatively few directors feel they have a clear and complete understanding of the industry dynamics of their companies, the ecosystems that they operate in, or, specifically, how their companies create value.

To remedy this problem, boards need to invest dedicated time to better understand the structure, dynamics, and value-creation potential of their business. Creating a forward-looking committee (or even designating a couple of board members) to focus on “what’s next” and setting time aside from Board meetings and Management discussions will enable a proactive point of view on strategic issues and help to challenge management biases and established doctrines of thought.

2. Challenge Company Strategy

Developing company strategy can become complex and multi-faceted, especially with a board’s active engagement. Armed with a foundational view, based on a clearer understanding of industry and the company’s economics, boards are better positioned to have the kinds of informed dialogue needed to improve and advance company strategy.

But the ability to have such dialogues with candor and trust depends on the board’s ability to develop a culture of constructive challenge – both, amongst members, and with senior management.

Institutionalising a culture of healthy debate and questioning can help to avoid the pitfalls of “group-think” in favor of improved scenario planning and enhanced value creation. Designating an “assigned dissenter” on a rotational basis, for example, can empower individuals to question the consensus view without fear of retaliation or retribution.

The board’s perspectives and expertise can also create positive tension and influence management teams to work together to find better answers. Management needs to:

- involve the board early in the development process (before the strategy is fully designed);

- approach the board with multiple strategic options and implications for consideration; and,

- seek input and ideas, not just approval.

Board members need to approach these discussions with an owner’s mindset and with the goal of helping management broaden its thinking by considering new – even unexpected – perspectives. If managed correctly, the process can be run very efficiently, especially if the strategic planning process with the board identifies issues early, giving the board and management time to develop robust strategic options.

3. Build Geopolitical Resilience

In a post-globalisation environment, geopolitical risks and uncertainties have assumed center stage. New powers have emerged where different countries and models of government are competing for control and influence. In this multi-polar environment, boards have a key role in building the foresight, response, and adaptation capabilities needed to navigate the changing landscape and manage future shocks.

Global business is already being shaped by the new “national security economy” and is transforming companies into unwitting geopolitical actors. Recognition of the inter-relatedness of these challenges is a first step towards instituting a more holistic decision-making approach, hiring the necessary expertise, and deploying an effective analysis of business opportunities that centers a geopolitical lens.

Boards regularly need to assess geopolitical risks through a trifocal lens – short, medium, and long term – and ensure that executive management incorporates geopolitical risks into strategic planning. Simultaneously, they must upgrade their capabilities to develop the expertise and knowledge to make informed decisions about managing geopolitical risk.

4. Think Technology

While few can challenge the importance of technology and its impact on almost every sector of the business environment – technological complexity and the speed of change can make it difficult for the board to effectively apply technology as a strategic lever of change to provide a competitive advantage. Technological transformations aren’t just about efficiencies, quality, and cost savings – they are about creating value. Boards don’t need to memorise the bits and bytes of technology but must seek a clear sense of the impact and implications of the technology transformation they seek to achieve.

Boards should not just rely on management to help them with this. It’s important that board members bring in external perspectives, as management has incentives to exploit existing technology as opposed to preparing for coming threats. Chasing every new technology opportunity is dangerous, and the situation must be approached in a balanced manner. Equally important is providing boards with a balanced set of metrics that cover the basis of speed, quality, costs, and overall impact – basically an aggregated form of ROI.

5. Rethink Roles and Composition

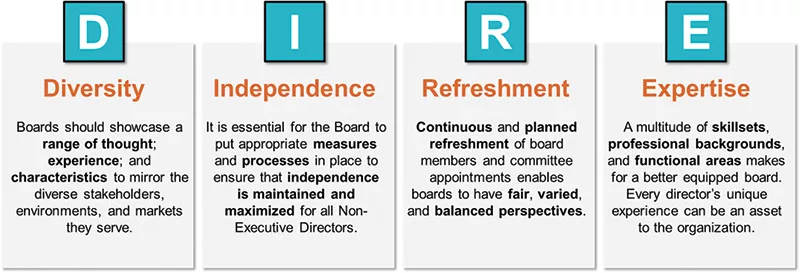

AccountAbility’s D.I.R.E Board Framework. Source: AccountAbility International, 2023

When it comes to board roles, composition, and structure, organisations can exercise three key governance levers:

- the disciplined enforcement of term limits

- regular capacity and capability reviews

- relevant training and development

Appropriate committees, such as the Nominating and Governance Committee, are expected to ensure that the board’s capabilities align with the company’s evolving strategy, identify the new skills the board will require, and develop a plan to obtain them.

AccountAbility’s D.I.R.E. Framework (Diversity, Independence, Refreshment, and Expertise) can be effectively applied to assist in the composition of a balanced and effective board. Focusing on building a board that comprises a diversity of thought and perspectives (cognitive diversity), one that is committed to the company, and is experienced in a wide array of industries and business functions – can help instill the necessary capabilities to face the challenges of the future.

AccountAbility’s D.I.R.E Board Framework. Source: AccountAbility International, 2023

6. Develop an Authentic Purpose

Today’s business leaders are often under pressure to articulate and communicate a statement of corporate purpose. Purpose isn’t about shareholder value or profit maximisation. It’s the reason why the organisation exists. Increasing stakeholder expectations and an intensifying scrutiny of corporate behavior and actions are the norm today. In this heightened environment, it is imperative for boards to engage with management to shape and articulate a clear and authentic purpose for the company’s existence.

Purpose can be a potential source of competitive advantage, but it needs to be genuine and infused in the organisation’s business model. Directors can steer the management team in sculpting and giving voice to the company’s purpose and embedding it in the organisation. The effective application of purpose can range the spectrum from a litmus test to a filter for board engagement – on governance, strategy, people, investments, risk, stakeholders, and performance management.

While every company could benefit from a purpose, not every purpose can take the form of a rallying social cause. Alternatively, defining your purpose as an embodiment of the organisation’s culture can result in being, both, authentic and effective. Improving ESG performance is critical for business – but it cannot become the purpose of the business.

Looking Ahead

Directors still continue to spend a majority of their time on Financial Reports, Risk & Compliance Reviews, and People Plans instead of strategic matters crucial to the future value and direction of the business. The board agenda of the future will need to explicitly focus on future value-generating activities and ensure that directors get sufficient time to address them.

In an environment of low trust and high expectations, there is increasing scrutiny on corporate actions further intensified by amplified stakeholder expectations. Consumers and society, as a whole, are expecting more (and different) from business. This is compounded by a pace of change that can be dizzying, and sometimes confusing.

For a majority of businesses, board governance remains a less discussed area of vulnerability, in part because it involves internal processes, systems, and controls, which in many cases are less visible to stakeholders and the broader public. Yet, there is immense potential to advance the Board agenda with a careful consideration of focus, re-balance and engaged action.

The future is now – and this may well be the moment when boards and leadership teams justify their value.

About the Authors

Mr Sunil “Sunny” A Misser

CEO of AccountAbility: Mr Sunil “Sunny” A Misser

Sunny Misser is the CEO of AccountAbility, a global consulting and standards firm that works with clients to innovate and advance the global sustainability/ESG agenda, by improving the practices, performance and impact of organisations.

Prior to joining AccountAbility, Sunny Misser was global managing partner of Sustainability Advisory Business at PricewaterhouseCoopers (PwC). Before that, he was global strategy Leader for PwC’s Assurance and Business Advisory Services — the firm’s accounting, risk-management, and consulting operation.

He also served as the New York Metro leader for the Governance, Risk, and Compliance practice. During his career, Misser has been a strategic business advisor to chief and senior executives and boards at Fortune 500 companies and multilateral organisations (MLOs).

Misser has extensive experience in working with global clients, developing and implementing solutions in the areas of strategy, structure, process, people, and systems. He tackles challenges such as improving the efficiency and effectiveness of global value chains, designing and implementing enterprise-wide performance improvement solutions, and managing complex business transformations.

His clients have included Abbott Laboratories, Merck, Pfizer, Bayer, Nestle, Anheuser Busch, UBS, Citigroup, ING, National Commercial Bank (NCB), Saudi Investment Bank, Credit Suisse, Saudi Arabian General Investment Authority, ConocoPhillips, Cinergy Duke, Saudi Aramco, Kodak, Seagram, Microsoft, Mobily, Walmart, Zain, National Institute of Standards and Technology, King Khalid Foundation, World Economic Forum, International Monetary Fund (IMF), and the UN.

Sunny Misser has also worked in industry operations and advanced manufacturing, with Mars Inc and Honeywell. He holds a Master of Science in Management from the famed Massachusetts Institute of Technology (MIT) – Sloan School of Management (Sloan Fellows Programme). He majored in International Business and Technology.

That MSc isn’t the only one he has earned; he has another in Industrial Engineering from Lehigh University. He also holds a Bachelor of Science in Mechanical Engineering from MS University.

Misser serves on the Dean’s Advisory Board of Lehigh University’s College of Engineering and Applied Science. He was on the advisory boards of E-Business @ MIT and for Innovation and Corporate Responsibility at MIT/Sloan. He served as an advisor on strategy and consulting at the MIT/Sloan School of Management, as well as the advisory board of Industrial and Systems Engineering at Lehigh.

During his career at PwC, Misser led the team that published the book Corporate Responsibility — Strategy, Management, and Value. He was a member of the Council on Foreign Relations, and is frequently quoted in Fortune, The Financial Times, The Economist, New York Times, New York Stock Exchange Quarterly, Forbes, Dow Jones Interactive, Capital Finance, Global Finance, and Internal Auditor’s Magazine.

Sunny Misser was honoured as the 2017 Distinguished Alumni for Excellence in Industry by Lehigh University, ISE. In 2020, he was appointed to serve on the Dean’s Advisory Council at Lehigh University.

Mr Vincent A Forlenza, Jr

Chariman of Moody’s Corporation: Mr Vincent A Forlenza, Jr

Vince Forlenza is the retired executive chairman of the board of directors of Becton, Dickinson and Co (BD), a global medical technology company headquartered in Franklin Lakes, New Jersey.

Serving as its CEO, Forlenza led the company’s transformation from a manufacturer of medical supplies to a “Top-Five” firm dealing in medical devices, diagnostics, and life-science.

During his 40-year career with BD, Forlenza has held global executive leadership positions in the US and Europe. He was named president of BD in January 2009, assumed additional responsibility as chief operating officer in July 2010. He became chief executive officer in October 2011, and chairman of the board in July 2012. His previous appointments include serving as senior vice-president of technology, strategy and development, presidency of BD Biosciences, and a stint as executive vice-president and president of BD Diagnostics. Forlenza retired from the chief executive’s role in January 2020, and as chair of the board in May 2021.

Vince Forlenza served as chairman of the board of directors at the Advanced Medical Technology Association (AdvaMed) from 2015 to 2017. In that role, he drove the association’s innovation agenda, collaborating with policymakers and industry partners to reinvigorate the ecosystem and promote the value of medical technology. He is the past chair of the association’s Board Committee on Technology and Regulation, and served as chair of AdvaMed’s Legal Committee.

He also served as chairman of the board for AdvaMedDx, a division of AdvaMed focused on the unique needs and issues facing diagnostics manufacturers.

Forlenza is chair of Moody’s Corporation board of directors. He chaired of The Valley Health Systems board of trustees in Ridgewood, and is currently chair of the board of trustees of Lehigh University. He is a past member of the advisory board for the PC Rossin College of Engineering and Applied Sciences at Lehigh. He now serves as advisor to the new College of Health, and is on the boards of three medical device start-ups.

He earned a Bachelor’s degree in Chemical Engineering from Lehigh University in 1975, and a Master’s in Business Administration from Wharton Graduate School at the University of Pennsylvania.

Doctor Shiva Rajgopal

Kester and Byrnes professor at the Columbia Business School (CBS): Doctor Shiva Rajgopal

Shiva Rajgopal is a world-renowned expert on ESG, financial reporting issues, fraud avoidance, executive compensation, corporate culture, and corporate governance.

Rajgopal has been internationally recognised for his academic excellence, and was awarded the prestigious American Accounting Association (AAA) Notable Contribution to the Literature Award — not once, but three times.

He twice won the Graham and Dodd Scroll Prize given by the Financial Analysts Journal, and the Glen McLaughlin Award for Research in Accounting Ethics — again three times. Shiva Rajgopal is passionate about bridging academic theory with policy setting and corporate practice. He writes a regular column for Forbes and has published op-eds in many major outlets. He advises think-tanks, asset-management and advisory firms, and several professional and trade associations.

You may have an interest in also reading…

Lights, Camera, Cash Cow: Decoding the Blockbuster Blueprint

From Jaws to Avatar, studios have pursued the elusive formula for box-office dominance. In an era of escalating budgets and

European Council’s Van Rompey: Europe Must Overcome Crisis to Defend Democratic Values

European Council President Herman Van Rompuy’s speech “Europe on the World Stage” recently given in London emphasized the complete change

Natrium: Taking a Nuclear Leap Towards a Low-Carbon Future

In June 2024, a silent revolution was taking place in the windswept plains of Kemmerer, Wyoming… A groundbreaking ceremony took