Take AIM, then Act: Leaders Taking their Firm to the Top

Affirmative Investment Management (AIM) is exclusive: it manages only fixed income portfolios that generate mainstream returns as well as environmental and social impact.

Affirmative Investment Management (AIM) is exclusive: it manages only fixed income portfolios that generate mainstream returns as well as environmental and social impact.

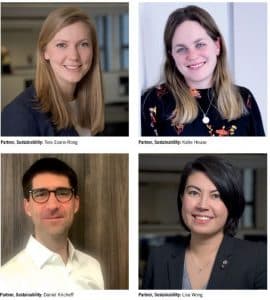

The sustainability team is responsible for the verification of the SPECTRUM Bond universe, and evidence of those impacts. It is led by four senior members, all experts in their fields: Tess Evans-Rong, Katie House, Daniel Kricheff, and Lisa Wong.

Tess Evans-Rong – Partner, Sustainability

Tess Evans-Rong has more than 10 years’ experience in responsible investment and ESG analysis. She joined AIM in 2016, after managing the market and data-analysis team at the Climate Bonds Initiative (CBI).

She launched the first public list of green bonds at CBI, and worked with the UNFCCC to add green bonds to its NAZCA Climate Action platform. Prior to that, Tess spent three years at BlackRock, where she was an associate in Corporate Governance and Responsible Investment.

As well as bond research and analysis, Tess drives the development of AIM’s internal impact database, which is leveraged for verification analysis and data collection. It is crucial for providing clients with transparent information.

Katie House – Partner, Sustainability

Katie House has deep expertise in the use of proceeds bonds, having specialised in green, social, and sustainability fixed income for seven years.

Katie joined AIM in 2019 after time as a senior research analyst at Climate Bonds Initiative, focusing on the Climate Bonds Standard: a certification scheme and rule set defining green bond financing eligibility for projects and assets across sectors.

She also supported the development of the European Commission’s Sustainable Finance Taxonomy. At AIM, Katie leverages her expertise in the creation of the investable universe and AIM’s award-winning impact reports.

Katie also drives AIM’s SFDR-related reporting and sits on various industry working groups as part of AIM’s collaboration with sustainability peers.

Daniel Kricheff – Partner, Sustainability

Daniel Kricheff has extensive experience internationally as an academic and within the United Nations. He began his career working as a communications strategist and speechwriter at the UN, holds a PhD in Anthropology and was most recently a visiting research fellow at University College London.

Daniel has worked on economic development and conducted research in developing and emerging markets, including establishing a sustainable forestry investment initiative in Central Africa and developing quantitative impact assessment tools.

He joined AIM in 2020, and leads AIM’s work on transition finance, a scalable, data- and research-driven approach to financing the transition to a low carbon economy, including identifying opportunities to drive GHG emissions reductions in hard to abate and major emitting sectors.

Lisa Wong – Partner, Sustainability

Lisa Wong has been at the forefront of sustainable fixed income for 11 years. She started her career with Citi’s social finance group, specialising in private debt in frontier market financial institutions.

She has experience across global, private and public sustainable-debt markets in frontier, emerging and advanced economies.

Lisa joined AIM in 2015 and was instrumental in setting-up the verification and impact reporting processes. At AIM, she has designed award-winning impact management and reporting capabilities, and co-developed market-leading climate impact-assessment tools on transition and physical risk.

Lisa previously worked at Nikko Asset Management, where she was part of the team that launched one of the world’s first dedicated green bond funds.

You may have an interest in also reading…

Convergence Partners CEO Brandon Doyle: Converging on Strategy and Social Needs

Investors naturally want to be associated with a success story that has a purpose, and positive progress. Convergence Partners gives

Creating More Strategic Relevance for the Investment Banking Sector

Many people think of investment banks as firms with a rolodex of fixed income and equity investors and companies that

African Risk Capacity (ARC): Towards Resilience – Africa Takes Disaster Management Into Its Own Hands

African Risk Capacity (ARC) has been named by CFI.co, for the second year running, as the most innovative environmental, social,