Verdant Capital: The Fintech Ecosystem in Africa is Entering into a New Era of Growth and Consolidation

The fintech ecosystem in Africa is entering an exciting and challenging phase with more capital, more competition, and more consolidation.

The fintech ecosystem in Africa is entering an exciting and challenging phase with more capital, more competition, and more consolidation.

As key segments grow, the rewards and risks grow for challengers and incumbents. Available capital has grown in amount and breadth recent years. “Home-grown” funds specialising in fintech — often with the support of international development finance institutions — have become a core part of the investor group.

Generalist investors from the African continent have taken a more active role, with most having made investments in the fintech sector from recent fund vintages.

As the sector in Africa has scaled and grown, larger, more mature players have started to catch the eye of global tier 1 venture funds. The recent Softbank-led $400m round into Opay is a case in point. Verdant Capital fintech transactions in the past year have involved investors from the US, Japan, China, the Netherlands, Switzerland, France and the Baltics. Certain major global VC investors, such a Partech Global, investor in tech-enabled asset finance business Tugende, and others — such as Wave, in Senegal — have invested from the dedicated Africa Fund since 2018. More VCs are now investing directly from global funds.

Large corporates have entered the competitive landscape through minority investments, such as incumbent payment businesses such as Mastercard and Visa. Others have used corporate repositioning, for example a recent Airtel decision to partially spin-off its mobile money business. It’s a strategy likely to be replicated by other mobile network operators.

Availability of capital is crucial for fintech. By its nature it is disrupting the financial services sector, which was in need of renewal, and had major barriers to entry. This is because of human- and operating expenditure-heavy product life cycles (lending or insurance), and over-reliance on legacy infrastructure not consistent with evolving customer preferences.

Barriers to entry are high, with significant minimum capitalisation for bank, insurance and other licences, lengthy application processes, and the importance of brand in the sector. The movement of financial and human capital has enabled the fintech sector to overcome these barriers.

Scale is becoming an important differentiator in the success of the funding rounds: “It’s good to be the best, but it’s better to be the biggest.” In some ways, this represents convergence with the major tech and venture ecosystems, where growth is prioritised above all — including profitability. In theory, this is justified by platform economics — the theory that the additional revenue from each additional “node” has a more linear impact on the aggregate revenues. Despite the theory’s logical basis, many unicorns, such as Uber and WeWork, remain unprofitable after multiple successful funding rounds.

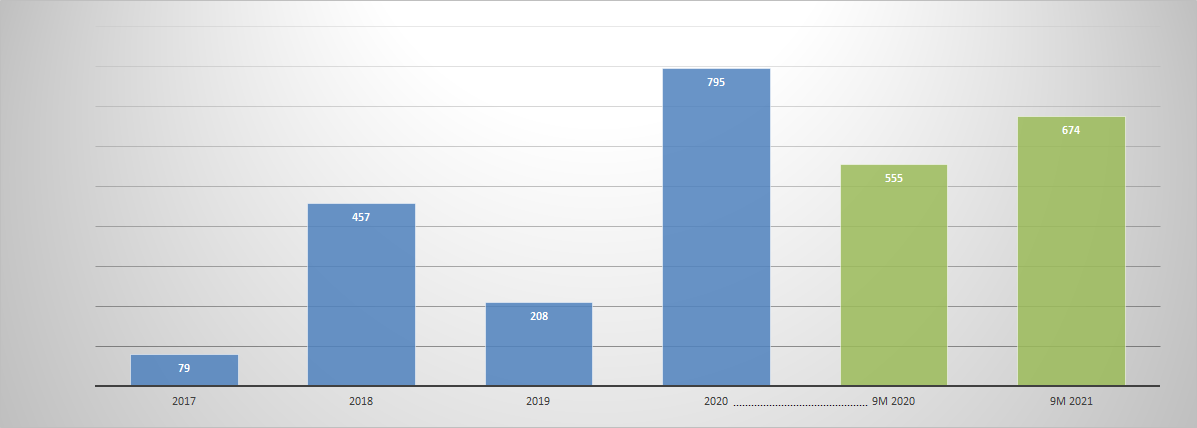

FinTech Africa Transactions. Source: Verdant Capital, S&P Capital IQ

In Africa, most fintech players have historically had to “eat what they kill”, i.e. prioritise profitability over growth to achieve profitability sooner. The latent potential of many fintechs, including disrupters to credit and payments, has made for rampant growth in the best operators. Zeepay, a pan-Africa, pan-diaspora electronic payment disrupter, has grown its revenues 13-fold in three-and-a-half years while maintaining constant profitability.

The preference for scale has also been driven by the entry to Africa of the Tier 1 global VCs. This has given fintechs in Africa an additional growth incentive to obtain the higher cheque amounts — and, typically, higher valuations. It has also been driven by competitive strategists from within and without.

Scale, growth, and competition have prompted consolidation from push and pull perspectives. Africa has an aggregate population and GDP similar to India’s, but fragmented into 54 countries. This has prompted cross-border M&A as the sector has matured, and larger players have pursued platform economics by adding national markets.

Horizontal consolidation across segments is also an exciting trend, with payments and credit-tech increasingly seen as highly synergistic. The “rails” to reach lower- and lower-middle market customers, and to receive data and repayments in the other direction, is a critical component in many credit-tech and tech-enabled businesses. Crossfin’s shareholding in Retail Capital, a leading South African tech-enabled SME-lender, is an example of a payment platform acquiring interests in the credit segment.

The “push” factors of strategic threats, including by global payments groups and regional telcos, has led to some fintechs in the growth phase to take pursue either an ever-larger capital round, or an exit. In some cases, the status quo is not an option.

The early-stage VC scene (angel, seed stage, and series A) has recently been pushed out of the headlines by the larger transactions, but activity levels are growing.

Newer disrupters are focusing on more recent themes, such as insurtech, and several ventures are targeting the crossover between fintech and cleantech — for example, OWatt from Nigeria. Insurtech has several interesting players getting closer to “escape velocity”, including Briisk, in South Africa, Alpha Direct, in Botswana, and Kalibre, a global insurtech with roots in South Africa.

Insurtech has greater barriers to entry than many other fintech segments, including a lack of real domain expertise and a longer revenue-building cycle (although the revenues are much “stickier” once built).

Credit tech still has a range of interesting start-ups and earlier stage businesses, including Finclusion, an embedded credit-player in southern and eastern Africa, and asset financing businesses, such as Planet42 in South Africa and Mexico.

As African start-ups from the early and mid-2010s reach a global audience, there is a fascinating new cohort arising…

You may have an interest in also reading…

Q&A with CEO of Insurance Corporation of Afghanistan: Jamal Asfour

What excited you about your earlier career, and what excites you about the business you now lead? Jamal Asfour: I

Check Creditworthiness in Seconds: SCHUMANN Has the Tech to Do It

Blocklists, customers with weak creditworthiness, important limit decisions — the economic consequences of the pandemic has made it vital to

Always Adapting Skilfully to Change: BAWAG Group Strategy Brings Success Before and During Covid Year

BAWAG Group AG is a publicly listed holding company headquartered in Vienna, serving 2.3m retail, small business, corporate and public