GoldenTree: Governance and Experience Equate to Winning Formula for Investment Firm that Boasts the Golden Touch

Asset management firm GoldenTree’s strong governance structure has been key to its success throughout its 20-year history.

-

- Founding Partner & Chief Investment Officer: Steven A Tananbaum

-

- Partner: Steven Shapiro

-

- Partner & Head of North American Bonds and Loans: Lee Kruter

-

- Partner: Pierre de Chillaz

-

- Partner & Head of Trading: Deeb Salem

-

- Partner & Global Head of Restructurings and Turnarounds: Ted S Lodge

-

- Partner & Head of Business Development and Strategy: Kathy Sutherland

-

- Partner, Head of Structured Products & Chair of Risk Committee: Joseph Naggar

-

- Partner & President: Christopher Hayward

GoldenTree is, and has always been, entirely employee-owned, with many of its 27 partners promoted internally. This ownership structure provides a strong alignment of interest with investors, and ensures a disciplined approach to capital raising.

The governance at GoldenTree is further exemplified by its executive committee, comprised of nine partners from across the firm. These members have worked together for an average of 13 years and meet regularly to formulate business strategy, discuss corporate governance, and review key areas of business from a management company and fund perspective.

GoldenTree is one of the largest independent asset managers focused on credit, with more than $30bn in assets under management. It has been managing assets on behalf of investors for two decades, celebrating its 20th year in business in 2020. It specialises in opportunities in sectors such as high yield bonds, leveraged loans, distressed debt, structured products, emerging markets, private equity and credit-themed equities.

GoldenTree by the Numbers

20-Year Track Record of Success

In 2000, GoldenTree was founded – based on the principles of fundamental value investing with a focus on a margin of safety and a “total return” approach. The investment process has been successfully executed across market cycles for two decades.15 Years of Global Presence

GoldenTree expanded its global footprint with the opening of its European office in 2005. Over the past decade, GoldenTree has become an established and respected participant in European credit markets. It offers local expertise in corporate credit, structured products, trading, restructuring, sourcing and business development.Over $30bn in AUM

GoldenTree is one of the largest independent asset managers focused on global credit markets. With expertise across areas such as corporate, structured, distressed and emerging markets, it is able to analyse a broad universe of opportunities.Partners Promoted from Within

GoldenTree is owned by its employees and offers a clear path to partnership. This culture allows the firm to attract and retain some of the world’s most talented investment and business professionals.An Experienced Team

GoldenTree has one of the most experienced investment teams in the industry, led by an executive committee with an average of 26 years of deep involvement in the investment field.Over 250 Employees Worldwide

GoldenTree is headquartered in New York City with offices in London, Singapore, Sydney, Tokyo and Dublin. GoldenTree has had a physical presence in Europe for many years, and opened an office in London in 2005. More than 20 languages are spoken across the firm.Over 50 Customised Accounts

GoldenTree is able to provide solutions to investors and offer customised accounts with individualised return profiles.

GoldenTree has invested globally since its inception in the US in 2000, and it established a presence in Europe in 2005. Today its global footprint includes offices in New York, London, Singapore, Sydney, Tokyo and Dublin.

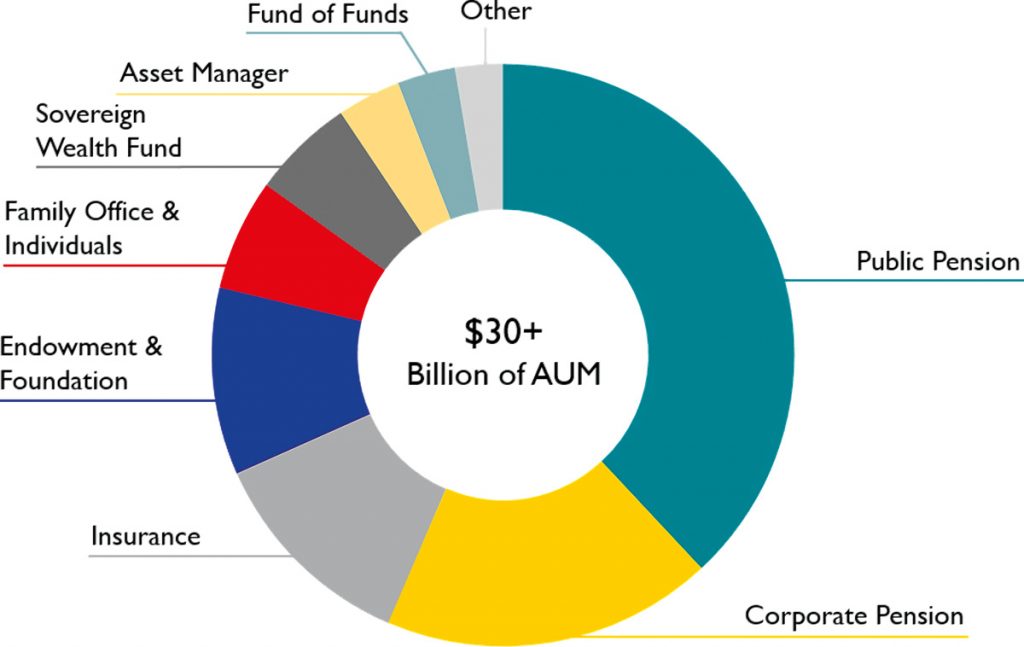

GoldenTree is supported by a diverse capital base of institutional investors, including leading public and corporate pensions, endowments, foundations, insurance companies and sovereign wealth funds. GoldenTree continues to experience growth in its investor base due to its diverse platform and consistent performance.

GoldenTree is primarily focused on institutional clients, which make up more than 90 percent of the firm’s AUM. Its largest investor categories are public and corporate pensions, which collectively make up over more than half the AUM total.

GoldenTree was founded on the principles of fundamental value investing, with a focus on safety margins and a “total return” approach. The firm’s investments are designed to preserve and grow investors’ capital with a value-based approach.

With a challenging environment ahead, as the world responds to the coronavirus pandemic, GoldenTree’s dedication to its investors and employees is paramount. The company’s breadth and depth of expertise, strong governance structure and adherence to core principles allows it to navigate market cycles and deliver attractive results.

Investor AUM breakdown is as of February 29, 2020. Excludes CLO vehicles assets under management. Endowment & Foundation also includes Private Bank. Asset Manager also includes Financial Advisor, RIA and Outsourced CIO. Other includes Commercial Bank, Corporate Treasury, Investment Bank and Sovereign Nation.

Featured Team Members:

Founding Partner & Chief Investment Officer: Steven A Tananbaum

Partner & President: Christopher Hayward

Partner & Head of North American Bonds and Loans: Lee Kruter

Partner: Pierre de Chillaz

Partner, Head of Structured Products & Chair of Risk Committee: Joseph Naggar

Partner & Global Head of Restructurings and Turnarounds: Ted S Lodge

Partner & Head of Business Development and Strategy: Kathy Sutherland

Partner & Head of Trading: Deeb Salem

Partner: Steven Shapiro

You may have an interest in also reading…

Bon Courage: Hard Work, a Tight Team and a Bold Approach Have Taken Le Groupe La Poste Ahead

Le Groupe La Poste’s director of strategy, Diane Abrahams, believes in challenging the status quo. “We must have the courage

Some of it may well be Rocket Science, but ASU’s Recipe for Success is Simple

Jordanian university has built on solid foundations to reach beyond the scope of its peers The term “pioneering” is often

Nazca: Meet the Team Keeping Entrepreneurs on Track

Nazca professionals have the qualifications and verve to keep things moving in Latin America. Héctor Sepúlveda Co-founder and Managing Partner