Equipment Leasing in the UAE: What Do a Bio-diesel Refinery, a Fork Lift Truck and a Laser Hair Removal Device Have In Common?

Leasing originated in the Middle East in 2000 BC, when Mesopotamian landowners hired-out farming equipment — with an option for workers to buy the equipment over time.

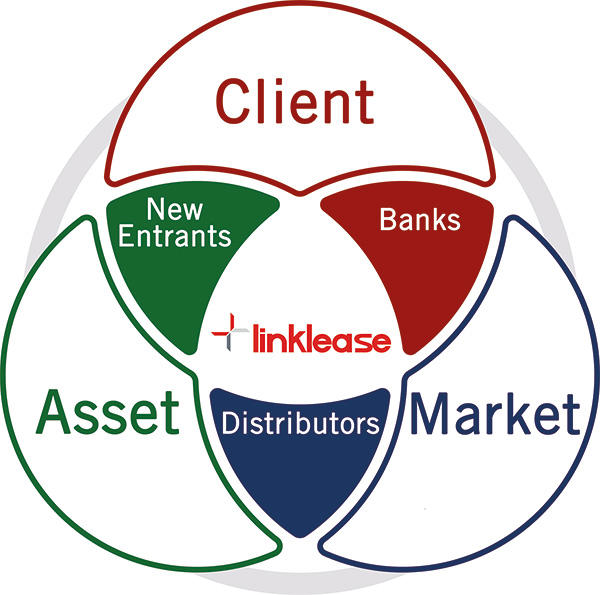

Figure 1: Linklease competitive position

In the modern GCC, leasing is still in its infancy — despite the practice’s regional roots. Just three percent of GCC equipment transactions are leases — mainly aircraft and shipping for major carriers.

Linklease pioneers the “true” leasing concept in the UAE and differs from companies or banks which provide a loan over a shorter period, using the equipment as collateral.

It focuses on operating leases, where businesses can access large, expensive or multiple pieces of equipment over a period linked to the useful life of the equipment. This means a lower monthly cash outflow with the option to buy, hand-back or re-lease at the end of the period.

“Linklease stays close to the customer during the lease period… and even closer to the equipment. Every item is RFID-tagged, and movable equipment is GPS-tracked, often with immobilisers or systems that require codes in order to function.”

The Equipment Capital gap in the Middle East is estimated to be worth $40bn. Companies need manufacturing plants, logistical vehicles and other equipment to cope with a rapidly expanding market place.

GCC-based Linklease has expanded into Saudi Arabia working with companies distributing equipment in the kingdom. It is also advancing into parts of Africa, where infrastructure growth requires significant capital.

Manufacturers and distributors of equipment are also seeking solutions for clients with low capital budgets who can afford monthly repayments. Sectors such as solar power and clean energy generation, healthcare, transport and education are high priority in the UAE. Linklease solutions allow businesses to access equipment that had been unaffordable, or absorbed cash that was needed for day-to-day running of the business.

Table 1: Commodity scale

The UAE has helped by focusing attention on laws supporting leasing, including the moveable asset registry. The registry helps to prove who owns the equipment, a major component of a sophisticated leasing environment.

Linklease has listings on several market exchanges, attracting global investors who recognise the regional potential of equipment leasing. Leasing is entering a growth period — and Linklease is perfectly placed to play its part.

Linklease comprises a small group of banking professionals with specialised knowledge of equipment, drawn from Gulf Finance Corporation, Lloyds Bank, Barclays Bank, GE, HSBC and other top finance institutions.

The company was founded in 2015 and is led by Steve Thomas-Williams. It has worked with Oracle, BLME, Aston Martin and Zoomlion to lease equipment to end users in the Middle East.

The predominant tendency in the GCC had been to own equipment — and the abundance of liquidity in the years leading into the late-2000s encouraged this.

Linklease has positioned itself by being able to understand the lessee (the client) and the asset (the equipment). It has a depth of experience in the market, including legal, structural and recovery procedures.

New entrants will usually have strong equipment and client experience, while banks offer a loan with the equipment as security or pledged. This means that they understand their client and the market, but (rightly) wouldn’t want to take a longer-term residual value position on the equipment. Distributors understand the equipment they sell, and the market — but are less keen to provide longer credit terms to clients. Linklease neatly pulls these strands together, creating a unique market position.

The “secret sauce” of leasing in the UAE is not difficult to work out, but in practice it can be tricky.

Due Diligence

It is crucial to have a blend of client due diligence approaches and an in-depth knowledge of equipment and its resale value, where in the world it can be resold, and its depreciation profile.

Assets fit onto a sliding commodity scale, at one end very generic (forklift truck, office laser printer) where value and useful life are established. At the other end, the equipment is either bespoke or custom, and resale is uncertain. Leasing prefers more generic equipment for this reason.

Asset value, blended with its commodity nature, gives an indication of what due diligence is needed.

Generic low-value equipment requires a lighter due diligence in order to turn an equipment sale around. Some basic criteria can be pre-agreed and offered through distributors. This is an attractive option for leasing companies.

Generic high-value equipment requires a greater depth of client due diligence to ensure capability to service the instalments. It is also attractive to leasing companies

Bespoke low-value equipment is less attractive and requires deep asset due diligence to understand its resale value. If it is too specialised or limited, it isn’t a natural fit for leasing.

Bespoke high-value, or custom-built equipment, has limited or no resale value. This is an “avoid” area for leasing.

Managing the Portfolio

Linklease stays close to the customer during the lease period… and even closer to the equipment. Every item is RFID-tagged, and movable equipment is GPS-tracked, often with immobilisers or systems that require codes in order to function. Every quarter, a company asset manager visits clients to check equipment is being correctly operated and that the lease is running smoothly.

Recovering the Asset

The most important job in leasing is to recover the monthly instalments and settle the amount outstanding at the conclusion of the lease. Specialist knowledge and skill-sets are needed in the area of recovery and disposal.

The best price for resale may be in another market, and global knowledge of traders, buyers and fair market value of the equipment are essential. Linklease has learned the necessary skills to operated in the MENA region, and is providing access to equipment for many sectors.

Aristotle said in that “wealth is in use, not ownership”, and Linklease has taken a leaf out of King Hammurabi’s book. The ruler of Babylon in 1750BC, who codified leasing as a concept. It was an obvious way to help small businesses and the Middle East market. It still is.

Back then, leasing contracts were written on clay tablets; today the tablets are electronic. Some things never change.

You may have an interest in also reading…

Modest, Frugal, Retiring, and Famous for Being Anonymous: the Founder of Zara, Amancio Ortega

By TONY LENNOX When the famously private Spanish entrepreneur Amancio Ortega finally gave his consent to a biography, he had

Fortman Cline: Are Boutique Investment Banks Here to Stay?

The financial crisis of 2007 spawned a proliferation of boutique investment banks as larger institutions started laying-off staff and eliminating

Banco FINCA Ecuador: Everything Is Possible with ‘Small-Is-Beautiful’ Model from FINCA

Equador’s FINCA Impact Finance (FIF) is a network of 20 microfinance institutions and banks that focuses on reaching low-income clients