Dollar Strains — Our Currency, Your Problem: Specialised Investment Research and Analysis from PGM Global Inc.

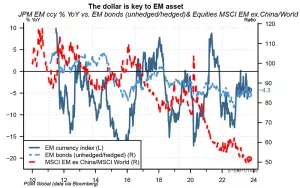

Unlike their DM counterparts, EM central banks have started to cut rates, in some cases aggressively, to offset weakening growth amid high inflation. The rate cuts and the weaker global growth outlook have hurt EM equities and local currency bonds. We think that things might get a whole lot worse for EMs. In particular, dollar strains are beginning to emerge, which may require liquidity lines from the Fed or rapid hikes by EM central banks.

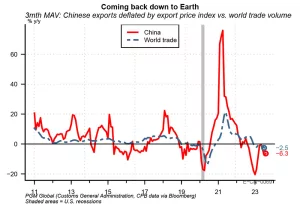

The prospects of most EMs are heavily tied to the global growth cycle, of which there are two drivers: the U.S. and China. Strong U.S. goods demand results in strong global industrial activity and large current account surpluses for global exporters. In periods where U.S. industrial activity is weak, Chinese credit usually picks up the baton. In the past, this has resulted in large investment projects and commodity demand, which support global reflation. At the moment, both of these global growth drivers are strained.

The lacklustre state of global growth is laid bare in a variety of metrics. An important one is global trade volumes. World trade volumes are contracting, and China, which accounts for about 50% of base metal consumption, is leading the decline. This means weaker current account surpluses, weaker EM currencies, and weaker FX reserve growth.

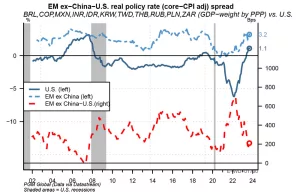

At the same time, global growth appears tired, real-rate differentials between Emerging Markets and the Federal Reserve are no longer as supportive of EM carry trades and plentiful dollar liquidity. Inflation is broadly cooling in the U.S., while the Fed articulates a higher for longer outlook. Some EMs have embarked on an aggressive pace of cuts to support growth, even when inflation remains high. Poland is a case in point; the central bank cut rates by 75bps with inflation at 10%, partly to help offset contracting PMIs.

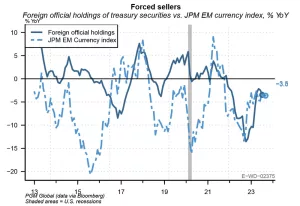

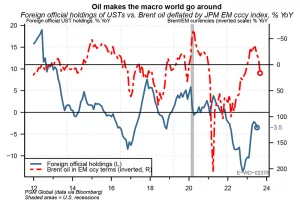

Weak global trade, economic growth, and less supportive interest rate differentials portend weaker EM currencies and less FX reserve accumulation. If EM currencies continue weakening, central banks will be forced to sell FX reserves (U.S. Treasuries) to support their currencies, mitigate balance of payments risks, and stem inflationary pressure.

Indeed, these strains look like they are about to intensify. Oil prices are rising in EM currency terms, implying inflationary and balance of payment pressures will increase. This will mean that EM central banks will come under pressure to tighten monetary policy and shore up their currencies. That might not be difficult when global growth is strong, but it is very challenging when U.S. manufacturing activity is in contraction, when China is deflating a credit bubble, and when Europe is mired in stagflation.

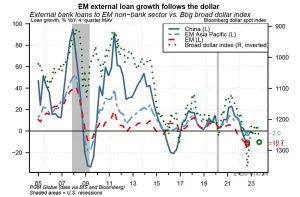

To make matters worse, dollar strength usually goes part and parcel with EM deleveraging of hard-currency debt. This also puts pressure on EM central banks to provide USD liquidity and shore up their local currencies.

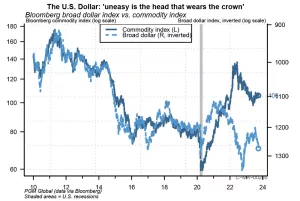

For over a year, we have argued that slowing global growth is part of the Fed’s plan. The Fed needs to get commodity prices down in USD-terms. Failure to do so would have two consequences. First, inflation would rise, making the Fed appear behind the curve again. Second, sharply higher commodity prices in USD terms would erode, at the margin, demand for Treasuries from large FX-reserve managers, just as the deficit is blowing out.

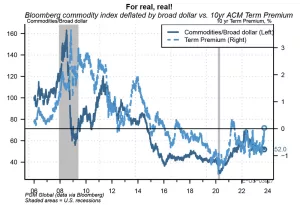

The clearest way to see the Fed’s conundrum is to look at the term premium vs. commodity prices. Higher commodity prices mean higher term premia, and the higher the yield investors demand for them to buy duration.

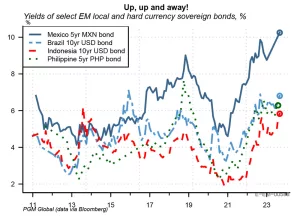

The upshot is that EM risk assets will likely underperform significantly in the months ahead. We think that this will create an opportunity for investors. Local currency yields have risen due to higher local policy rates, while dollar-denominated bonds have re-priced higher in line with U.S. Treasuries. At face value, EM bonds look attractive, but we don’t think they reflect the tighter USD liquidity coming over the transom. EM bond investors should remain patient.

Bottom Line

Dollar liquidity is beginning to tighten in the periphery (EMs). As this ramps, EMs will need to shore up their currencies and stem inflationary pressure. Expect EM sovereign bond yields to rise. The Fed will likely respond with liquidity swap lines. That will serve as a signal for investors to search for opportunities.

About PGM Global Inc.

PGM Global Inc. is an established player in international capital markets, offering securities trading, global macro research and transition management services to institutional investors. For over half a century, PGM Global Inc. has provided expertise in execution and advice to institutional clients worldwide. We bring industry-recognised capabilities to the table – including specialised investment research and analysis, a top-ranking global trading desk and state-of-the-art technology – to help our institutional clients worldwide excel in the capital markets.

PGM Global Inc. is Winner of Best Global Portfolio Strategy Team North America for a third year in a row and Winner of Best Transition Management Team North America for a fourth year in a row.

Find out more at www.pgmglobal.com.

Disclaimer

This report was prepared for circulation to institutional and sophisticated investors only and without regard to any individual’s circumstances. This report is not to be construed as a solicitation, an offer, or an investment recommendation to buy, sell or hold any securities. Any returns discussed represent past performance and are not necessarily representative of future returns, which will vary. The opinions, information, estimates and projections, and any other material presented in this report are provided as of this date and are subject to change without notice. Some of the opinions, information, estimates and projections, and other material presented in this report may have been obtained from numerous sources and while we have made reasonable efforts to ensure that the content is reliable, accurate and complete, we have not independently verified the content nor do we make any representation or warranty, express or implied, in respect thereof. We accept no liability for any errors or omissions which may be contained herein and accept no liability whatsoever for any loss arising from any use of or reliance on this report or its contents.

You may have an interest in also reading…

EQDOM, subsidiary of SOCIETE GENERALE GROUP: Inclusivity, Fintech Power and Agility Provides Competitive Edge to Moroccan Consumer Credit Provider

Consumer credit, carefully designed and fairly implemented, has the power to transform lives, promote financial inclusion, boost social mobility, and

Why Coffee and Chocolate Prices Are Heating Up in 2025

If you’re a fan of mocha lattes or indulgent chocolate treats, 2025 might be a challenging year for your wallet.

Ithra Director Who Followed His Passion to Ignite Saudi’s Creative Economy

As comfortable in traditional Saudi attire as he is sporting a modern suit, Abdullah Alrashid is a global citizen with