Finance

Back to homepageSustainable Stock Exchanges: Urgent Need for Simple Metrics

The 4th biennial Global Dialogue on the Sustainable Stock Exchanges (SSE) Initiative, concluded yesterday (10/14) at the United Nations Geneva headquarters, unveiled the urgent need for all stakeholders – stock exchanges, regulators, investors, and businesses – to adopt simple, yet

Read MoreSustainable Stock Exchanges: The Relevance of Green Indices

At the fourth Global Dialogue of Sustainable Stock Exchange (SSE) Initiative, last Tuesday in Geneva, Nasdaq OMX vice-chairman Meyer “Sandy” Frucher livened up discussions by spelling out a few hard-hitting truths. Though delivered in way that elicited chuckles from the

Read MoreWIF: Start-Up Democracy Tunisia Steals the Show

Interim Prime-Minister Mehdi Jomâa of Tunisia has offered to host the next World Investment Forum (WIF), scheduled to take place two years from now. In Geneva for the 2014 WIF, an event organised by the United Nations Conference on Trade

Read MoreWorld Bank Group: Can Resource-Financed Infrastructure Fix the Natural Resource Curse?

By Håvard Halland, John Beardsworth, Bryan Land, and James Schmidt How can resource-rich countries ensure that a sufficiently large share of oil, gas, and mining revenues are used for productive investment rather than excessive or wasteful consumption? “Resource-financed infrastructure” (RFI)

Read MoreJames Zhan, UNCTAD: Investing in Sustainable Development Goals

The SDGs, which are being formulated by the United Nations together with the widest possible range of stakeholders, are intended to galvanise action worldwide through concrete targets to 2030 for poverty reduction, food security, human health and education, climate change

Read MoreThe Underrated Modesty of Executive Pay at the World Bank

There are moments in time when the proverbial storm in a teacup serves to underscore a point. The World Bank Group is living one such moment. The bank is in the midst of a possibly painful restructuring process that is

Read MoreDeutsche Börse and Thai Exchange Join Sustainable Stock Exchanges Initiative

The Deutsche Börse is the latest of a growing number of stock exchanges that have joined the United Nations-supported Sustainable Stock Exchanges (SSE) Initiative aimed at encouraging listed companies to adhere to specific environmental, social, and corporate governance (ESG) guidelines.

Read MoreMukhisa Kituyi, UNCTAD: Sustainable Stock Exchanges and the 21st Century Challenge for Global Finance

Faced with common global economic, social, and environmental challenges, the international community is in the process of defining a set of Sustainable Development Goals (SDGs). As part of the United Nations post-2015 agenda, the SDGs will play a crucial role

Read MoreJohannesburg Stock Exchange: Pioneering Sustainable Development

Shifting attention away from the next quarter’s results towards sustainability parameters indicative of long-term objectives, has been a challenge for stock exchanges the world over. Only recently has the concept of socially responsible investment (SRI) moved out of its niche

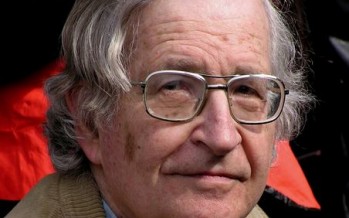

Read MoreNoam Chomsky: Unravelling Established Truths

It is hard, if not downright impossible, to gain the upper hand in a debate with a logician who is a walking, and talking, encyclopaedia to boot. Noam Chomsky, a self-styled anarcho-syndicalist and a linguist of great distinction, is not

Read More