Quantitative Tightening and Capital Flows to Emerging Markets

In its May 15th meeting, the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve (Fed) lifted its benchmark policy rate by 0.75% to 1.50%–1.75%, the most significant increase since 1994. The central bank also signaled an additional increase of 0.75% ahead. FOMC members also raised the median projection for the Fed funds rate to a range between 3.25% and 3.50% next year.

In addition to hikes in basic interest rates, liquidity conditions in the US economy will also be affected by the shrinking of the Fed’s balance sheet starting this month. The “quantitative easing” (QE) that resumed vigorously in March 2020, in response to the financial shock at the beginning of the pandemic, will now give way to a “quantitative tightening” (QT).

How complementary – or substitute – will be those movements in interest rates and balance sheet downsizing? What are their likely consequences on capital flows to emerging markets (EM)?

From QE to QT

QE corresponds to large-scale asset purchases by central banks, typically of long-term government debt but also private assets, such as corporate debt or asset-backed securities. QE has primarily happened in unconventional circumstances, when short-term nominal interest rates are meager, zero, or even negative. It has been implemented during periods of crisis to provide liquidity and maintain a smooth market functioning.

The Bank of Japan began a QE in 2001. Then, during and after the 2008 global financial crisis, QE became much more widespread, with central banks in the U.S., the U.K., the euro area, Switzerland, and Sweden joining the band. QE aligns with forward guidance and negative nominal interest rates as an unconventional monetary policy action. .

Conventional monetary policy corresponds to establishing the target for the short-term nominal interest rate, with that interest rate target depending on observations regarding aggregate economic performance. Typically, the central bank’s nominal interest rate target is expected to go up if inflation exceeds the central bank’s inflation target and to be lowered if aggregate output – for instance, real gross domestic product (GDP) – comes down below what is deemed to be the economy’s potential.

However, limits to how low the short-term nominal interest rate can go may appear on the way. Central banks in the euro area, Sweden, Denmark, and Switzerland have gone down to negative short-term interest rates. In the U.S., this lower bound has been taken as zero, as was the case in the U.S. at the end of 2008, during the financial crisis, when the Fed resorted to unconventional monetary policy, including a series of QE programs afterward.

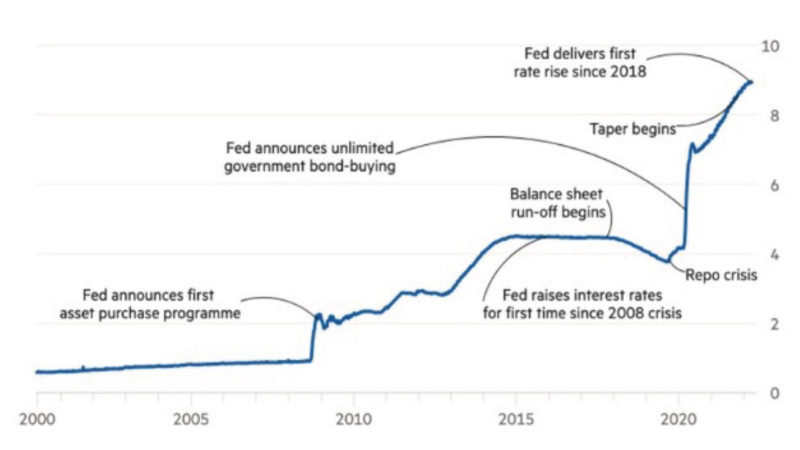

Figure 1 shows the evolution of total assets held by the Fed since then. The magnitude of QE programs can be gauged by noticing that the total Fed assets increased from 6.0% of U.S. GDP in the fourth quarter of 2007 to 23.5% of GDP in the first quarter of 2017. It reached around US$ 4.5 trillion at the end of the Q3 in October 2014, after which the level was maintained as the Fed reinvested (or rolled over) bonds as they matured.

Then, in September 2017, the Fed announced an upcoming shift to QT, when it would reduce its balance sheet not by selling bonds but by slowing the reinvestment of maturing bonds. After slightly shrinking its balance sheet, QE returned in September 2019 as a reaction to the liquidity crisis happening in the markets of overnight repurchase agreements (or “repos”). These are short-term loans between financial institutions. They experienced a sudden and unexpected spike in interest rates, and the Fed moved in to avoid contamination of the rest of the financial system.

The pandemic financial shock led to a robust response by the Fed. Between March 2020 and March 2022, the Fed bought monthly US$80 billion of Treasury bonds and US$40 billion of mortgage-backed securities. Asset holdings in the Fed’s portfolio more than doubled in this period, from US$3.9 trillion at the beginning of the period to US$8.5 trillion in May of this year, corresponding to 18% and 35% of GDP.

Figure 1: Assets Held by the Federal Reserve (US$ trillions). Source: Smith and Duguid (2022).

Meanwhile, the average maturity of the assets in the Fed’s portfolio became much higher than before the global financial crisis, with an increased share of long-maturity Treasury securities and mortgage-backed securities. In all these QE programs implemented worldwide during and after the global financial crisis, central banks seemed primarily focused on how the type and quantity of asset purchases would affect financial market conditions and, ultimately, inflation and aggregate economic activity—but doing it as a direct intervention on longer-term assets. During the pandemic crisis, some EM implemented some QE (Canuto, 2020 a).

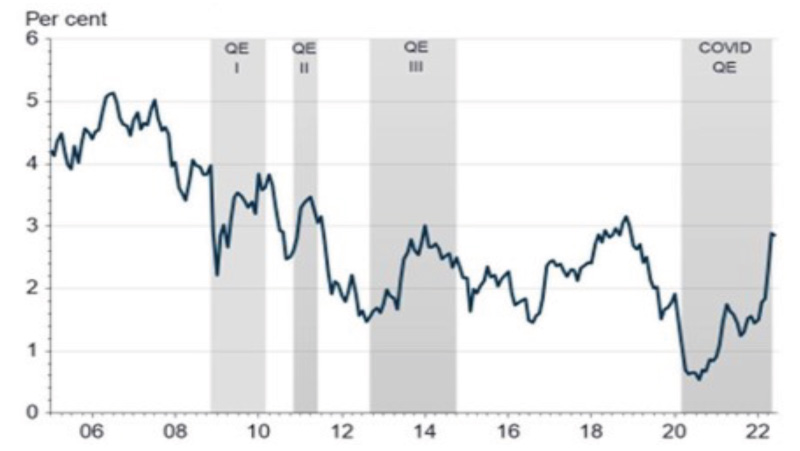

As shown in Figure 2, U.S. QE programs started at moments when U.S. 10-year government bond yields descended drastically. By buying medium- and long-term assets, the Fed aimed to raise their prices and yields. The counterpart of QE acquisitions is larger net reserves in the private sector.

Figure 2: U.S. 10-Year Government Bond Yield and QE. Source: Loane (2022).

Now, given the current overheated labor market conditions and inflation well above the target, the reduction in the Fed’s balance sheet will correspond to a gradual reversal of that counterpart in liquidity as a reinforcement of interest rate hikes.

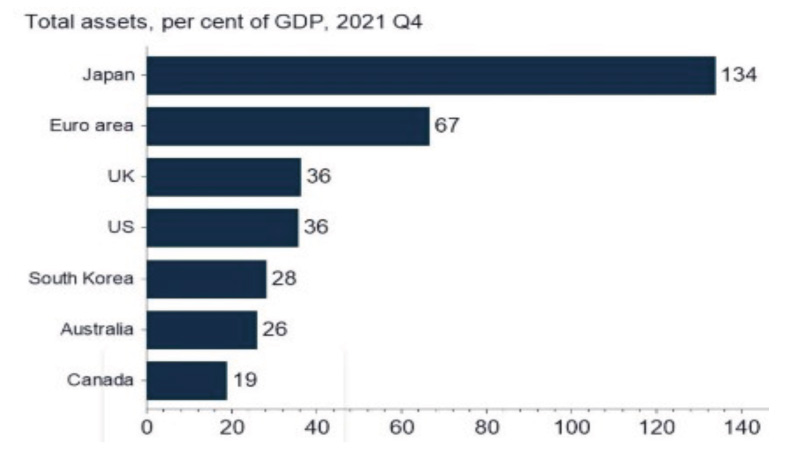

Figure 3 provides a glimpse of where the several QE programs implemented by major developed economies have led their central banks’ balance sheets. Central bank balance sheets of emerging economies also went up due to drying out domestic liquidity impacts of their accumulation of foreign-exchange reserves (Canuto and Cavallari, 2017).

Figure 3: Central Bank Balance Sheets of Advanced Economies. Source: Loane (2022).

For the U.S. Fed QT, it will suffice that those funds from maturing securities are not reinvested. The Fed set a monthly cap of US$60 billion of Treasury bonds and US$35 billion of mortgage bonds for balance sheet shrinkage starting in September of this year, starting this month until August with half those amounts.

Under that plan, the Fed’s balance sheet is expected to shrink by around $520 billion this year. It will still enter 2023 well above the 20% of nominal GDP where it was before the pandemic. But the rate of decrease of US$ 1.1 trillion a year starting in September will have a corresponding decline in the liquidity – bank reserves and deposits – available in the economy.

How complementary – or substitute – can interest rate and central bank balance sheet policies be?

How complementary will base rate increases and QT be concerning longer interest rates that affect decisions underlying aggregate demand (private sector investment and consumption) and thus inflationary stabilization? QE and QT are seen to tend to have a direct impact on longer interest rates. In principle, they converge with policy rate decisions on short-term interest rates to manage aggregate demand, even though different channels.

After all, the policy rate and balance sheet tools influence the economy primarily through their effects on the medium- and longer-term interest rates that drive economic activity. Policy rate actions and communications affect the cost of short-term borrowing and expectations about the path of short-term interest rates. Balance sheet policies primarily influence the term premiums embedded in medium- to longer-term yields by changing the supply—current and expected—of longer-term securities held by the public.

As they are complementary, the two tools might also be taken as substitutes in terms of their ability to affect medium- and longer-term interest rates, employment, and inflation when lower bounds on policy rates are not binding. Put it another way: could a central bank economize on interest rate hikes (decreases) by using QT (QE)?

Crawley et al (2022), from the Federal Reserve, have recently provided an exercise of translating balance sheet reductions in terms of equivalent increases in the path of the federal funds rate that would lead to similar macroeconomic outcomes:

“(…) a one-time permanent reduction in the Federal Reserve’s holdings of 10-year equivalent Treasury securities equal to 1 percent of nominal GDP raises the term premium on a 10-year Treasury security by about 10 basis points, all else equal. In the model, this amount of policy tightening can also be achieved by raising the average expected path of the federal funds rate over the coming decade by about 10 basis points. Together, these relationships provide a simple rule of thumb for the substitutability between balance sheet reductions and policy rate hikes in the model when the economy is away from the ELB [Effective Lower Bound]. However (…) the translation of dollar amounts of balance sheet reductions into equivalent policy rate hikes depends on the evolution of the size and maturity composition of the balance sheet. (…) there is significant uncertainty regarding the transmission of balance sheet and policy rate actions to medium- to longer-term interest rates, as well as the transmission of the resulting yield curve movements to the broader economy (…) Furthermore, there is some evidence that increases in longer-term interest rates may have smaller effects on macroeconomic outcomes when they originate from increased term premiums than when they originate from increased expectations of the policy rate.”

By their simulations, shrinking the size of the Fed balance sheet by approximately US$ 2.5 trillion over the next few years is equivalent to lifting the federal funds rate by just over half a percentage point.

QE (QT) are expected to impact the yield curve flatter (steeper) as the central bank purchases (sells, or not buy) long-term assets. Ultimately, it all depends on how private agents use signals to project future central bank decisions on interest rates. In 2013, all it took was a reference by then-president Ben Bernanke that a reduction in the pace of QE underway was being considered, for a taper tantrum to occur, with markets anticipating a sharp rise in basic interest rates, with immediate effects on asset prices. In turn, between the beginning and the end of the first QT – light and brief – in 2017, the premiums on 10-year Treasury bonds fell.

This time, however, it is possible to assume that the Fed wants the instruments working in earnest in the same direction of containing demand. Doubts concern the pace and extent of the tightening, both about base rates and the size of the Fed’s balance sheet at the end of QT. After all, everything will depend on how employment and inflation behave along the way, considering the inevitable lag between monetary policy decisions and their effects on the economy. However, as Frederik Ducrozet, head of macroeconomic research at Pictet Wealth Management, has recently said, central banks have moved “from whatever it takes to whatever it breaks”.

There is another component in the evolution of liquidity that maintains a relative autonomy –and potential rebellion– about what monetary authorities formulate, even if conditioned by them: bank credit. In addition to the liquidity created/destroyed by the Central Bank, commercial banks also create money via the bank multiplier, depending on how idle or not they decide to leave their reserves. Banks create money when they lend or acquire an asset. Central banks act on reserves, but what is made of them depends on the banks’ decisions on how much use them.

Banks in the United States have created a lot of money in the recent past. Since the beginning of the pandemic, bank credit grew by US$ 1.5 trillion in 2021 and; since it has been expanding at a pace not seen before the global financial crisis in 2008. One may expect them not to mitigate the impact of QT, but rather to enhance it. But how much they will do is an open variable.

Another variable in the equation is the values of financial assets. Market-valuation of assets in bank portfolios makes those asset prices transmittable to bank credit via capital restrictions and other decision rules regarding the volume of their operations.

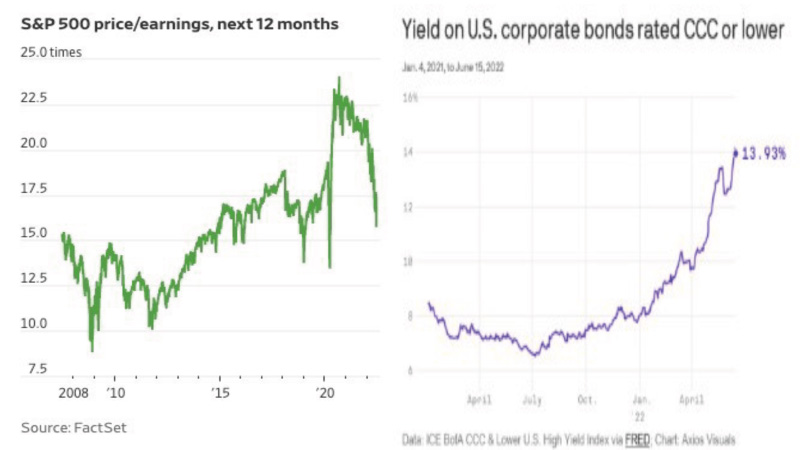

Tighter liquidity conditions and expected interest rate hikes have underlain the fall in equity markets this year, particularly in the case of (technology-related) long-duration assets that have received high-prices relative to current earnings because of extraordinary earnings expected in the future. Higher expected interest rates in the United States have increased discounts on such future earnings.

Share values have melted (Figure 4, left side), whereas riskier bonds have faced stiffer risk premiums (Figure 4, right side). The selloff in US bond and stock markets in recent months has led to a substantial write down in balance sheet values: close to US$ 16 trillion, 60% of 2019 GDP. The recent deterioration of conditions in the real estate market, where a substantial part of the credit goes, tends to reinforce a cooling of bank credit as potential reinforcement of QT.

Figure 4: Prices-to-Earnings and Bond Yields

Financial asset values also affect the target of monetary policy through their so-called “wealth effect” on aggregate demand. In fact, it can even be said that in recent decades the economic cycle in the United States and other advanced economies has been strongly conditioned by what happens in their financial sphere (Canuto, 2021).

Rising interest rates, QT and falling stocks are consistently pointing in the direction of economic slowdown and, tentatively, declining inflation. Until then, the global high inflation shock has led to a global interest rate shock (Canuto, 2022a). Even with different magnitudes of effects, QT adds itself to policy rate increases to tighten financial conditions, change risk evaluations, and impact capital flows to emerging markets.

Capital flows to emerging markets

How have tightening global financial conditions affected capital flows to emerging market economies? How likely is a repeat of the 2013 taper tantrum or the May storm of 2018? How about the dollar appreciation, which is reckoned as painful for emerging markets with significant shares of US-dollar-denominated liabilities (Canuto, 2020b).

The situation tends to be challenging for emerging markets when, like now, the tightening of global financial conditions is driven by concerns about inflation or changes in risk sentiment. When interest rates in advanced economies go up because of excessive economic growth, the trade channel of transmission may compensate the financial one, which is not the case now. The nature of tightening will make a difference – whether it is orderly or accompanied by market turbulence, including episodic tantrums in US dollar funding markets.

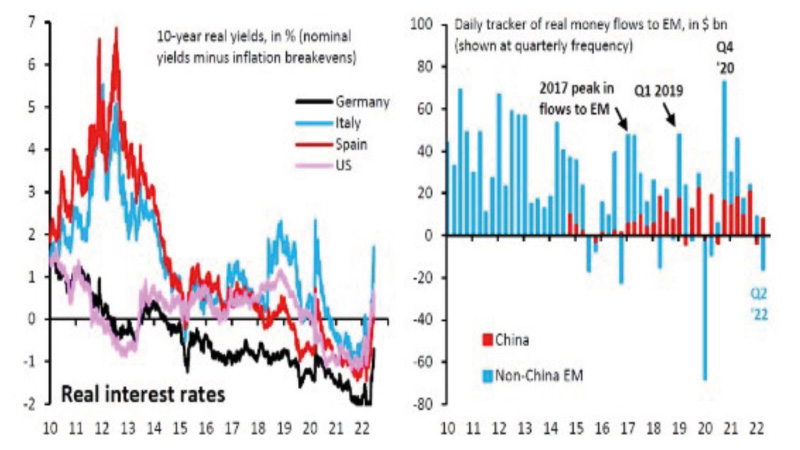

And the global interest rate shock has been accompanied by capital outflows from emerging markets (Figure 5). While long-term government bond yields rose across advanced economies (left side) because of tightening financial conditions and reflecting augmented risk aversion, outflows from emerging markets took place – as captured by the Institute of International Finance (IIF)’s high-frequency flow tracking across the world’s most significant EM (right side). According to Brooks et al. (2022), U.S. 10-year real Treasury yields moved from -1.1% at the end of last year to currently positive 0.7%, a higher jump than during the 2013 “taper tantrum” (Figure 5, left side).

Figure 5: Global Interest Rates and Emerging Market Capital Outflows. Source: Brooks et al. (2022).

By the end-May, close to US$ 36bn had flowed out of emerging market mutual and exchange-traded bond funds since the start of the year. Equity market flows have also gone into reverse since the beginning of May. The picture on flows to local-currency bonds has been diverse and uneven.

In the case of China, Covid and geopolitics – after the Russian invasion of Ukraine – seem to have triggered a sharp sell-off of stocks earlier this year, after rising sharply in 2020-21. But investors have started to return gradually in the end of May.

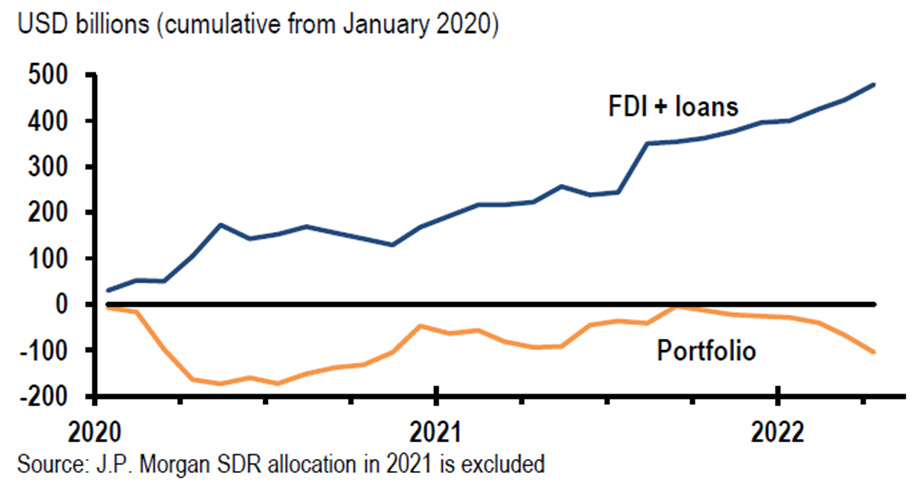

It should be noted, however, that non-portfolio flows (foreign direct investment and loans) have exhibited a higher resilience (Figure 6). Furthermore, more broadly, as remarked in a recent report by JPMorgan economists (Aziz et al, 2022), looking only at net capital flows may lead to a wrong underestimation of capital inflows relative to pre-global financial crisis, as resident outflows have risen since 2013 in search of risk diversification. Portfolio flows to EM have shrunk, as well as bank and corporate external loans, while foreign direct investments remained strong.

Figure 6: EMX Monthly Net Capital Flows

Looking at those flows from the standpoint of the emerging markets’ vulnerabilities, the picture looks less gloomy than in previous situations of outflows. Projected current account deficits in the 12 months ahead are certainly small by historical standards. Furthermore, fiscal deficits have not fully normalized yet, but many countries have announced large cuts soon.

Many emerging markets responded to local impacts of the global inflation shock before advanced economies and current interest rate differentials tend to mitigate the effects of interest rate increases in the latter. There are though emerging markets where interest rates remain exceptionally low – including negative real levels in some cases.

Here diversity comes to the fore, and one needs to go on a case-by-case basis. On one extreme, we have frontier market economies that are overly indebted and importers of food and energy (Lanaual al.l, 2022). Sri Lanka may have just been a canary in the coal mine, signaling a wave of incoming debt defaults and restructuring, as the IMF and the World Bank have warned about. Over 20% of emerging market bond issuers have debt trading in the distressed territory.

On the other extreme, more favorable, several emerging markets have boosted reserves stocks there and strengthened current account positions relative to the past. At the end of last year, 58 percent of EM were estimated to have international reserves exceeding 100% of the IMF’s adequacy metric. Commodity exporters have slightly improved their trade balances, GDPs, and public revenues with the commodity price shock (Canuto, 2022b).

The “original sin” of currency mismatch in the case of public debt is not as a deep sin as in the past, despite the outflows from EM local currency debt last year. Increased private savings during the pandemic have even facilitated a substitution of foreign creditors by domestic investors in acquiring domestic public debt.

Private non-financial debt in foreign currency relative to the size of the economy varies considerably across countries, and some have significant exposures, particularly on the corporate side. Turkey remains like in its “fragile 5” times and Argentina has been out since its default. But they are not representative.

Overall, the point is that one must rely on a country-by-country basis– looking at their global trade and financial linkages – when analyzing risks/returns in emerging markets along with the ongoing perfect storm (Canuto, 2022a). However, overall, the global environment – including QT and interest rate hikes in advanced economies, accompanied by global economic deceleration – is bringing headwinds to capital flows and economic growth in emerging markets.

References

Aziz, J.; Marney, K.; and Jain, T. (2022). “EM capital flows: whatever gets you thru the night”, in JPMorgan, Global Data Watch, June 17.

Brooks, R.; Fortun, J.; and Pingle, J. (2022). Global Macro Views – The Global Interest Rate Shock and EM Outflows, Institute of International Finance (IIF), June 16.

Canuto, O. (2020a). Quantitative Easing in Emerging Market Economies, Policy Center for the New South, November.

Canuto, O. (2020b). Why a Weaker Dollar Might Be Good for Emerging Markets? Policy Center for the New South, December.

Canuto, O. (2021). U.S. Bubble-Led Macroeconomics, PB-21/29, August.

Canuto, O. (2022a). Emerging Economies, Global Inflation, and Growth Deceleration, Policy Center for the New South, PB-30/22, April.

Canuto, O. (2022b). Biggest Commodity Price Shock in Fifty Years, Policy Center for the New South, May 6.

Canuto, O.; and Cavallari, M. (2017). The Mist of Central Bank Balance Sheets, Policy Center for the New South, PB-17/07, February.

Crawley, E.; Gagnon, E.; Hebden, J.; and Trevino, J. (2022). Substitutability between Balance Sheet Reductions and Policy Rate Hikes: Some Illustrations and a Discussion, FEDS Notes. Washington: Board of Governors of the Federal Reserve System, June 03.

Lanau, S.; Figueroa, M.P.; Fortun, J.; and Hilgenstock, B. (2022). Economic Views – External Risk in Frontier Markets, Institute of International Finance (IIF), June 7.

Loane, K. (2022). QE: Not Cause, But Symptom, Fathom, June 17.

Smith and Duguid (2022). Can the Fed shrink its $9tn balance sheet without causing market mayhem? Financial Times, April 7.

Abstract

In its May 15th meeting, the Federal Open Market Committee of the U.S. Federal Reserve (Fed) lifted its benchmark policy rate by 0.75% to 1.50%–1.75%, the biggest increase since 1994. The central bank also signaled an additional increase of 0.75% ahead. FOMC members also raised the median projection for the Fed funds rate to a range between 3.25% and 3.50% next year.

In addition to hikes in basic interest rates, liquidity conditions in the US economy will also be affected by the shrinking of the Fed’s balance sheet starting this month. The “quantitative easing” (QE) that resumed strongly in March 2020, in response to the financial shock at the beginning of the pandemic, will now give way to a “quantitative tightening”.

How complementary – or substitute – will be those movements in interest rates and balance sheet downsizing? What are their likely consequences on capital flows to emerging markets?

About the Author

Otaviano Canuto, based in Washington, D.C, is a senior fellow at the Policy Center for the New South, a professorial lecturer of international affairs at the Elliott School of International Affairs – George Washington University, a nonresident senior fellow at Brookings Institution, a professor affiliate at UM6P, and principal at Center for Macroeconomics and Development. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund and a former vice-president at the Inter-American Development Bank. He is also a former deputy minister for international affairs at Brazil’s Ministry of Finance and a former professor of economics at University of São Paulo and University of Campinas, Brazil.

You may have an interest in also reading…

The “Sell America” Trade Returns — With Greenland at the Centre

A familiar market pattern reasserted itself on 20 January 2026: the dollar slid, Treasury yields rose, US equities fell sharply,

CFI.co Meets the CEO of Travant Capital Partners: Sanyade Okoli

Sanyade Okoli returned to Africa in 2006 following nearly two decades of living in the United Kingdom. She was driven

ISID, McGill University: Updating the DFIs’ Operating Models to Achieve the UN 2030 SDG Agenda

The UN General Assembly set the Sustainable Development Goals (SDGs) five years ago. The estimated annual amount of investment needed