Otaviano Canuto, Center for Macroeconomics and Development: Is There a Middle-Income Trap?

The “middle-income trap” has become a broad designation trying to capture the many cases of developing countries that succeeded in evolving from low- to middle-levels of per capita income, but then appeared to stall, losing momentum along the route toward the higher income levels of advanced economies.

Such a trap may well characterise the experience of most of Latin America since the 1980s, and in recent years middle-income countries elsewhere have expressed fears of following a similar path. Underlying these views is a more general feeling that moving up on the income ladder gets harder the higher one climbs.

“Traps are seen as shortcomings resulting from the absence of any of those policy and institutional changes considered key to gearing up the transition from middle- to upper-income levels.”

This article outlines two different ways in which the concept has been approached since its first use 12 years ago by Gill and Kharas (2007). One has been empirical, where search is made to identify — or deny — breaks or turning points in time-series data exhibiting growth traps for middle-income economies. The other, closer to the way it was originally suggested, refers to the need of policy and institutional change for a country to keep climbing the income ladder after a transition from low levels.

Traps are seen as shortcomings resulting from the absence of any of those policy and institutional changes considered key to gearing up the transition from middle- to upper-income levels.

Is there a middle-income trap? The empirical approach

Some authors have taken up the task of checking whether one can empirically detect, using either econometric techniques or other criteria, features that can be considered as common — or frequent — among middle-income economies.

One way to define the middle-income trap is in absolute terms, as a productivity and growth slowdown impeding hitherto fast-growing economies to graduate into the ranks of high-income countries. Since the 1950s, rapid growth has allowed a significant number of countries to reach middle-income status; yet, very few have made the additional leap needed to become high-income economies. Rather, many developing countries have become caught by a sharp deceleration in growth and in the pace of productivity increases.

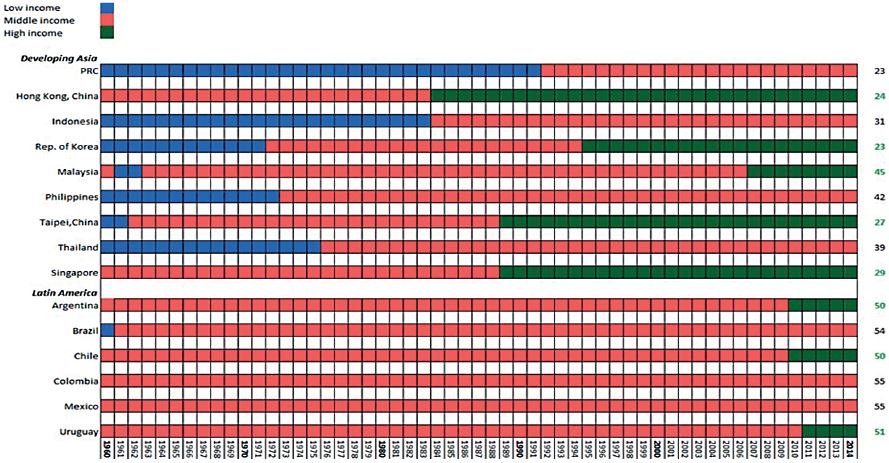

Chart 1 depicts several countries as staying in a narrow income band over the period from 1960 to 2014. The question then becomes whether middle-income countries are more likely than others to experience a growth slowdown or whether they face a greater frequency of slowdowns than either advanced or low-income countries.

Chart 1: Absolute approach. Source: ADB, Asian Development Outlook 2017: transcending the middle-income challenge.

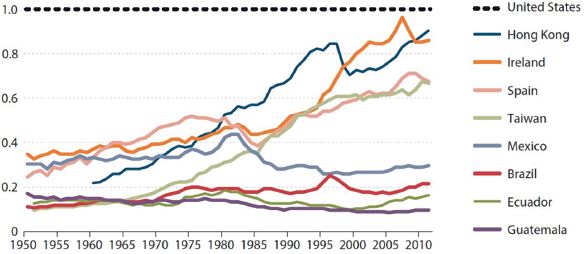

The middle-income trap can also be defined in relative terms, as a lack of convergence to some benchmark high-income country. Chart 2 displays the stagnation, in relative terms, of some Latin American countries (Mexico, Brazil, Ecuador and Guatemala), while Hong Kong, Spain, Ireland and Taiwan have managed to move up the scale toward high-income levels. The question then becomes whether middle-income countries are more likely to experience a slowdown of their catching-up with upper-income countries than it is the case at lower stages of the income ladder.

Overall, the evidence on the supposed middle-income trap is mixed. While Spence, Eichengreen, Park, and Shin, Aiyar et al find evidence that countries are more likely to slow down at middle income than at high or low income, others — Im and Rosenblatt, Felipe et al and Han and Wei — do not find growth patterns conforming to one clear pattern that can be characterised as a trap.

Bulman et al distinguish between “escapees” and “non-escapees”. Escapees grow rapidly at all income levels (and all income ranges), whereas non-escapees tend to grow slowly at any development stage (not only within the middle-income range). Felipe et al remark that the small number of former middle-income economies that became high-income economies relatively quickly were outliers from a historic perspective, whereas the rest of the middle-income economies have exhibited a weaker growth performance.

They conclude: “(W)e reject the existence of a middle-income trap as a generalised phenomenon. Instead, we argue that what distinguishes economies in their transition from middle to high income is the speed of these transitions, fast versus slow, a standard growth question.”

Such attempts to identify turning points or any other empirical regularities across middle-income countries are inevitably riddled with challenges (Glawe & Wagner, Agenor). Thresholds — which often vary among studies — reflect some arbitrariness; results are data-sensitive. Empirical definitions have no theoretical underpinning that may lead someone to expect the observed phenomena to be independent of space and time of observation.

They also differ from the way Gill & Kharas approached the possibility — not as a matter of destiny — of middle-income traps as the result of lack of requisite policy and institutional changes to underpin the transition from middle- to upper-income levels, as policy and institutional requirements tend to be different from those of the evolution from low- to middle-income. As the authors remarked later, they referred to complacency risks — taking past successes as a guarantee of future ones, rather than updating policies and institutions (Gill & Kharas).

This approach leads to assessing economies as individual cases. Furthermore, Gill & Kharas also call attention to the need of theoretical developments on growth and productivity appropriate to inform policies in middle-income economies as such. There is a gap between the classic poverty trap arguments used as references regarding the departure from low-income levels. On the other hand, there is the Solow growth model, where technological learning is absent and endogenous growth models mainly applicable to frontier advanced countries. Implications of being in the middle of the trajectory between low- and upper-income levels are also uncovered in North-South growth models (Krugman, Ocampo).

In what follows, we summarise a possible narrative about policy and institutional changes expected to be faced by middle-income countries to climb up the income ladder.

Middle income as a stage of growth and development

In most cases of successful evolution from low- to middle-income per capita in recent history, the underlying development process has been broadly similar. Typically, there is a large pool of unskilled labour that is transferred from subsistence-level occupations to more modern manufacturing or service activities that do not require much skill upgrade from those workers, but nonetheless employ higher levels of capital and embedded technology. The associated technology is available from richer countries and easy to adapt to local circumstances. The gross effect of such a transfer — usually happening in tandem with urbanisation — is a substantial increase in “total factor productivity”. an expansion of the value of GDP that goes beyond what can be explained by the expansion of labour, capital and other physical factors of production to the economy.

Reaping the gains from such low-hanging fruit, in terms of growth opportunities, sooner or later faces limits, after which growth may slow, and the economy may get trapped in middle-income levels. The turning point in this transition occurs either when the pool of transferrable unskilled labour is exhausted, or in some cases, when the expansion of labour-absorbing modern activities peaks before that exhaustion happens.

Chart 2: GDP per capita relative to the US. Source: Federal Reserve Bank of St. Louis, “Relative income traps”, first quarter, 2016.

Beyond this point, raising total factor productivity and maintaining a fast growth pace becomes dependent on the economy’s domestic ability to move upward in manufacturing, service or agriculture value chains, toward activities characterised by technological sophistication. Also, there are high requirements in terms of human capital and intangible assets such as design and organisational capabilities. The path from low- to middle- and then to high-income per capita corresponds to increasing the shares of population moved from subsistence activities to simple modern tasks, and then to sophisticated ones. Within-sector productivity gains and “moving up value chains” rise in weight relative to productivity-lifting cross-sector structural change (Gill & Kharas).

An institutional setting supportive of innovations and complex chains of market transactions is of the essence. Instead of mastering existing standardised technologies, the challenge becomes the local creation of domestic capabilities and institutions, which cannot be simply brought or copied from abroad. Provision of education to labour and of appropriate infrastructure becomes a minimum condition.

Current middle-income countries in Latin America decelerated their labour-transfer process from subsistence before exhausting labour surpluses, as macro-economic mismanagement and inward orientation until the 1990s established early limits to that process. Nevertheless, some enclaves up on the ladder of value chains have been established (for instance, the technology-intensive agriculture, and sophisticated capabilities of deep-sea oil drilling and aircraft design in Brazil).

By contrast, fast-growth Asian economies have relied extensively on international trade to scale-up their labour transfer through insertion into the unskilled labour-intensive segments of global value chains. This has been facilitated by advances in information and communication technologies, combined with decreasing transport costs and lower international trade barriers. Taken together, these factors made possible the unbundling of production lines in chains of tasks with different degrees of sophistication requirements that can be geographically dispersed (Canuto).

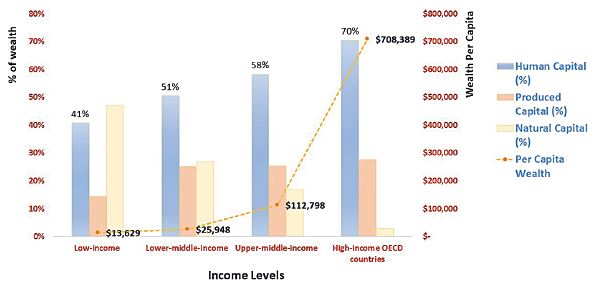

Chart 3 shows the structure of wealth for economies by income group and they illustrate the path of evolution that a country is expected to cross on the way up the ladder. It displays averages and individual countries will differ because of different levels of natural wealth (Canuto & Cavallari). However, three broad features may be highlighted: the high and increasing weight of human capital (World Bank); the weight of produced capital — physical capital — stabilises in relative terms after the ascent from low-income levels; and, regardless of country-specific natural resource richness, its weight decreases relatively along the ascent.

Natural resource-rich middle-income countries face a road of their own. Unlike manufacturing, natural resource use is to a large extent idiosyncratic, in the sense that each concrete experience is unique. That creates a privileged scope for local creation of capabilities in sophisticated upstream and downstream activities, with the corresponding challenge to do so in a sustainable fashion. Nevertheless, an institutional setting supportive of innovations and complex chains of market transactions, high-level education and local building of intangible assets are also preconditions.

Although not included in the data displayed in Chart 3, one may expect a strong correlation between the human capital accumulation and local development of intangible assets (capabilities to adapt technologies and innovate; managerial and organizational capabilities; rules and institutions that do not impose costs and waste on chains of transactions which tend to become dense and complex as the economy climbs the ladder). One may expect the return from these assets to underlie what Moses Abramovitz called our “measured ignorance” – namely, total factor productivity increases not explained by the accumulation of production factors in exercises of production function-based GDP and productivity decomposition.

Local development of capabilities of imitation and creative adaptation of existing technologies, followed by or in tandem with capabilities to innovate, is a requisite to raise productivity, upgrade occupation and move up the income ladder. Any application of technology needs locally specific content that cannot be acquired or transferred by means of textbooks or other codifiable forms of knowledge transmission. This knowledge cannot be made explicit, simply transmissible in blueprints, and thus cannot be perfectly diffused as public information or private property. It must be developed locally. Production, technology adoption, and invention requires a relatively high level of such idiosyncratic knowledge and local capabilities (Canuto).

While technology originators tend to follow a sequence reverse to latecomers, it is typical for the latter to start from production and technological adoption and only then move on to invention. That has been the case in South Korea and China (Canuto). These countries have developed innovation capabilities after intense learning through using and adapting existing technologies.

Simple interconnectedness does not automatically spark productivity increases and local innovation. Success depends on the presence of a broad set of complementary factors: access to finance, infrastructure, skilled labour, and good managerial and organisational practices. In the absence of these factors, returns from investing in the development of capabilities are likely to be low (Canuto, Dutz & Reis; Cirera & Maloney).

Chart 3: Composition of wealth by country income levels, 2014.

Source: World Bank, The Changing Wealth of Nations 2018: Building a Sustainable Future, 2018.

Solutions must be found to market failures that generate disincentives to the accumulation of knowledge, but the private and public sector interaction cannot be unfriendly to the rising density and complexity of chains of transactions accompanying progression. Transaction costs associated with doing business” — trading across borders, hiring and enforcing contracts — cannot be too high, whereas other dimensions of the investment climate —policy uncertainty, macroeconomic instability, corruption, losses due to crime, infrastructure and others — must be favourable so as to not disincentivise investment in the acquisition of capabilities. In a broad sense, the structure of incentives for economic agents must be such as to favour the search for efficiency rather than seeking “rents” (Canuto & Ribeiro dos Santos).

International trade and technology transfer have proven to be important boosters to such a journey, but institutional change, high-level education and local building of intangible assets are also essential for sustaining this over the long run. South Korea is a prime example of a country that exploited these opportunities to move all the way up the ladder.

It is worth remarking that, particularly in the case of large economies, heterogeneity and diversity of states is to be expected. Brazil’s per-capita income, classified as upper-middle by the World Bank, is associated with an economic structure where one locates both high- and low-income types of activities and jobs. Overcoming middle-income traps in such a case means upgrading a substantial share of overall employment, including by rescuing low-income agents left behind as such by the previous transition.

Traps may take place in situations when upgrading faces high obstacles to gain competitiveness because of incumbents in global markets. Gill & Kharas used “middle-income trap” to designate economies that were being squeezed between the low-wage poor country competitors that dominate in mature industries, and the rich-country innovators that dominate in industries undergoing rapid technological change. Manufacturing in Latin America was relatively squeezed by the large addition of cheaper labour to the global economy, resulting from the downfall of the Soviet Union as well as China’s economic integration.

Ultimately, however, one may point to local insufficiency or appropriateness of some of the policies and institutions necessary to underpin the transition upward as potential causes of middle-income traps. Agenor & Canuto developed analytical models of multiple equilibria in which distorted incentives and misallocation of talent, weak contract enforcement and protection of intellectual property rights, lack of access to advanced infrastructure, and lack of access to finance create the possibility of a middle-income economy to settle on a “bad” low-growth path. In turn, Aiyar et al and Han & Wei approach the negative implications for growth of a high frequency of macroeconomic booms-and-busts.

Policies and institutions needed to climb the ladder

ADB offers a summary of the morphing set of policy priorities if an economy is to move beyond the track from low- to middle-income stages:

- As economies evolve from low- to middle-income, so do their growth drivers. While accumulating physical (produced) capital remains important for growth in middle-income economies, human capital accumulation and total factor productivity improvement — or growth in production not derived from higher use of inputs — acquire larger weight in growth determination. Productivity-centred growth is needed to reach high income.

- Innovation matters more as economies approach the technological frontier and entrepreneurship turns new ideas or technology into innovation-based growth. Opportunity-driven entrepreneurship, which is often built on new ideas or technology, increasingly outweighs necessity-driven entrepreneurship, which responds to existing market needs.

- Risk-taking entrepreneurs take the lead in fostering innovation, and these individuals respond to incentives that are either strengthened or weakened by economic policies and institutions. Governments can promote innovative entrepreneurship through stronger intellectual property protection and rule of law, better access to finance, and allowing private-sector competition to prevail.

- Graduation to high income requires a diverse and sophisticated product mix. In addition to producing a wider range of goods, middle-income economies must aim to produce more complex goods and services, which support higher productivity and better wages.

- Human capital accumulation rises in relevance and the emphasis must be on ramping-up the quality of education. Economies with relatively high cognitive skills benefit from having a critical mass of students likely to become innovators. As economies move closer to the technological frontier, the returns on research-oriented innovation increases.

- Infrastructure needs to shift as an economy becomes more complex and sophisticated. There is a nexus between advanced infrastructure, highly developed skills, and innovation.

- The role of the government necessarily evolves as an economy progresses, becoming more of a supportive type as the private sector is fully fledged. The government must shape an environment conducive to innovative entrepreneurship by promoting investment in education and infrastructure.

- An environment conducive to growth needs macro-economic stability. When a country reaches middle income, its growth rate tends to become more vulnerable to indicators affecting macroeconomic stability — given hysteresis effects of banking and currency crises, the exposure to capital inflow fluctuations, and the legacy of macroeconomic instability.

The qualitatively distinctive nature of the middle-income stage of development differentiates it from both high- and low-income phases, demanding an effort to go beyond generalisations about growth and productivity. In our view, the relevance of the concept of middle-income traps stems not from being a hypothesis about deterministic trends in growth, but rather as a warning shot about complacency risks of casting forward past transition successes instead of updating policies and institutions to new requirements. Individual middle-income country experiences of falling into a trap may be approached as cases of lack of or failing performance in footing the bill in terms of appropriate policies and institutions. i

About the author

Author: Otaviano Canuto

Otaviano Canuto is principal at the Center for Macroeconomics and Development, a senior fellow at the Policy Centre for the New South and a non-resident senior fellow at Brookings Institution. He is a former vice-president and a former executive director at the World Bank, a former executive director at the International Monetary Fund, and a former vice-president at the Inter-American Development Bank. Otaviano has been a regular columnist for CFI.co for the past seven years.

Follow him on Twitter: @ocanuto

You may have an interest in also reading…

US Welcomed at Davos as the New Emerging Market

The annual meeting of top businessmen, leading public officials, and a host of other VIPs in Davos usually sees emerging

Business in Times of Corona: The Dangerous Fruit of the Magic Money Tree

In one of life’s little ironies, it was not the senator from Vermont but the billionaire businessman from New York

Otaviano Canuto, World Bank: Overlapping Globalisations

Current technological developments in manufacturing are likely to lead to a partial reversal of the wave of fragmentation and global