Otaviano Canuto, Center for Macroeconomics and Development: How to Heal the Brazilian Economy

Author: Otaviano Canuto

If I were to encapsulate the current situation of the Brazilian economy in one sentence, I would say: “It is suffering from a combination of ‘productivity anemia’ and ‘public sector obesity’”.

On the one hand, the country’s mediocre productivity performance in recent decades has limited its GDP growth potential. On the other, the gluttony for expanding public spending has become increasingly incompatible with the potential expansion of GDP – particularly since the former has not been achieving socio-economic results that match such an appetite.

In my judgment, the crisis, followed by slow recovery in recent years, reflects the advanced stage of evolution of the disease, preceded by an incubation period during which its symptoms were disguised.

On August 23, the World Bank released a set of public policy notes laying down three reform paths to rediscover a trajectory of shared prosperity. As well as proposals to improve productivity performance, the notes suggest reforms in the governance model of the Brazilian public sector. Those reforms should be accompanied by a review of public spending as the main element of a necessary adjustment in public accounts.

Let’s start with the anaemic productivity increases in goods and services that the Brazilian economy can produce with its available material and human resources. More than half of per-capita income growth over the past two decades has come from increases in the share of the economically active population, a source of expansion that will decline with the aging of the population.

“The World Bank suggests the adoption of a programme of trade liberalisation, as low productivity levels are one of the consequences of the exacerbated closure in Brazilian foreign trade. This imposes barriers to access to foreign inputs and technologies.”

From the mid-1990s, Brazilian production per employee has been increasing at a snail’s pace rate – just 0.7% a year – partly because the level of physical investments has remained low, but mainly because the overall efficiency in the use of human and material resources has remained stagnant (Chart 1 – left side).

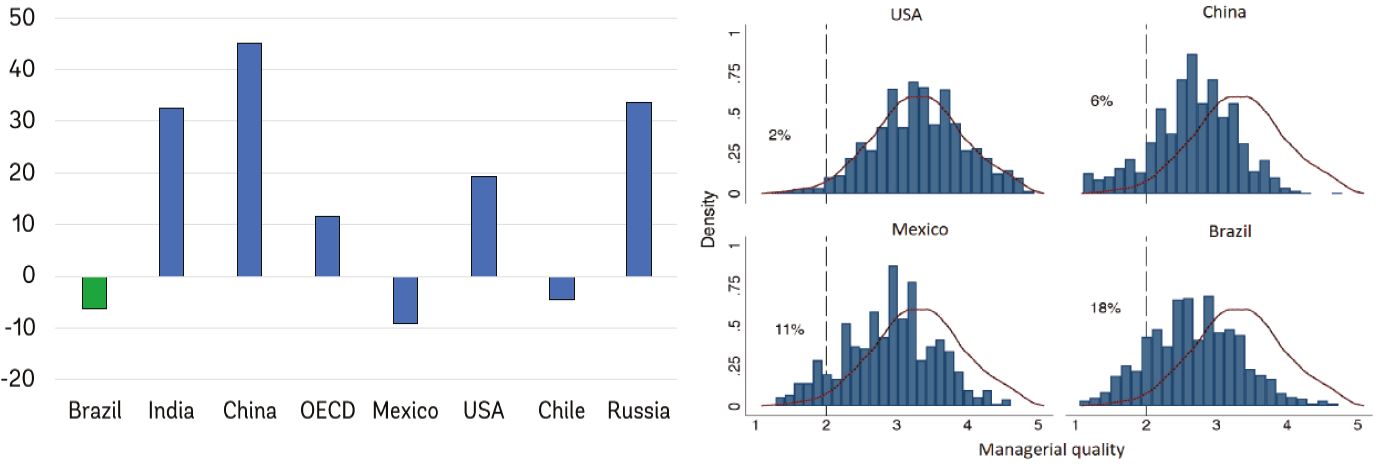

Chart 1 – The Productivity Anemia: Total Factor Productivity growth during 1995-2014 (left). Distribution of firms’ managerial quality compared to the USA (right). Source: World Bank, “Promoting sustainable productivity growth”, (Brazil) Public Policy Notes – Towards a fair adjustment and inclusive growth, August 23, 2018.

The World Bank suggests the adoption of a programme of trade liberalisation, as low productivity levels are one of the consequences of the exacerbated closure in Brazilian foreign trade. This imposes barriers to access to foreign inputs and technologies.

There are other factors that limit competition in domestic markets – lack of logistics infrastructure, differentiated state tax regimes, subsidies to specific firms – that make the rate of survival and resource retention in less efficient companies higher than in other countries. The price to be paid is in terms of lower average productivity. Such a retention of resources in inefficient uses is illustrated in the right side of Chart 1, which shows Brazil’s distribution of firms’ managerial quality compared with the US. Policies to support the private sector need to shift from compensation for high internal costs to strengthening the adoption and diffusion of technologies.

The unfavourable business environment for entrepreneurs also undermines productivity. The complexity and imbalance of the tax system is a priority item for reform. The lack of investments in infrastructure, and their declining quality in the recent past, takes another toll on productivity (Chart 2).

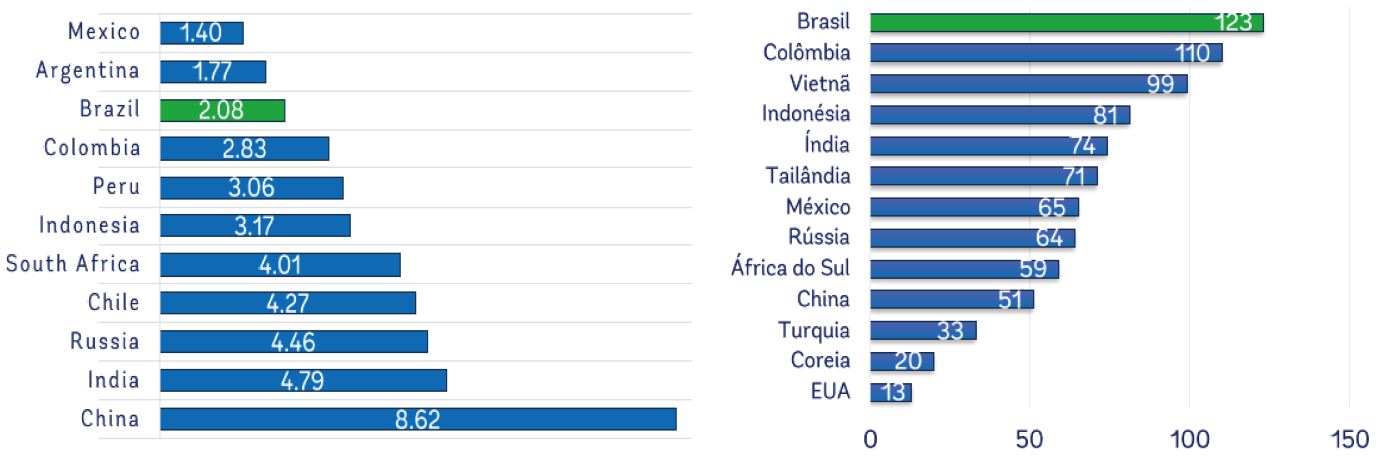

Chart 2 – Infrastructure Investments: Infrastructure investments (% of GDP) (left). Quality of infrastructure (Ranking WEF – the lower the better) (right). Source: World Bank, “Overcoming the challenge of improving and expanding infrastructure services”, (Brazil) Public Policy Notes – Towards a fair adjustment and inclusive growth, August 23, 2018.

In the same way, financial intermediation in the country does not provide financing appropriate to investment. The World Bank also notes how the quality of education and the formation of human capital could benefit from the less-rigid allocation of public resources and sharing the successful experiences taking place in states and municipalities.

While productivity and GDP growth potential have maintained their weak increases, annual public spending has risen sharply in real terms over the past decades: 68% between 2006 and 2017. As a proportion of GDP, public expenditure rose from less than 30% in the 1980s to about 40% in 2017. Meanwhile, public investment declined – less than 0.7 percent of GDP last year – partly explaining the precariousness of infrastructure.

With tax revenues reflecting the decline in GDP in 2015-16 and the subsequent fragile macro-economic recovery, a deterioration in the primary balance by more than four percentage points of GDP launched public debt on an explosive trajectory, rising from 54% to 74% of GDP between 2012 and 2017.

Not surprisingly, fiscal adjustment is another of the paths suggested by the World Bank, which noted that a path of gradual improvement in the primary balance (equivalent to that contained in the constitutional amendment establishing a spending ceiling – 0.6% of GDP per year) could allow a return to a sustainable debt trajectory in 10 years.

Given the levels achieved by public spending, as well as the automatic expansion mechanisms in place and the potential pace of GDP growth, the World Bank’s macro-economic projections do not give any hope for recovery of primary balances by tax collection. Attempts to revitalise the economy via increases in public spending that is not backed by some credible fiscal adjustment plan will not be able to convince private players to believe that growth might be sustainable.

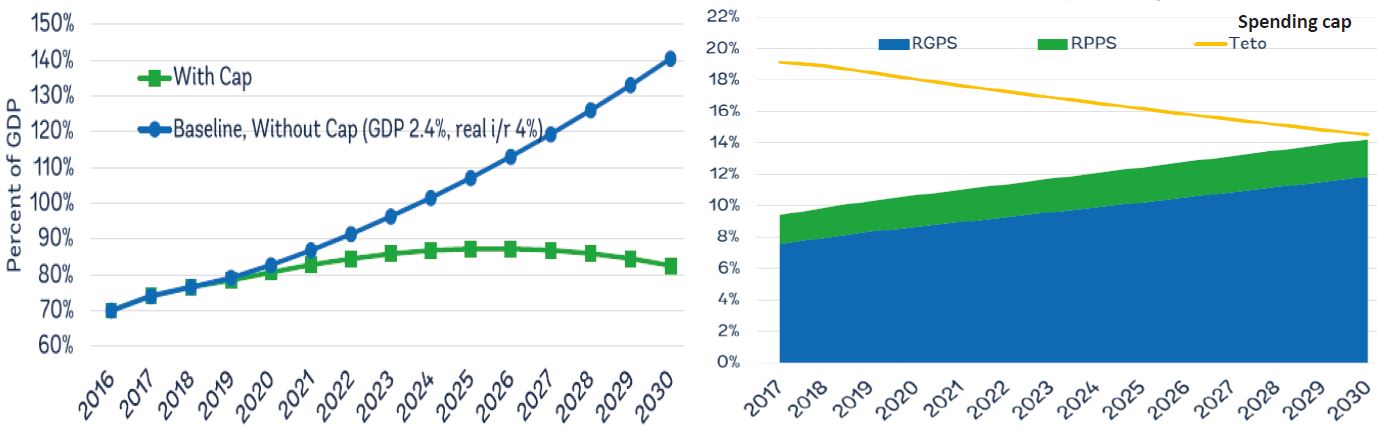

Under the assumption of a combination of a GDP growth rate at 2.4% per year and real interest rates at 4%, the World Bank projects rising and dampening public debt trajectories, respectively, with and without the spending cap (or an equivalent fiscal adjustment in the latter case). (Chart 3 – left side).

Chart 3 – Fiscal Obesity: Projections of General Government Gross Debt, without and with spending cap (GDP growth at 2.4%% and real interest rate at 4%) (left). Projection of pensions expenditures and spending rule (% of GDP) (right). Source: World Bank, “Fiscal stabilization and fiscal adjustment: returning to a sustainable fiscal path”, (Brazil) Public Policy Notes – Towards a fair adjustment and inclusive growth, August 23, 2018.

Expenditures on social security, the public sector payroll and subsidies and tax exemptions are areas in which the World Bank highlights existing opportunities to reduce public expenditures while minimising impacts on the bottom layers of the income pyramid, and opening space for other types of public expenditure. The right side of Chart 3 shows how a pension reform will be necessary to turn the spending cap feasible.

If the option to reconstitute primary balances falls to some extent on the tax side, there are possibilities for reform that would not only reduce its negative weight in the business environment, but also reduce the social inequality of the current system. Similar directions are also proposed for subnational public accounts.

The third path outlined by the World Bank is state reform. The mismatch between the limited growth potential that results from the “productivity anaemia” and growing public spending is aggravated by an inefficiency in the provision of several services, comprising a “public sector obesity”.

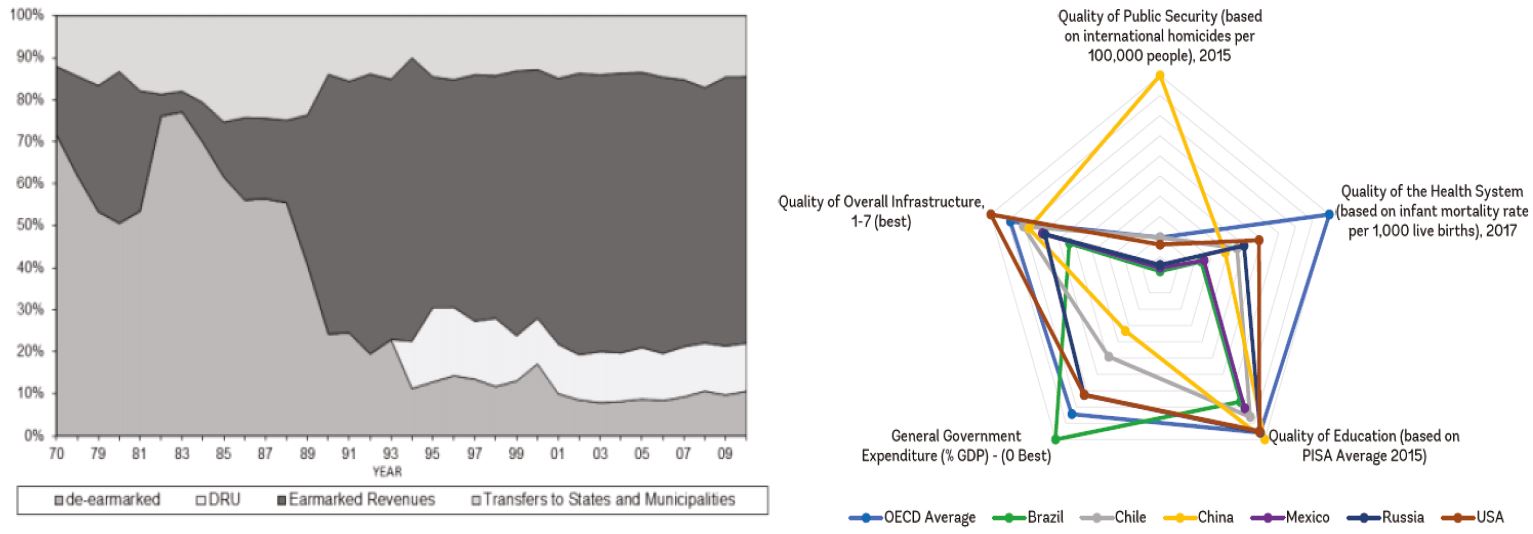

The World Bank pins the cause on an excessive number of rules and budget rigidity, fragmentation of service delivery, poor planning, monitoring and evaluation of projects and policies, human resource management without positive performance incentives, judicialisation of policy decisions, and growing risk-aversion in the bureaucracy. Chart 4 illustrates these points by displaying the evolution of earmarked revenues (left side) and results achieved by public spending (right side).

Chart 4 – Public Sector Obesity: Evolution of earmarked revenues (left). Brazil’s state spends more than most peers but achieves less (right).

Source: World Bank, “Reforming the state”, (Brazil) Public Policy Notes – Towards a fair adjustment and inclusive growth, August 23, 2018.

This is true for health, education, violence, infrastructure, transportation and logistics and water resources management. In all these areas, greater consistency between planning and execution, emphasis on evaluation, and higher fine-tuning between public and private sectors would lead to better socio-economic results per unit of public expenditure.

An acknowledgement of the double malaise afflicting the Brazilian economy here approached can be noticed in some policy priorities already hinted by the government team to assume on January 1st: maintenance of the spending cap, for which a pension reform and some de-indexation of revenues and expenditures will be necessary; a gradual foreign trade opening; a tax reform; privatization as a way to help adjust the public-sector balance sheet; reinforcement of market-friendly aspects of infrastructure regulation; moving ahead with the agenda of “microeconomic reforms” pursued by the outgoing government and others. The feebleness of the on-going macroeconomic recovery will open some space for a higher GDP growth in 2019. A transition to a new sustained growth path, however, will depend on the success of the new government in using the opportunity to make real those intended reforms.

About the Author

Otaviano Canuto is a world-renowned economist and the principal for the Center for Macroeconomics and Development (Washington, D.C.). He is a former Vice President and a former Executive Director of the World Bank, as well as a former Executive Director of the IMF and a former Vice President of the Inter-American Development Bank. Otaviano has been a regular columnist for CFI.co for the last six years. Follow him on Twitter: @ocanuto

You may have an interest in also reading…

Indonesia To Top “Happy Index”

Indonesian are the world’s most content people according to new research. Emerging markets and half of the BRIC economies (represented

Otaviano Canuto & Matheus Cavallari, World Bank: Bloated Central Bank Balance Sheets

Central banks of large advanced and many emerging market economies have recently gone through a period of extraordinary expansion of

Sustainable Investment in the Dominican Republic: Driving Economic Development in the Caribbean

The Dominican Republic has emerged as a regional leader in attracting foreign direct investment (FDI) within Central America and the