Egypt: Investors Rally Billions to Empower Development

Abdel Fattah al-Sisi

Governments and private investors earmarked well over $36bn to underwrite projects in Egypt at a three-day economic conference held over the weekend in the Red Sea resort Sharm el Sheikh. The mega-event, hosted by President Abdel Fattah al-Sisi, was attended by about 3,500 investors, government delegates, corporate moguls, and – inevitably – droves of consultants.

President al-Sisi took the opportunity to unveil his plan for the building of a new capital city to relieve the demographic pressure on Cairo. Egypt’s yet-to-be-named future capital is to arise on the plains between Cairo and the Suez Canal. The city is slated to cost in excess of $45bn to build. It will be home to the country’s entire state apparatus and, eventually, some five million inhabitants.

President al-Sisi framed his ambitious project as a catalyst for the government’s accelerated development drive which aims to reinvigorate the country’s long-ailing economy. The Egypt Economic Development Conference was organised to herald the arrival of more promising times. The event showcased over sixty large-scale projects open to foreign investors. President al-Sisi is in a hurry since his administration’s survival depends on its ability to deliver sustained levels of economic growth to, and improved living conditions for, the country’s burgeoning population, now standing at close to 90 million.

“It has fully paid down the country’s $7bn debt with oil and natural gas suppliers, floated the currency thereby easing trade and deflating the back market, and scaled back state fuel subsidies which earlier claimed up to a quarter of the government’s total expenditure.”

At the conference, the delegations of the United Arab Emirates (UAE), Saudi Arabia, and Kuwait – President al-Sisi’s staunched supporters – jointly pledged over $12bn in new investment on top of the $20bn or so already in the pipeline. However, Egypt’s notoriously bloated bureaucracy – little changed since President al-Sisi came to power in June 2014 – remains a stumbling block to rapid development. Although a number of reforms have been implemented, the government has so far proved unable to streamline the civil service and drag it into the 21st century.

The president seems aware of the challenges yet to be tackled. His first order of duty is to maintain political stability. Before the Arab Spring blossomed in 2011 and dethroned the atrophied Mubarak Administration, Egypt was already beginning to gain favour with foreign investors. President al-Sisi now wants to recapture that moment, firmly inserting his country into the global marketplace. After years of lacklustre performance, Egypt’s economy is forecast to grow by an average of 7% annually over the next four years.

Seizing the moment, the Egyptian government now seeks to capitalise on its so far almost exemplary management of the country’s strained finances. It has fully paid down the country’s $7bn debt with oil and natural gas suppliers, floated the currency thereby easing trade and deflating the back market, and scaled back state fuel subsidies which earlier claimed up to a quarter of the government’s total expenditure. The al-Sisi Administration also introduced a number of laws aimed at bolstering investor confidence by providing both incentives and added protection.

As a result, investor interest has returned: British Petroleum announced a $12bn project to bring online the natural gas reserves of the West Nile Delta while Siemens from Germany is to build a $4.2bn to build a power plant and wind farm in the country. Siemens CEO Joe Kaeser, also present in Sharm el-Sheikh over the weekend, was particularly pleased with the speedy conclusion of the deal. Mr Kaeser revealed that his company engaged directly with President al-Sisi whom he hailed as an “exceptionally shrewd and skilful negotiator.”

You may have an interest in also reading…

WTO: The Changing Nature of Global Trade

By DG Pascal Lamy Although global supply chains have been with us for several decades, their increasing prominence is rapidly

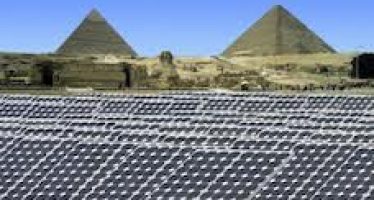

Solar Industry in the MENA Region: Sunny Prospects

A trend towards generating electricity from solar power is on the horizon for the countries of the MENA region (Middle

Water in the Desert: A Challenge that TANQIA has Taken to Heart

TANQIA, the UAE’s first privately owned wastewater collection and treatment utility, does not lack vision. The state-of-the-art wastewater collection and