Otaviano Canuto, World Bank Group: Navigating Brazil’s Path to Growth

Brazil: Rio de Janeiro

Brazil’s macroeconomic management faces four major immediate challenges. The response to them will be strengthened if economic agents could have some indication of how the Brazilian economy will be steered back to a growth route.

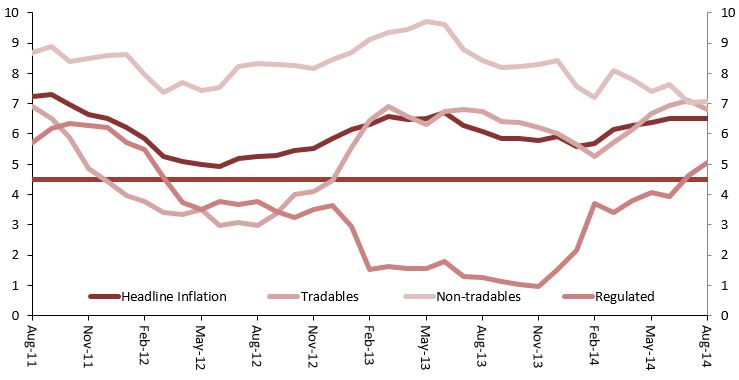

The first challenge will be the upward realignment of domestic regulated prices in a context of inflationary pressures that are still high. Since the second half of 2012, inflation has remained near or above 6.5% – the upper limit of the target. In recent years, the main inflationary factors – services and non-tradable goods – appear to be slowing down. However, the ongoing correction of regulated prices, until recently repressed, has still some way to go (Chart 1).

Difficulties to decelerate inflation will be compounded by another potential challenge: the pressure towards local currency depreciation that will likely accompany the process of normalisation of US monetary policy. Some increase of interest rates is expected for 2015. At the very least there will be higher volatility of interest and exchange rates. This tends to lower the attractiveness of Brazilian securities.

“Since the second half of 2012, inflation has remained near or above 6.5% – the upper limit of the target.”

In fact, one can assume that the Brazilian real would have already lost significant value were it not for the foreign currency hedge transactions massively offered by the central bank since the “taper tantrum” of last year (the notional value of which has now reached $100bn).

Chart 1: Inflation. Source: IBGE

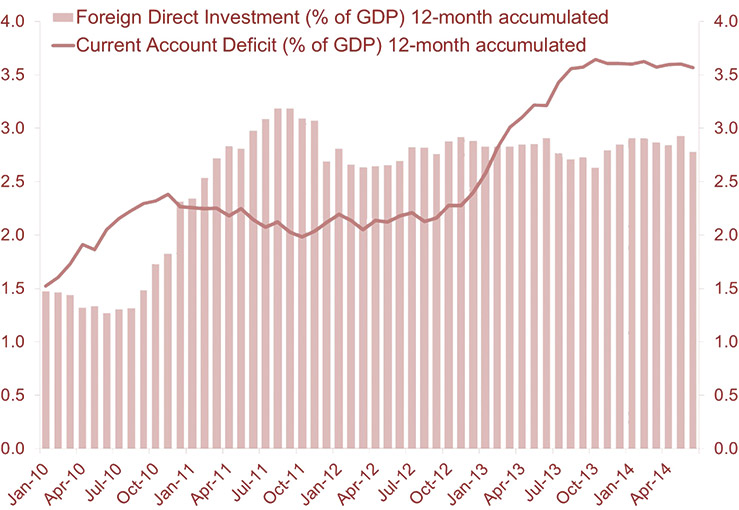

Flows of foreign direct investment have remained stable since 2011, but have no longer been sufficient to cover the current account deficit of the balance of payments since last year, when the latter surpassed 3.5% of GDP. (Chart 2)

To the extent that some retrenchment in portfolio capital inflows takes place, the pressure to devalue the real will increase. The challenge then will become an opportunity for the partial recovery of industrial competitiveness which was eroded in recent years. This occurs only as long as the effects of a devaluation is not negated by a subsequent inflation spurt.

Inflationary Pressures

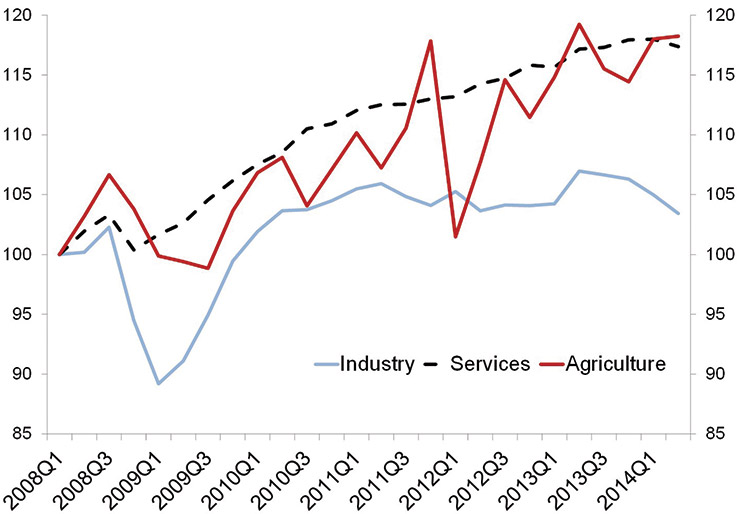

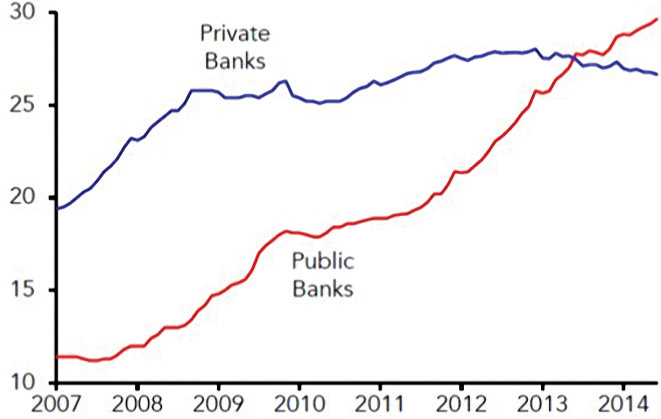

The third challenge will be to respond to such inflationary pressures without resorting to massive doses of monetary tightening, in addition to the restrictive policy already in effect, while those adjustments in relative prices (exchange rate and regulated prices) take place. The Brazilian economy is now in its fourth year of low growth with industrial production remaining stagnant at levels close to those of 2010 (Chart 3). Bank credit has not decreased more only because of the expansion of public banks’ portfolios. Today, these exceed in volume the total lending by private banks (Chart 4).

Chart 2: Foreign Direct Investment and Current-Account Deficits. Source: Central Bank of Brazil

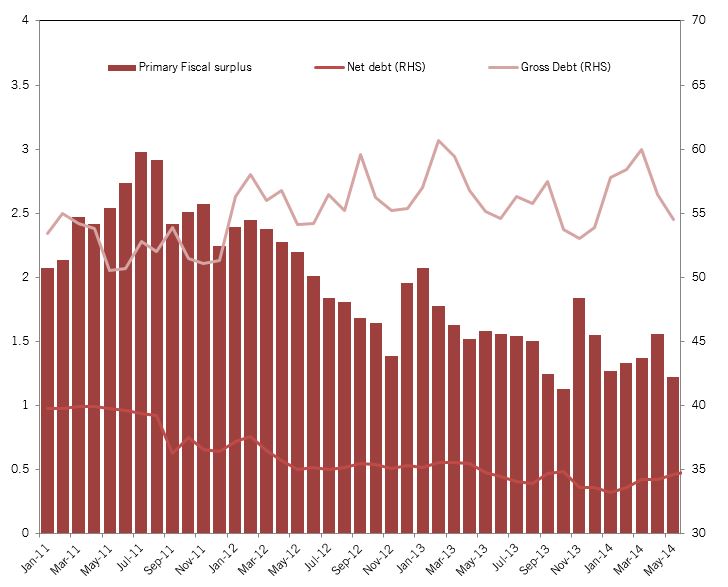

Fiscal policy will be the key to addressing this challenge, insofar as it can reduce the burden of responsibility placed on monetary authorities. The primary public sector surplus has shrunk since 2012 and is unlikely to reach this year’s goal (Chart 5). A reversal of fiscal and para-fiscal expansionism – through the injection of funds by the treasury into public banks – would ease the requirement in terms of higher interest rates that, in turn, help keep inflation in check.

Such review of the fiscal stance would meet the fourth great challenge, which is to reverse the perception of fiscal deterioration of recent years thus mitigating the risk of losing the “investment grade” ratings of Brazil’s public debt. Given the limits to ambitious change in fiscal targets, mostly due to inflexibility in the current structure of public expenditures, establishing multiannual targets for primary balances and/or caps on public spending-to-GDP ratios would enhance the credibility of any fiscal adjustment effort.

Chart 3: GDP by Sectors (Quarterly GDP, Q1 2008 = 100). Source: IBGE

Strictly speaking, if the answers to these four major immediate challenges are taken as credible, improvements in confidence and expectations of private agents will facilitate the crossing of turbulences. This will be the case particularly if private investments – in decline since the middle of last year – start to reflect a higher optimism about future macroeconomic performance.

Plan Upfront

Therefore, a plan to return to growth must be presented upfront. There is now a widespread understanding that a systematic increase in Brazil’s “total factor productivity” (TFP) will be needed from now on if the growth-with-social-inclusion that prevailed in the 2000s is to make a comeback. For this to happen, workers need to benefit from more and better education. However, there are other areas where Brazil can find sources of increased TFP while the country is working on improving its education system.

The first of these other areas is infrastructure. In addition to its role as gross fixed capital formation, sustainable investments in infrastructure would alleviate transportation bottlenecks that have become increasingly tight in the recent past. The reduction of wasted resources, as a consequence of such investments, would not only cause productivity gains, but also more robust private investment in other sectors. Here, it will be necessary to fine-tune the division of responsibilities between the public and private sectors.

Chart 4: Bank Credit Outstanding (percent of GDP).

Source: IIF, Central Bank of Brazil

Additionally, horizontal productivity gains could be achieved through reforms in various operating parameters of the private sector. For example, the annual Doing Business Report, published by the World Bank for 189 countries, indicates that a Brazilian company today spends 2,600 man-hours per year just to pay taxes.

The average in Latin America and the Caribbean, and the OECD are 367 and 176 respectively. Building permits take 460 days to be issued in Brazil, against 225 days elsewhere on the continent and 143 days in the OECD. These numbers indicate that human and material resources are wasted on activities that do not generate value. This is harmful to both the competitiveness of businesses and, at macro level, Brazil’s TFP.

Simplifying the tax system should be, in our judgment, an immediate priority. The bang for the buck, in terms of a reduction in the waste of resources, would be significant and be felt across the board. Improving the legal and tax frameworks in which the labour market operates should also be high on the agenda. Brazil is a country where – compared to its peers in levels of per capita income – private companies invest the least in the training of personnel. Disincentives embedded in current tax and labour laws are among the reasons for this poor performance.

Unfriendly

The foreign trade chapter of the Brazilian business environment is also noted as unfriendly to investments and technological innovation. Transaction costs and difficulties to access technologies, equipment, and supplies from outside have limited the local scope for innovation, productivity increases, and competitiveness. Physical investments in logistics infrastructure will bring a positive contribution in this case. However, a re-evaluation of the costs of the complex structure of tariff and non-tariff barriers by which the country protects its market, is also highly due.

Chart 5: Primary Fiscal Balances and Public Debt. Source: Brazilian National Treasury

The third area that holds the potential of contributing significantly to TFP and economic growth is a review of public spending. International experience has shown how transparency, result evaluation, accountability, and competition in public procurement reduce corruption and improve the quality of public spending. There is also evidence that the quality of public services (education, health, etc.) responds positively to the presence of incentives that reward good performance. Improvements in the quality of public spending would provide gains not only as a significant part of GDP, but also as part of the production inputs used by the private sector.

Potential gains in TFP to be accrued with the review of public spending go beyond the search for more efficiency and effectiveness. To the extent that one may locate benefits and public subsidies that do not find justification in terms of poverty reduction or needs of the productive system, their elimination would make room for tax reductions or a redirection of the freed-up resources.

Brazil therefore has four major short-term macroeconomic challenges and three broad areas of medium-term reform where it is possible to increase its potential for economic growth. Fixing the short term while launching long-term growth foundations will be essential in retaking the course of sustainable development and social inclusion. After all, it is easier to navigate angry seas when one keeps sights of the true north.

About the Author

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

Otaviano Canuto is Senior Advisor on BRICS Economies in the Development Economics Department, World Bank, a new position established by President Kim to bring a fresh research focus to this increasingly critical area. He previously served as the Bank’s Vice President and Head of the Poverty Reduction Network (PREM), a division of more than 700 economists and other professionals working on economic policy, poverty reduction, gender equality and analytic work for client countries. He also served as an Executive Director of the Board of the World Bank from 2004-2007. Outside of the Bank he has held leadership positions at the Inter-American Development Bank where he was Vice President for Countries, and for the Government of Brazil where he was Secretary for International Affairs at the Ministry of Finance. He also has an extensive academic background, serving as Professor of Economics at the University of São Paulo and University of Campinas (UNICAMP) in Brazil.

The opinions expressed here are the author’s and should not be attributed to the World Bank.

Follow Otaviano Canuto on Twitter:

www.twitter.com/ocanuto

You may have an interest in also reading…

EU Offers a Third Bailout: Greece Will Remain in the Eurozone but Austerity Stays too

The EU has survived the Greek debt default crisis and after seventeen hours of negotiations agreement for a third bailout

Norway’s Prime Minister Jens Stoltenberg: Need to see Renewed Growth in the EU

On Monday Dec 10th Norway’s Prime Minister Jens Stoltenberg hosted a working lunch for EU leaders who will be in

The BRICS Leaders’ Summit: Rich Outcomes

President Jacob Zuma hosted the Fifth BRICS Summit in March 2013 in Durban, South Africa under the theme: “BRICS and