SegurCaixa Adeslas Emphasises Value Creation as a Way to Endure Its Sustainable Growth Strategy

The Spanish insurance company stands out for the digitalization of its proceses that allows it to offer more accesible, personalised and convenient services.

Throughout the world, the insurance industry responds to today’s major societal challenges, providing a tool to counteract uncertainty.

SegurCaixa Adeslas is a leading player in Spain, thanks to its ability to take the best advantage of tailwinds and, at the same time, adapt to meet an emerging environment.

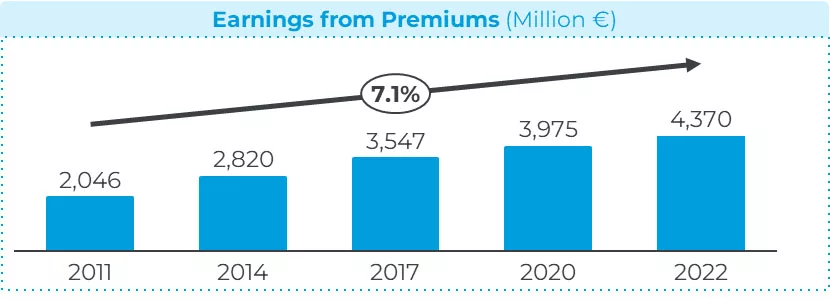

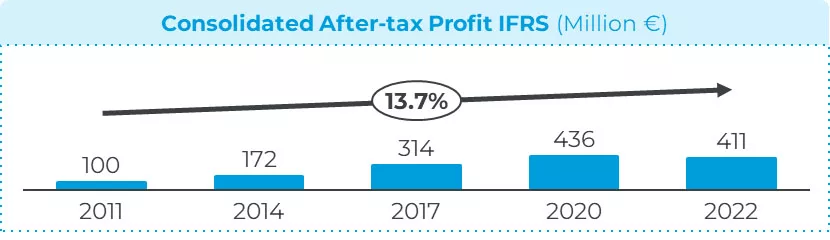

The company, belonging to Group Mutua Madrileña and in which CaixaBank has an ownership interest, achieved last year a turnover of €4,370m in premiums — 5.15 percent up on the previous financial year, thanks largely to good results in the health, multi-risk, and auto fields.

The company, belonging to Group Mutua Madrileña and in which CaixaBank has an ownership interest, achieved last year a turnover of €4,370m in premiums — 5.15 percent up on the previous financial year, thanks largely to good results in the health, multi-risk, and auto fields.

These results derive from a strategy focused on profitable, sustainable growth, as well as the ability to anticipate clients’ needs. The firm’s expertise and depth of experience is reflected in the MyBox range of three-year policies with fixed premiums. Its popularity has led to its extension to the business and company segments.

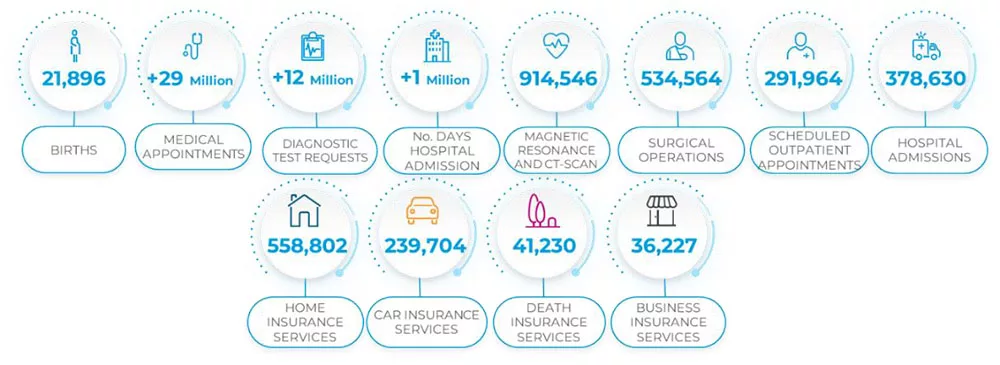

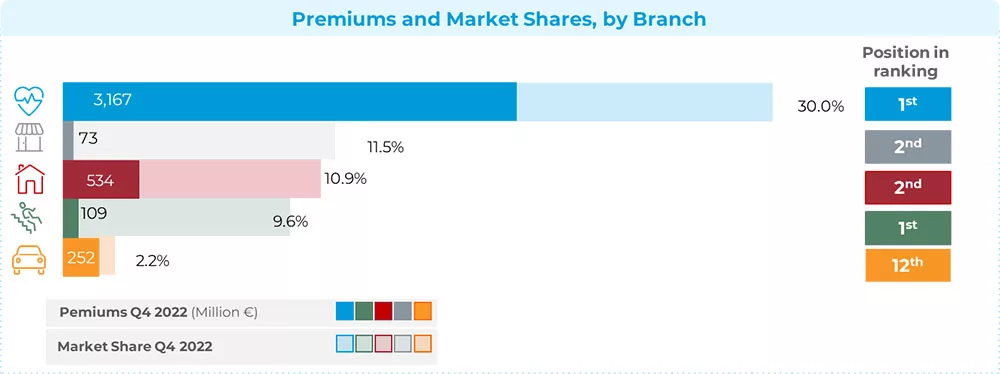

The value proposition of SegurCaixa Adeslas is based on designing solutions that provide access to quality services, on reasonable economic terms. This has cemented the company’s position in the health field, with consistent, impressive growth. SegurCaixa Adeslas currently has a market share of 28.5 percent, and meets the care needs of 5.9 million people.

The value proposition of SegurCaixa Adeslas is based on designing solutions that provide access to quality services, on reasonable economic terms. This has cemented the company’s position in the health field, with consistent, impressive growth. SegurCaixa Adeslas currently has a market share of 28.5 percent, and meets the care needs of 5.9 million people.

To maintain the level of care quality, the company works with a network of 48,000 healthcare professionals, 217 hospitals, and 1,367 medical centres. There are also 25 Adeslas medical centres with a network 185 dental clinics.

The company stands out for the digitalisation of its processes, offering its clients an expanding range of accessible, personalised, and convenient services. The Adeslas Salud y Bienestar (Health and Wellbeing) digital hub has passed the milestone of a million registered users, offering self-care and prevention features and services.

The company stands out for the digitalisation of its processes, offering its clients an expanding range of accessible, personalised, and convenient services. The Adeslas Salud y Bienestar (Health and Wellbeing) digital hub has passed the milestone of a million registered users, offering self-care and prevention features and services.

The platform is a key component in health promotion. The tool is designed to anticipate pathologies and cope with acute episodes. The insurer boosts the efficiency of care resources in a context marked by the rise in the average age of the population. Extended longevity brings with it an increasing need to cope with chronic illness, comorbidity, and the care needs of society.

SegurCaixa Adeslas is the number one insurer in Spain’s accident segment, with a 9.6 percent market share; it is also a major player in the multi-risk segment. In home insurance, the company grew by 10.9 percent in 2022 — posting the highest growth in the top 10 of the segment.

You may have an interest in also reading…

CryptoEvolution™: Why Bitcoin Will Overtake Fiat

First, There Was QE Two things happened after the financial collapse of 2008. First, the US Federal Reserve started printing

The BRICS Leaders’ Summit: Rich Outcomes

President Jacob Zuma hosted the Fifth BRICS Summit in March 2013 in Durban, South Africa under the theme: “BRICS and

Carlo Giugovaz, Supernovae Labs: Innovation, Inspiration, Experience and a Passion for Financial Industry Challenges

Innovation visionary and industry thought leader, after only six years since founding Supernovae Labs, a consulting boutique specialised in innovation,