CBRE: Approaching Shadows of Data Opacity and Risk From Flexible Office Market

Author: David Casas Alarcón, CBRE Property Management Accounting Lead

We live in a world that offers and value tailored convenience. We are accustomed to the smartphone, the internet, transit options and retail offerings delivering more flexibility than ever before.

New business models cater for people’s preferences, disrupting retail and hospitality sectors. Office space has its own catalyst for change — one that addresses companies’ desire for more flexibility while putting the focus on the human experience of the workplace. Flexible space solutions mean lease agreements that can be procured quickly, with variable terms, and little capital improvement required.

This brings profound implications for occupiers and investors, challenging many aspects of the established office leasing model.

Sub-leasing office space

Co-working is the category that has shown the biggest growth over the past four years. Operators lease office space to the landlord, and sub-lease it to individuals, providing shared areas with the equipment and services of a state-of-the-art corporate workplace.

Co-working brands were pioneered by a wave of entrepreneurs seeking a fresh workplace approach and came to the fore after the 2008 global financial crisis.

This was driven by shifts in lifestyle, along with the spread of cloud computing, VPNs, fast wifi and 4G (soon 5G) connectivity. It was a dramatic expansion in the range of spaces where office work is conducted.

About co-working…

Many co-working companies have adapted their space and services for a corporate audience, with a hybrid of private offices and co-working spaces. This model has driven unprecedented growth, with more than 900,000 square metres of space added in European markets in 2019, representing 56 percent of the new “flex space”.

High dependency and investors

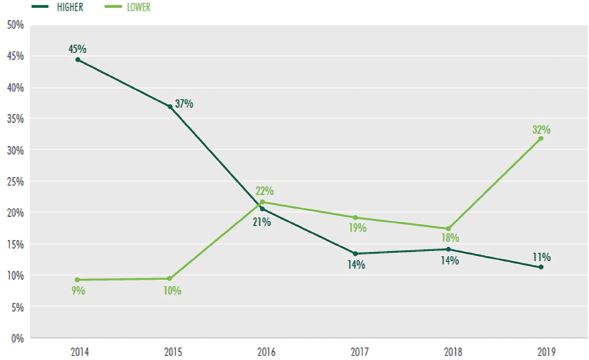

The CBRE 2019 Global Investor Intentions Survey revealed that investors are intrigued by flexible-workspace opportunities — but are still assessing potential risks.

Most investors indicated that the higher the proportion of co-working space in a building, the worse it was for long-term capital values.

“Many co-working companies have adapted their space and services for a corporate audience, with a hybrid of private offices and co-working spaces. This model has driven unprecedented growth, with more than 900,000 square metres of space added in European markets in 2019, representing 56 percent of the new “flex space”.”

Lease Terms

The rise of flex space will probably mean a drop in average lease lengths. Flex space operators don’t demand traditional commitments and restrictions from their users to provide income security. It is not yet known how this variable income stream will function during economic downturns.

Flex tenants rarely have strong covenants, so buildings with high flex concentrations are susceptible to more risk than those where flex space is just a small proportion of the total rent roll.

Figure 1: Investors risk appetite compared with 2019. Source: CBRE Research, Global Investor Intentions Survey, 2014 to 2019.

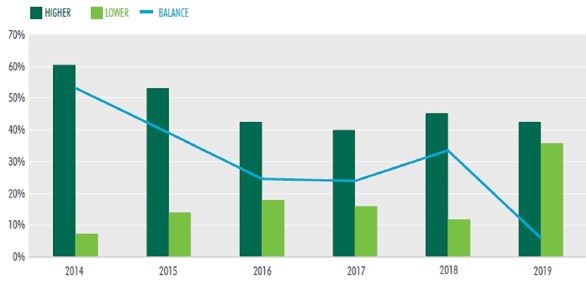

Impact on Yields

Limited exposure to flexible space has not had a noticeable impact on yields. Developers and investors may benefit from diversification and the operator’s ability to use communal spaces.

Lack of tenant track record and underlying tenancy risk typically increases an asset’s risk profile. Buildings where flexible space represents greater than 50 percent of Rentable Building Area (RBA) have so far traded at a discount. Recent deals on the Continent have shown a decreasing yield differential, although the current cycle and the absence of quality investment product will have to be taken into account.

Figure 2: Purchase level expectation compared with the previous year. Source: (see figure 1 above)

Opaque market Data

As the flexible segment grows, it becomes harder to have a clear view on real occupancy and rent cost levels. Space which is listed as let could still be on the market. Some larger corporate deals will be well documented, but the majority of short-term deals are almost impossible to track.

This means that real vacancy rates and supply levels become more opaque, and calculation methods prone to distortion. The rents paid by final users are also obscured, making it harder to agree development or investment decisions based on current forecast pricing and supply levels.

The incorporation of flexible space to the investment portfolio has the potential to increase and diversify a building’s income stream. Tenants command higher rental rates and improve effective occupancy relative to a traditional office lease. But this can be difficult to achieve, and there is little transparency about rental revenue and effective occupancy for the major flex operators — predominantly private companies.

Landlords often do not negotiate a profit-sharing agreement, or share any potential increase in revenue to cover the risk. The relationship remains a traditional one, which introduces additional risk because of the creditworthiness, lease longevity and variable business models of flex space operators.

About the Author

David Casas Alarcón is an economist from the university of Malaga, Spain, with more than a decade of experience in the real estate and finance industries. In 2012, he took over the role of Outsourcing Analyst for Capgemini Consulting, where he advised the company’s real estate clients on the most efficient solutions for financial process externalisation. Since 2016, Alarcón has been part of the CBRE Corporate Outsourcing Hub in Warsaw, which drives the finance process transformation for property management and other CBRE business lines across Europe, Middle East and Africa (EMEA), delivering efficiencies and compliance.

About CBRE

CBRE Group, Inc is a commercial real estate services and investment firm. It is the largest company of its kind in the world. It is based in Los Angeles, California and operates more than 450 offices worldwide and serves clients in more than 100 countries.

CBRE offers a broad range of integrated services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services. The CBRE Global Investors subsidiary sponsors real estate investments via investment funds and direct investments that it manages.

You may have an interest in also reading…

Government Should End Secretive Trade Negotiations, say UK Parliamentarians

The government should overhaul its secretive approach to post-Brexit trade negotiations, according to a new report. The All-Party Parliamentary Group

BBE Chief Victor van der Kwast Uses Life Experience to Guide His Hand in Finance

Victor van der Kwast’s long career could be seen as leading to this place, this time, and this role: chief

Deloitte: Constructing a Sustainable Future in the Middle East

Towards the end of 2019, at the United Nations Climate Change (COP25) conference, the UN Secretary-General António Guterres warned that