OECD: Key Takeaways From the Third OECD Conference on Private Finance to Realise the SDGs

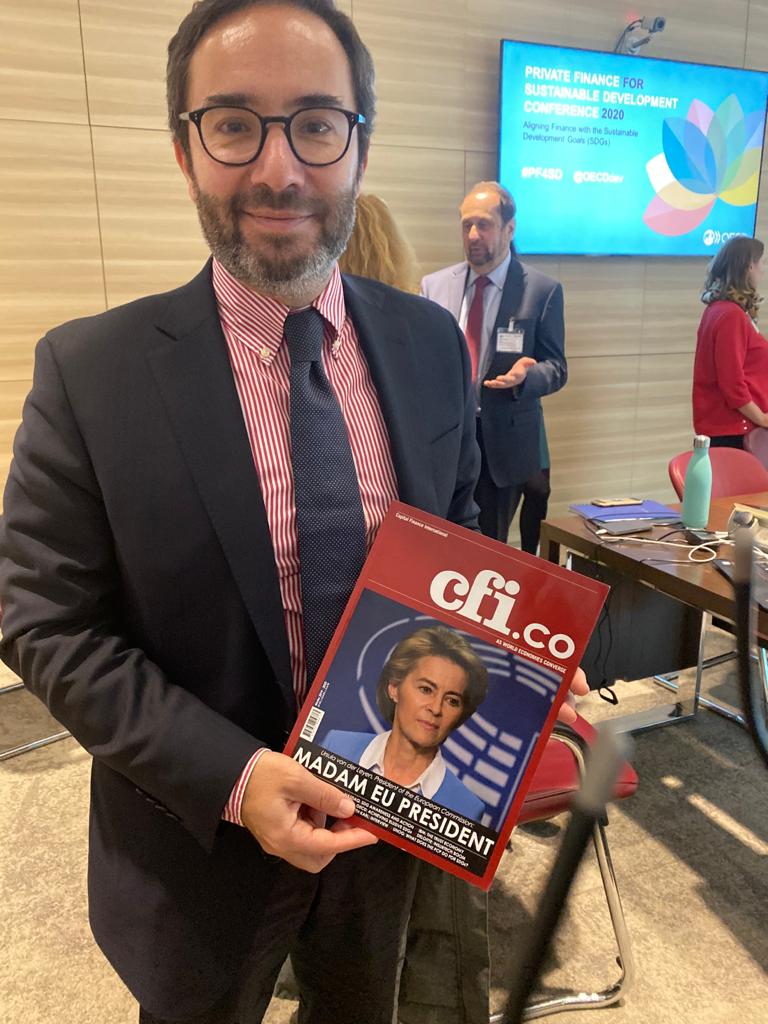

Director of the Development Co-operation Directorate (DCD) at OECD: Jorge Moreira da Silva

The third annual OECD conference on private finance for sustainable development brought together more than 600 public and private actors to determine the steps ahead.

There is an urgency for the private sector to shift more resources to sustainable development. At the 2020 OECD Private Finance for Sustainable Development (PF4SD) Conference, there was urgency to find ways to get ahead of global trends using global finance in smarter ways.

The world is 10 years away from delivering on the SDGs, including the goal of eradicating extreme poverty. This means lifting just under 10 percent of the world’s population — around 700 million women and men — from poverty over the next decade. In the meantime, the climate crisis is threatening to overshadow all development challenges and to overturn hard-won gains.

According to the World Bank, the worsening impacts of climate change could force over 140m people to leave their homes by 2050. Furthermore, the planet’s main life support system — the ocean — is under unprecedented pressure.

There are direct implications for 40 percent of the world’s population: those living within 100km of the coast. It is no longer enough to react to crises as they arise. Strategic investments in sustainable development is needed, and this means thinking outside the box.

This means shifting the culture of profit-making; giving returns on investment a new meaning, and creating incentives to match. It means understanding and shaping how the next generation is defining the value of people and planet.

Private finance to sustainable development is increasing, but gaps remain.

Jorge Moreira da Silva, left with OECD Secretary-General Angel Gurría, center

Jorge Moreira da Silva, left with OECD Secretary-General Angel Gurría, center

Shifting just one percent of total global financial assets — estimated at $382tn — could bridge the existing $2.5tn annual investment gap for delivering the goals. The good news is that shareholders are gradually moving from simple profit-making to both profit and purpose.

They are reorienting management towards more sustainable business practices to address ESG issues. The sector has grown in recent years, rising to nearly $18tn in assets, with additional $6tn in sustainable investing to capture some component of ESG. This is a sizeable amount of the $30tn “sustainable investment universe”, suggesting that ESG is more than a fad.

Impact investing is also capturing the growing attention of mainstream investors, whose market size is estimated at more than $500bn and growing. For many impact investors, the SDGs have become a guideline for key performance indicators. At the conference, Travis Spence, MD of JP Morgan Asset Management, highlighted a change in the dialogue around ESG from a “nice to have” to a “must have”.

In investment portfolios, ESG criteria are material factors and the main drivers shaping portfolios.

Long way to go

International capital markets have never seen as much investment as we see today. Yet, too few of these flows are serving the wellbeing of people and planet. Newly released data on blended finance show that private finance, mobilised by development finance, reached $205bn between 2012 and 2018.

But less than six percent went to least developed countries, and less than six percent to social services such as education and health. The majority went to economic infrastructure. This is misaligned with the objective of leaving no one behind.

The PF4SD Conference also dived into alignment of private finance with specific SDGs.

Gender equality – SDG 5

Gender equality is a prerequisite for sustainable development, and interest in gender-investing is increasing. Finance institutions have accepted the “2X Challenge: Financing for Women” and mobilised $2.5m of the $3bn goal. India has launched the world’s first domestically funded SDG bond to help tribal women become self-reliant. As a minimum requirement and a first step, investors need to ensure that their activities do not undermine women’s empowerment.

Climate action – SDG 13

The majority of private finance mobilised for development continues to be channelled into economic infrastructure. Sustainable infrastructure will be the foundation to realise the transformation to low emissions and climate resilient development pathways. There are improved estimates for the additional benefits of climate action, such as reduced pollution and improved land use. With low global interest rates and the window closing on the opportunity to limit temperature rise to below 1.5°C, the time to close the investment gap is now. Technology is on our side, but all pools of finance, and all actors, need to work together. This starts with governments.

Life below water – SDG 14

The “ocean economy” is expected to grow rapidly until 2030 (OECD, 2016[2]) and as more capital enters ocean-based industries, it is critical that investments are geared toward improved sustainability. But the majority of investors are not aware of their investments’ impact on the marine environment, and how a degrading ocean may subsequently affect their portfolios’ performance and value.

Decent work and economic growth – SDG 8

With 30 million young African people expected to enter the labour market every year to 2030 makes SDG 8 one of the most pressing challenges. SDG 8 calls for reducing informal employment, narrowing the gender pay gap and improving working conditions. ILO’s Decent Work Agenda highlights the importance of promoting sustainable enterprises for innovation and growth. High-impact investments create quality jobs. Enhancing social dialogue is a key lever to achieve this agenda, and governments should invest in institutions underpinning multi-stakeholder engagement and social dialogue.

Aligning private finance with the SDGs requires an open dialogue and trust-building between public and private actors. The Kampala Principles on Effective Private Sector Engagement in Development Co-operation aim specifically to guide collective work on making private sector partnerships more effective while ensuring inclusivity at country level.

The road ahead

After five years of slow progress towards financing the SDGs, there is a clear need for more resolute action.

Governments hold primary responsibility. Public policy and regulation must foster public and private investments truly aligned with the SDGs. Capital allocation towards sustainable development means incentivising long-term green investments, and channelling existing finance.

The G7 Ministers of Development have called for a SDG-compatible finance framework to make private investment and savings work better for the goals. At the PF4SD Conference, Cyrille Pierre, deputy director for global affairs, culture, education and international development at the Ministry for Europe and Foreign Affairs of France expressed readiness to take leadership here, with the support of the G7, the G20, the UN and the OECD.

Scaling-up private finance for sustainable development requires data to bridge understanding, measurement and disclosure of risks. The OECD is working to promote a more consistent, standardised measurement of all types of flows for SDG financing, monitoring and reporting as well as that of all finance through the new Total Official Support for Sustainable Development (TOSSD).

Financial institutions, public and private, need to rethink their models and incentives, and partner better to take on the risks of investments in difficult contexts — and there are many. Looking at megatrends, these risks can’t be ignored. We need to invest in stability. With 85 percent of the poorest people living in the top 20 climate-affected countries, these countries’ economic and environmental instability can’t be subsidised with non-renewable activity. Finance must be aligned with sustainable development in the toughest contexts. The cost to global economic, environmental and social stability is too high, and the returns are too great.

The Private Finance for Sustainable Development (PF4SD) conference is an annual OECD event that provides a forum for sharing successes in altering incentives, targeting investment better and improving operations for sustainable development.

The inaugural PF4SD Conference in 2018 explored new ways of mobilising more and better finance. The 2019 edition stressed the need for universal measures of the social and environmental impacts of development finance. In 2020, the theme was aligning finance with the SDGs, convening public and private actors committed to working together to promote a better alignment of global financial flows with the 2030 Agenda in developing countries, including development finance, private investment flows and business activities. i

About the Author

Author: Jorge Moreira da Silva

Since November 2016, Jorge Moreira da Silva has been the director of the Development Co-operation Directorate (DCD) at OECD. From 2013 to 2015, he was Portugal’s Minister of Environment, Energy and Spatial Planning.

About the OECD

The OECD Development Co-operation Directorate promotes co-ordinated, innovative international action to accelerate progress towards the UN’s Sustainable Development Goals (SDGs).

You may have an interest in also reading…

María Dolores de Cospedal: Seeking More Bang

Almost nobody saw her coming. In barely ten years, María Dolores de Cospedal went from a political nobody to become

DESERTEC: Clean Power From Deserts

By Michael Düren Solar power from deserts can contribute significantly to a future renewable energy system. The technically accessible solar

Uzbekistan on the Path to Becoming Carbon-Neutral

In the race to become carbon-neutral, it is useful to look at where the race began. In Uzbekistan, a nation