Evan Harvey, Nasdaq: Something New Under the Sun

A report from the WFE annual meeting in Qatar.

Stock exchange leaders, policymakers, regulators, investors, and corporates all gathered in Doha, Qatar, for the World Federation of Exchanges (WFE) annual general meeting in October. The Qatar Stock Exchange (QSE) served as host for the event, and QSE leader Rashid al-Mansoori set an ambitious tone from the opening keynote.

Stock exchange leaders, policymakers, regulators, investors, and corporates all gathered in Doha, Qatar, for the World Federation of Exchanges (WFE) annual general meeting in October. The Qatar Stock Exchange (QSE) served as host for the event, and QSE leader Rashid al-Mansoori set an ambitious tone from the opening keynote.

“This event is an opportunity to exchange views and strengthen the means of cooperation between participating exchanges,” he said. “Exchanges must come together to address challenges, “especially in light of the rapid economic, social, and political changes seen throughout the world.” Mr al-Mansoori closed by highlighting “a responsibility to ensure that market participants can trade fairly and efficiently on our platform.”

The WFE represents virtually every public stock, futures, and options exchange on the planet. Over 44,000 companies representing a total market cap of $64 trillion (trading value of $76 trillion) list on WFE member exchanges. That’s the equivalent of more than 75% of global GDP. Its annual meeting is the largest and most comprehensive of its kind – and this marked the first time in its 55-year history that it was held in an Arab nation.

“Perhaps the first industry attempts to take sustainability seriously came in the form of the UN Sustainable Stock Exchanges (SSE) initiative, which has been driving towards consensus on this topic for several years.”

Economic vitality and market growth in the Middle East was another touchpoint for speakers, eliciting supportive comments from the Qatari Ministry of Economy & Commerce, IOSCO (International Organisation of Securities Commissions), and multiple exchange executives.

Exchanges Step Up Sustainability Reporting

Nasdaq Vice Chairman Sandy Frucher, a WFE board member, presented his case for making exchanges more active in the promotion of sustainable business practices.

“Stock exchanges are efficiently adapted to raise, sustain, and distribute capital,” Mr Frucher said. “We help businesses both large and small innovate, build better products, serve their customers, and create jobs. We also provide investors with access to a diverse and dynamic marketplace. But stock exchanges are also change agents, responsive to market demand for new products, better services, and more transparent data. The time has come to take sustainability seriously as part of that mission.”

Perhaps the first industry attempts to take sustainability seriously came in the form of the UN Sustainable Stock Exchanges (SSE) initiative, which has been driving towards consensus on this topic for several years. The SSE recently published its Model Guidance on Reporting ESG Information to Investors: A Voluntary Tool for Stock Exchanges. That document is not necessarily advocating a new listing requirement, but rather aims to provide exchanges with a globally consistent base to start from as they work to create their own, locally customised, voluntary guidance to help their issuers meet investors’ need for ESG information.

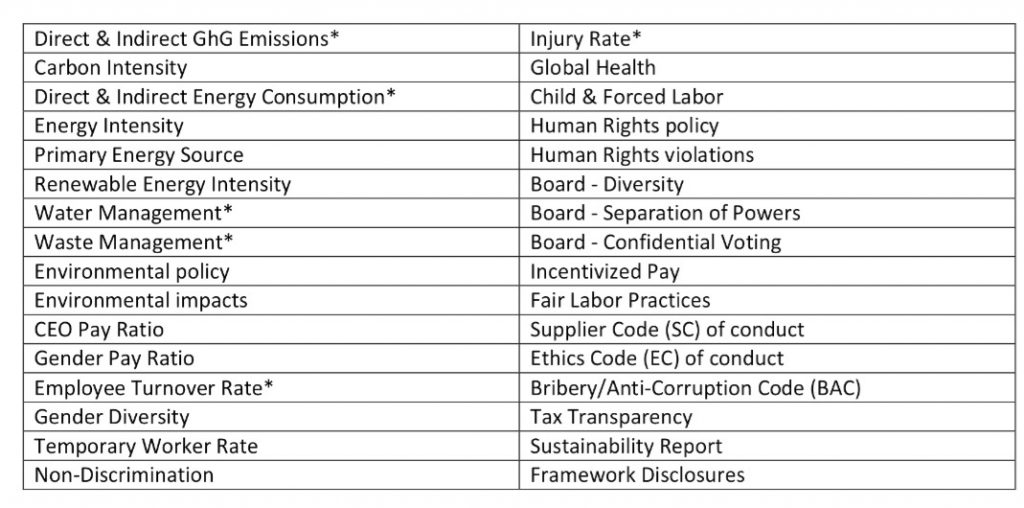

WFE Recommended Sustainability Disclosures (as identified in a recent publication to exchanges).

And now, launched after the meeting in Qatar, we have the publication of the WFE’s own Exchange Guidance & Sustainability Recommendation. The WFE document provides a useful and necessary starting point for exchanges, because strategic and transparent ESG practices can be as beneficial to exchanges as they are to individual companies.

This document was the culmination of the work of the WFE Sustainability Working Group (full disclosure: I served as the group’s chairman for two years). The recommendation focuses on principles and data, with correlating bottom line impacts, but it also politely advocates for improvement and harmonisation in management practices. It also includes a selection of Material ESG Metrics, which call attention to 33 indicators across Environmental, Social, and Governance (ESG) categories that may well be of utmost concern for exchanges.

Balancing Regulation and Revenue

WFE Chairman Juan Pablo Cordoba, CEO of the Bolsa de Valores de Colombia, used the occasion of his concluding remarks to praise the Qatar venue and also highlight some of the challenges that exchanges face.

“We have received strong messages from regulators,” he said, “and we look forward to the conversation moving from stability and risk mitigation to economic development and the growth of capital markets. For most exchanges, the past five to six years have been bombarded by regulation that is hampering markets in certain ways, and it is clear that we are moving towards a constructive phase.”

Evan Harvey

The proper role of sustainability in this “constructive phase” is still being debated. As listing venues, exchanges must serve the needs of public companies. Overregulation tends to crush the entrepreneurial spirit and may make companies less willing or able to capitalise on opportunities. The constant churn of filings, disclosures, statements, applications, and surveys may distract businesses from meeting long-term goals, but a lack of regulatory control emboldens bad leaders to grow into bad corporate citizens.

About the Author

Evan Harvey is the Director of Corporate Responsibility for Nasdaq. He also serves on the Board of Directors for the UNGC US Network and chairs the Sustainability Working Group at the World Federation of Exchanges.

You may have an interest in also reading…

Michelle Obama: A Debt of Gratitude

The 2012 speech by Michelle Obama at the Democratic National Convention in support of her husband was undeniably brilliant and

UN Concern over Job Creation for Youth in Least developed Nations

There should be a greater emphasis on job creation in the world’s 49 poorest nations, where the number of young

CBRE: Multifamily Assets Consolidate Real Estate Investment Growth

Real estate investor appetite for European multifamily properties has been thriving in the past decade. Resilient income-driven performance, sustained by