World Bank Group: Are Stars Aligning for Clean-Energy Financing?

One of the biggest bangs on the opening day of the Paris COP21 climate summit was without doubt the dual announcements by the Breakthrough Energy Coalition, led by Bill Gates and other high-net worth individuals, and the multilateral Mission Innovation, whose signatory governments have committed to doubling their allocations to clean-energy research. The two initiatives aim to increase financing for clean-energy innovation from the basic research stage, funded by governments, to the commercialisation of promising new technologies, with venture financing provided by private investors. In developing countries, where many households and companies have very limited access to energy, new clean-energy technologies will serve the dual purpose of expanding energy access and constraining carbon emissions. For this to happen, innovative thinking will be needed also with regard to financing the deployment of these technologies.

One of the biggest bangs on the opening day of the Paris COP21 climate summit was without doubt the dual announcements by the Breakthrough Energy Coalition, led by Bill Gates and other high-net worth individuals, and the multilateral Mission Innovation, whose signatory governments have committed to doubling their allocations to clean-energy research. The two initiatives aim to increase financing for clean-energy innovation from the basic research stage, funded by governments, to the commercialisation of promising new technologies, with venture financing provided by private investors. In developing countries, where many households and companies have very limited access to energy, new clean-energy technologies will serve the dual purpose of expanding energy access and constraining carbon emissions. For this to happen, innovative thinking will be needed also with regard to financing the deployment of these technologies.

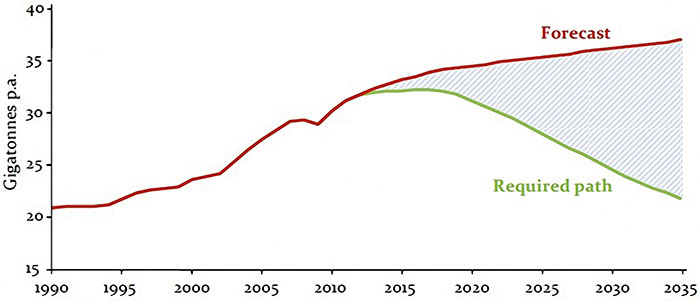

The two initiatives announced in Paris reflect the realisation that carbon-dioxide emissions would continue to rise even if every commitment to cut carbon emissions were fulfilled (see figure). By 2035, the concentration of carbon in the atmosphere will already exceed the estimated levels required to maintain the internationally agreed two-degree Celsius limit. In addition to further deployment of existing clean energy technology, the development of new technologies – for example to increase energy storage capacity and generation efficiency – will increase the options available to efficiently address climate change.

But global public funding for clean-energy research has been only a small fraction of what governments spend on other research-incentive sectors such as biomedical. Due in part to the long lead-times from research to commercialization in the energy technology sector, private venture financing has not been sufficient to bridge the proverbial “valley of death” between basic research and commercialization of a product.

“Global public funds are a convenient way to pool individual countries’ resources for the common purpose of addressing climate change. But multilateral funds’ resources are insufficient to meet countries’ needs for clean-energy investment.”

Mission Innovation and the Breakthrough Energy Coalition aim to address the technology finance gap. Even if these initiatives turn out to be highly successful, the challenge still remains of substantially scaling up financing for the deployment of clean-energy technologies, including in developing countries. Pooling public funding and leveraging it with private sector capital could increase the uptake of existing and new clean-energy technologies.

Indeed, a new trend is emerging in the deployment of public capital: an increasing number of governments are considering the use of investment structures that combine public and private capital, mainly for the purpose of infrastructure investment and venture financing for young firms. This trend has been underpinned by shrinking government budgets since the 2008 financial crisis, a persistent infrastructure financing gap, and a realization that the active involvement of private capital is critical for the achievement of national development goals.

Global public funds are a convenient way to pool individual countries’ resources for the common purpose of addressing climate change. But multilateral funds’ resources are insufficient to meet countries’ needs for clean-energy investment. Could national or regional government-owned strategic investment funds, or public-private hybrid funds also become important actors in financing the deployment of climate-smart energy?

This type of funds aims to drive investment in key sectors of national economies, to support the realisation of critical infrastructure, and to “crowd in” private investors. A recent example is the Ireland Strategic Investment Fund (ISIF), established in December 2014 with a statutory mandate to invest on a commercial basis in a manner designed to support economic activity and employment in the country. ISIF uses a “double bottom line” criterion of commercial return and economic impact to identify investment opportunities.

Graph 1: Energy-related CO2 emissions. Source: Global Apollo Program to Combat Climate Change.

Public-private hybrid funds could be another possible investment vehicle to support or fast-track the uptake of climate-smart energy infrastructure. These funds manage pools of combined public and private capital, and may offer a variety of investor return-enhancing mechanisms, including differential timing of investment draw-downs of public and private investors, leveraging the returns of private investors with publically provided debt, capping the profit entitlement of the public investor, and partial guarantee of compensation to the private investor for loss of invested capital.

The model of the strategic investment fund is relatively new. But the provision of patient risk capital to finance new sectors or industries goes back in history. For example, venture capital (VC) funds, now commonly seen as entirely pertaining to corporate finance, were initially a creation of the US government to improve financing for fast-growing young firms (the UK had similar structures). The Small Business Investment Company (SBIC) programme, established in 1958, consists of federally guaranteed risk-capital pools that in the 1960s represented the bulk of venture capital raised in the US. While not all these early VC funds (called SBICs) were successful, some of the most dynamic technology companies around today – including Apple, Intel and Compaq (now part of Hewlett-Packard) – received support from the SBIC programme.

A central issue for publically-owned or capitalised funds is the independence of investment decisions from political pressures. The SBIC, contrary to its predecessor, the American Research and Development Corporation (est. 1946), places investment decisions in the hands of private investment managers rather than government-appointed bureaucrats. This arrangement aims at solving the problem of picking winners, which has beset industrial policy initiatives where government officials make business decisions.

In hybrid funds, investment decisions are left in the hands of a private general partner, with countries participating as limited partners, under an investment mandate that addresses the moral hazard issues of managing an investment portfolio that may be partially subsidised. To reduce the risk of political interference in the investment process, sovereign funds’ governance arrangements must be designed to underpin managerial independence from the government that owns the fund. Market-based checks and balances include co-investment and partnership arrangements.

Finance has come a long way since the days of the first SBICs, which could borrow up to half of their capital from the US federal government. Risk-sharing arrangements for today’s funds can be targeted to investors with different preferences and tolerance for risk. The Breakthrough coalition aims to provide “truly patient risk capital” beyond what markets are willing to offer for clean energy venture finance. This is expected to result in higher uptakes of young government-funded green energy technologies, and fast-track the research cycle. But the efficient deployment of these technologies in developing countries and elsewhere may require the use of investment funds that have the ability to tailor risk-return combinations to different sets of public, private and impact investors – private investors that are willing to accept longer-term returns balanced by a desirable impact, for example on carbon emissions.

Climate change has already generated a considerable amount of financial innovation, notably emissions trading and green bonds. Following the lead from Paris, this innovation must continue, and sovereign funds may have a significant role to play. For oil-rich countries, their sovereign wealth funds could be instrumental in enabling a transition towards clean-energy generation. With a well-defined investment mandate and strong governance, sovereign wealth funds and strategic investment funds could be well suited to provide truly patient capital for clean-energy infrastructure.

The views expressed in this article are not necessarily those of the World Bank.

About the Authors

Håvard Halland is a senior economist at the World Bank’s Finance & Markets Global Practice, Investment Funds Group. His research and advisory work focus on sovereign wealth funds and strategic investment funds. In particular, his work has focused on fund mandates, governance frameworks, as well as economic and policy implications of SWFs’ domestic investment. He is an author or joint author of academic and policy research papers, book chapters, magazine articles and blogs, and regularly presents at international conferences and seminars. He earned a PhD in economics from the University of Cambridge.

Michel Noel is currently head of Investment Funds in the Finance and Markets Global Practice, Equitable Finance and Institutions Vice-Presidency of the World Bank. Previously, Mr Noel was practice manager for non-bank financial institutions in the Finance and Markets Global Practice and lead financial sector specialist in the Africa Region and in the Europe and Central Asia Regions of the bank. He was on secondment to Dexia Asset Management in Geneva and London from 2000 to 2003 working on local infrastructure private equity funds. Previously, Mr Noel held a number of positions in the Africa and Europe and Central Asia Regions of the bank. He also consulted for the OECD Development Research Centre in Paris. Mr Noel holds a MA in Economics and Social Sciences from the University of Namur, Belgium.

Silvana Tordo is a lead energy economist at the World Bank’s Energy and Extractives Global Practice, Extractives Group. She focuses on extractive sector legal and contractual frameworks, taxation, and sovereign wealth funds. Her advisory work, research, and publications include value creation by national oil companies, auction design in oil and gas, extractives-led productive policies, petroleum taxation, resource revenue frameworks, and sovereign wealth management, with particular focus on governance arrangements and policies for domestic investment. Prior to joining the World Bank in 2003, Ms Tordo held various senior management positions in new ventures, negotiations, legal affairs, finance, and mergers and acquisitions.

You may have an interest in also reading…

Türkiye in the Economic Spotlight: Globalturk Capital Keeps the Focus on the Country’s Growing Status

A growing body of international luminaries, government ministers and experts are taking note of Türkiye’s rise in international economic affairs.

A New Generation of Banker

Brazilian Alessandra França, by no means fits the banking stereotype at only 26 she has already, established a bank for the

Rwanda’s Largest Bank Strengthens Its Position

Global Credit Rating Co Upgrades Bank of Kigali’s Long Term Rating of A+ to AA- and reaffirms the Short Term