Evangelos Marinakis: A Councilman of Note

Though the past made him a rich man, Evangelos Marinakis now wants to break with it. Elected councilman in Piraeus, Mr Marinakis aims to introduce new models for the management and development of the port city: “This is something people with experience in private business can and must provide.”

Though the past made him a rich man, Evangelos Marinakis now wants to break with it. Elected councilman in Piraeus, Mr Marinakis aims to introduce new models for the management and development of the port city: “This is something people with experience in private business can and must provide.”

That sort of experience is not lacking in Greece’s perhaps most powerful councilman. Mr Marinakis is a shipping magnate with an estimated personal net worth of $750m and CEO of Capital Product Partners, a tanker company listed on the NASDAQ stock exchange with a fleet of thirty vessels traversing the world’s oceans. Since 2010, he also owns the Olympiacos Football Club of Piraeus boasting the best team in the country with no less than 41 Greek League titles to its name.

In the May elections that landed Mr Marinakis a seat on the city council, Olympiacos Vice-President Yannis Moralis won the mayoral race in Piraeus. Though the city is now firmly in the hands of Mr Marinakis and his close associates, this is not necessarily a disaster in the making as some would have the nation believe.

In Greece, big business has traditionally steered well clear of politics – at least on the surface. Governments of all ideological stripes have usually preferred to let big business do its thing without too much interference. Greek corporate moguls returned the favour by not publically expressing any opinions on national affairs. However, and in light of the crisis that hit the country, Mr Marinakis now considers this arrangement quite unsuitable for facing the challenges ahead.

“By not remaining on the side lines while the country tries to climb out of the economic abyss, Mr Marinakis may have exposed himself to fierce criticism from those who question his motives; he also showed his true colours as a patriot more than businessman.”

Through his extensive international business activity, and the close ties he keeps with many foreign government officials for example in Japan and elsewhere where he does business, Mr Marinakis is trying to attract foreign investment in the country and notably in Piraeus.

Mr Marinakis has repeatedly stated his believe that the traditional political labels of left and right have little meaning: “Support for my candidacy comes from across the political spectrum. I believe that we can be something quite different and new; something not tainted by party politics.”

As one of the richest men in Greece, Mr Marinakis has done his part in ameliorating the social ills that were caused by the sharp economic downturn that followed the debt crisis. He supports an impressive number of charity and humanitarian projects throughout the country and recently mobilised the Olympiacos squad to help UNICEF raise money for the vaccination of children.

Mr Marinakis has also been buying up Greek debt on the secondary market for pennies on the dollar in order to help ease the country’s financial burden. The bonds acquired are handed to Greek Debt Free, a private organisation that aims to rally Greek tycoons to prop up government finances by taking bonds out of the market where they may now be had at steep discounts.

By not remaining on the side lines while the country tries to climb out of the economic abyss, Mr Marinakis may have exposed himself to fierce criticism from those who question his motives; he also showed his true colours as a patriot more than businessman. Mr Marinakis’ hometown Piraeus has been particularly hard hit. Cargo volumes and shipping traffic were down while unemployment shot up to 26% until, in 2010, the Chinese state-owned shipping conglomerate Cosco leased half of the port for $650m from the Greek government. Since then, the Chinese side of the port has seen its cargo volume triple while the Greek side languishes with little, if any, uptake in traffic.

It is precisely this lopsided development that Mr Marinakis aims to tackle as a politician. A lone councilman may perhaps not be able to accomplish all that much, but one of Mr Marinakis’ standing may yet cause a few surprises.

You may have an interest in also reading…

Frans Timmermans: A Knowledgeable Pragmatist

He is rather unassuming and speaks softly without carrying a big stick. Dutch foreign affairs minister Frans Timmermans, however, has

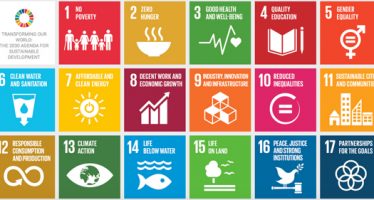

UN SDGs and Gun Control: UNODA to Coordinate Action on Small Arms Under UN Disarmament Agenda

The UN Secretary-General’s has a detailed action plan for disarmament in order to save humanity – including future generations –

IFC: After Glasgow, Four Steps to Keep Us On Track

The UN Climate Conference in Glasgow saw a flurry of commitments and proposals to limit temperature rises to 1.5°C. While