BlackRock: Bridging the Gap – The Rise of Infra Funds in Privately Financed Infrastructure

By BlackRock Infrastructure Debt Team

![]() In the wake of the global recession, privately-financed infrastructure has become a hot topic for policy makers from Berlin to Paris, London, and Washington. The attractions are not hard to see – private infrastructure is a way of encouraging investment in the economy and providing efficient essential services to the local population without further encumbering already stretched national balance sheets. According to the OECD, governments will need to raise about US$40trn by 2030 to fund infrastructure projects. But there is also a problem. The traditional funders of infrastructure projects – the large commercial and wholesale banks – are pulling back. This retrenchment is providing institutional investors and asset managers such as BlackRock with an opportunity to step into the breach.

In the wake of the global recession, privately-financed infrastructure has become a hot topic for policy makers from Berlin to Paris, London, and Washington. The attractions are not hard to see – private infrastructure is a way of encouraging investment in the economy and providing efficient essential services to the local population without further encumbering already stretched national balance sheets. According to the OECD, governments will need to raise about US$40trn by 2030 to fund infrastructure projects. But there is also a problem. The traditional funders of infrastructure projects – the large commercial and wholesale banks – are pulling back. This retrenchment is providing institutional investors and asset managers such as BlackRock with an opportunity to step into the breach.

Perfect Storm

Historically, industry surveys of project finance put banks’ contribution at 75-80% of funds raised according to ratings agency Moody’s. But banks are now facing something of a perfect storm when it comes to long-term lending. New Basel III regulations will increase the capital charges that are applied against long-term infrastructure loans, which make them less profitable. On top of this, regulators and bank executives are looking hard at banks’ liquidity profiles after the events of 2007 and 2008 demonstrated the challenge of funding long-term, illiquid assets with short term liquidity. Finally, despite the political attractiveness of infrastructure finance, it often comes behind lending to SMEs and mortgages, the benefits of which are more tangible and more immediately felt by the general public. Many banks have decided that what capital they have left can be more effectively used in other areas, such as lending to finance mergers and acquisitions. Numerous banks have reportedly been offloading their portfolios of infrastructure loans. In June, Bank of Ireland announced the sale of a €270m portfolio to a Danish pension fund and other banks are expected to follow suit in the near future. This retrenchment has meant that financing roads, railways, and schools has become significantly more challenging.

“For insurance companies and pension funds, however, infrastructure debt looks much more attractive. It offers the potential for steady returns, diversification, and an attractive yield compared to asset classes with a similar risk profile.”

For insurance companies and pension funds, however, infrastructure debt looks much more attractive. It offers the potential for steady returns, diversification, and an attractive yield compared to asset classes with a similar risk profile. It is also backed by real assets that provide an essential service such as drinking water or education. In a market environment where bond yields are at historic lows, the opportunity to gain a yield premium is particularly sought after. Infrastructure debt can also provide a more efficient way of investing. Under insurance company capital rules, for example, infrastructure debt is treated in the same way as corporate bonds, but generates an illiquidity premium of as much as 1.25%, allowing insurers to improve their return on capital metrics. It also provides a good match for institutions that have long-term committed liabilities, such as life insurance companies. Perhaps not surprisingly, institutional investors are showing strong interest in the infrastructure debt market. From the docks at Liverpool to French Universities, Dutch prisons, and American power plants, institutional investors have been keen to provide financing.

Complex Business

But as well as being eye-catching, infrastructure finance is a complex business. Transactions are often private, requiring investors to be “in the flow” to originate opportunities by having an on-going dialogue with industry players, particularly banks. Despite the balance-sheet retrenchment of banks, the depth of experience and market knowledge within these institutions means that they will continue to play a pivotal role in structuring and arranging transactions. Institutions will have to continue work together with banks in a complementary fashion to provide finance to projects. Banks will continue to use their structuring expertise, providing shorter-term funding, and ancillary services such as swaps while looking to institutions to provide longer-term capital. Banks are also the main channel for sourcing secondary loans as they look to shed assets and recycle capital. Having a close relationship with project finance and syndication teams at the major banking institutions is thus crucial to success in the infra debt space.

The Gherkin

Sourcing investments is not the only challenge, however. Infrastructure loans also require large amounts of due diligence and upfront work. Third party technical, legal, commercial, tax and other advisors are usually engaged to fully understand the risks involved in building and maintaining a bridge or running an electricity distribution network. Due diligence reports and legal documentation usually run to hundreds of pages of complex analysis that need to be reviewed to ensure that the transaction is appropriately structured. As private, illiquid transactions, the debt is also usually unrated, and so investors need a way to score the credit profile and price the investment as part of the investment process. In the past, institutional investors have sometimes been tempted to enter projects after only minimal due diligence, relying on a high-level overview of the asset from the arranging bank or on a rating from a rating agency if one is available. But this approach is rarely prudent. Recently, for example, Spanish gas storage project Castor announced that it was suspending operations following a small earthquake a matter of weeks after issuing debt to investors. Several institutions had bought the bonds but were given very limited time to perform meaningful due diligence.

And as the case of Castor shows, although assets are usually buy-and-hold, they are certainly not ‘buy-and-forget’. Once investments are made, they require on-going monitoring throughout their (long) lives. Amendments and waivers to the documentation are common as the transaction evolves and investors must be on hand to ensure that these are dealt with effectively.

Meeting these challenges is where investment managers, that have dedicated teams with long-standing industry experience, contacts, and knowledge, come into play. It is usually more efficient for institutional investors to use an intermediary for origination, due diligence, and monitoring rather than developing this expertise in house. Investment managers are able to aggregate capital from several clients, creating economies of scale not available to an individual investor, for whom infrastructure debt may make up a fairly small part of a portfolio. They are also able deal with the complex cross-border tax and regulatory issues that can arise when lending to infrastructure projects in different countries.

A Variety of Formats

Portfolio construction is a key area that institutions will look to the expertise of specialist managers. Infrastructure investment comes in a variety of formats and categories, each of which has different liquidity, risk, and return dynamics. Generally speaking, the infrastructure sector consists of assets or companies that provide essential services for the general public and is characterised by stable cash flows, long life spans and capital intensity. Yet there is a significant difference between investing in a UK airport, a Canadian pipeline, and a Spanish toll road. Institutions will usually be able to construct bespoke managed accounts (rather than a generic fund), and will have to carefully consider the structure and parameters of their portfolio. Managers can help them make decisions on issues such as the types of regulatory and sovereign risk, revenue risk, and concentration risk they are willing to accept when investing in the asset class.

One of the key decisions for investors is whether to invest solely in operating assets – so called “brownfield” projects – or whether to include “greenfield” projects that are under construction in an infra debt portfolio. Historically, institutional investors have been somewhat reluctant to take construction risk, preferring assets with a proven operational track record to more complex construction risk investments. Certainly, there are additional complexities to financing the construction of a suspension bridge compared to a school that has already been built. However, greenfield assets potentially provide attractive relative value. These assets are higher yielding than operating projects, and the spreads put in place at the start of construction usually last for the twenty or thirty year life of the investment. By putting appropriately-structured construction support packages in place, such as guarantees or letters of credit, many of the main construction risks can be effectively mitigated. Mixing greenfield and brownfield assets can also provide diversification benefits to a portfolio. Understanding these risk and reward dynamics is an important service that asset managers can assist with.

On Choosing a Manager

If institutional investors can best access the market via a dedicated manager, given the complexity and opacity of the infra debt market, it is important to recognize managers approach the market in different ways. An important decision is therefore to choose a manager to ensure that funds are being put to work in a way that maximizes relative value. For example, a manager may focus on a particular jurisdiction, such as the UK, or specific asset types, such as greenfield projects, which could limit the investment universe. Similarly, managers may be large investors in the equity or mezzanine debt of infrastructure projects, which can mean that they are not able to look at certain debt investments or because they are conflicted or because sponsors are reluctant to share potential investments with competitors.

Some managers may use a co-investment model, where they put their own capital to work. This gives them ‘skin-in-the game’ but may create conflicts of interest between internal and external stakeholders as the investor seeks to balance the interests of shareholders, policy holders, and clients. A fiduciary model, by contrast, seeks to limit conflicts of interest by acting only as a dedicated third-party asset manager and not investing for its own account. This model provides better access to banks and more closely aligns the goals of the manager and investors.

Bridging the infrastructure gap remains a key priority for governments, infrastructure providers, and investors. But ultimately the success of the process will depend on the institutional investors finding a way to access the market that works for all parties. It is this access that BlackRock, and other infrastructure managers, can provide. Choosing the right manager, who is able to provide access to the market in the most appropriate way, will be an important consideration for institutional investors looking to capitalize on the opportunity that exists in infrastructure debt.

This material is for distribution to Professional Clients (as defined by the FCA Rules) and should not be relied upon by any other persons.

Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: 020 7743 3000. Registered in England No. 2020394. For your protection telephone calls are usually recorded. BlackRock is a trading name of BlackRock Investment Management (UK) Limited.

Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

You may have an interest in also reading…

Ten Guiding Principles to Encourage Foreign Direct Investment

Worldwide, foreign direct investment (FDI) volumes are shortly expected to breach the $3tn mark – representing fully 4% of the

Deflation, Inflation, and the Disappearance of Deficit Phobia

Inflation is, essentially, the expression of excess demand or, on its flip side, a sign of depressed supply. The trillions

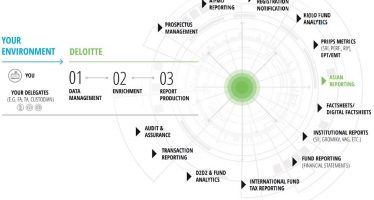

Deloitte: Changes on the Horizon for Europe’s Alternative Investment Fund Market

The European Commission’s ongoing efforts to establish the Capital Market Union have reached the alternative investment manager’s market in Europe.