Bonds: Name of the Game for Cool (and Resilient) Operators

KelloggInsight-Riley Mann

US corporate bonds certainly lack the thrill of that other famous Bond, James. But when it comes to strength and resilience, they can genuinely hold their own with Fleming’s cunning protagonist.

By Efraim Benmelech

Corporate bond markets have proven remarkably resilient in the face of the sharp contraction caused by the Covid-19 pandemic.

Bond issuance increased substantially in the last week of March 2020 and has remained substantially above average pre-pandemic levels. For example, between March and June 2020, $502bn of corporate bonds were issued — compared with just $151bn in 2019 and $204bn in 2018.

Yet the syndicated loan market — in which groups of banks provide debt financing to firms — shut down, and the origination of new loans fell below their levels in previous years.

This pattern, in which, the bond market remains open while the syndicated loan market shuts down, is typical for financial crises. During the global financial crisis, for instance, when the Lehman Brothers filed for bankruptcy on September 15, 2008, issuance of corporate bonds declined. However, by January 2009, the market was up and running and the number of bonds issued reverted to its pre-crisis average. In contrast, syndicated loan originations declined sharply and remained low throughout most of 2009.

What makes the corporate bond market so resilient in times of crises? And why does the syndicated loan market consistently prove so fragile? There are three potential explanations for this divergent behaviour.

First, firms that issue bonds tend to be of higher credit quality than those that rely on bank financing. For example, 87 percent of recent bonds issuers have an investment-grade credit rating, while only 19 percent of syndicated loans were rated as investment grade. This phenomenon is known as credit-market segmentation. And since the segmentation becomes even more pronounced during financial crises, banks stop lending to these risky firms.

Corporate bond markets have proven remarkably resilient in the face of the sharp contraction caused by the Covid-19 pandemic.

— Efraim Benmelech

A second explanation has to do with a fundamental difference between commercial banks and bond investors. During a crisis, banks’ balance sheets become contaminated with non-performing loans, and the losses from these leave them with less money to offer new loans. In contrast, institutional bond investors such as pension funds and insurance companies are long-term investors not prone to the same balance-sheet problems.

The third explanation is that perhaps credit and monetary interventions set by the Fed or other policymakers — especially unconventional monetary policy — are more effective in stimulating bond issuance than in boosting loan originations. Unconventional polices implemented in response to the pandemic such as the Secondary Market Corporate Credit Facility (which purchases investment-grade corporate bonds in the secondary market) and the Primary Market Corporate Credit Facility (which helps large employers issue bonds) targeted the corporate bond market directly, and appear to have stimulated bond issuance significantly. Given the current ultra-low-interest-rate environment, however, it may be difficult for the Federal Reserve to affect bank lending through traditional balance-sheet channels.

This is sobering news for firms with lower credit ratings. Syndicated loans, also known as leveraged loans, exploded in recent years, and the leveraged loan market doubled in size since the global financial crisis. But while there is abundant supply of leveraged loans when credit markets are frothy, the loan market dries up during crises.

The message for chief financial officers is that the composition of credit matters: not only the amount of debt, but the type of debt. And those firms that rely mostly on the leveraged loan market will find it difficult to obtain credit when they need it the most.

Or, to put it more simply: Bonds. Issue corporate bonds.

- This article from the Kellogg School of Management at Northwestern University originally appeared in Forbes.

- Featured faculty: Efraim Benmelech; Harold L Stuart, professor of finance; director of the Guthrie Centre for Real Estate Research.

You may have an interest in also reading…

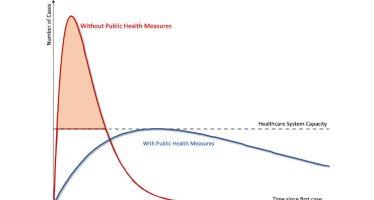

Otaviano Canuto: More Than One Coronavirus Curve to Manage – Infection, Recession and External Finance

Flattening Coronavirus Curves – Otaviano Canuto First appeared at the Policy Center for the New South The global reach of

Global Imbalances and the Pandemic

The International Monetary Fund’s tenth annual External Sector Report (ESR, August 2021) shows how current account deficits in the global

When It Pours, Rainy Day Funds Help – A Little

Both the United States and the United Kingdom have joined the increasingly crowded ranks of countries sustaining a debt load