Clash over Eurobonds Widens Rift in Eurozone

Eurogroup Chairman: Mario Centeno

Sixteen hours into their videoconference, sleep deprived Eurozone finance ministers early this morning agreed to disagree and try again for consensus later today. Eurogroup Chairman Mario Centeno suspended the discussion and said a deal was close, but still out of reach. The inconclusive marathon meeting was meant to find additional ways to funnel cash to fiscally weaker Eurozone members as the pandemic takes a sizeable bite out of their slow-moving economies and unhinges precariously balanced budgets. It was also hoped to put a stop to the almost incessant bickering that has marred relations between member states.

However, Dutch Finance Minister Wopke Hoekstra, the bogeyman of the ‘Club Med group’ led by Italy, stood firm throughout the proceedings and simply refused to contemplate the possibility of issuing Eurobonds, or any other form of mutualised debt, irking nearly all participants with the notable exception of his German colleague Olaf Scholz who kept mostly silent and was only too happy to shield behind the obtuse Dutchman.

Minister Hoekstra did reluctantly agree to allow for the disbursement of funds from the €410 billion European Stability Mechanism (ESM) to cover unforeseen medical expenses, but he remained unwilling to waive the strict conditions attached to pay outs of a more general nature. After a good 14 hours of talks, The Hague was the last holdout as Mr Hoekstra flatly refused to budge. Whilst tensions flared between the Dutch and Italians, some ministers apparently lost interest and dozed off.

Just hours before the start of the meeting, the Minister Hoekstra had received the near-unanimous support of parliament for his standpoint with individual members vowing to block any attempt to ‘infect’ the prized AAA credit rating of their country by sharing risk with less prudent Eurozone countries. On national television, Minister Hoekstra explained that the Dutch government was eager to help fellow EU member states deal with the financial consequences of the pandemic. He likened the outbreak to a house being on fire. Mr Hoekstra said that the Dutch will provide all assistance needed to extinguish the blaze but cannot reasonably be expected to take over the mortgage on the house.

A French proposal to allow for a one-time only limited issue of ‘coronabonds’ was also unceremoniously shot down by Mr Hoekstra, causing his French colleague Bruno Le Maire to suffer a fit of anger during which he appealed to stop ‘this clownesque show’. The finance ministers discussed three proposals, totalling some €540 billion, that added to the emergency measures already implemented by national governments, the European Union, and the European Central Bank (ECB) would by far surpass the $2.2 trillion US aid package approved by Congress in late March.

The clash between The Hague and Rome went further than just Eurobonds and also involved the conditions that rule access to ESM funds. Although the Dutch agreed to deploy these funds to help kickstart the post-corona recovery, they insist on demanding fiscal reforms from countries accessing ESM money. The only concession Minister Hoekstra was prepared to make involved oversight by the much-despised ‘troika’, a cabal of inspectors from the European Commission, ECB, and International Monetary Fund charged with monitoring compliance. Mr Hoekstra agreed to do away with the troika and find other ways to check for progress on reforms. However, that fig leaf was immediately rejected by Italian Finance Minister Roberto Gualtieri for being ‘offensive’.

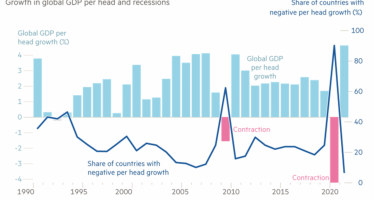

The Italian government strongly feels that the northern EU member states fail to recognise the almost unprecedented severity of the crisis which it considers an existential threat to both the nation and the continent. The country faces its deepest recession since the end of World War II and senses that less affected nations do not yet fully grasp the implications of the pandemic and the need for solidarity.

Former minister of Economic Development and self-confessed Europhile Carlo Calenda warned of a ‘massive shift’ taking place in his country with a growing number of Italians questioning the use of the European Union: “The impression is that Italy has been abandoned by northern member states and may be better off on its own.”

A recent survey confirms that shift and showed that 67 percent of respondents feel that belonging to the European Union does not benefit the country – up from 47 percent one year ago. Former European Council President Donald Tusk chipped in and warned that the pandemic may prove even more dangerous to EU cohesion than the euro crisis was a decade ago: “The loss of reputation is huge.” Mr Tusk, who now leads the centre-right European People’s Party, said that the power of perception must not be underestimated: “Whilst northern member states have already provided substantial aid to Italy and Spain, a few cargo planes with medical supplies arriving from Russia and China receive all the credit. That may not reflect reality but is what people remember.”

Those same perceptions take centre stage in the widening rift between Europe’s purportedly frugal north and the apparently profligate south. However, as a hot topic the issuance of Eurobonds or any other form of mutualised debt is a moot point and merely represents a political show put on for the benefit of domestic audiences. After the European Central Bank in March solemnly promised to buy up all government bonds issued by Eurozone members, ditching its rulebook in the process, euro-denominated debt has already been mutualised for all practical intents and purposes.

Moreover, the European Commission last month agreed to relax the terms of the 1997 European Stability and Growth Pact that underpins the euro. This pact limits fiscal deficits to 3 percent of GDP and national debt to a ceiling of 60 percent of GDP. However, few countries outside Germany, The Netherlands, Finland, Austria, and the Baltics abide by the rules. Thus, the relaxation or removal of these merely theoretical checks on fiscal imprudence is meaningless to countries already ignoring them as a matter of course.

Though Mr Hoekstra, and the less outspoken finance ministers happily riding his coattails, may contribute to the discussion by tabling a great many recriminations, that does not help end the present impasse. Rather, it serves to undermine the EU’s credibility and adds an extra layer of complexity to an already challenging scenario that baffles all governments equally.

Italy, for its part, would perhaps be well-advised to accept a compromise solution in recognition of its own well-known refusal to fix the proverbial roof when the sun was still shining. Messrs Hoekstra and Gualtieri must come to terms with the irrefutable fact that they are living in the same house which is indeed on fire.

Unless the recriminations stop and a way forward is found ‘pronto’, Europe’s future looks particularly bleak. The Hague and Rome need to tone down the rhetoric and get to work shaping the post-corona future whilst ensuring the continued relevance of the union that delivered prosperity to all EU member states, albeit in different forms.

You may have an interest in also reading…

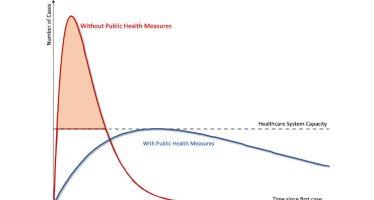

Otaviano Canuto: More Than One Coronavirus Curve to Manage – Infection, Recession and External Finance

Flattening Coronavirus Curves – Otaviano Canuto First appeared at the Policy Center for the New South The global reach of

Otaviano Canuto: Shapes of the Post-Coronavirus Economic Recovery

Data recently released on the first-quarter global domestic product (GDP) performance of major economies have showed how significant the impact

Few Strings in US, Many in Europe

As trillions of dollars and euros were being doled out in state aid by governments and central banks trying to